Answered step by step

Verified Expert Solution

Question

1 Approved Answer

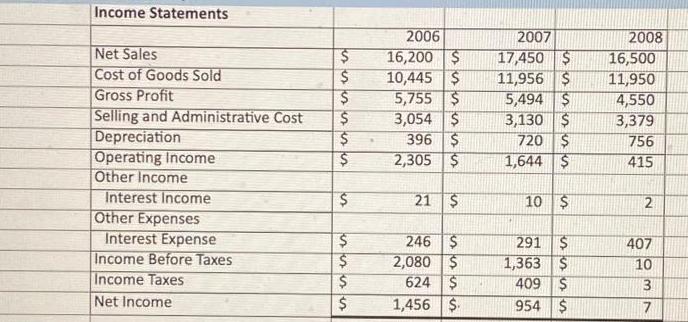

Income Statements Net Sales Cost of Goods Sold Gross Profit Selling and Administrative Cost Depreciation Operating Income Other Income Interest Income Other Expenses Interest

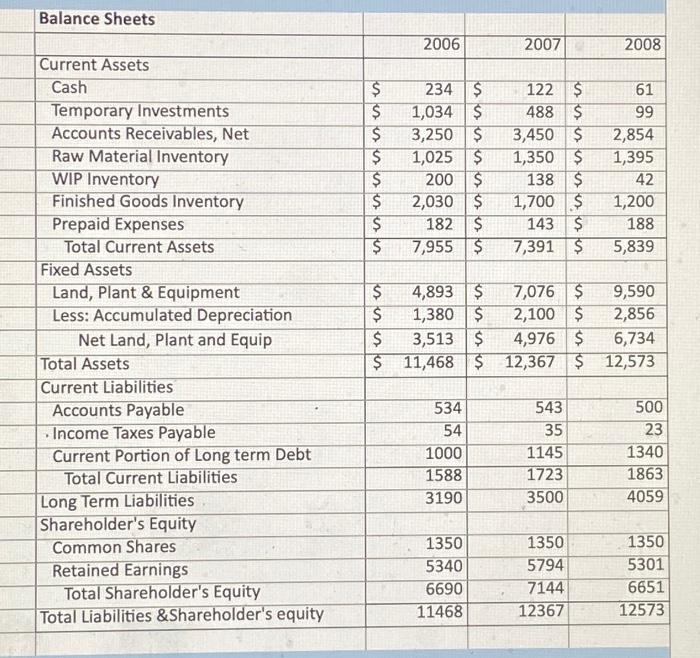

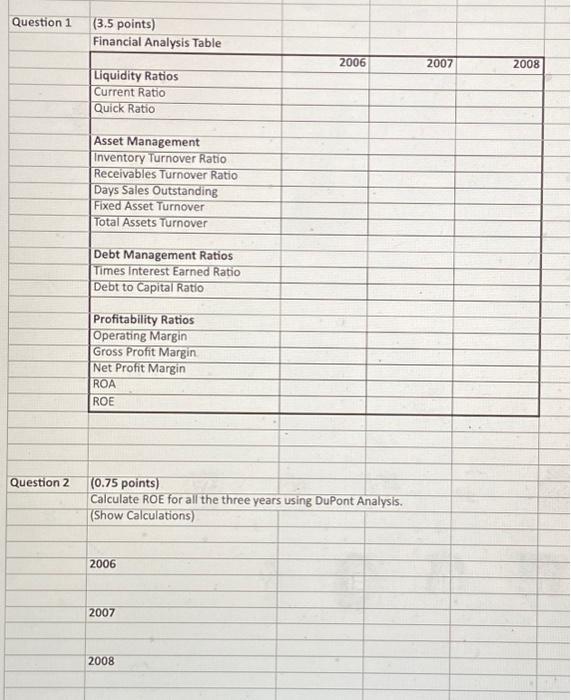

Income Statements Net Sales Cost of Goods Sold Gross Profit Selling and Administrative Cost Depreciation Operating Income Other Income Interest Income Other Expenses Interest Expense Income Before Taxes Income Taxes Net Income les es les es $ $ $ $ $ $ $ is er es S $ $ $ $ W 2006 16,200 $ 10,445 $ 5,755 $ 3,054 $ 396 $ 2,305 $ 21 $ 246 $ 2,080 $ 624 $ 1,456 $ 2007 17,450 $ 11,956 $ 5,494 $ 3,130 $ 720 $ 1,644 $ 10 $ 291 $ 1,363 $ 409 $ 954 $ 2008 16,500 11,950 4,550 3,379 756 415 2 407 10 3 7 Balance Sheets Current Assets Cash Temporary Investments Accounts Receivables, Net Raw Material Inventory WIP Inventory Finished Goods Inventory Prepaid Expenses Total Current Assets Fixed Assets Land, Plant & Equipment Less: Accumulated Depreciation Net Land, Plant and Equip Total Assets Current Liabilities Accounts Payable . Income Taxes Payable Current Portion of Long term Debt Total Current Liabilities Long Term Liabilities Shareholder's Equity Common Shares Retained Earnings Total Shareholder's Equity Total Liabilities & Shareholder's equity $ $ $ $ $ $ $ $ $ $ $ $ 2006 234 $ 122 $ 1,034 $ 488 $ 3,250 $ 3,450 $ 1,025 $ 1,350 $ 200 $ 138 $ 2,030 $ 1,700 $ 182 $ 7,955 $ 534 54 2007 1000 1588 3190 1350 5340 6690 11468 143 $ 7,391 $ 4,893 $ 7,076 $ 9,590 1,380 $ 2,100 $ 2,856 3,513 $ 4,976 $ 6,734 11,468 $ 12,367 $ 12,573 543 35 1145 1723 3500 2008 1350 5794 7144 12367 61 99 2,854 1,395 42 1,200 188 5,839 500 23 1340 1863 4059 1350 5301 6651 12573 Question 1 Question 2 (3.5 points) Financial Analysis Table Liquidity Ratios Current Ratio Quick Ratio Asset Management Inventory Turnover Ratio Receivables Turnover Ratio Days Sales Outstanding Fixed Asset Turnover Total Assets Turnover Debt Management Ratios Times Interest Earned Ratio Debt to Capital Ratio Profitability Ratios Operating Margin Gross Profit Margin Net Profit Margin ROA ROE (0.75 points) Calculate ROE for all the three years using DuPont Analysis. (Show Calculations) 2006 2007 2006 2008 2007 2008 Question 3 (0.75 points) Prepare Common Size Income Statement and Balance Sheet for the Year 2008

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 1 To calculate the financial ratios for the years 2006 2007 and 2008 we need to use the financial data provided in the question Here are the calculations for each ratio Liquidity Ratios Curre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started