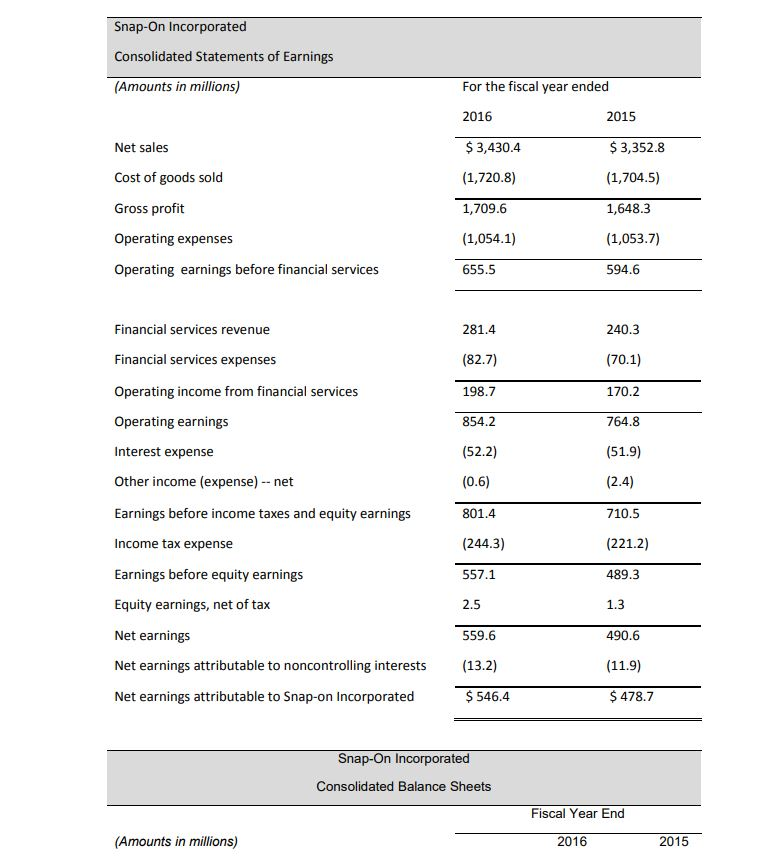

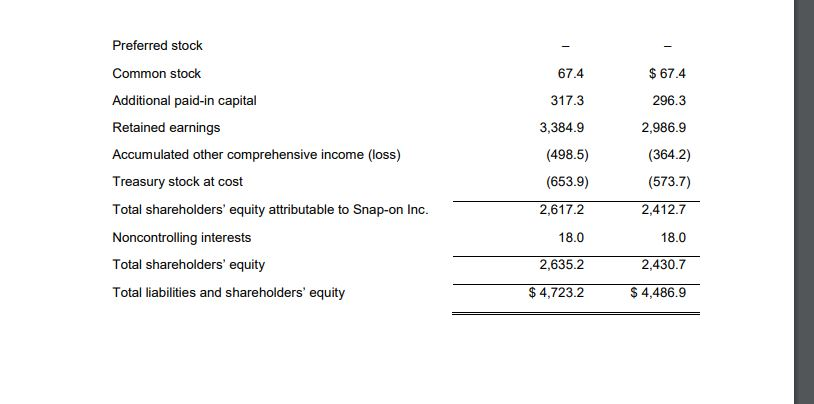

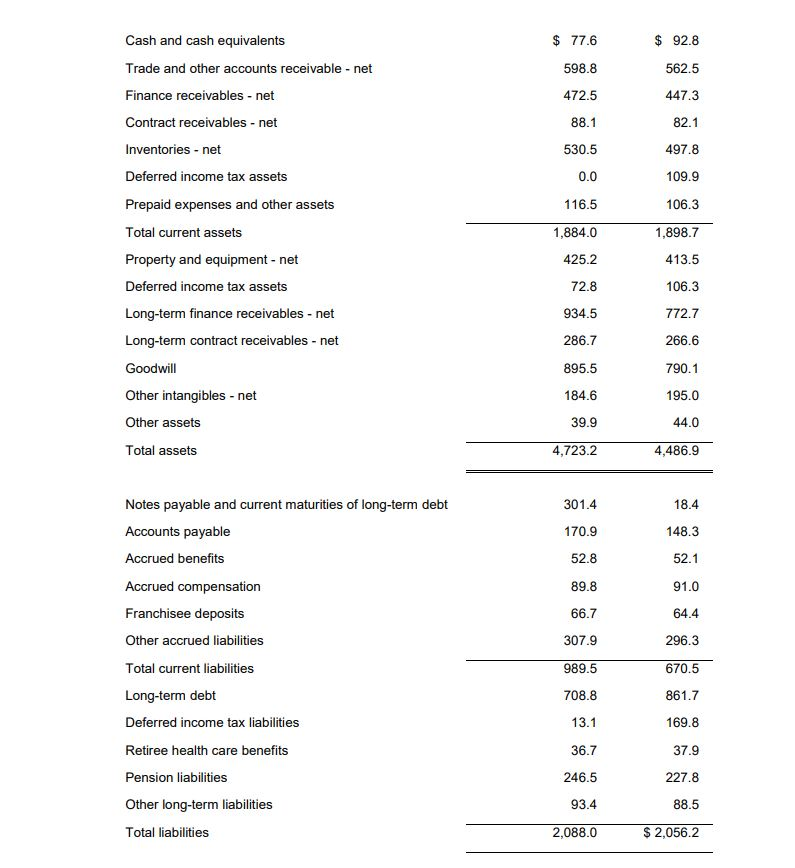

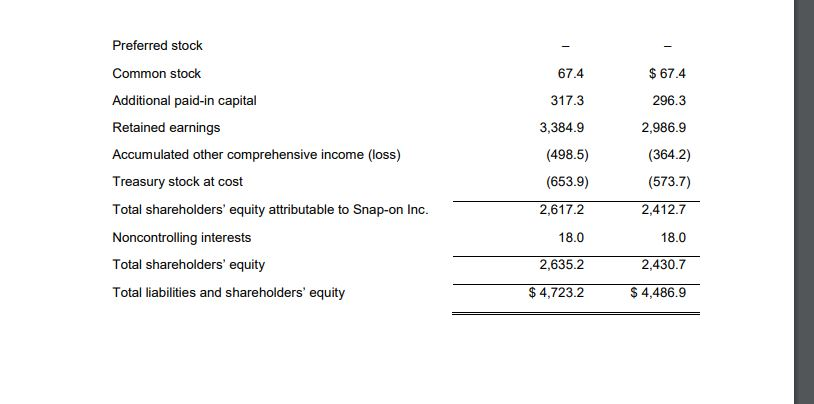

Income statements and balance sheets follow for Snap-On Incorporated. Refer to these financial statements to answer the following questions.

- Compute net operating profit after tax (NOPAT) for 2016 and 2015. Assume that combined federal and state statutory tax rate is 37% for both fiscal years.

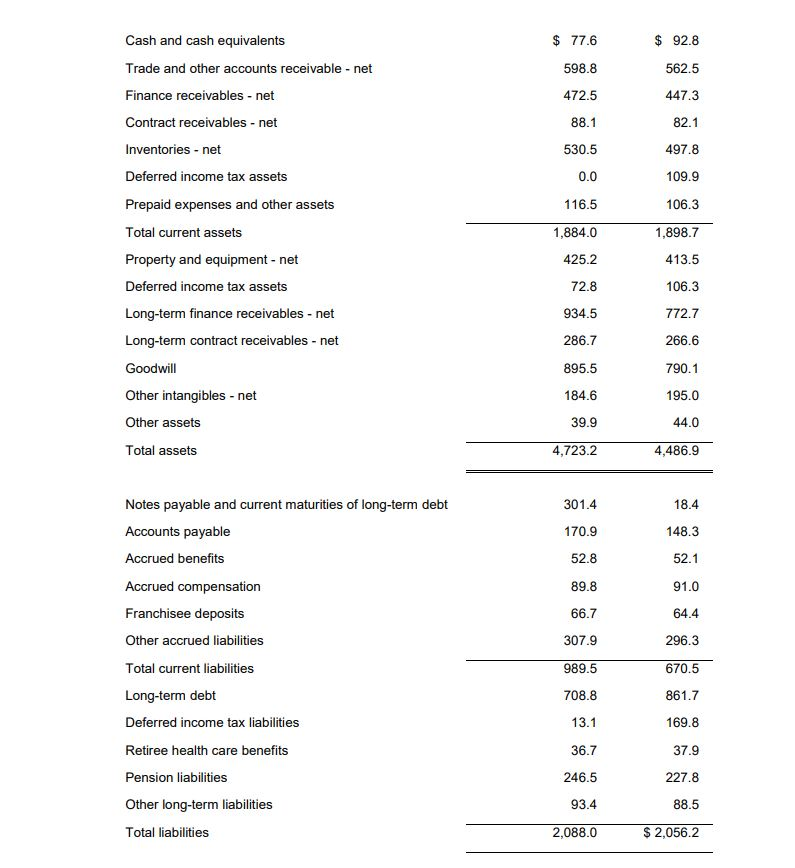

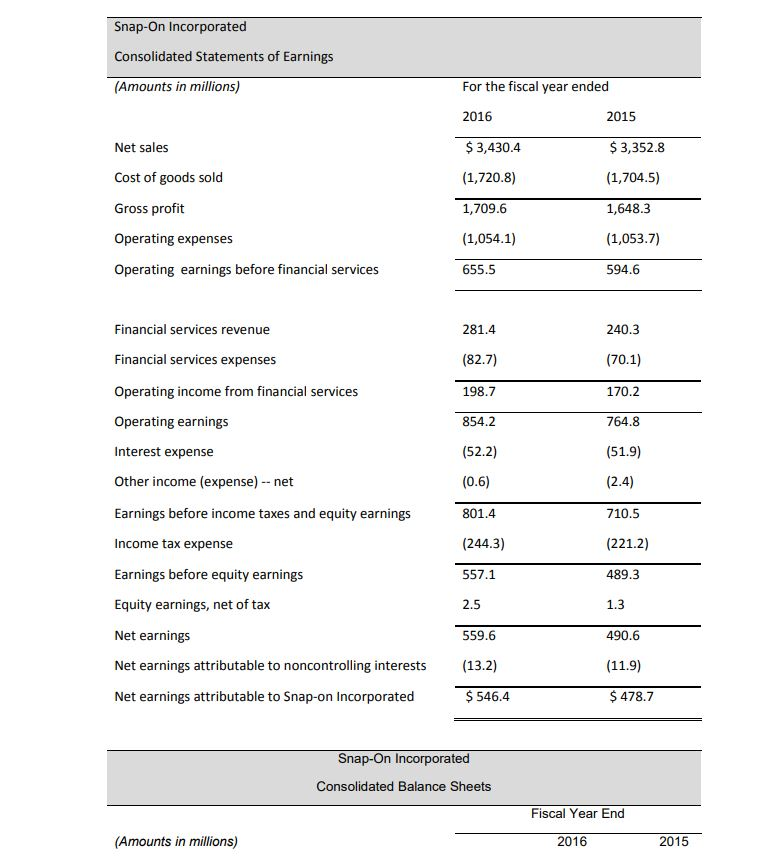

- Compute net operating assets (NOA) for 2016 and 2015.

- Compute return on net operating assets (RNOA) for 2016 and 2015. Comment on the year-over-year change. Net operating assets are $3,011.7 million in 2014.

- Disaggregate RNOA into profitability and asset turnover components (NOPM and NOAT, respectively). Remember to include both net sales and financial services revenue in total revenue. What explains the year-over-year change in RNOA?

Snap-On Incorporated Consolidated Statements of Earnings (Amounts in millions) For the fiscal year ended 2016 2015 $3,430.4 $3,352.8 Net sales (1,720.8) Cost of goods sold (1,704.5) Gross profit 1,709.6 1,648.3 Operating expenses (1,054.1) (1,053.7) Operating earnings before financial services 655.5 594.6 Financial services revenue 281.4 240.3 Financial services expenses (70.1) (82.7) Operating income from financial services 198.7 170.2 Operating earnings 854.2 764.8 Interest expense (52.2) (51.9) Other income (expense) net (0.6) (2.4) Earnings before income taxes and equity earnings 801.4 710.5 (244.3) (221.2) Income tax expense Earnings before equity earnings 557.1 489.3 Equity earnings, net of tax 2,5 1.3 Net earnings 559.6 490.6 Net earnings attributable to noncontrolling interests (13.2) (11.9) $ 546.4 $ 478.7 Net earnings attributable to Snap-on Incorporated Snap-On Incorporated Consolidated Balance Sheets Fiscal Year End (Amounts in millions) 2016 2015 Cash and cash equivalents 77.6 92.8 Trade and other accounts receivable net 598.8 562.5 Finance receivables net 472.5 447.3 Contract receivables -net 88.1 82.1 Inventories net 530.5 497.8 109.9 Deferred income tax assets 0.0 Prepaid expenses and other assets 116.5 106.3 1,884.0 Total current assets 1,898.7 Property and equipment net 425.2 413.5 Deferred income tax assets 72.8 106.3 Long-term finance receivables net 934.5 772.7 Long-term contract receivables 286.7 266.6 net Goodwill 895.5 790.1 Other intangibles net 184.6 195.0 39.9 Other assets 44.0 Total assets 4,723.2 4,486.9 Notes payable and current maturities of long-term debt 301.4 18.4 Accounts payable 170.9 148.3 Accrued benefits 52.8 52.1 Accrued compensation 89,8 91.0 Franchisee deposits 66.7 64.4 Other accrued liabilities 307.9 296.3 Total current liabilities 989.5 670.5 Long-term debt 708.8 861.7 169.8 Deferred income tax liabilities 13.1 Retiree health care benefits 36.7 37.9 Pension liabilities 246.5 227,8 Other long-term liabilities 93.4 88.5 $ 2,056.2 Total liabilities 2,088.0 Preferred stock 67.4 Common stock $67.4 Additional paid-in capital 317.3 296.3 Retained earnings 3,384.9 2,986.9 Accumulated other comprehensive income (loss) (498.5) (364.2) Treasury stock at cost (653.9) (573.7) Total shareholders' equity attributable to Snap-on Inc 2,412.7 2,617.2 Noncontrolling interests 18.0 18.0 2,635.2 Total shareholders' equity 2,430.7 Total liabilities and shareholders' equity $4,723.2 $4,486.9 Snap-On Incorporated Consolidated Statements of Earnings (Amounts in millions) For the fiscal year ended 2016 2015 $3,430.4 $3,352.8 Net sales (1,720.8) Cost of goods sold (1,704.5) Gross profit 1,709.6 1,648.3 Operating expenses (1,054.1) (1,053.7) Operating earnings before financial services 655.5 594.6 Financial services revenue 281.4 240.3 Financial services expenses (70.1) (82.7) Operating income from financial services 198.7 170.2 Operating earnings 854.2 764.8 Interest expense (52.2) (51.9) Other income (expense) net (0.6) (2.4) Earnings before income taxes and equity earnings 801.4 710.5 (244.3) (221.2) Income tax expense Earnings before equity earnings 557.1 489.3 Equity earnings, net of tax 2,5 1.3 Net earnings 559.6 490.6 Net earnings attributable to noncontrolling interests (13.2) (11.9) $ 546.4 $ 478.7 Net earnings attributable to Snap-on Incorporated Snap-On Incorporated Consolidated Balance Sheets Fiscal Year End (Amounts in millions) 2016 2015 Cash and cash equivalents 77.6 92.8 Trade and other accounts receivable net 598.8 562.5 Finance receivables net 472.5 447.3 Contract receivables -net 88.1 82.1 Inventories net 530.5 497.8 109.9 Deferred income tax assets 0.0 Prepaid expenses and other assets 116.5 106.3 1,884.0 Total current assets 1,898.7 Property and equipment net 425.2 413.5 Deferred income tax assets 72.8 106.3 Long-term finance receivables net 934.5 772.7 Long-term contract receivables 286.7 266.6 net Goodwill 895.5 790.1 Other intangibles net 184.6 195.0 39.9 Other assets 44.0 Total assets 4,723.2 4,486.9 Notes payable and current maturities of long-term debt 301.4 18.4 Accounts payable 170.9 148.3 Accrued benefits 52.8 52.1 Accrued compensation 89,8 91.0 Franchisee deposits 66.7 64.4 Other accrued liabilities 307.9 296.3 Total current liabilities 989.5 670.5 Long-term debt 708.8 861.7 169.8 Deferred income tax liabilities 13.1 Retiree health care benefits 36.7 37.9 Pension liabilities 246.5 227,8 Other long-term liabilities 93.4 88.5 $ 2,056.2 Total liabilities 2,088.0 Preferred stock 67.4 Common stock $67.4 Additional paid-in capital 317.3 296.3 Retained earnings 3,384.9 2,986.9 Accumulated other comprehensive income (loss) (498.5) (364.2) Treasury stock at cost (653.9) (573.7) Total shareholders' equity attributable to Snap-on Inc 2,412.7 2,617.2 Noncontrolling interests 18.0 18.0 2,635.2 Total shareholders' equity 2,430.7 Total liabilities and shareholders' equity $4,723.2 $4,486.9