Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Income Tax Act 1967 stated about a foreign worker or person entitled to have tax resident status in Malaysia under section 7. Several clauses

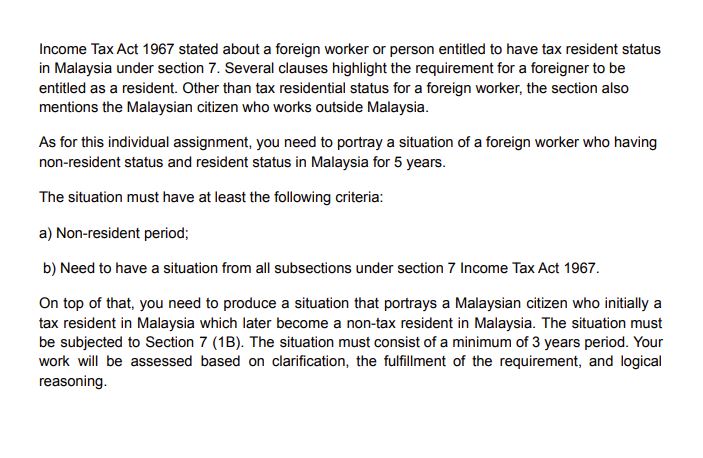

Income Tax Act 1967 stated about a foreign worker or person entitled to have tax resident status in Malaysia under section 7. Several clauses highlight the requirement for a foreigner to be entitled as a resident. Other than tax residential status for a foreign worker, the section also mentions the Malaysian citizen who works outside Malaysia. As for this individual assignment, you need to portray a situation of a foreign worker who having non-resident status and resident status in Malaysia for 5 years. The situation must have at least the following criteria: a) Non-resident period; b) Need to have a situation from all subsections under section 7 Income Tax Act 1967. On top of that, you need to produce a situation that portrays a Malaysian citizen who initially a tax resident in Malaysia which later become a non-tax resident in Malaysia. The situation must be subjected to Section 7 (1B). The situation must consist of a minimum of 3 years period. Your work will be assessed based on clarification, the fulfillment of the requirement, and logical reasoning.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Foreign Worker Scenario NonResident Period Years 12 MrTanakaa Japanese nationalarrives in Malaysia on a 2year work visa to work as an engineer for a m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started