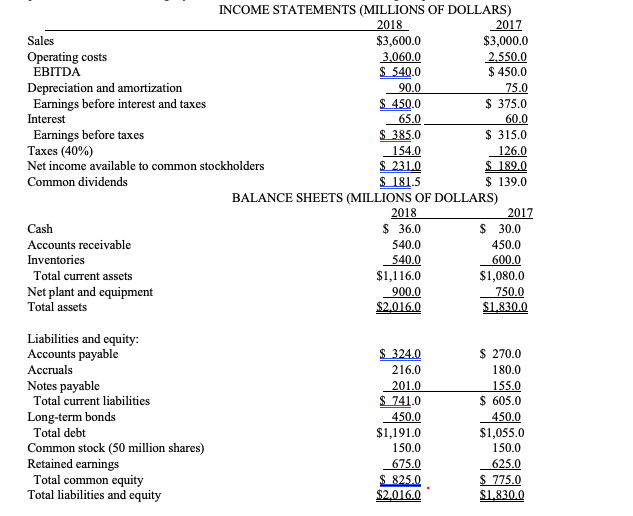

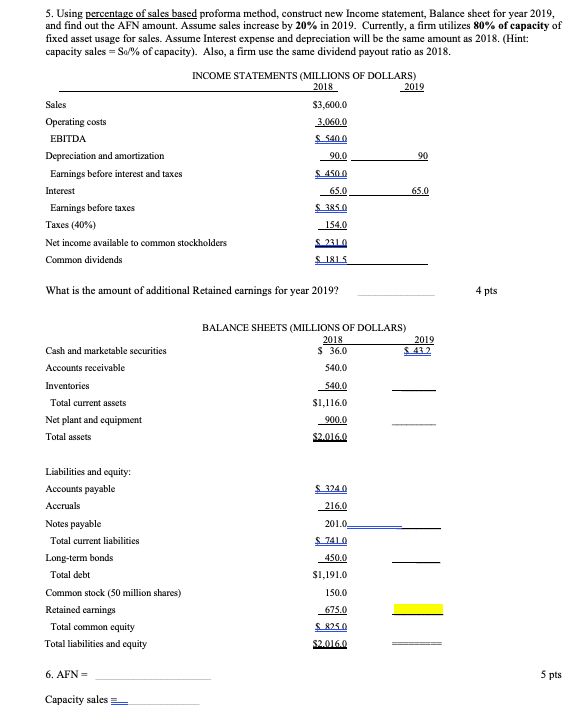

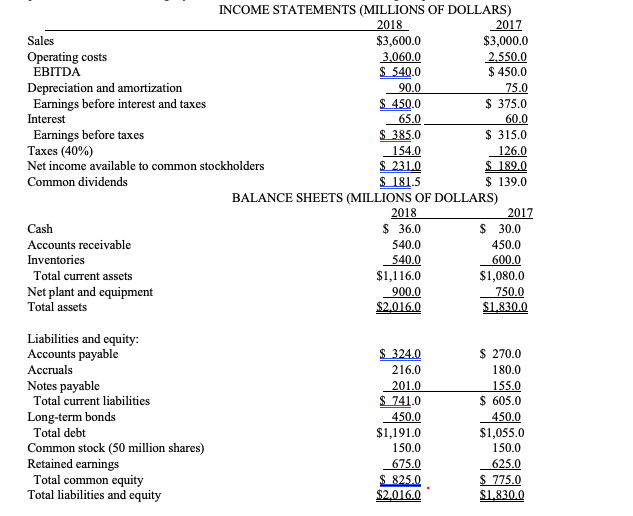

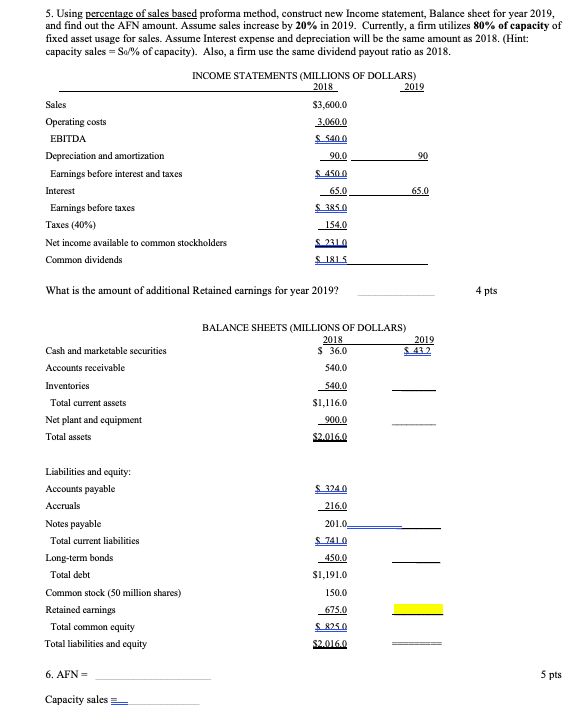

INCOME STATEMENTS (MILLIONS OF DOLLARS) 2018 2017 Sales $3,600.0 $3,000.0 Operating costs 3,060.0 2.550.0 EBITDA $ 540.0 $ 450.0 Depreciation and amortization 90.0 75.0 Earnings before interest and taxes $_450.0 $ 375.0 Interest 65.0 60.0 Earnings before taxes $ 385.0 $ 315.0 Taxes (40%) 154.0 126.0 Net income available to common stockholders $ 231.0 $ 189,0 Common dividends $ 181.5 $ 139,0 BALANCE SHEETS (MILLIONS OF DOLLARS) 2018 2017 Cash $36.0 $ 30.0 Accounts receivable 540.0 450.0 Inventories 540.0 600.0 Total current assets $1,116.0 $1,080.0 Net plant and equipment 900.0 750.0 Total assets $2.0160 $1.830.0 Liabilities and equity: Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total debt Common stock (50 million shares) Retained earnings Total common equity Total liabilities and equity $ 324.0 216.0 201.0 $ 741.0 450.0 $1,191.0 150.0 675.0 S 825.0 $2.0160 $ 270.0 180.0 155.0 $ 605.0 450.0 $1,055.0 150.0 625.0 $ 775.0 $1.830.0 5. Using percentage of sales based proforma method, construct new Income statement, Balance sheet for year 2019, and find out the AFN amount. Assume sales increase by 20% in 2019. Currently, a firm utilizes 80% of capacity of fixed asset usage for sales. Assume Interest expense and depreciation will be the same amount as 2018. (Hint: capacity sales = Sol% of capacity). Also, a firm use the same dividend payout ratio as 2018. INCOME STATEMENTS (MILLIONS OF DOLLARS) 2018 2019 Sales $3,600.0 Operating costs 3.060.0 EBITDA S 5400 Depreciation and amortization 90.0 90 Earnings before interest and taxes S 4500 Interest 65.0 65.0 Earnings before taxes $385.0 Taxes (40%) 154.0 Net income available to common stockholders S 2310 Common dividends S1815 What is the amount of additional Retained earnings for year 2019? 4 pts BALANCE SHEETS (MILLIONS OF DOLLARS) 2018 $36.0 540.0 2012 $422 $40.0 Cash and marketable securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets $1,116.0 900.0 $2.016.0 $3240 Liabilities and equity: Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total debt Common stock (50 million shares) Retained earnings Total common equity Total liabilities and equity 216.0 201.02 S 7410 450.0 $1,191.0 150.0 675.0 S 825.0 $2.016, 6. AFN = 5 pts Capacity sales = INCOME STATEMENTS (MILLIONS OF DOLLARS) 2018 2017 Sales $3,600.0 $3,000.0 Operating costs 3,060.0 2.550.0 EBITDA $ 540.0 $ 450.0 Depreciation and amortization 90.0 75.0 Earnings before interest and taxes $_450.0 $ 375.0 Interest 65.0 60.0 Earnings before taxes $ 385.0 $ 315.0 Taxes (40%) 154.0 126.0 Net income available to common stockholders $ 231.0 $ 189,0 Common dividends $ 181.5 $ 139,0 BALANCE SHEETS (MILLIONS OF DOLLARS) 2018 2017 Cash $36.0 $ 30.0 Accounts receivable 540.0 450.0 Inventories 540.0 600.0 Total current assets $1,116.0 $1,080.0 Net plant and equipment 900.0 750.0 Total assets $2.0160 $1.830.0 Liabilities and equity: Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total debt Common stock (50 million shares) Retained earnings Total common equity Total liabilities and equity $ 324.0 216.0 201.0 $ 741.0 450.0 $1,191.0 150.0 675.0 S 825.0 $2.0160 $ 270.0 180.0 155.0 $ 605.0 450.0 $1,055.0 150.0 625.0 $ 775.0 $1.830.0 5. Using percentage of sales based proforma method, construct new Income statement, Balance sheet for year 2019, and find out the AFN amount. Assume sales increase by 20% in 2019. Currently, a firm utilizes 80% of capacity of fixed asset usage for sales. Assume Interest expense and depreciation will be the same amount as 2018. (Hint: capacity sales = Sol% of capacity). Also, a firm use the same dividend payout ratio as 2018. INCOME STATEMENTS (MILLIONS OF DOLLARS) 2018 2019 Sales $3,600.0 Operating costs 3.060.0 EBITDA S 5400 Depreciation and amortization 90.0 90 Earnings before interest and taxes S 4500 Interest 65.0 65.0 Earnings before taxes $385.0 Taxes (40%) 154.0 Net income available to common stockholders S 2310 Common dividends S1815 What is the amount of additional Retained earnings for year 2019? 4 pts BALANCE SHEETS (MILLIONS OF DOLLARS) 2018 $36.0 540.0 2012 $422 $40.0 Cash and marketable securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets $1,116.0 900.0 $2.016.0 $3240 Liabilities and equity: Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total debt Common stock (50 million shares) Retained earnings Total common equity Total liabilities and equity 216.0 201.02 S 7410 450.0 $1,191.0 150.0 675.0 S 825.0 $2.016, 6. AFN = 5 pts Capacity sales =