Answered step by step

Verified Expert Solution

Question

1 Approved Answer

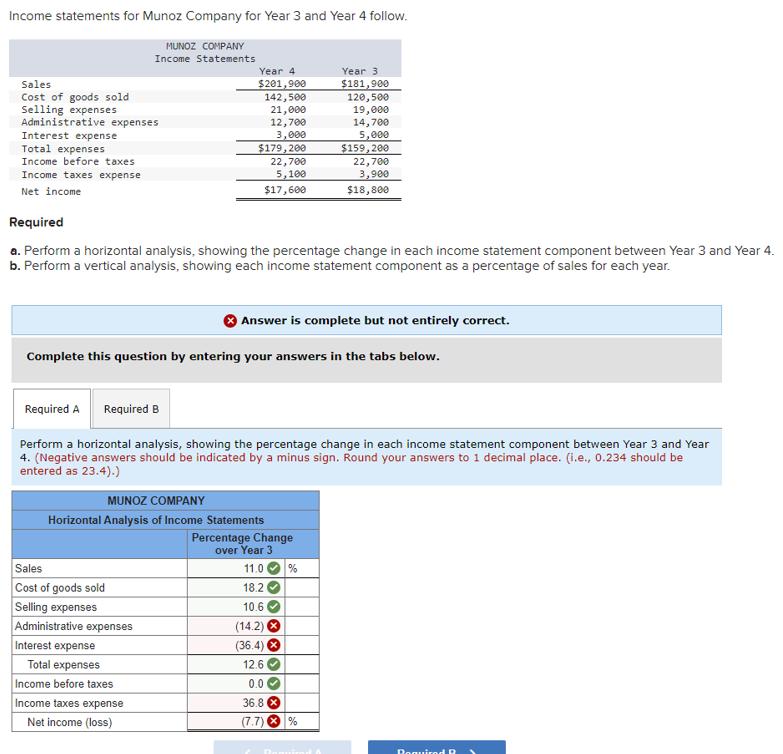

Income statements for Munoz Company for Year 3 and Year 4 follow. MUNOZ COMPANY Income Statements Sales Year 4 $201,900 Year 3 $181,900 Cost

Income statements for Munoz Company for Year 3 and Year 4 follow. MUNOZ COMPANY Income Statements Sales Year 4 $201,900 Year 3 $181,900 Cost of goods sold 142,500 120,500 Selling expenses 21,000 19,000 Administrative expenses. 12,700 14,700 Interest expense 3,000 5,000 Total expenses $179,200 $159,200 Income before taxes Income taxes expense 22,700 5,100 $17,600 22,700 3,900 $18,800 Net income Required a. Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. b. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. (Negative answers should be indicated by a minus sign. Round your answers to 1 decimal place. (i.e., 0.234 should be entered as 23.4).) MUNOZ COMPANY Horizontal Analysis of Income Statements Percentage Change over Year 3 Sales 11.0 % Cost of goods sold 18.2 Selling expenses 10.6 Administrative expenses (14.2) Interest expense (36.4) Total expenses Income before taxes Income taxes expense Net income (loss) 12.6 0.0- 36.8 x (7.7)% Required R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Munoz Company Horizontal Analysis Income Statement Component Year 3 Year 4 P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dd836ef683_961715.pdf

180 KBs PDF File

663dd836ef683_961715.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started