Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Income tax Question, thank you for your help Rose Stone has been transferred by her employer from Edmonton, AB to Montreal, QC. In the course

Income tax Question, thank you for your help

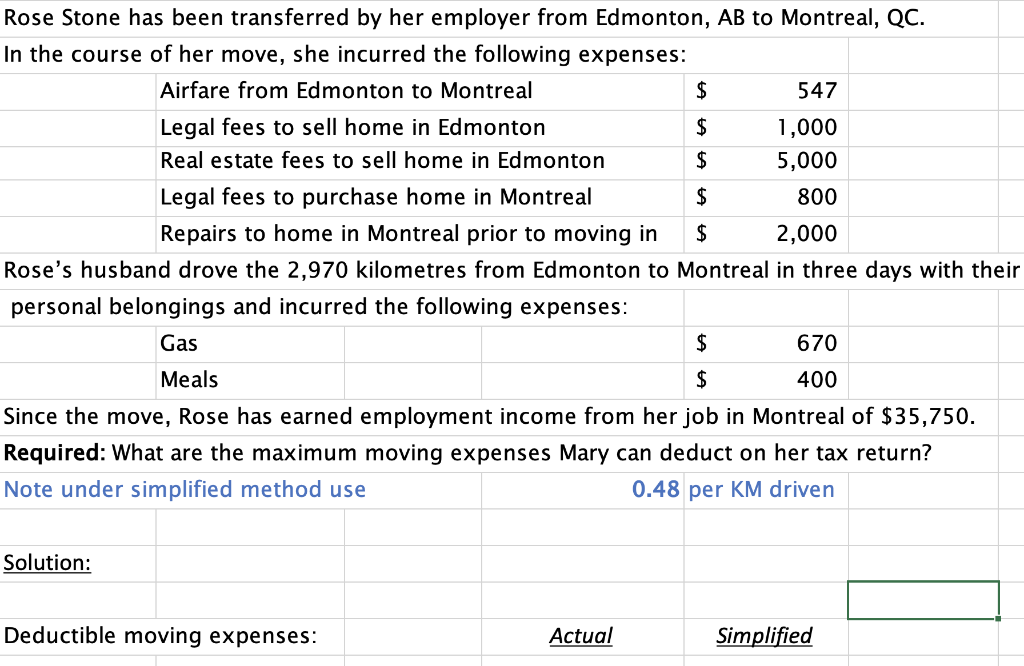

Rose Stone has been transferred by her employer from Edmonton, AB to Montreal, QC. In the course of her move, she incurred the following expenses: Airfare from Edmonton to Montreal $ 547 Legal fees to sell home in Edmonton $ 1,000 Real estate fees to sell home in Edmonton $ 5,000 Legal fees to purchase home in Montreal $ 800 Repairs to home in Montreal prior to moving in $ 2,000 Rose's husband drove the 2,970 kilometres from Edmonton to Montreal in three days with their personal belongings and incurred the following expenses: Gas $ 670 Meals $ 400 Since the move, Rose has earned employment income from her job in Montreal of $35,750. Required: What are the maximum moving expenses Mary can deduct on her tax return? Note under simplified method use 0.48 per KM driven Solution: Deductible moving expenses: Actual SimplifiedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started