Answered step by step

Verified Expert Solution

Question

1 Approved Answer

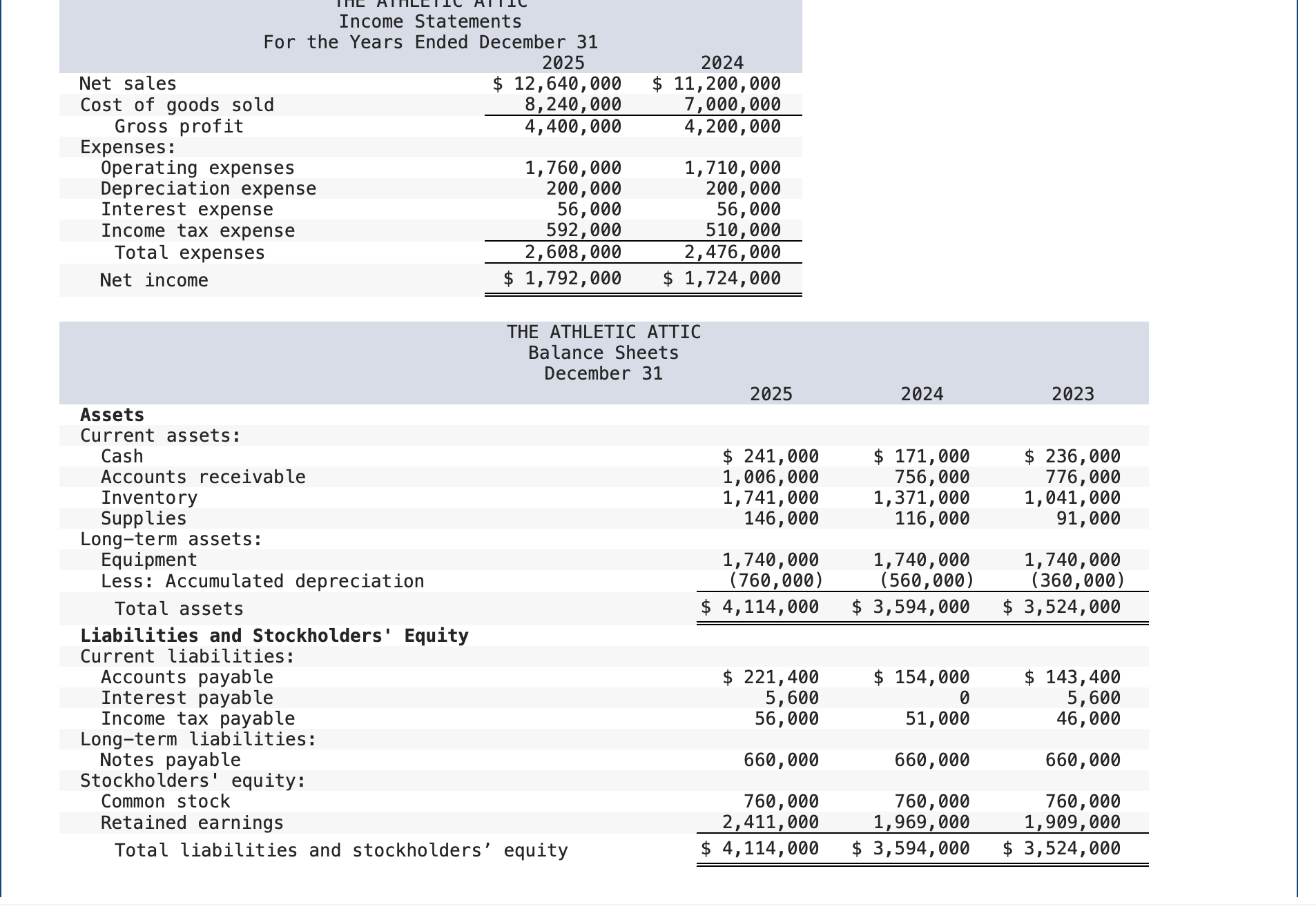

Income Statements For the Years Ended December 31 Net sales Gross profit begin{tabular}{lr} 2025 & 2024 2,640,000 & $11,200,000 8,240,000 & 7,000,000

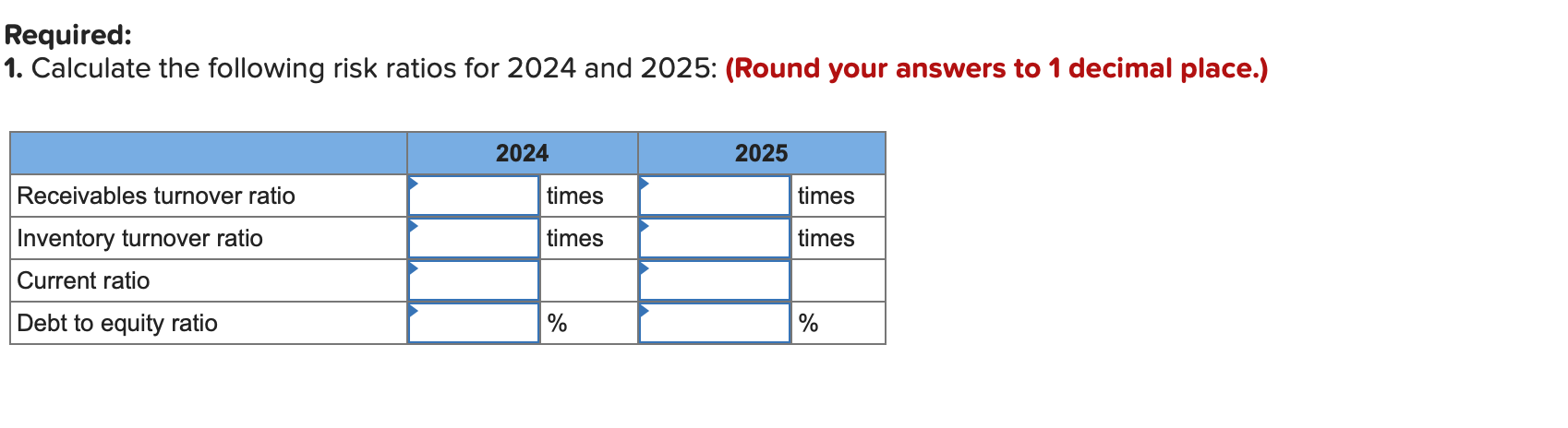

Income Statements For the Years Ended December 31 Net sales Gross profit \begin{tabular}{lr} 2025 & 2024 \\ 2,640,000 & $11,200,000 \\ 8,240,000 & 7,000,000 \\ \hline 4,400,000 & 4,200,000 \end{tabular} Expenses: Operating expenses Depreciation expense Interest expense Income tax expense Total expenses Net income \begin{tabular}{rr} 1,760,000 & 1,710,000 \\ 200,000 & 200,000 \\ 56,000 & 56,000 \\ 592,000 & 510,000 \\ \hline 2,608,000 & 2,476,000 \\ \hline$1,792,000 & $1,724,000 \\ \hline \hline \end{tabular} THE ATHLETIC ATTIC Balance Sheets December 31 Assets Current assets: CashAccountsreceivableInventorySupplies$241,0001,006,0001,741,000146,000$171,000756,0001,371,000116,000$236,000776,0001,041,000 Long-term assets: Equipment Less: Accumulated depreciation \begin{tabular}{rrr} 1,740,000 & 1,740,000 & 1,740,000 \\ (760,000) & (560,000) & (360,000) \\ \hline$4,114,000 & $3,594,000 & $3,524,000 \\ \hline \hline \end{tabular} Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity : Common stock Retained earnings Total liabilities and stockholders' equity \begin{tabular}{rrr} $221,400 & $154,000 & $143,400 \\ 5,600 & 0 & 5,600 \\ 56,000 & 51,000 & 46,000 \\ 660,000 & 660,000 & 660,000 \\ 760,000 & 760,000 & 760,000 \\ 2,411,000 & 1,969,000 & 1,909,000 \\ \hline$4,114,000 & $3,594,000 & $3,524,000 \\ \hline \hline \end{tabular} Required: 1. Calculate the following risk ratios for 2024 and 2025: (Round your answers to 1 decimal place.)

Income Statements For the Years Ended December 31 Net sales Gross profit \begin{tabular}{lr} 2025 & 2024 \\ 2,640,000 & $11,200,000 \\ 8,240,000 & 7,000,000 \\ \hline 4,400,000 & 4,200,000 \end{tabular} Expenses: Operating expenses Depreciation expense Interest expense Income tax expense Total expenses Net income \begin{tabular}{rr} 1,760,000 & 1,710,000 \\ 200,000 & 200,000 \\ 56,000 & 56,000 \\ 592,000 & 510,000 \\ \hline 2,608,000 & 2,476,000 \\ \hline$1,792,000 & $1,724,000 \\ \hline \hline \end{tabular} THE ATHLETIC ATTIC Balance Sheets December 31 Assets Current assets: CashAccountsreceivableInventorySupplies$241,0001,006,0001,741,000146,000$171,000756,0001,371,000116,000$236,000776,0001,041,000 Long-term assets: Equipment Less: Accumulated depreciation \begin{tabular}{rrr} 1,740,000 & 1,740,000 & 1,740,000 \\ (760,000) & (560,000) & (360,000) \\ \hline$4,114,000 & $3,594,000 & $3,524,000 \\ \hline \hline \end{tabular} Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity : Common stock Retained earnings Total liabilities and stockholders' equity \begin{tabular}{rrr} $221,400 & $154,000 & $143,400 \\ 5,600 & 0 & 5,600 \\ 56,000 & 51,000 & 46,000 \\ 660,000 & 660,000 & 660,000 \\ 760,000 & 760,000 & 760,000 \\ 2,411,000 & 1,969,000 & 1,909,000 \\ \hline$4,114,000 & $3,594,000 & $3,524,000 \\ \hline \hline \end{tabular} Required: 1. Calculate the following risk ratios for 2024 and 2025: (Round your answers to 1 decimal place.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started