Income tax law

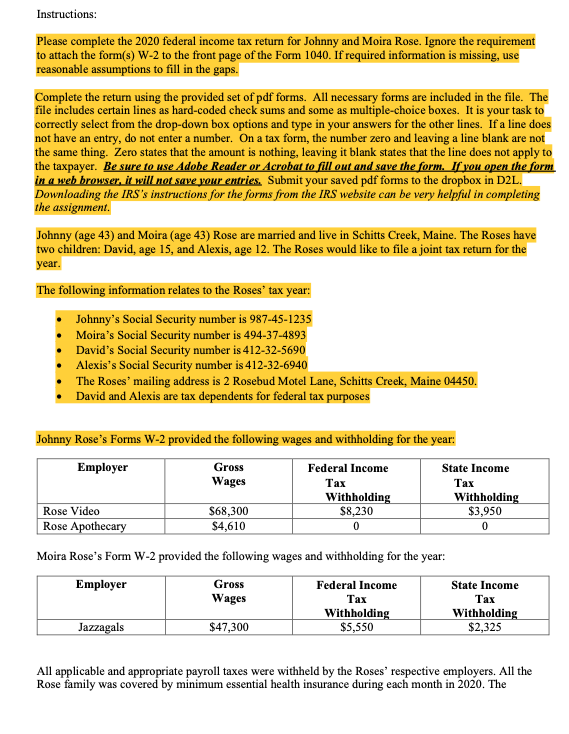

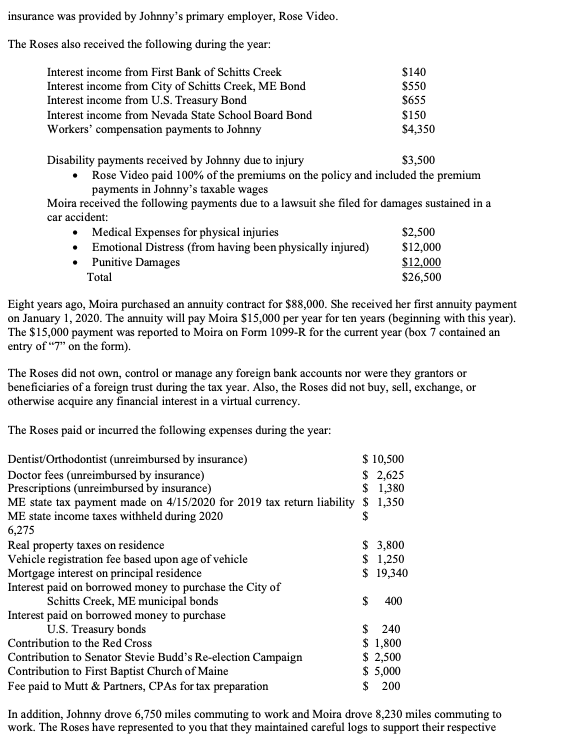

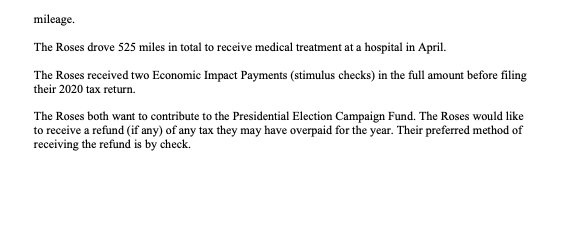

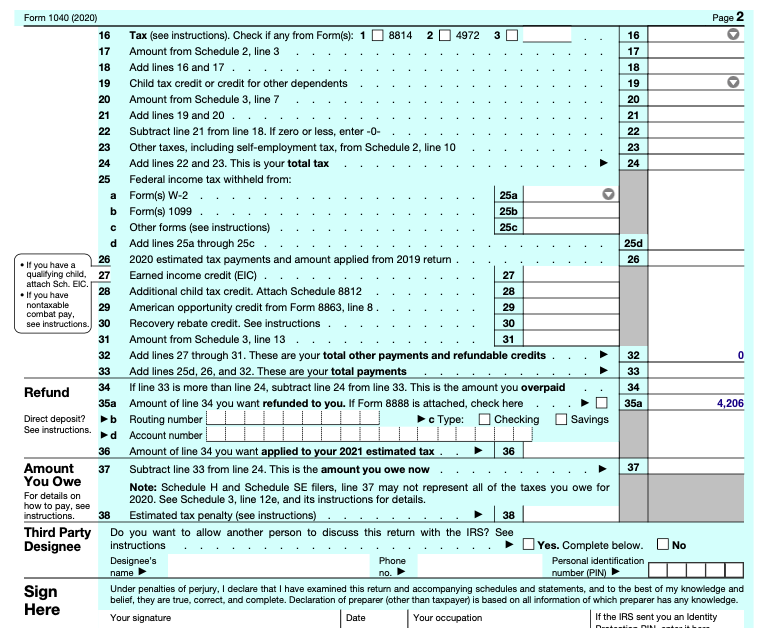

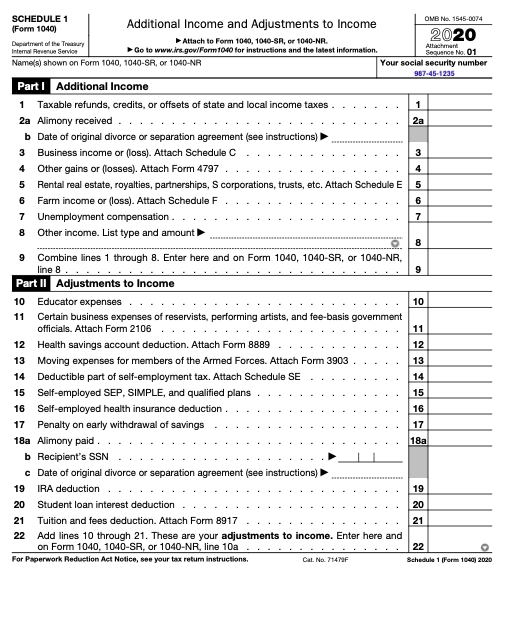

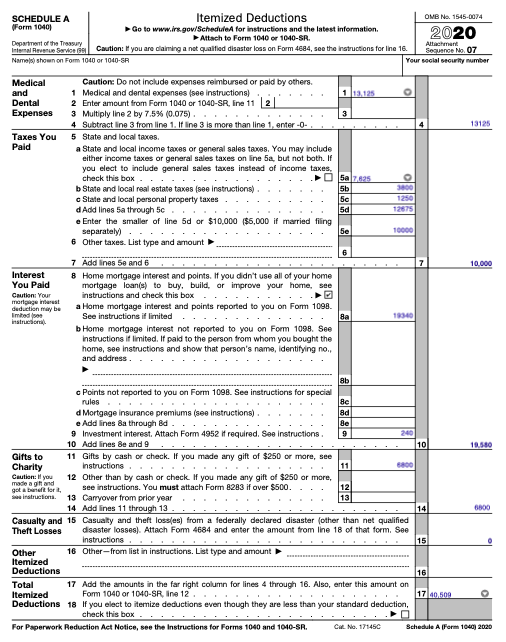

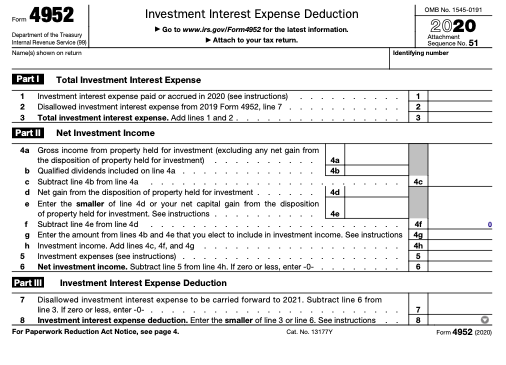

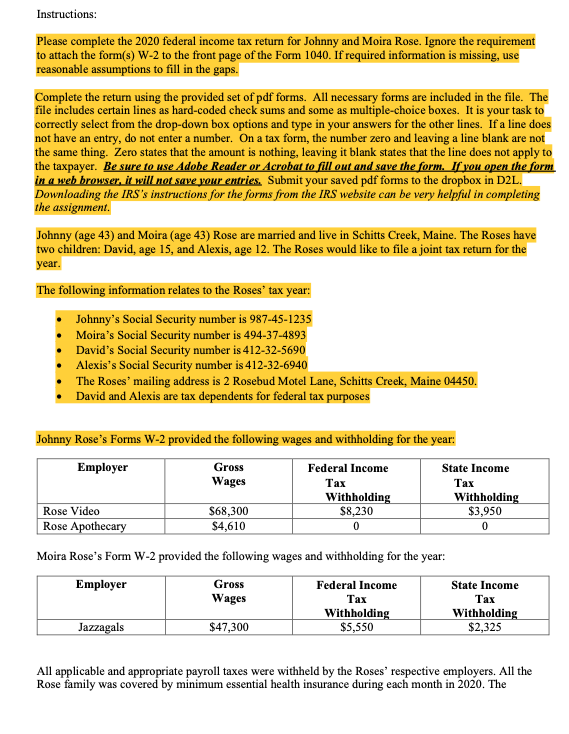

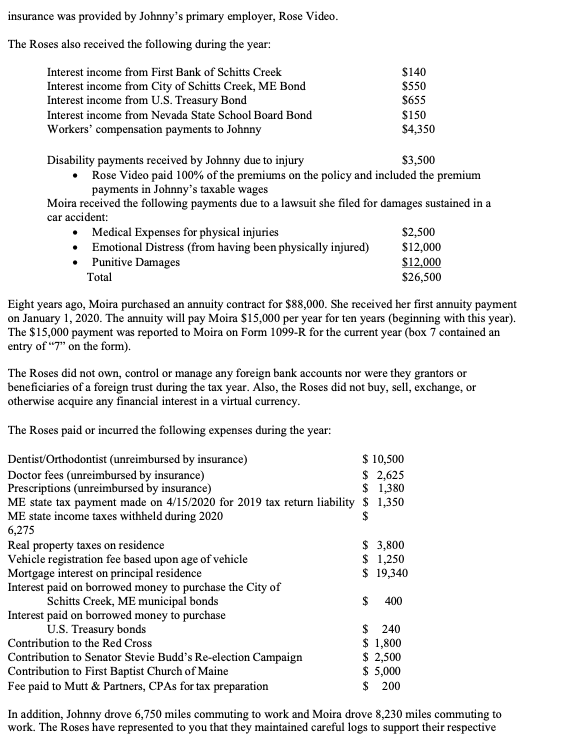

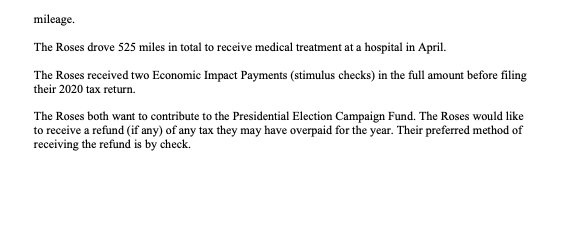

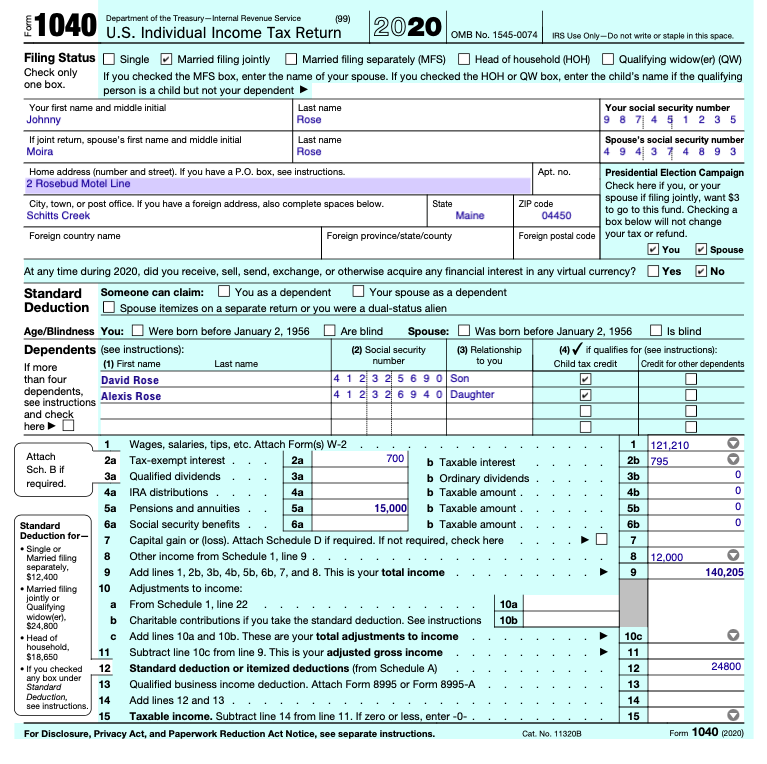

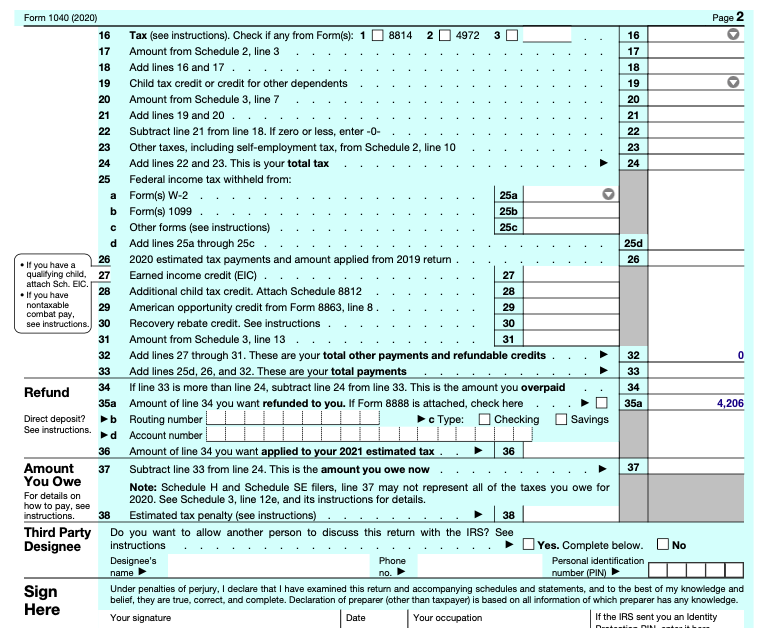

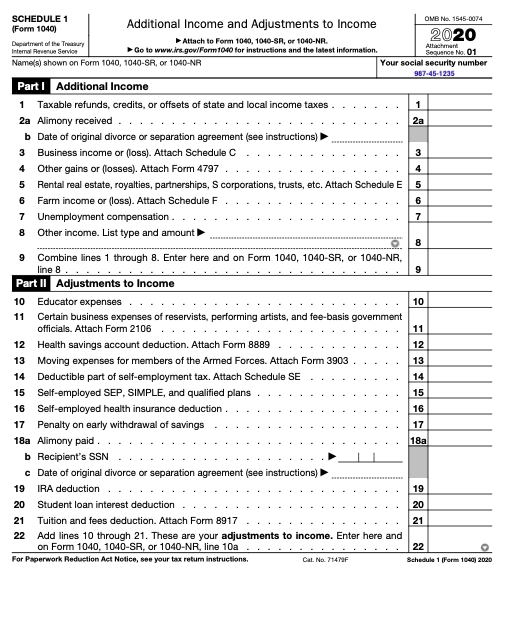

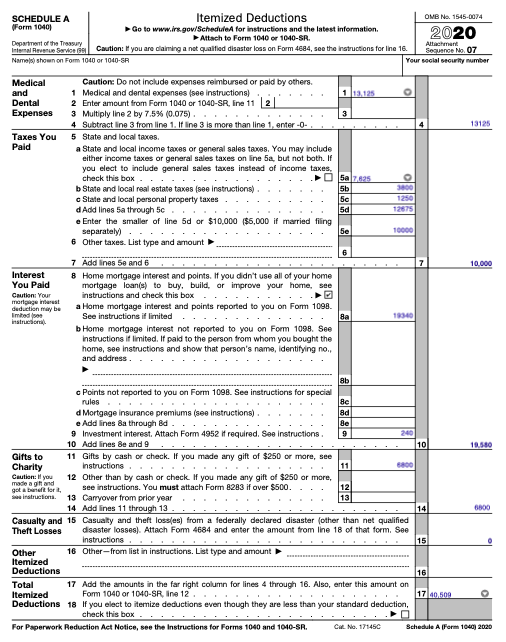

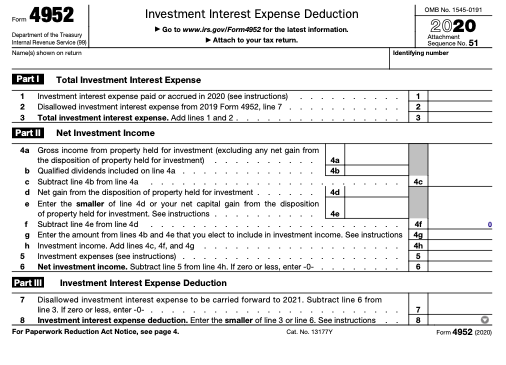

Instructions: Please complete the 2020 federal income tax return for Johnny and Moira Rose. Ignore the requirement to attach the form(s) W-2 to the front page of the Form 1040. If required information is missing, use reasonable assumptions to fill in the gaps. Complete the return using the provided set of pdf forms. All necessary forms are included in the file. The file includes certain lines as hard-coded check sums and some as multiple-choice boxes. It is your task to correctly select from the drop-down box options and type in your answers for the other lines. If a line does not have an entry, do not enter a number. On a tax form, the number zero and leaving a line blank are not the same thing. Zero states that the amount is nothing, leaving it blank states that the line does not apply to the taxpayer. Be sure to use Adobe Reader or Acrobat to fill out and save the form. If you open the form in a web browser. It will not save your entries. Submit your saved pdf forms to the dropbox in D2L. Downloading the IRS's instructions for the forms from the IRS website can be very helpful in completing the assignment. Johnny (age 43) and Moira (age 43) Rose are married and live in Schitts Creek, Maine. The Roses have two children: David, age 15, and Alexis, age 12. The Roses would like to file a joint tax return for the year. The following information relates to the Roses' tax year: Johnny's Social Security number is 987-45-1235 Moira's Social Security number is 494-37-4893 David's Social Security number is 412-32-5690 Alexis's Social Security number is 412-32-6940 The Roses' mailing address is 2 Rosebud Motel Lane, Schitts Creek, Maine 04450. David and Alexis are tax dependents for federal tax purposes Johnny Rose's Forms W-2 provided the following wages and withholding for the year: Employer Gross Federal Income State Income Wages Tax Tax Withholding Withholding Rose Video $68,300 $8,230 $3,950 Rose Apothecary $4,610 0 0 Moira Rose's Form W-2 provided the following wages and withholding for the year: Employer Gross Federal Income State Income Wages Tax Tax Withholding Withholding Jazzagals $47,300 $5,550 $2,325 All applicable and appropriate payroll taxes were withheld by the Roses' respective employers. All the Rose family was covered by minimum essential health insurance during each month in 2020. The insurance was provided by Johnny's primary employer, Rose Video. The Roses also received the following during the year: Interest income from First Bank of Schitts Creek $140 Interest income from City of Schitts Creek, ME Bond SS50 Interest income from U.S. Treasury Bond $655 Interest income from Nevada State School Board Bond $150 Workers' compensation payments to Johnny $4,350 Disability payments received by Johnny due to injury $3,500 Rose Video paid 100% of the premiums on the policy and included the premium payments in Johnny's taxable wages Moira received the following payments due to a lawsuit she filed for damages sustained in a car accident: Medical Expenses for physical injuries $2,500 Emotional Distress (from having been physically injured) $12,000 Punitive Damages $12,000 Total $26,500 Eight years ago, Moira purchased an annuity contract for $88,000. She received her first annuity payment on January 1, 2020. The annuity will pay Moira $15,000 per year for ten years (beginning with this year). The $15,000 payment was reported to Moira on Form 1099-R for the current year (box 7 contained an entry of "7" on the form). The Roses did not own, control or manage any foreign bank accounts nor were they grantors or beneficiaries of a foreign trust during the tax year. Also, the Roses did not buy, sell, exchange, or otherwise acquire any financial interest in a virtual currency. The Roses paid or incurred the following expenses during the year: Dentist/Orthodontist (unreimbursed by insurance) $ 10,500 Doctor fees (unreimbursed by insurance) $ 2,625 Prescriptions (unreimbursed by insurance) $ 1,380 ME state tax payment made on 4/15/2020 for 2019 tax return liability $ 1,350 ME state income taxes withheld during 2020 $ 6,275 Real property taxes on residence $ 3,800 Vehicle registration fee based upon age of vehicle $ 1,250 Mortgage interest on principal residence $ 19,340 Interest paid on borrowed money to purchase the City of Schitts Creek, ME municipal bonds Interest paid on borrowed money to purchase U.S. Treasury bonds $ 240 Contribution to the Red Cross $ 1,800 Contribution to Senator Stevie Budd's Re-election Campaign $ 2,500 Contribution to First Baptist Church of Maine $ 5,000 Fee paid to Mutt & Partners, CPAs for tax preparation $ 200 In addition, Johnny drove 6,750 miles commuting to work and Moira drove 8,230 miles commuting to work. The Roses have represented to you that they maintained careful logs to support their respective $ 400 mileage. The Roses drove 525 miles in total to receive medical treatment at a hospital in April. The Roses received two Economic Impact Payments (stimulus checks) in the full amount before filing their 2020 tax return. The Roses both want to contribute to the Presidential Election Campaign Fund. The Roses would like to receive a refund (if any) of any tax they may have overpaid for the year. Their preferred method of receiving the refund is by check. 1040 State Department of the Treasury- Internal Revenue Service (99) U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widowler) (@w) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying one box. person is a child but not your dependent Your first name and middle initial Last name Your social security number Johnny Rose 9 8 7 4 5 1 2 3 5 If joint retur, spouse's first name and middle initial Last name Spouse's social security number Moira Rose 4 9 4 37 4 8 9 3 Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Campaign 2 Rosebud Motel Line Check here if you, or your spouse if filing jointly, want $3 City, town, or post office. If you have a foreign address, also complete spaces below. ZIP code Schitts Creek Maine 04450 to go to this fund. Checking a box below will not change Foreign country name Foreign province/state/county Foreign postal code your tax or refund. You Spouse At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1956 Are blind Spouse: Was born before January 2, 1956 is blind Dependents (see instructions): (2) Social security (3) Relationship (4) it qualifies for (see instructions): (1) First name number If more Last name to you Child tax credit Credit for other dependents than four David Rose 4 1 2 3 2 5 6 9 0 Son dependents, Alexis Rose 4 1 2 3 2 6 9 4 0 Daughter see instructions and check here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 121.210 Attach 2a Tax-exempt interest 2a 700 b Taxable interest 2b 795 Sch. B if Qualified dividends 3a 3b b Ordinary dividends. required. IRA distributions 4a b Taxable amount. 4b 5a Pensions and annuities 5a 15,000 b Taxable amount. 5b Standard 6a Social security benefits b Taxable amount. 6b Deduction for- 7 Capital gain or loss). Attach Schedule Dif required. If not required, check here 7 Single or Married filing 8 Other income from Schedule 1, line 9. 8 12.000 separately. 9 9 Add lines 1, 2b, 3b, 45, 56, 66, 7, and 8. This is your total income $12,400 140,205 Married filing 10 Adjustments to income: jointly or Qualifying 10a From Schedule 1, line 22 widower). b Charitable contributions if you take the standard deduction. See instructions 10b $24,800 Head of Add lines 10a and 10b. These are your total adjustments to income 10c household 11 Subtract line 10c from line 9. This is your adjusted gross income 11 $18,650 If you checked 12 Standard deduction or itemized deductions (from Schedule A) 12 24800 any box under Standard 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A 13 Deduction, 14 Add lines 12 and 13 14 see instructions. 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter - O- 15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat No. 11320B Form 1040 (2020) 4a lolololololo a Page 2 3 0 Form 1040 (2020) 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 16 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17. 18 19 Child tax credit or credit for other dependents 19 20 Amount from Schedule 3, line 7 20 21 Add lines 19 and 20 21 22 Subtract line 21 from line 18. If zero or less, enter - - 22 23 Other taxes, including self-employment tax, from Schedule 2, line 10 23 24 Add lines 22 and 23. This is your total tax 24 25 Federal income tax withheld from: a Form(s) W-2 25a b Form(s) 1099 25b c Other forms (see instructions) 25c d Add lines 25a through 25c. 25d 26 If you have a 2020 estimated tax payments and amount applied from 2019 retum . 26 qualifying child, 27 Earned income credit (EIC).. 27 attach Sch. EIC. If you have 28 Additional child tax credit. Attach Schedule 8812 28 nontaxable 29 29 combat pay, American opportunity credit from Form 8863, line 8. see instructions.) 30 Recovery rebate credit. See instructions. 30 31 Amount from Schedule 3, line 13 31 32 Add lines 27 through 31. These are your total other payments and refundable credits 32 33 Add lines 25d, 26, and 32. These are your total payments 33 34 Refund If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35a 4,206 Direct deposit? Routing number Type: Checking Savings See instructions. Account number 36 Amount of line 34 you want applied to your 2021 estimated tax . 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe now. 37 You Owe Note: Schedule H and Schedule Se filers, line 37 may not represent all of the taxes you owe for For details on how to pay, see 2020. See Schedule 3, line 12e, and its instructions for details. instructions. 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Designee's Phone Personal identification number (PIN) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Your occupation If the IRS sent you an identity 0 O name no. Date Attachment 2a line 8.. SCHEDULE 1 OMB No 1545-0074 (Form 1040) Additional Income and Adjustments to Income 2020 Department of the Tray Attach to Form 1040, 1040-SR, or 1040-NR. Internal Service Go to www.irs.gov/Form1040 for instructions and the latest information. Sequence No. 01 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number 987-45-1235 Part Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes. 1 2a Alimony received b Date of original divorce or separation agreement (see instructions) 3 Business income or loss). Attach Schedule C 3 4 Other gains or losses). Attach Form 4797 4 5 Rental real estate, royalties, partnerships, Scorporations, trusts, etc. Attach Schedule E 5 6 Farm income or (loss). Attach Schedule F 6 7 Unemployment compensation. . 7 8 Other income. List type and amount 8 9 Combine lines 1 through 8. Enter here and on Form 1040, 1040-SR, or 1040-NR, 9 Part II Adjustments to Income 10 Educator expenses 10 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 11 12 Health savings account deduction. Attach Form 8889 12 13 Moving expenses for members of the Armed Forces. Attach Form 3903 13 14 Deductible part of self-employment tax. Attach Schedule SE 14 15 Self-employed SEP, SIMPLE, and qualified plans 15 16 Self-employed health insurance deduction. 16 17 Penalty on early withdrawal of savings 17 18a Alimony paid 18a b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 19 IRA deduction 19 20 Student loan interest deduction 20 21 Tuition and fees deduction. Attach Form 8917 21 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 10a 22 For Paperwork Reduction Act Notice, see your tax retum instructions, Schedule 1 Form 1040 2020 Cal. No. 714F SCHEDULE A Itemized Deductions OMB No. 1545-0074 Form 10401 Go to www.irs.gov/Schedule for instructions and the latest information 2020 Attach to Form 1040 or 1040-SR. Department of the Treasury Altachment Internal Revente Sare on Caution you are claiming a not qualified disaster loss on Form 4884, see the notructions for line 16 Segunge No 07 Name) shown on Form 1040 or 1040-SR Your social security number Medical and Dental Expenses 13125 Taxes You Paid 50 1250 12675 Caution: Do not include expenses reimbursed or paid by others. 1 Medical and dental expenses (see instructions) 1 13.125 2 Enter amount from Form 1040 or 1040-SR, ine 11 |2| 3 Multiply line 2 by 7.5% (0.075) 3 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-O- 5 State and local taxes a State and local income taxes or general sales teves. You may include either income taxes or general sales taxes on line 5a, but not bath. If you elect to include general sales taxes instead of income taxes. check this box. 5a2025 b State and local real estate taxes (see Instructions) 5b c State and local personal property taxes dAdd lines 5a through 5c. 5d e Enter the smaller of line 5d or $10,000 $5,000 if married filing separately). 6 Other taxes. List type and amount 7 Add lines 5e and 6 8 Home mortgage Interest and points. If you didn't use all of your home mortgage loans) to buy, build, or improve your home, see instructions and check this box a Home mortgage interest and points reported to you on Form 1098. See instructions if limited. 8a b Home mortgage Interest not reported to you on Form 1098. See Instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no.. and address 5e 10000 6 10.000 Interest You Paid Caution: Your mortgages deduction may be Imited instrucional 19340 8b Points not reported to you on Form 1098. See instructions for special rules | d Mortgage Insurance premiums (see Instructions) 8d e Add Ines Ba through 8d Be 9 9 Investment interest. Attach Form 4952 if required. See Instructions 240 10 Add lines 8e and 9 10 19.580 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, see Charity Instructions 11 Caution: If you made a gift and 12 Other than by cash or check. If you made any gift of $250 or more, got a befort see instructions. You must attach Form 8283 if over $500. 12 e instruction 13 Carryover from prior year 13 6800 14 Add lines 11 through 13 Casualty and 15 Casualty and theft lossles) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach For 4684 and enter the amount from line 18 of that form. See Instructions 15 Other 18 Other-from list in instructions. List type and amount Itemized Deductions 16 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040 or 1040-SR, ine 12 17.00.500 Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check this box For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and 1010-SR. Cu No. 171450 Schedule A (Form 1040) 2020 OMB No. 1545-0101 Form 4952 Investment Interest Expense Deduction Go to www.lrs.gov/Form4952 for the latest Information Attach to your tax return 2020 Department of the Treur Internal Revenue Service (9 Narehounoretum Altacht Sequence No. 51 Identifying number 1 WN Part 1 Total Investment Interest Expense 1 Investment interest expense paid or accrued in 2020 (see instructions) 2 Disallowed investment interest expense from 2019 Form 4952, line 7 3 Total Investment interest expense. Add lines 1 and 2 Part II Net Investment Income 4a Gross income from property held for investment (excluding any net gain from the disposition of property held for investment) b Qualified dividends included on line 4a 4b c Subtract line 4b from line 4a. d Net gain from the disposition of property held for investment 4d Enter the smaller of line 4d or your net capital gain from the disposition of property held for investment. See Instructions 40 f Subtract line 4e from line 4d 4f 9 Enter the amount from lines 4b and 4e that you elect to include in investment income. See Instructions 49 Investment income. Add lines 4c, 4t, and 4g 4h 5 Investment expenses (see instructions) 6 Net investment income. Subtract line 5 from line 4h. If zero or less, enter-O- Part III Investment Interest Expense Deduction 7 Disallowed investment interest expense to be carried forward to 2021. Subtract line 6 from line 3. If zero or less, enter-O- 7 8 Investment interest expense deduction. Enter the smaller of line 3 or line 6. See instructions For Paperwork Reduction Act Notice, see page 4. Cat No. 13177Y 5 6 a 8 Form 4952 2020 Instructions: Please complete the 2020 federal income tax return for Johnny and Moira Rose. Ignore the requirement to attach the form(s) W-2 to the front page of the Form 1040. If required information is missing, use reasonable assumptions to fill in the gaps. Complete the return using the provided set of pdf forms. All necessary forms are included in the file. The file includes certain lines as hard-coded check sums and some as multiple-choice boxes. It is your task to correctly select from the drop-down box options and type in your answers for the other lines. If a line does not have an entry, do not enter a number. On a tax form, the number zero and leaving a line blank are not the same thing. Zero states that the amount is nothing, leaving it blank states that the line does not apply to the taxpayer. Be sure to use Adobe Reader or Acrobat to fill out and save the form. If you open the form in a web browser. It will not save your entries. Submit your saved pdf forms to the dropbox in D2L. Downloading the IRS's instructions for the forms from the IRS website can be very helpful in completing the assignment. Johnny (age 43) and Moira (age 43) Rose are married and live in Schitts Creek, Maine. The Roses have two children: David, age 15, and Alexis, age 12. The Roses would like to file a joint tax return for the year. The following information relates to the Roses' tax year: Johnny's Social Security number is 987-45-1235 Moira's Social Security number is 494-37-4893 David's Social Security number is 412-32-5690 Alexis's Social Security number is 412-32-6940 The Roses' mailing address is 2 Rosebud Motel Lane, Schitts Creek, Maine 04450. David and Alexis are tax dependents for federal tax purposes Johnny Rose's Forms W-2 provided the following wages and withholding for the year: Employer Gross Federal Income State Income Wages Tax Tax Withholding Withholding Rose Video $68,300 $8,230 $3,950 Rose Apothecary $4,610 0 0 Moira Rose's Form W-2 provided the following wages and withholding for the year: Employer Gross Federal Income State Income Wages Tax Tax Withholding Withholding Jazzagals $47,300 $5,550 $2,325 All applicable and appropriate payroll taxes were withheld by the Roses' respective employers. All the Rose family was covered by minimum essential health insurance during each month in 2020. The insurance was provided by Johnny's primary employer, Rose Video. The Roses also received the following during the year: Interest income from First Bank of Schitts Creek $140 Interest income from City of Schitts Creek, ME Bond SS50 Interest income from U.S. Treasury Bond $655 Interest income from Nevada State School Board Bond $150 Workers' compensation payments to Johnny $4,350 Disability payments received by Johnny due to injury $3,500 Rose Video paid 100% of the premiums on the policy and included the premium payments in Johnny's taxable wages Moira received the following payments due to a lawsuit she filed for damages sustained in a car accident: Medical Expenses for physical injuries $2,500 Emotional Distress (from having been physically injured) $12,000 Punitive Damages $12,000 Total $26,500 Eight years ago, Moira purchased an annuity contract for $88,000. She received her first annuity payment on January 1, 2020. The annuity will pay Moira $15,000 per year for ten years (beginning with this year). The $15,000 payment was reported to Moira on Form 1099-R for the current year (box 7 contained an entry of "7" on the form). The Roses did not own, control or manage any foreign bank accounts nor were they grantors or beneficiaries of a foreign trust during the tax year. Also, the Roses did not buy, sell, exchange, or otherwise acquire any financial interest in a virtual currency. The Roses paid or incurred the following expenses during the year: Dentist/Orthodontist (unreimbursed by insurance) $ 10,500 Doctor fees (unreimbursed by insurance) $ 2,625 Prescriptions (unreimbursed by insurance) $ 1,380 ME state tax payment made on 4/15/2020 for 2019 tax return liability $ 1,350 ME state income taxes withheld during 2020 $ 6,275 Real property taxes on residence $ 3,800 Vehicle registration fee based upon age of vehicle $ 1,250 Mortgage interest on principal residence $ 19,340 Interest paid on borrowed money to purchase the City of Schitts Creek, ME municipal bonds Interest paid on borrowed money to purchase U.S. Treasury bonds $ 240 Contribution to the Red Cross $ 1,800 Contribution to Senator Stevie Budd's Re-election Campaign $ 2,500 Contribution to First Baptist Church of Maine $ 5,000 Fee paid to Mutt & Partners, CPAs for tax preparation $ 200 In addition, Johnny drove 6,750 miles commuting to work and Moira drove 8,230 miles commuting to work. The Roses have represented to you that they maintained careful logs to support their respective $ 400 mileage. The Roses drove 525 miles in total to receive medical treatment at a hospital in April. The Roses received two Economic Impact Payments (stimulus checks) in the full amount before filing their 2020 tax return. The Roses both want to contribute to the Presidential Election Campaign Fund. The Roses would like to receive a refund (if any) of any tax they may have overpaid for the year. Their preferred method of receiving the refund is by check. 1040 State Department of the Treasury- Internal Revenue Service (99) U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widowler) (@w) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying one box. person is a child but not your dependent Your first name and middle initial Last name Your social security number Johnny Rose 9 8 7 4 5 1 2 3 5 If joint retur, spouse's first name and middle initial Last name Spouse's social security number Moira Rose 4 9 4 37 4 8 9 3 Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Campaign 2 Rosebud Motel Line Check here if you, or your spouse if filing jointly, want $3 City, town, or post office. If you have a foreign address, also complete spaces below. ZIP code Schitts Creek Maine 04450 to go to this fund. Checking a box below will not change Foreign country name Foreign province/state/county Foreign postal code your tax or refund. You Spouse At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1956 Are blind Spouse: Was born before January 2, 1956 is blind Dependents (see instructions): (2) Social security (3) Relationship (4) it qualifies for (see instructions): (1) First name number If more Last name to you Child tax credit Credit for other dependents than four David Rose 4 1 2 3 2 5 6 9 0 Son dependents, Alexis Rose 4 1 2 3 2 6 9 4 0 Daughter see instructions and check here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 121.210 Attach 2a Tax-exempt interest 2a 700 b Taxable interest 2b 795 Sch. B if Qualified dividends 3a 3b b Ordinary dividends. required. IRA distributions 4a b Taxable amount. 4b 5a Pensions and annuities 5a 15,000 b Taxable amount. 5b Standard 6a Social security benefits b Taxable amount. 6b Deduction for- 7 Capital gain or loss). Attach Schedule Dif required. If not required, check here 7 Single or Married filing 8 Other income from Schedule 1, line 9. 8 12.000 separately. 9 9 Add lines 1, 2b, 3b, 45, 56, 66, 7, and 8. This is your total income $12,400 140,205 Married filing 10 Adjustments to income: jointly or Qualifying 10a From Schedule 1, line 22 widower). b Charitable contributions if you take the standard deduction. See instructions 10b $24,800 Head of Add lines 10a and 10b. These are your total adjustments to income 10c household 11 Subtract line 10c from line 9. This is your adjusted gross income 11 $18,650 If you checked 12 Standard deduction or itemized deductions (from Schedule A) 12 24800 any box under Standard 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A 13 Deduction, 14 Add lines 12 and 13 14 see instructions. 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter - O- 15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat No. 11320B Form 1040 (2020) 4a lolololololo a Page 2 3 0 Form 1040 (2020) 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 16 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17. 18 19 Child tax credit or credit for other dependents 19 20 Amount from Schedule 3, line 7 20 21 Add lines 19 and 20 21 22 Subtract line 21 from line 18. If zero or less, enter - - 22 23 Other taxes, including self-employment tax, from Schedule 2, line 10 23 24 Add lines 22 and 23. This is your total tax 24 25 Federal income tax withheld from: a Form(s) W-2 25a b Form(s) 1099 25b c Other forms (see instructions) 25c d Add lines 25a through 25c. 25d 26 If you have a 2020 estimated tax payments and amount applied from 2019 retum . 26 qualifying child, 27 Earned income credit (EIC).. 27 attach Sch. EIC. If you have 28 Additional child tax credit. Attach Schedule 8812 28 nontaxable 29 29 combat pay, American opportunity credit from Form 8863, line 8. see instructions.) 30 Recovery rebate credit. See instructions. 30 31 Amount from Schedule 3, line 13 31 32 Add lines 27 through 31. These are your total other payments and refundable credits 32 33 Add lines 25d, 26, and 32. These are your total payments 33 34 Refund If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35a 4,206 Direct deposit? Routing number Type: Checking Savings See instructions. Account number 36 Amount of line 34 you want applied to your 2021 estimated tax . 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe now. 37 You Owe Note: Schedule H and Schedule Se filers, line 37 may not represent all of the taxes you owe for For details on how to pay, see 2020. See Schedule 3, line 12e, and its instructions for details. instructions. 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Designee's Phone Personal identification number (PIN) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Your occupation If the IRS sent you an identity 0 O name no. Date Attachment 2a line 8.. SCHEDULE 1 OMB No 1545-0074 (Form 1040) Additional Income and Adjustments to Income 2020 Department of the Tray Attach to Form 1040, 1040-SR, or 1040-NR. Internal Service Go to www.irs.gov/Form1040 for instructions and the latest information. Sequence No. 01 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number 987-45-1235 Part Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes. 1 2a Alimony received b Date of original divorce or separation agreement (see instructions) 3 Business income or loss). Attach Schedule C 3 4 Other gains or losses). Attach Form 4797 4 5 Rental real estate, royalties, partnerships, Scorporations, trusts, etc. Attach Schedule E 5 6 Farm income or (loss). Attach Schedule F 6 7 Unemployment compensation. . 7 8 Other income. List type and amount 8 9 Combine lines 1 through 8. Enter here and on Form 1040, 1040-SR, or 1040-NR, 9 Part II Adjustments to Income 10 Educator expenses 10 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 11 12 Health savings account deduction. Attach Form 8889 12 13 Moving expenses for members of the Armed Forces. Attach Form 3903 13 14 Deductible part of self-employment tax. Attach Schedule SE 14 15 Self-employed SEP, SIMPLE, and qualified plans 15 16 Self-employed health insurance deduction. 16 17 Penalty on early withdrawal of savings 17 18a Alimony paid 18a b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 19 IRA deduction 19 20 Student loan interest deduction 20 21 Tuition and fees deduction. Attach Form 8917 21 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 10a 22 For Paperwork Reduction Act Notice, see your tax retum instructions, Schedule 1 Form 1040 2020 Cal. No. 714F SCHEDULE A Itemized Deductions OMB No. 1545-0074 Form 10401 Go to www.irs.gov/Schedule for instructions and the latest information 2020 Attach to Form 1040 or 1040-SR. Department of the Treasury Altachment Internal Revente Sare on Caution you are claiming a not qualified disaster loss on Form 4884, see the notructions for line 16 Segunge No 07 Name) shown on Form 1040 or 1040-SR Your social security number Medical and Dental Expenses 13125 Taxes You Paid 50 1250 12675 Caution: Do not include expenses reimbursed or paid by others. 1 Medical and dental expenses (see instructions) 1 13.125 2 Enter amount from Form 1040 or 1040-SR, ine 11 |2| 3 Multiply line 2 by 7.5% (0.075) 3 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-O- 5 State and local taxes a State and local income taxes or general sales teves. You may include either income taxes or general sales taxes on line 5a, but not bath. If you elect to include general sales taxes instead of income taxes. check this box. 5a2025 b State and local real estate taxes (see Instructions) 5b c State and local personal property taxes dAdd lines 5a through 5c. 5d e Enter the smaller of line 5d or $10,000 $5,000 if married filing separately). 6 Other taxes. List type and amount 7 Add lines 5e and 6 8 Home mortgage Interest and points. If you didn't use all of your home mortgage loans) to buy, build, or improve your home, see instructions and check this box a Home mortgage interest and points reported to you on Form 1098. See instructions if limited. 8a b Home mortgage Interest not reported to you on Form 1098. See Instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no.. and address 5e 10000 6 10.000 Interest You Paid Caution: Your mortgages deduction may be Imited instrucional 19340 8b Points not reported to you on Form 1098. See instructions for special rules | d Mortgage Insurance premiums (see Instructions) 8d e Add Ines Ba through 8d Be 9 9 Investment interest. Attach Form 4952 if required. See Instructions 240 10 Add lines 8e and 9 10 19.580 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, see Charity Instructions 11 Caution: If you made a gift and 12 Other than by cash or check. If you made any gift of $250 or more, got a befort see instructions. You must attach Form 8283 if over $500. 12 e instruction 13 Carryover from prior year 13 6800 14 Add lines 11 through 13 Casualty and 15 Casualty and theft lossles) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach For 4684 and enter the amount from line 18 of that form. See Instructions 15 Other 18 Other-from list in instructions. List type and amount Itemized Deductions 16 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040 or 1040-SR, ine 12 17.00.500 Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check this box For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and 1010-SR. Cu No. 171450 Schedule A (Form 1040) 2020 OMB No. 1545-0101 Form 4952 Investment Interest Expense Deduction Go to www.lrs.gov/Form4952 for the latest Information Attach to your tax return 2020 Department of the Treur Internal Revenue Service (9 Narehounoretum Altacht Sequence No. 51 Identifying number 1 WN Part 1 Total Investment Interest Expense 1 Investment interest expense paid or accrued in 2020 (see instructions) 2 Disallowed investment interest expense from 2019 Form 4952, line 7 3 Total Investment interest expense. Add lines 1 and 2 Part II Net Investment Income 4a Gross income from property held for investment (excluding any net gain from the disposition of property held for investment) b Qualified dividends included on line 4a 4b c Subtract line 4b from line 4a. d Net gain from the disposition of property held for investment 4d Enter the smaller of line 4d or your net capital gain from the disposition of property held for investment. See Instructions 40 f Subtract line 4e from line 4d 4f 9 Enter the amount from lines 4b and 4e that you elect to include in investment income. See Instructions 49 Investment income. Add lines 4c, 4t, and 4g 4h 5 Investment expenses (see instructions) 6 Net investment income. Subtract line 5 from line 4h. If zero or less, enter-O- Part III Investment Interest Expense Deduction 7 Disallowed investment interest expense to be carried forward to 2021. Subtract line 6 from line 3. If zero or less, enter-O- 7 8 Investment interest expense deduction. Enter the smaller of line 3 or line 6. See instructions For Paperwork Reduction Act Notice, see page 4. Cat No. 13177Y 5 6 a 8 Form 4952 2020