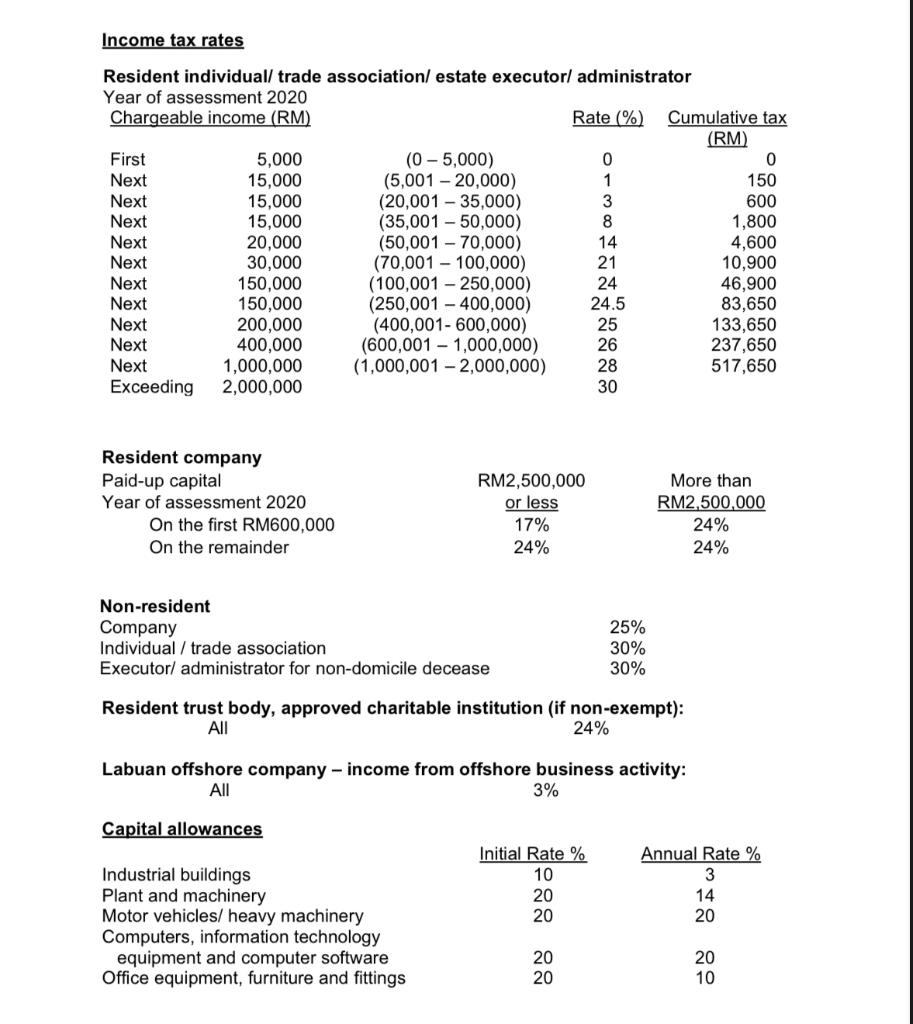

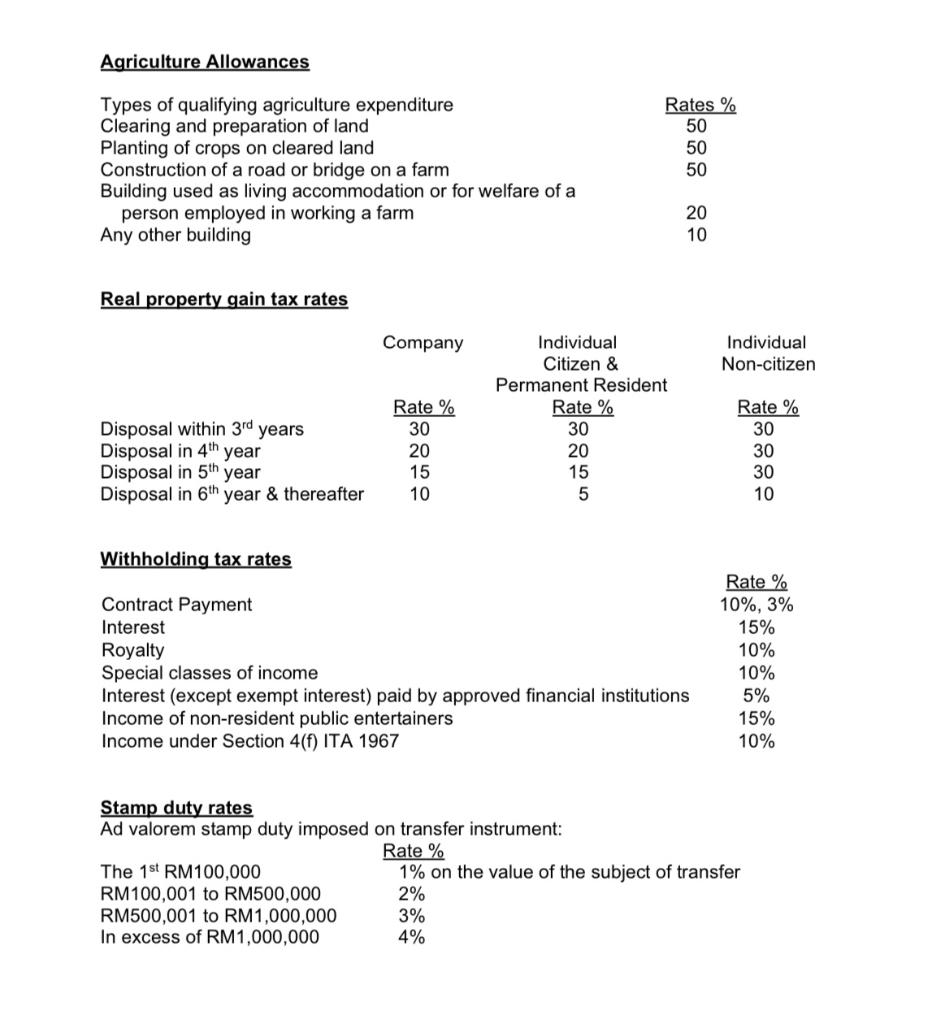

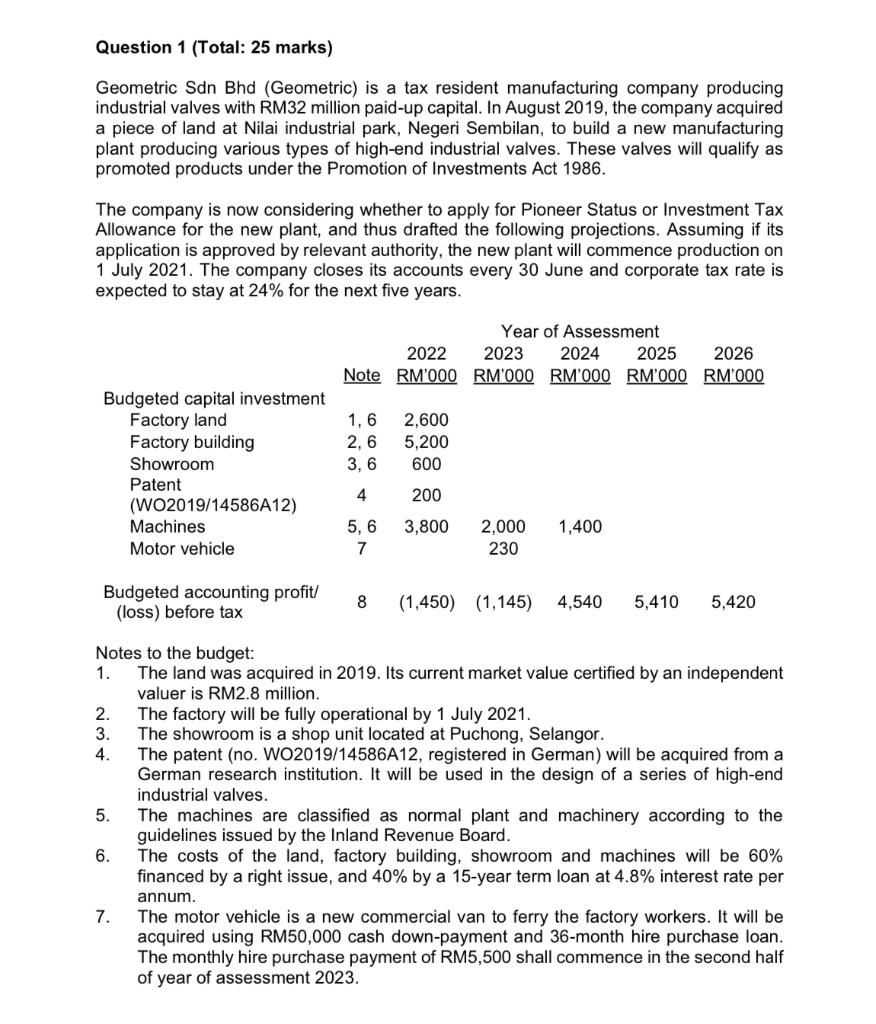

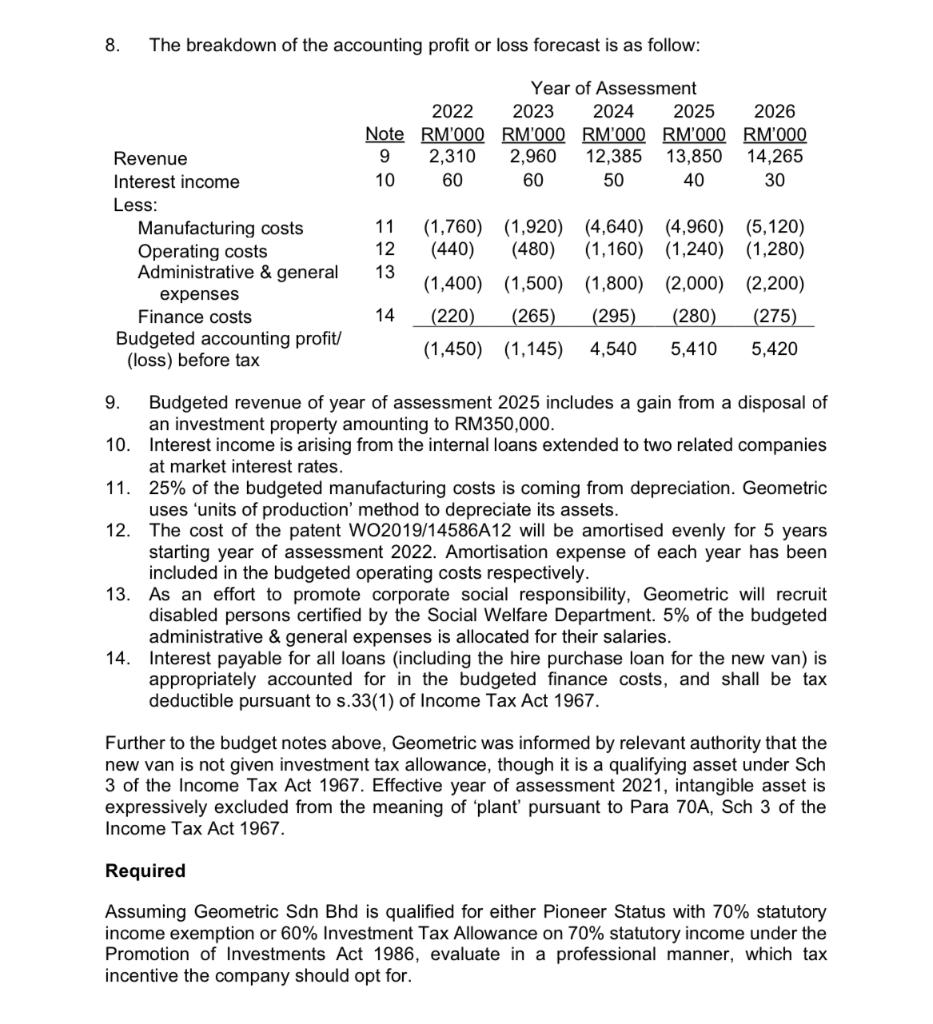

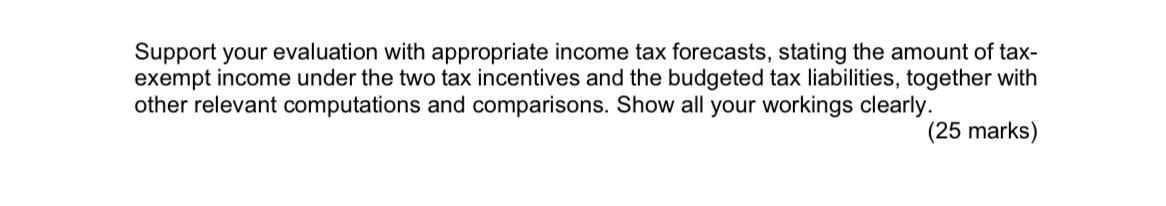

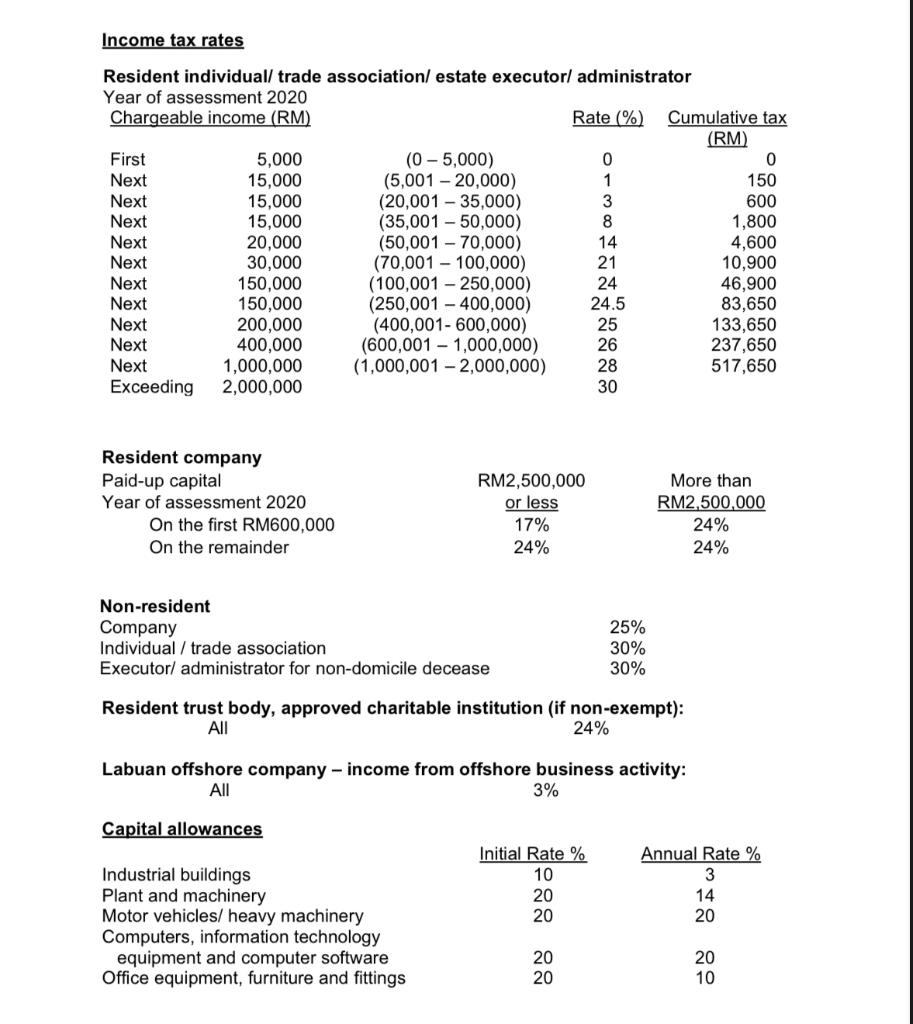

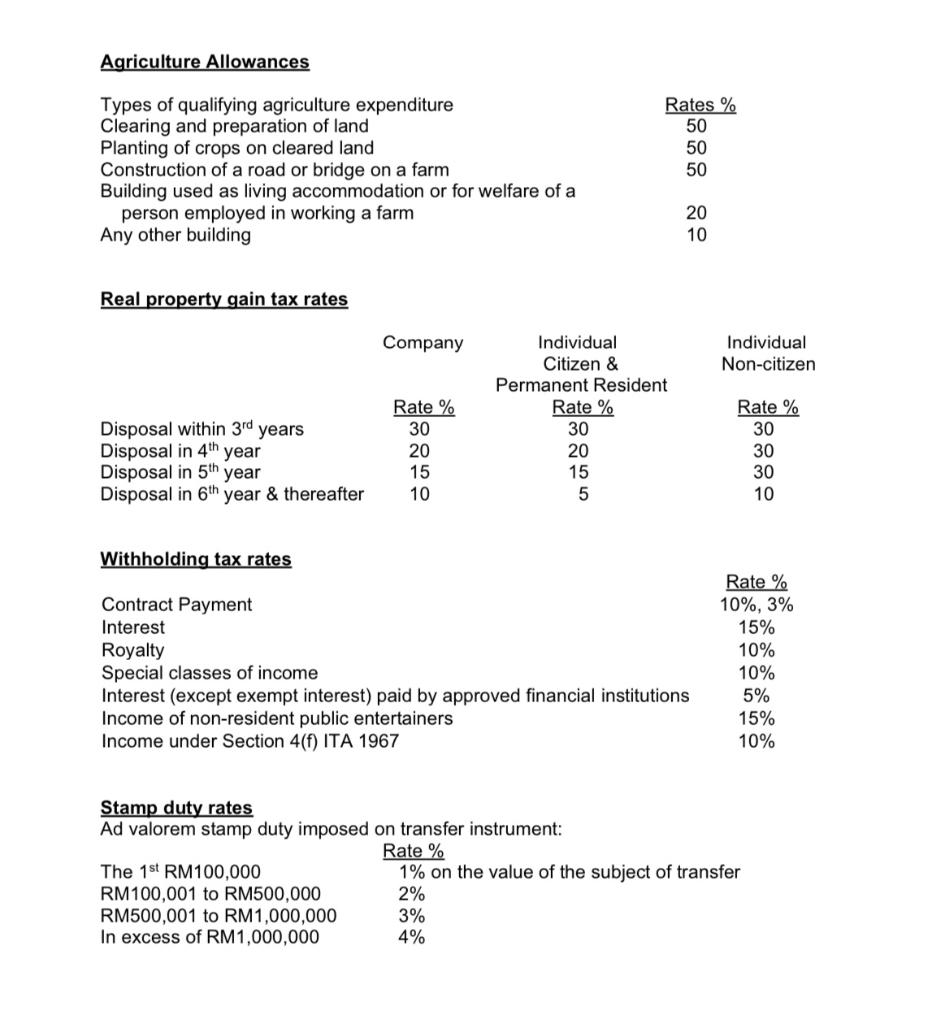

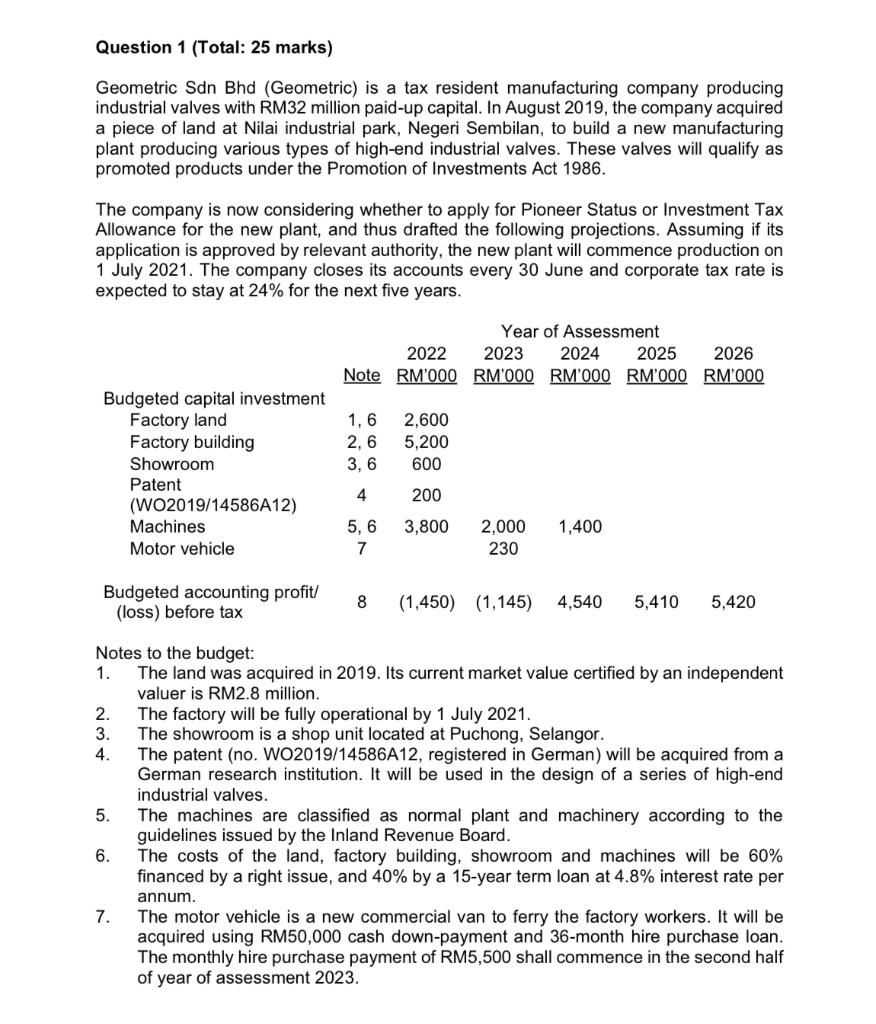

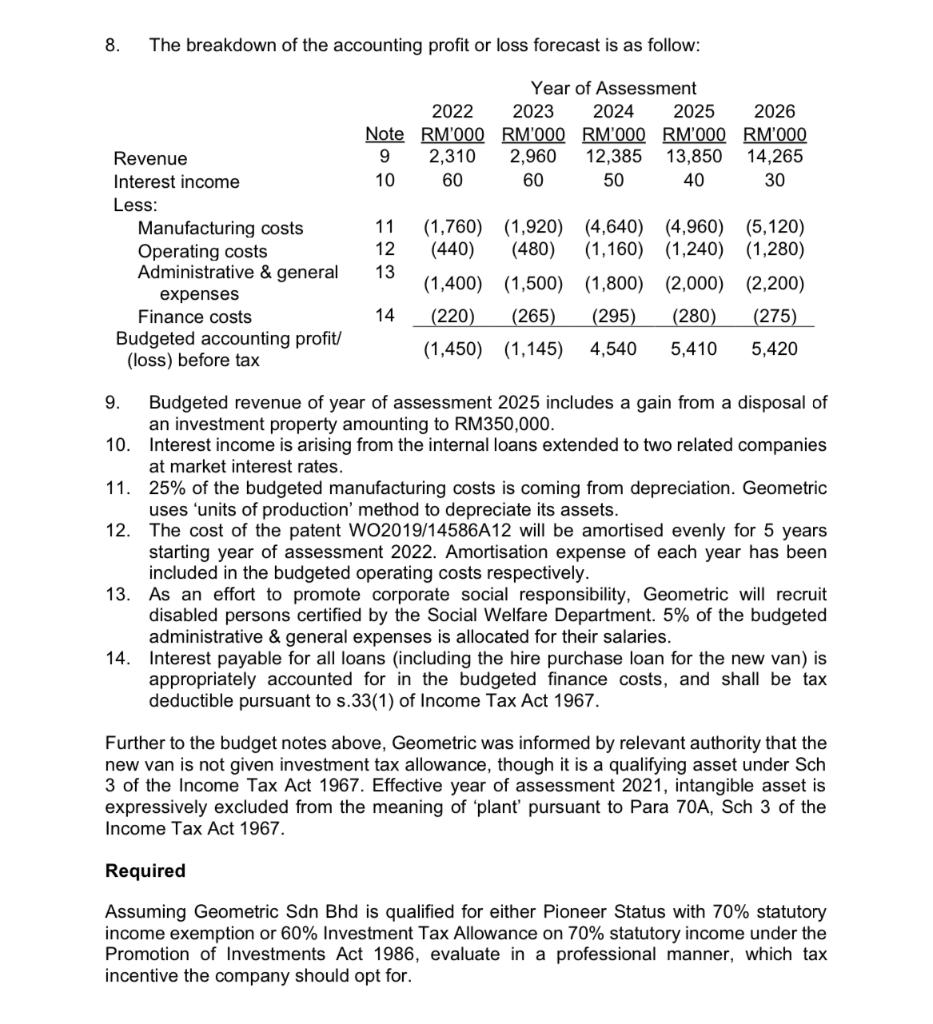

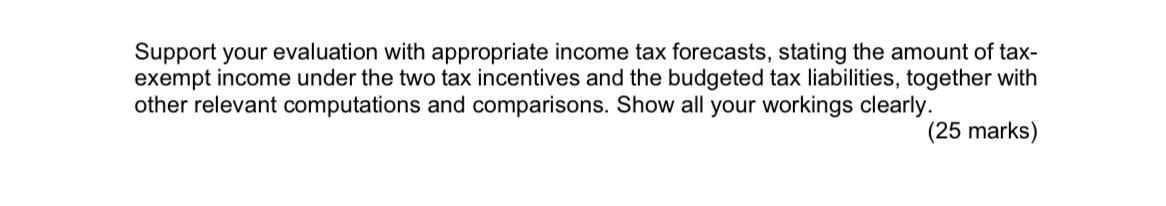

Income tax rates 600 Resident individual/ trade association/ estate executor/ administrator Year of assessment 2020 Chargeable income (RM) Rate (%) Cumulative tax (RM) First 5,000 (0 - 5,000) 0 0 Next 15,000 (5,001 - 20,000) 1 150 Next 15,000 (20,001 - 35,000) 3 Next 15,000 (35,001 - 50,000) 8 1,800 Next 20,000 (50,001 - 70,000) 14 4,600 Next 30,000 (70,001 - 100,000) 21 10,900 Next 150,000 (100,001 - 250,000) 24 46,900 150,000 (250,001 - 400,000) 24.5 83,650 Next 200,000 (400,001 - 600,000) 25 133,650 Next 400,000 (600,001 - 1,000,000) 26 237,650 Next 1,000,000 (1,000,001 - 2,000,000) 28 517,650 Exceeding 2,000,000 30 Next Resident company Paid-up capital Year of assessment 2020 On the first RM600,000 On the remainder RM2,500,000 or less 17% 24% More than RM2,500,000 24% 24% Non-resident Company Individual / trade association Executor/ administrator for non-domicile decease 25% 30% 30% Resident trust body, approved charitable institution (if non-exempt): All 24% Labuan offshore company - income from offshore business activity: All 3% Capital allowances Initial Rate % Annual Rate % 3 14 20 20 20 Industrial buildings Plant and machinery Motor vehicles/ heavy machinery Computers, information technology equipment and computer software Office equipment, furniture and fittings 20 20 20 10 Agriculture Allowances Types of qualifying agriculture expenditure Clearing and preparation of land Planting of crops on cleared land Construction of a road or bridge on a farm Building used as living accommodation or for welfare of a person employed in working a farm Any other building Rates % 50 50 50 20 10 Real property gain tax rates Company Individual Non-citizen Disposal within 3rd years Disposal in 4th year Disposal in 5th year Disposal in 6th year & thereafter Rate % 30 20 15 10 Individual Citizen & Permanent Resident Rate % 30 20 15 5 Rate % 30 30 30 10 Withholding tax rates Contract Payment Interest Royalty Special classes of income Interest (except exempt interest) paid by approved financial institutions Income of non-resident public entertainers Income under Section 4(f) ITA 1967 Rate % 10%, 3% 15% 10% 10% 5% 15% 10% Stamp duty rates Ad valorem stamp duty imposed on transfer instrument: Rate % The 1st RM100,000 1% on the value of the subject of transfer RM100,001 to RM500,000 2% RM500,001 to RM1,000,000 3% In excess of RM1,000,000 4% Question 1 (Total: 25 marks) Geometric Sdn Bhd (Geometric) is a tax resident manufacturing company producing industrial valves with RM32 million paid-up capital. In August 2019, the company acquired a piece of land at Nilai industrial Park, Negeri Sembilan, to build a new manufacturing plant producing various types of high-end industrial valves. These valves will qualify as promoted products under the Promotion of Investments Act 1986. The company is now considering whether to apply for Pioneer Status or Investment Tax Allowance for the new plant, and thus drafted the following projections. Assuming if its application is approved by relevant authority, the new plant will commence production on 1 July 2021. The company closes its accounts every 30 June and corporate tax rate is expected to stay at 24% for the next five years. Year of Assessment 2022 2023 2024 2025 2026 Note RM'000 RM'000 RM'000 RM'000 RM'000 1,6 2,6 3,6 2,600 5,200 600 Budgeted capital investment Factory land Factory building Showroom Patent (WO2019/14586A12) Machines Motor vehicle 4 200 3,800 1,400 5, 6 7 2,000 230 Budgeted accounting profit/ (loss) before tax 8 (1,450) (1,145) 4,540 5,410 5,420 Notes to the budget: 1. The land was acquired in 2019. Its current market value certified by an independent valuer is RM2.8 million. 2. The factory will be fully operational by 1 July 2021. 3. The showroom is a shop unit located at Puchong, Selangor. 4. The patent (no. WO2019/14586A12, registered in German) will be acquired from a German research institution. It will be used in the design of a series of high-end industrial valves. 5. The machines are classified as normal plant and machinery according to the guidelines issued by the Inland Revenue Board. 6. The costs of the land, factory building, showroom and machines will be 60% financed by a right issue, and 40% by a 15-year term loan at 4.8% interest rate per annum. 7. The motor vehicle is a new commercial van to ferry the factory workers. It will be acquired using RM50,000 cash down-payment and 36-month hire purchase loan. The monthly hire purchase payment of RM5,500 shall commence in the second half of year of assessment 2023. 8. The breakdown of the accounting profit or loss forecast is as follow: Year of Assessment 2022 2023 2024 2025 2026 Note RM'000 RM'000 RM'000 RM'000 RM'000 9 2,310 2,960 12,385 13,850 14,265 10 60 60 50 40 30 Revenue Interest income Less: Manufacturing costs Operating costs Administrative & general expenses Finance costs Budgeted accounting profit/ (loss) before tax 11 12 13 (1,760) (1,920) (4,640) (4,960) (5,120) (440) (480) (1,160) (1,240) (1,280) (1,400) (1,500) (1,800) (2,000) (2,200) (220) (265) (295) (280) (275) (1,450) (1,145) 4,540 5,410 5,420 14 9. Budgeted revenue of year of assessment 2025 includes a gain from a disposal of an investment property amounting to RM350,000. 10. Interest income is arising from the internal loans extended to two related companies at market interest rates. 11. 25% of the budgeted manufacturing costs is coming from depreciation. Geometric uses 'units of production method to depreciate its assets. 12. The cost of the patent WO2019/14586A12 will be amortised evenly for 5 years starting year of assessment 2022. Amortisation expense of each year has been included in the budgeted operating costs respectively. 13. As an effort to promote corporate social responsibility, Geometric will recruit disabled persons certified by the Social Welfare Department. 5% of the budgeted administrative & general expenses is allocated for their salaries. 14. Interest payable for all loans (including the hire purchase loan for the new van) is appropriately accounted for in the budgeted finance costs, and shall be tax deductible pursuant to s.33(1) of Income Tax Act 1967. Further to the budget notes above, Geometric was informed by relevant authority that the new van is not given investment tax allowance, though it is a qualifying asset under Sch 3 of the Income Tax Act 1967. Effective year of assessment 2021, intangible asset is expressively excluded from the meaning of plant' pursuant to Para 70A, Sch 3 of the Income Tax Act 1967. Required Assuming Geometric Sdn Bhd is qualified for either Pioneer Status with 70% statutory income exemption or 60% Investment Tax Allowance on 70% statutory income under the Promotion of Investments Act 1986, evaluate in a professional manner, which tax incentive the company should opt for. Support your evaluation with appropriate income tax forecasts, stating the amount of tax- exempt income under the two tax incentives and the budgeted tax liabilities, together with other relevant computations and comparisons. Show all your workings clearly. (25 marks) Income tax rates 600 Resident individual/ trade association/ estate executor/ administrator Year of assessment 2020 Chargeable income (RM) Rate (%) Cumulative tax (RM) First 5,000 (0 - 5,000) 0 0 Next 15,000 (5,001 - 20,000) 1 150 Next 15,000 (20,001 - 35,000) 3 Next 15,000 (35,001 - 50,000) 8 1,800 Next 20,000 (50,001 - 70,000) 14 4,600 Next 30,000 (70,001 - 100,000) 21 10,900 Next 150,000 (100,001 - 250,000) 24 46,900 150,000 (250,001 - 400,000) 24.5 83,650 Next 200,000 (400,001 - 600,000) 25 133,650 Next 400,000 (600,001 - 1,000,000) 26 237,650 Next 1,000,000 (1,000,001 - 2,000,000) 28 517,650 Exceeding 2,000,000 30 Next Resident company Paid-up capital Year of assessment 2020 On the first RM600,000 On the remainder RM2,500,000 or less 17% 24% More than RM2,500,000 24% 24% Non-resident Company Individual / trade association Executor/ administrator for non-domicile decease 25% 30% 30% Resident trust body, approved charitable institution (if non-exempt): All 24% Labuan offshore company - income from offshore business activity: All 3% Capital allowances Initial Rate % Annual Rate % 3 14 20 20 20 Industrial buildings Plant and machinery Motor vehicles/ heavy machinery Computers, information technology equipment and computer software Office equipment, furniture and fittings 20 20 20 10 Agriculture Allowances Types of qualifying agriculture expenditure Clearing and preparation of land Planting of crops on cleared land Construction of a road or bridge on a farm Building used as living accommodation or for welfare of a person employed in working a farm Any other building Rates % 50 50 50 20 10 Real property gain tax rates Company Individual Non-citizen Disposal within 3rd years Disposal in 4th year Disposal in 5th year Disposal in 6th year & thereafter Rate % 30 20 15 10 Individual Citizen & Permanent Resident Rate % 30 20 15 5 Rate % 30 30 30 10 Withholding tax rates Contract Payment Interest Royalty Special classes of income Interest (except exempt interest) paid by approved financial institutions Income of non-resident public entertainers Income under Section 4(f) ITA 1967 Rate % 10%, 3% 15% 10% 10% 5% 15% 10% Stamp duty rates Ad valorem stamp duty imposed on transfer instrument: Rate % The 1st RM100,000 1% on the value of the subject of transfer RM100,001 to RM500,000 2% RM500,001 to RM1,000,000 3% In excess of RM1,000,000 4% Question 1 (Total: 25 marks) Geometric Sdn Bhd (Geometric) is a tax resident manufacturing company producing industrial valves with RM32 million paid-up capital. In August 2019, the company acquired a piece of land at Nilai industrial Park, Negeri Sembilan, to build a new manufacturing plant producing various types of high-end industrial valves. These valves will qualify as promoted products under the Promotion of Investments Act 1986. The company is now considering whether to apply for Pioneer Status or Investment Tax Allowance for the new plant, and thus drafted the following projections. Assuming if its application is approved by relevant authority, the new plant will commence production on 1 July 2021. The company closes its accounts every 30 June and corporate tax rate is expected to stay at 24% for the next five years. Year of Assessment 2022 2023 2024 2025 2026 Note RM'000 RM'000 RM'000 RM'000 RM'000 1,6 2,6 3,6 2,600 5,200 600 Budgeted capital investment Factory land Factory building Showroom Patent (WO2019/14586A12) Machines Motor vehicle 4 200 3,800 1,400 5, 6 7 2,000 230 Budgeted accounting profit/ (loss) before tax 8 (1,450) (1,145) 4,540 5,410 5,420 Notes to the budget: 1. The land was acquired in 2019. Its current market value certified by an independent valuer is RM2.8 million. 2. The factory will be fully operational by 1 July 2021. 3. The showroom is a shop unit located at Puchong, Selangor. 4. The patent (no. WO2019/14586A12, registered in German) will be acquired from a German research institution. It will be used in the design of a series of high-end industrial valves. 5. The machines are classified as normal plant and machinery according to the guidelines issued by the Inland Revenue Board. 6. The costs of the land, factory building, showroom and machines will be 60% financed by a right issue, and 40% by a 15-year term loan at 4.8% interest rate per annum. 7. The motor vehicle is a new commercial van to ferry the factory workers. It will be acquired using RM50,000 cash down-payment and 36-month hire purchase loan. The monthly hire purchase payment of RM5,500 shall commence in the second half of year of assessment 2023. 8. The breakdown of the accounting profit or loss forecast is as follow: Year of Assessment 2022 2023 2024 2025 2026 Note RM'000 RM'000 RM'000 RM'000 RM'000 9 2,310 2,960 12,385 13,850 14,265 10 60 60 50 40 30 Revenue Interest income Less: Manufacturing costs Operating costs Administrative & general expenses Finance costs Budgeted accounting profit/ (loss) before tax 11 12 13 (1,760) (1,920) (4,640) (4,960) (5,120) (440) (480) (1,160) (1,240) (1,280) (1,400) (1,500) (1,800) (2,000) (2,200) (220) (265) (295) (280) (275) (1,450) (1,145) 4,540 5,410 5,420 14 9. Budgeted revenue of year of assessment 2025 includes a gain from a disposal of an investment property amounting to RM350,000. 10. Interest income is arising from the internal loans extended to two related companies at market interest rates. 11. 25% of the budgeted manufacturing costs is coming from depreciation. Geometric uses 'units of production method to depreciate its assets. 12. The cost of the patent WO2019/14586A12 will be amortised evenly for 5 years starting year of assessment 2022. Amortisation expense of each year has been included in the budgeted operating costs respectively. 13. As an effort to promote corporate social responsibility, Geometric will recruit disabled persons certified by the Social Welfare Department. 5% of the budgeted administrative & general expenses is allocated for their salaries. 14. Interest payable for all loans (including the hire purchase loan for the new van) is appropriately accounted for in the budgeted finance costs, and shall be tax deductible pursuant to s.33(1) of Income Tax Act 1967. Further to the budget notes above, Geometric was informed by relevant authority that the new van is not given investment tax allowance, though it is a qualifying asset under Sch 3 of the Income Tax Act 1967. Effective year of assessment 2021, intangible asset is expressively excluded from the meaning of plant' pursuant to Para 70A, Sch 3 of the Income Tax Act 1967. Required Assuming Geometric Sdn Bhd is qualified for either Pioneer Status with 70% statutory income exemption or 60% Investment Tax Allowance on 70% statutory income under the Promotion of Investments Act 1986, evaluate in a professional manner, which tax incentive the company should opt for. Support your evaluation with appropriate income tax forecasts, stating the amount of tax- exempt income under the two tax incentives and the budgeted tax liabilities, together with other relevant computations and comparisons. Show all your workings clearly. (25 marks)