Answered step by step

Verified Expert Solution

Question

1 Approved Answer

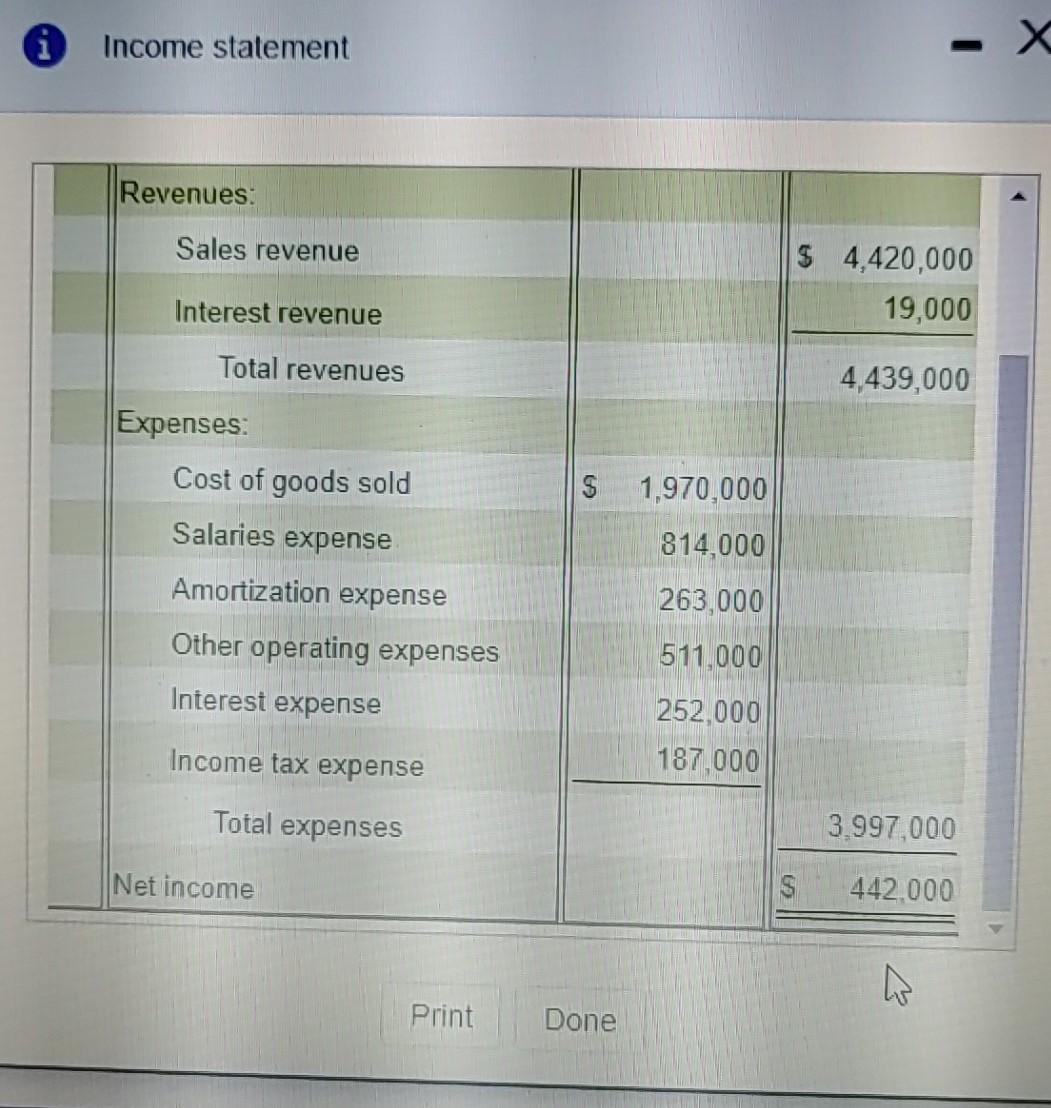

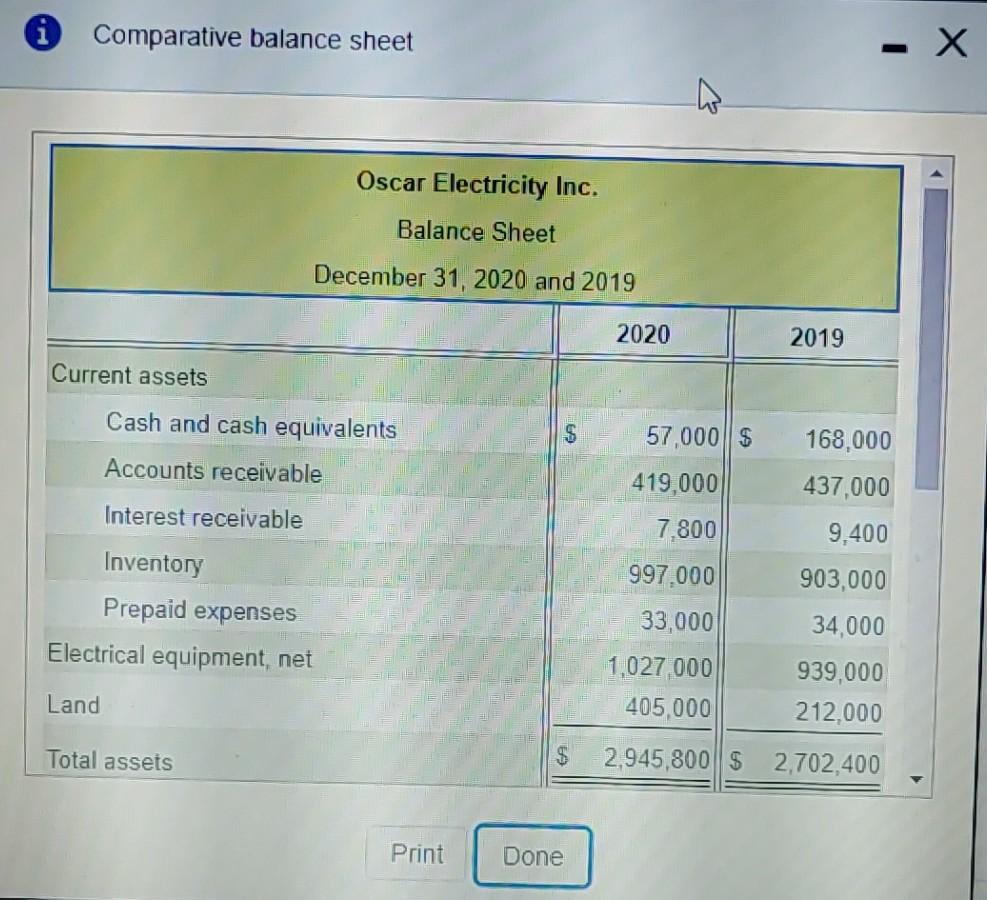

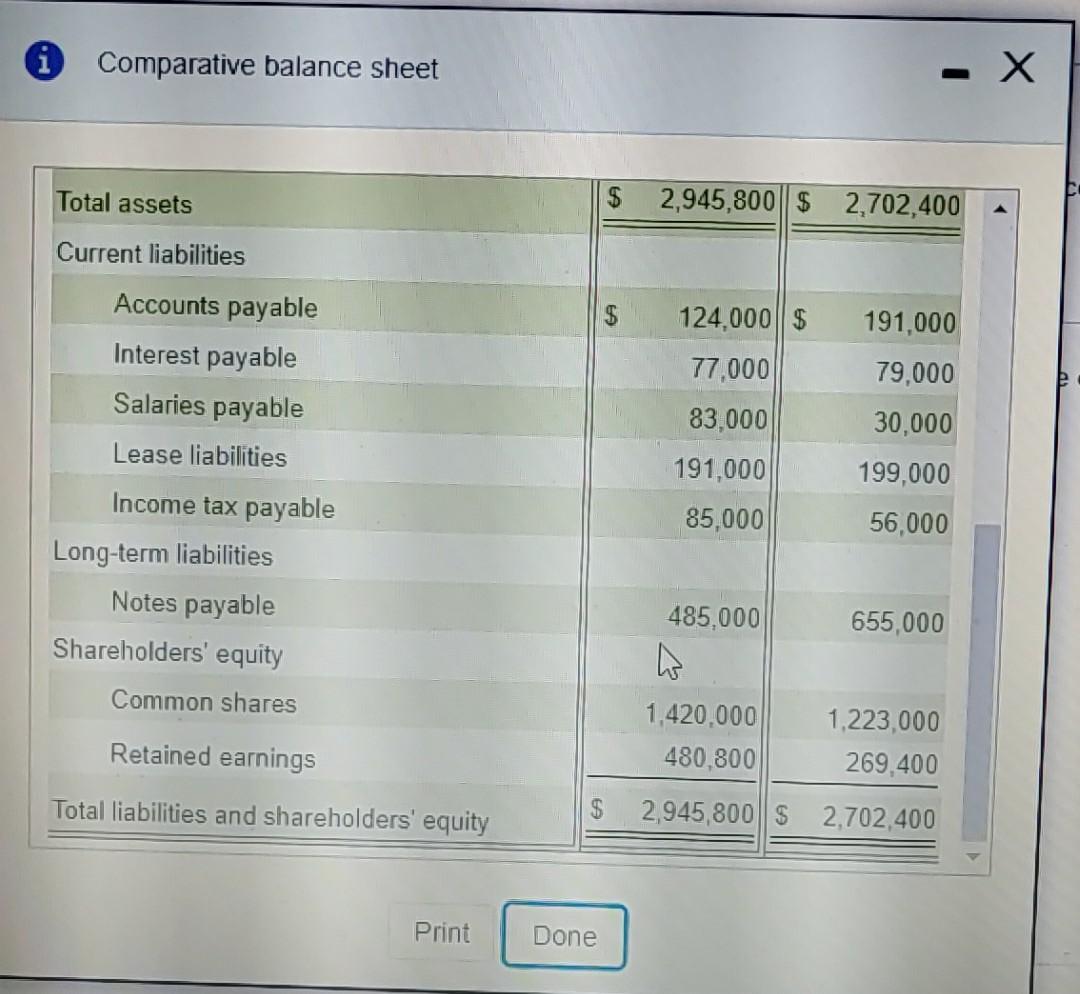

Income statement x Revenues: Sales revenue 4,420,000 19,000 Interest revenue Total revenues 4,439,000 Expenses: Cost of goods sold S 1.970,000 Salaries expense 814,000 263,000 Amortization

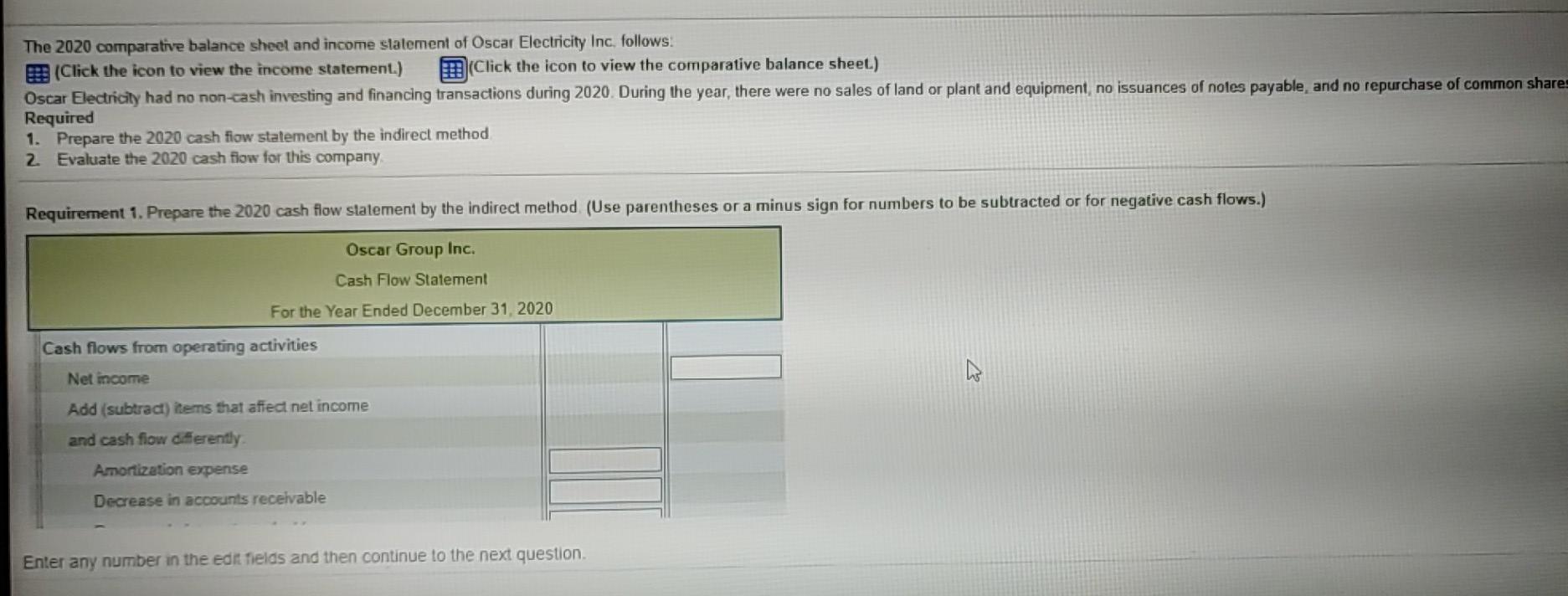

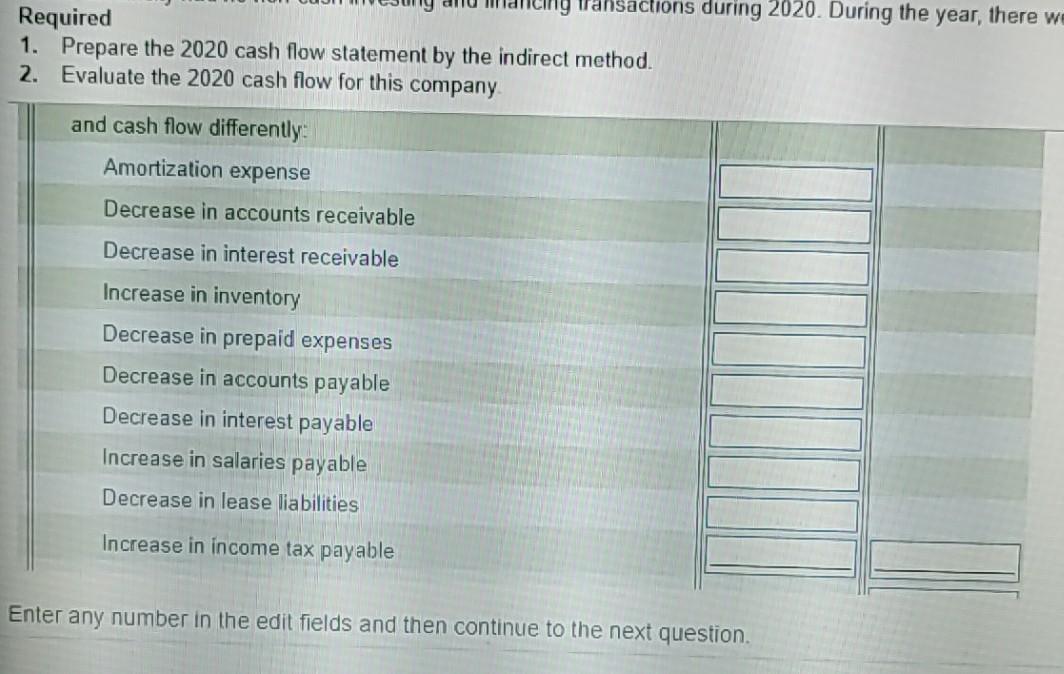

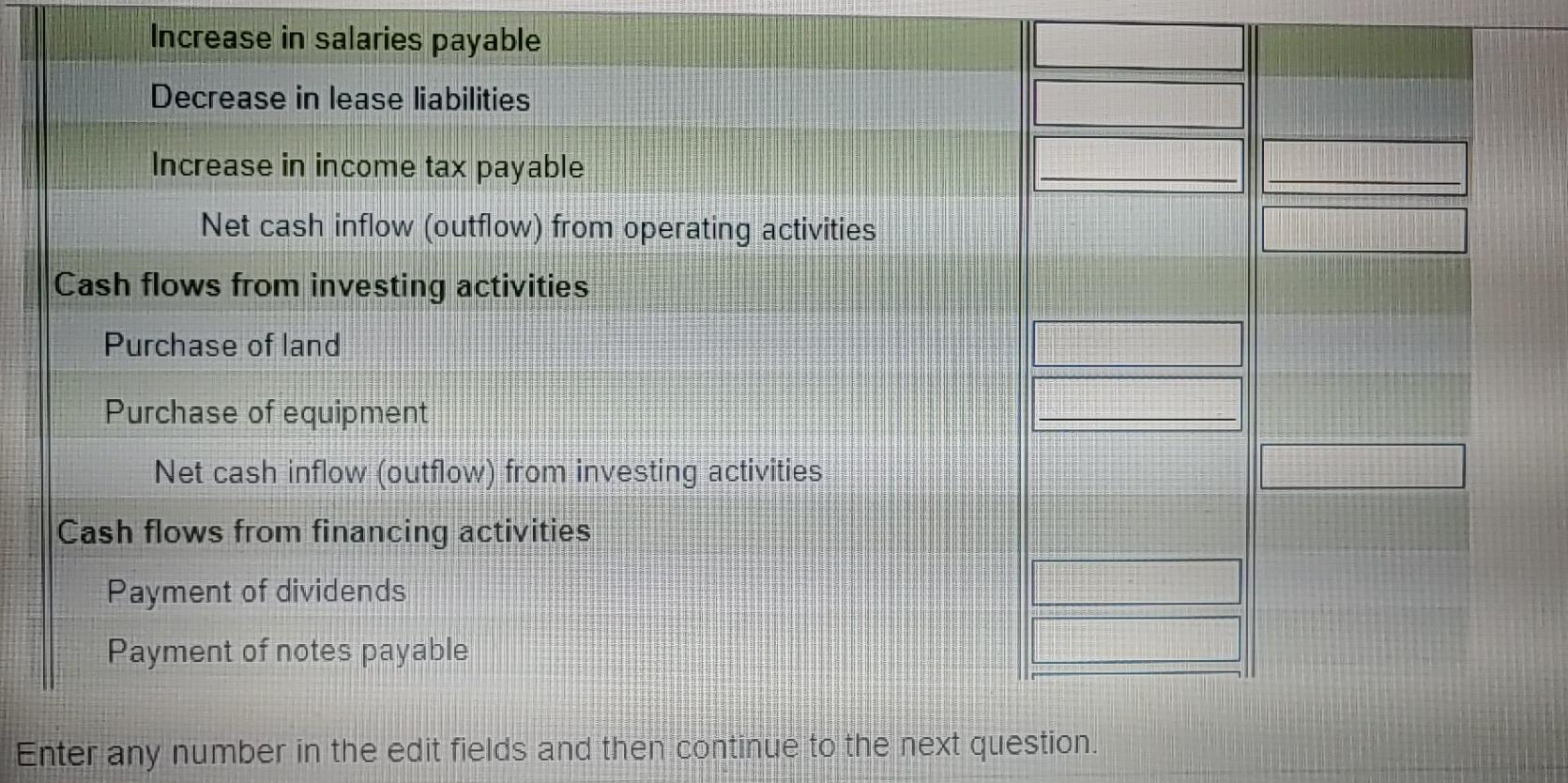

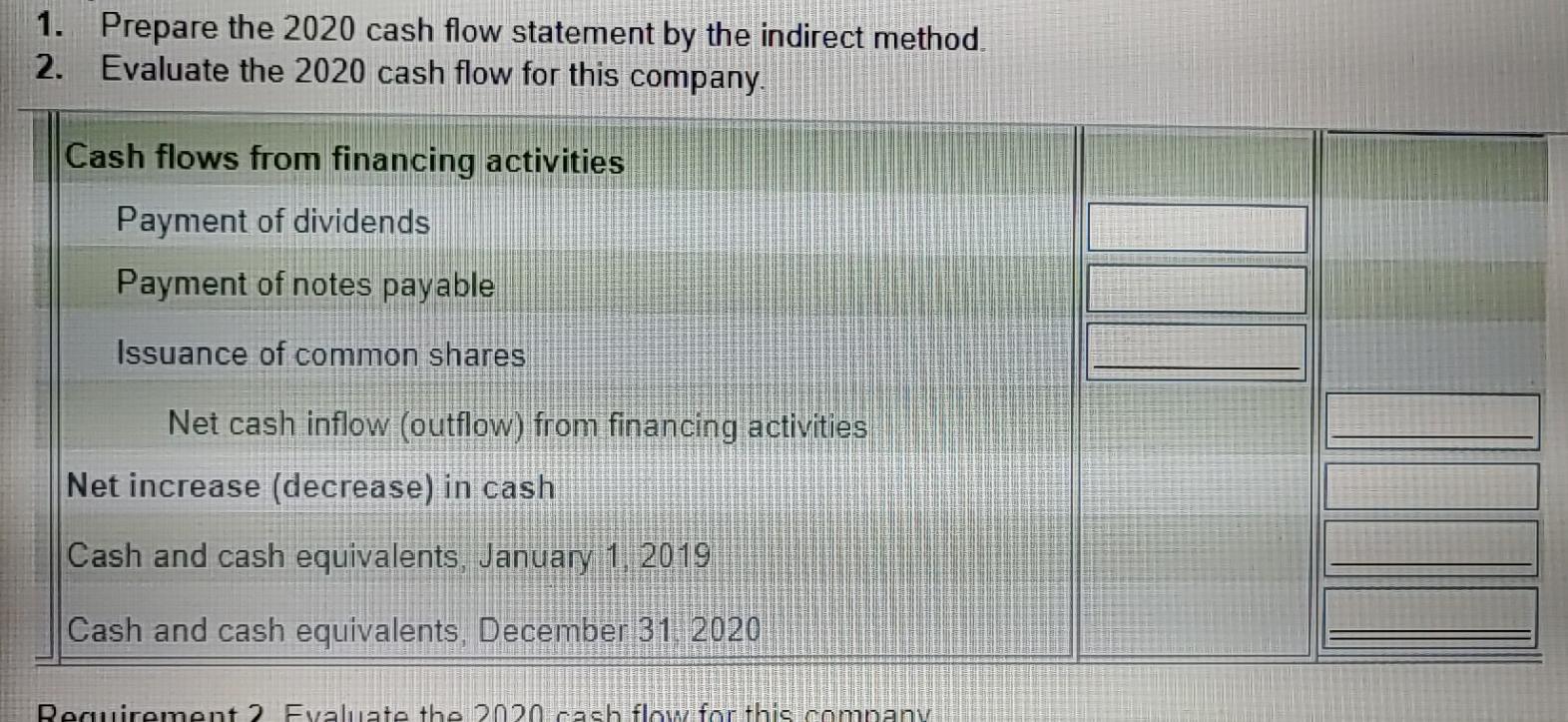

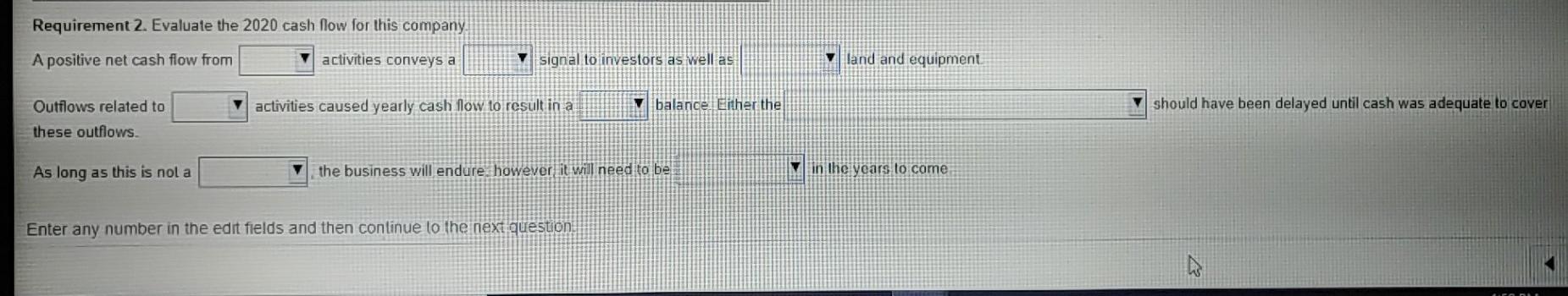

Income statement x Revenues: Sales revenue 4,420,000 19,000 Interest revenue Total revenues 4,439,000 Expenses: Cost of goods sold S 1.970,000 Salaries expense 814,000 263,000 Amortization expense Other operating expenses 511,000 Interest expense 252,000 187,000 Income tax expense Total expenses 3,997,000 Net income 442.000 Print Done 0 Comparative balance sheet - X Oscar Electricity Inc. Balance Sheet December 31, 2020 and 2019 2020 2019 Current assets Cash and cash equivalents $ Accounts receivable Interest receivable Inventory Prepaid expenses Electrical equipment, net 57,000 $ 419,000 7,800 997.000 33,000 1,027 000 405,000 168,000 437,000 9,400 903,000 34,000 939,000 212,000 Land Total assets 2.945,800 $ 2,702,400 Print Done i Comparative balance sheet - X Total assets 2,945,800||$ 2,702,400 Current liabilities 124,000 $ 191,000 77,000 79,000 83,000 191,000 Accounts payable Interest payable Salaries payable Lease liabilities Income tax payable Long-term liabilities Notes payable Shareholders' equity Common shares 30,000 199,000 56,000 85,000 485,000 655,000 Retained earnings 1.420,000 480,800 1,223,000 269.400 Total liabilities and shareholders' equity 2,945,800S 2,702,400 Print Done The 2020 comparative balance sheet and income statement of Oscar Electricity Inc, follows: (Click the icon to view the income statement.) Click the icon to view the comparative balance sheet.) Oscar Electricity had no non-cash investing and financing transactions during 2020. During the year, there were no sales of land or plant and equipment, no issuances of notes payable, and no repurchase of common share Required 1. Prepare the 2020 cash flow statement by the indirect method 2 Evaluate the 2020 cash flow for this company Requirement 1. Prepare the 2020 cash flow statement by the indirect method (Use parentheses or a minus sign for numbers to be subtracted or for negative cash flows.) Oscar Group Inc. Cash Flow Statement For the Year Ended December 31, 2020 Cash flows from operating activities Net income Add (subtract) items that affect net income and cash flow differently Amortization expense Decrease in accounts receivable Enter any number in the edit fields and then continue to the next question Iransactions during 2020. During the year, there we Required 1. Prepare the 2020 cash flow statement by the indirect method. 2. Evaluate the 2020 cash flow for this company and cash flow differently Amortization expense Decrease in accounts receivable Decrease in interest receivable Increase in inventory Decrease in prepaid expenses Decrease in accounts payable Decrease in interest payable Increase in salaries payable Decrease in lease liabilities Increase in income tax payable Enter any number in the edit fields and then continue to the next question. Increase in salaries payable Decrease in lease liabilities Increase in income tax payable Net cash inflow (outflow) from operating activities Cash flows from investing activities Purchase of land Purchase of equipment Net cash inflow (outflow) from investing activities Cash flows from financing activities Payment of dividends Payment of notes payable Enter any number in the edit fields and then continue to the next question. 1. Prepare the 2020 cash flow statement by the indirect method. 2. Evaluate the 2020 cash flow for this company. Cash flows from financing activities Payment of dividends Payment of notes payable Issuance of common shares Net cash inflow (outflow) from financing activities Net increase (decrease) in cash Cash and cash equivalents, January 1, 2019 Cash and cash equivalents, December 31, 2020 Requirement 2 Evaluate the 2020 cash flow for this company Requirement 2. Evaluate the 2020 cash flow for this company. A positive net cash flow from activities conveys a signal to investors as well as v land and equipment activities caused yearly cash Now to result in a v balance. Either the should have been delayed until cash was adequate to cover Outflows related to these outflows. As long as this is nol a the business will endure. however it will need to be in the years to come Enter any number in the edit fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started