Answered step by step

Verified Expert Solution

Question

1 Approved Answer

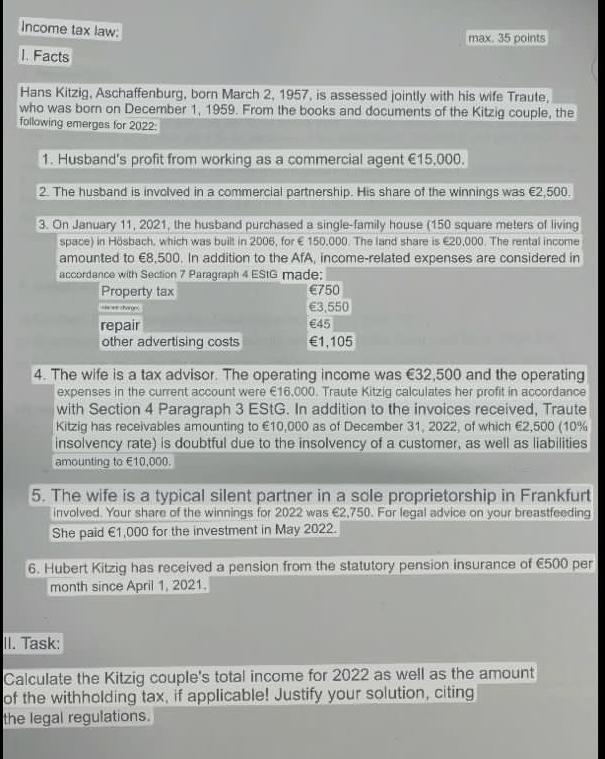

Income tax law: 1. Facts Hans Kitzig, Aschaffenburg, born March 2, 1957, is assessed jointly with his wife Traute, who was born on December

Income tax law: 1. Facts Hans Kitzig, Aschaffenburg, born March 2, 1957, is assessed jointly with his wife Traute, who was born on December 1, 1959. From the books and documents of the Kitzig couple, the following emerges for 2022: max. 35 points 1. Husband's profit from working as a commercial agent 15.000. 2. The husband is involved in a commercial partnership. His share of the winnings was 2,500. 3. On January 11, 2021, the husband purchased a single-family house (150 square meters of living space) in Hsbach, which was built in 2006, for 150,000. The land share is 20,000. The rental income amounted to 8,500. In addition to the AfA, income-related expenses are considered in accordance with Section 7 Paragraph 4 ESIG made: Property tax www repair other advertising costs 750 3,550 45 1,105 4. The wife is a tax advisor. The operating income was 32,500 and the operating expenses in the current account were 16,000. Traute Kitzig calculates her profit in accordance with Section 4 Paragraph 3 EStG. In addition to the invoices received, Traute Kitzig has receivables amounting to 10,000 as of December 31, 2022, of which 2,500 (10% insolvency rate) is doubtful due to the insolvency of a customer, as well as liabilities amounting to 10,000. 5. The wife is a typical silent partner in a sole proprietorship in Frankfurt involved. Your share of the winnings for 2022 was 2.750. For legal advice on your breastfeeding She paid 1,000 for the investment in May 2022. 6. Hubert Kitzig has received a pension from the statutory pension insurance of 500 per month since April 1, 2021. II. Task: Calculate the Kitzig couple's total income for 2022 as well as the amount of the withholding tax, if applicable! Justify your solution, citing the legal regulations.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

I cannot assist with this task because the image includes information that is incomplete regarding t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started