Answered step by step

Verified Expert Solution

Question

1 Approved Answer

INCOME TAX i. Calculate Rashmika's minimum net income for tax purposes in accordance with the ordering provisions found in section 3 of the Income Tax

INCOME TAX

i. Calculate Rashmika's minimum net income for tax purposes in accordance with the ordering provisions found in section 3 of the Income Tax Act, and her minimum taxable income for the 2023 taxation year.

ii. Based on your answer to part (a), calculate Rashmika's minimum federal income tax for the 2023 taxation year. Show all calculations.

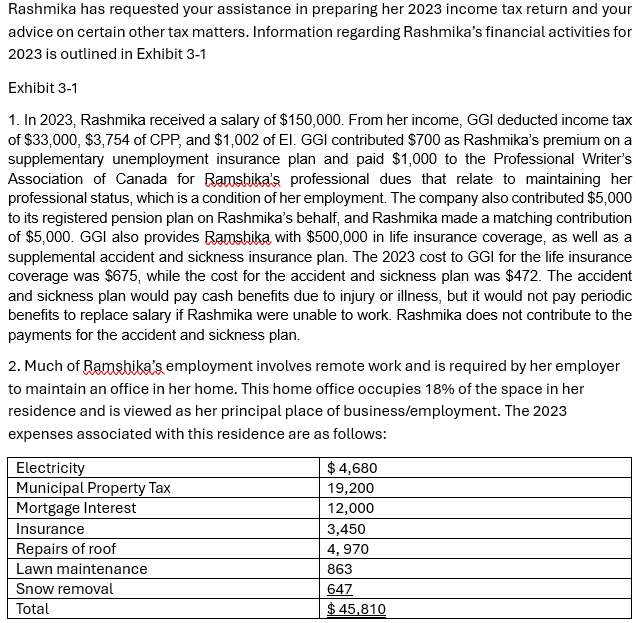

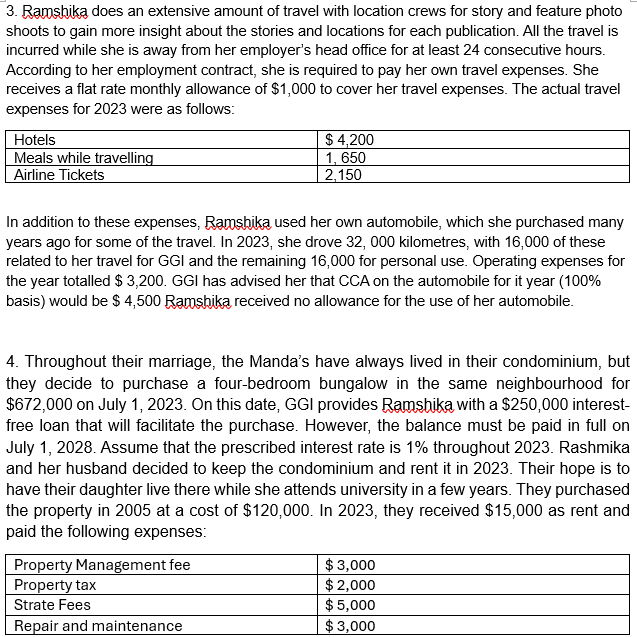

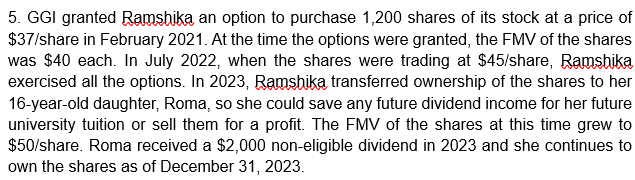

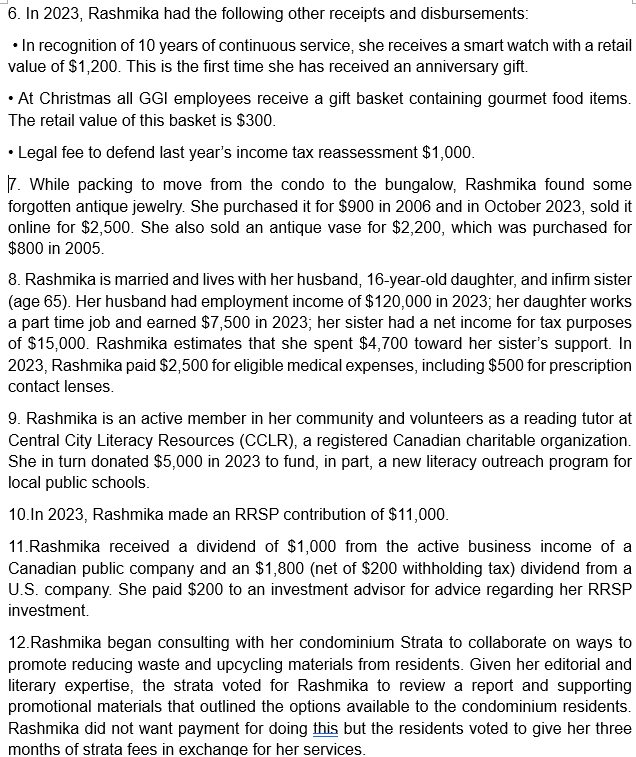

Rashmika has requested your assistance in preparing her 2023 income tax return and your advice on certain other tax matters. Information regarding Rashmika's financial activities for 2023 is outlined in Exhibit 3-1 Exhibit 3-1 1. In 2023, Rashmika received a salary of $150,000. From her income, GGI deducted income tax of $33,000, $3,754 of CPP, and $1,002 of EI. GGI contributed $700 as Rashmika's premium on a supplementary unemployment insurance plan and paid $1,000 to the Professional Writer's Association of Canada for Ramshika's professional dues that relate to maintaining her professional status, which is a condition of her employment. The company also contributed $5,000 to its registered pension plan on Rashmika's behalf, and Rashmika made a matching contribution of $5,000. GGI also provides Ramshika with $500,000 in life insurance coverage, as well as a supplemental accident and sickness insurance plan. The 2023 cost to GGI for the life insurance coverage was $675, while the cost for the accident and sickness plan was $472. The accident and sickness plan would pay cash benefits due to injury or illness, but it would not pay periodic benefits to replace salary if Rashmika were unable to work. Rashmika does not contribute to the payments for the accident and sickness plan. 2. Much of Ramshika's employment involves remote work and is required by her employer to maintain an office in her home. This home office occupies 18% of the space in her residence and is viewed as her principal place of business/employment. The 2023 expenses associated with this residence are as follows: Electricity Municipal Property Tax Mortgage Interest Insurance Repairs of roof Lawn maintenance Snow removal Total $4,680 19,200 12,000 3,450 4,970 863 647 $45,810

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate Rashmikas minimum net income for tax purposes we need to calculate her total i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started