Question

Income tax Normal rates Dividend rates % % Basic rate 1 - 37,500 20 7.5 Higher rate 37,501 - 150,000 40 32.5 Additional rate 150,001

Income tax

Normal rates Dividend rates

% %

Basic rate 1 - 37,500 20 7.5

Higher rate 37,501 - 150,000 40 32.5

Additional rate 150,001 and above 45 38.1

Savings income nil rate band - Basic rate taxpayers 1,000

-Higher rate taxpayers 500

Dividend nil rate band 2,000

A starting rate of 0% applies to savings income where it falls within the first 5,000 of taxable income..

Personal allowances

Personal allowance 12,500

Transferable amount 1,200

Income limit 100,000

Where adjusted net income is 125,000 or more, the personal allowance is reduced to zero.

Capital gains tax

Normal Residential

Rates property

Rate of tax-Lower rate 10% 18%

-Higher rate 20% 28%

Annual exempt amount 12,000

Entrepreneurs relief Lifetime limit 10,000,000

- Rate of tax 10%

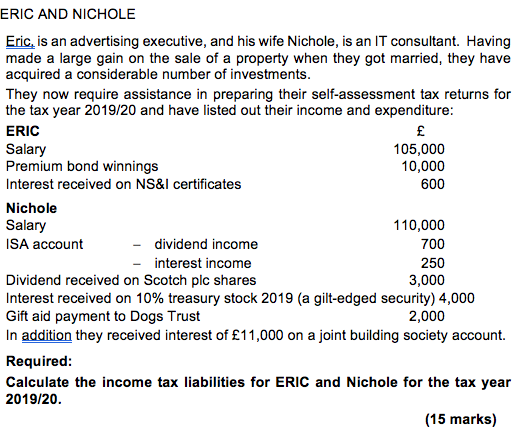

ERIC AND NICHOLE Eric, is an advertising executive, and his wife Nichole, is an IT consultant. Having made a large gain on the sale of a property when they got married, they have acquired a considerable number of investments. They now require assistance in preparing their self-assessment tax returns for the tax year 2019/20 and have listed out their income and expenditure: ERIC Salary 105,000 Premium bond winnings 10,000 Interest received on NS&I certificates 600 Nichole Salary 110,000 ISA account dividend income 700 interest income 250 Dividend received on Scotch plc shares 3,000 Interest received on 10% treasury stock 2019 (a gilt-edged security) 4,000 Gift aid payment to Dogs Trust 2,000 In addition they received interest of 11,000 on a joint building society account. Required: Calculate the income tax liabilities for ERIC and Nichole for the tax year 2019/20 (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started