Answered step by step

Verified Expert Solution

Question

1 Approved Answer

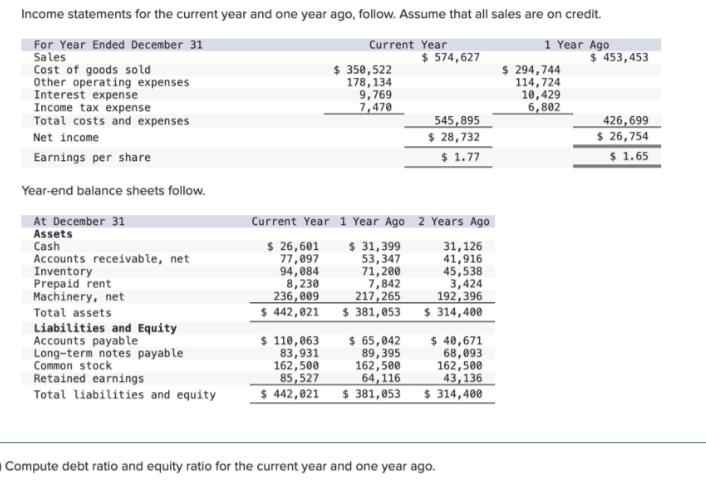

Income statements for the current year and one year ago, follow. Assume that all sales are on credit. Sales Cost of goods sold For

Income statements for the current year and one year ago, follow. Assume that all sales are on credit. Sales Cost of goods sold For Year Ended December 31 Other operating expenses Interest expense Current Year $350,522 178,134 9,769 7,470 $ 574,627 1 Year Ago $ 294,744 114,724 10,429 $ 453,453 Income tax expense Total costs and expenses Net income Earnings per share Year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Inventory Prepaid rent Machinery, net 6,802 545,895 $ 28,732 $1.77 Current Year 1 Year Ago 2 Years Ago $ 26,601 $ 31,399 77,097 53,347 71,200 7,842 217,265 31,126 41,916 45,538 94,084 8,230 236,009 $442,021 $ 381,053 $ 65,042 89,395 162,500 64,116 3,424 192,396 $ 314,400 $ 40,671 68,093 162,500 43,136 Total assets Liabilities and Equity Accounts payable $ 110,063 Long-term notes payable Common stock 83,931 162,500 Retained earnings 85,527 Total liabilities and equity $442,021 $ 381,053 $ 314,400 Compute debt ratio and equity ratio for the current year and one year ago. 426,699 $ 26,754 $1.65

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started