Answered step by step

Verified Expert Solution

Question

1 Approved Answer

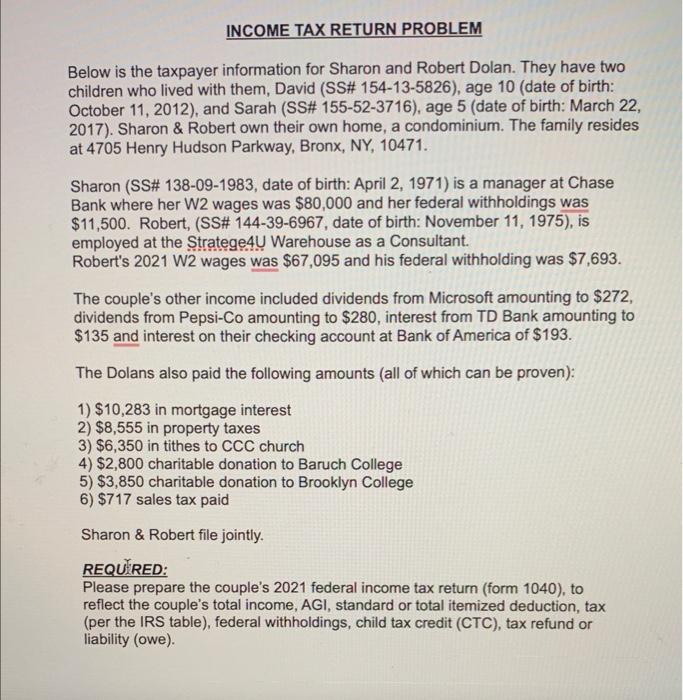

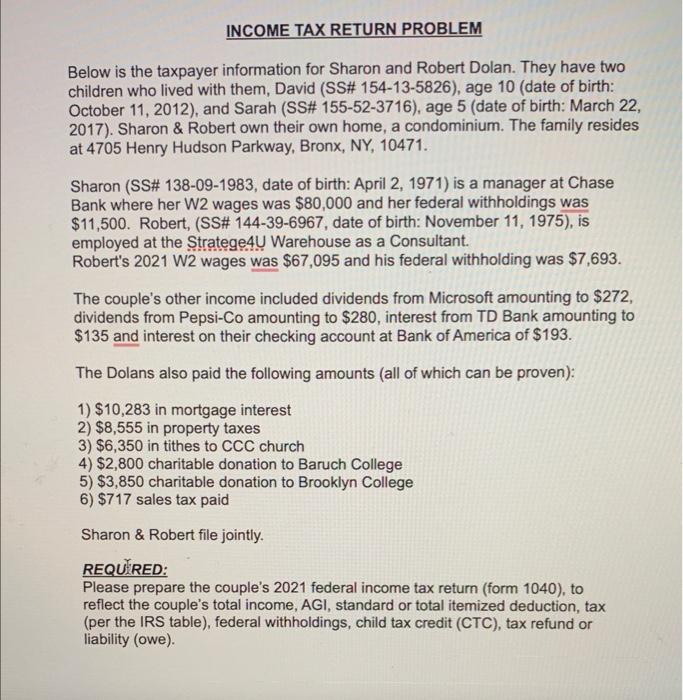

! INCOME TAX RETURN PROBLEM Below is the taxpayer information for Sharon and Robert Dolan. They have two children who lived with them, David (SS#154-13-5826),

!

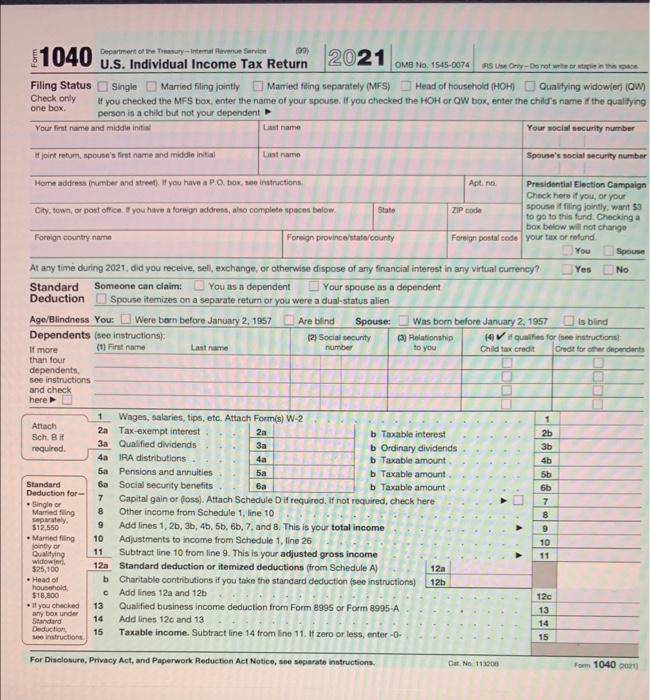

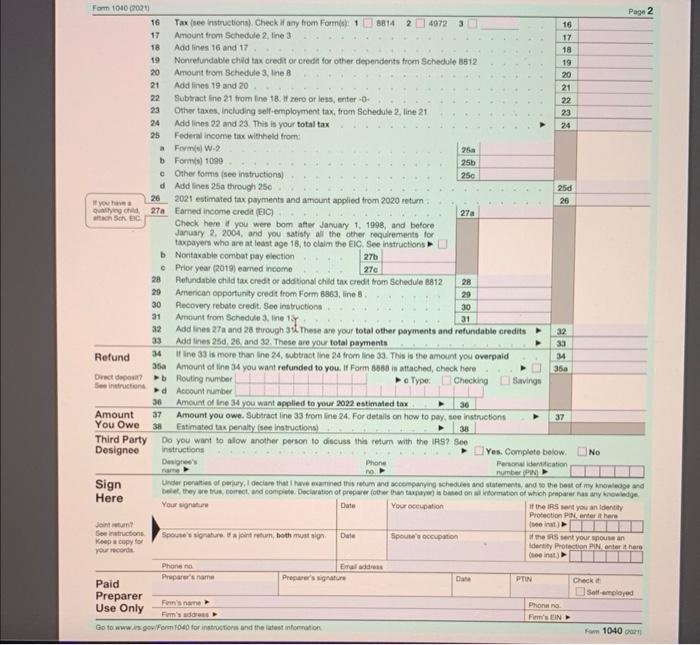

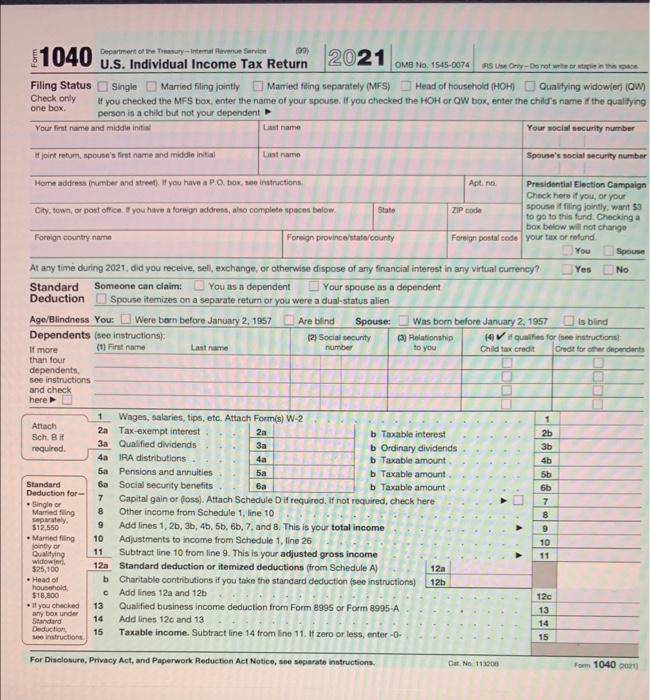

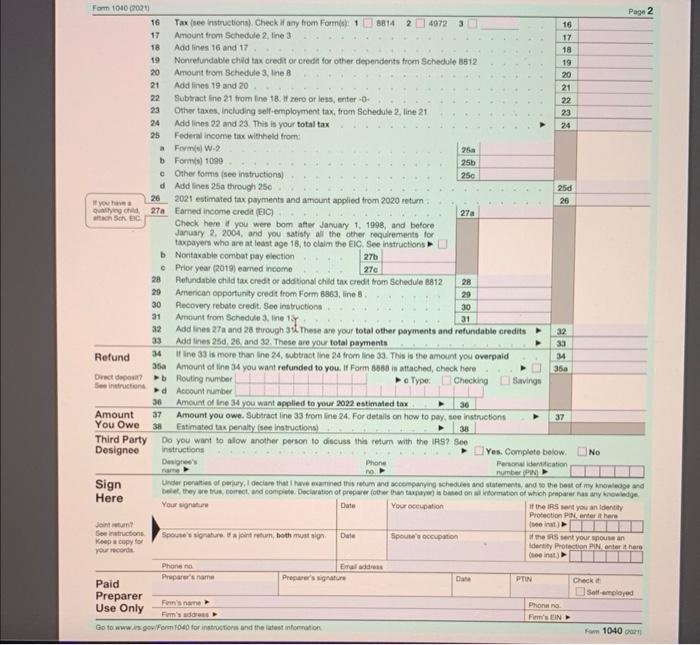

INCOME TAX RETURN PROBLEM Below is the taxpayer information for Sharon and Robert Dolan. They have two children who lived with them, David (SS\#154-13-5826), age 10 (date of birth: October 11, 2012), and Sarah (SS\# 155-52-3716), age 5 (date of birth: March 22, 2017). Sharon \& Robert own their own home, a condominium. The family resides at 4705 Henry Hudson Parkway, Bronx, NY, 10471. Sharon (SS\# 138-09-1983, date of birth: April 2, 1971) is a manager at Chase Bank where her W2 wages was $80,000 and her federal withholdings was $11,500. Robert, (SS\# 144-39-6967, date of birth: November 11, 1975), is employed at the Stratege4U Warehouse as a Consultant. Robert's 2021 W2 wages was $67,095 and his federal withholding was $7,693. The couple's other income included dividends from Microsoft amounting to $272, dividends from Pepsi-Co amounting to $280, interest from TD Bank amounting to $135 and interest on their checking account at Bank of America of \$193. The Dolans also paid the following amounts (all of which can be proven): 1) $10,283 in mortgage interest 2) $8,555 in property taxes 3) $6,350 in tithes to CCC church 4) $2,800 charitable donation to Baruch College 5) $3,850 charitable donation to Brooklyn College 6) $717 sales tax paid Sharon \& Robert file jointly. REQU'RED: Please prepare the couple's 2021 federal income tax return (form 1040), to reflect the couple's total income, AGI, standard or total itemized deduction, tax (per the IRS table), federal withholdings, child tax credit (CTC), tax refund or liability (owe). Check only Hyou checked the MFS box, enter the name of your spouse. If you checked the HOH or OW box, enter the child's name if the qualtying one box. person is a child but not your dependent Your fint name and middle inital Fom toso co2vil INCOME TAX RETURN PROBLEM Below is the taxpayer information for Sharon and Robert Dolan. They have two children who lived with them, David (SS\#154-13-5826), age 10 (date of birth: October 11, 2012), and Sarah (SS\# 155-52-3716), age 5 (date of birth: March 22, 2017). Sharon \& Robert own their own home, a condominium. The family resides at 4705 Henry Hudson Parkway, Bronx, NY, 10471. Sharon (SS\# 138-09-1983, date of birth: April 2, 1971) is a manager at Chase Bank where her W2 wages was $80,000 and her federal withholdings was $11,500. Robert, (SS\# 144-39-6967, date of birth: November 11, 1975), is employed at the Stratege4U Warehouse as a Consultant. Robert's 2021 W2 wages was $67,095 and his federal withholding was $7,693. The couple's other income included dividends from Microsoft amounting to $272, dividends from Pepsi-Co amounting to $280, interest from TD Bank amounting to $135 and interest on their checking account at Bank of America of \$193. The Dolans also paid the following amounts (all of which can be proven): 1) $10,283 in mortgage interest 2) $8,555 in property taxes 3) $6,350 in tithes to CCC church 4) $2,800 charitable donation to Baruch College 5) $3,850 charitable donation to Brooklyn College 6) $717 sales tax paid Sharon \& Robert file jointly. REQU'RED: Please prepare the couple's 2021 federal income tax return (form 1040), to reflect the couple's total income, AGI, standard or total itemized deduction, tax (per the IRS table), federal withholdings, child tax credit (CTC), tax refund or liability (owe). Check only Hyou checked the MFS box, enter the name of your spouse. If you checked the HOH or OW box, enter the child's name if the qualtying one box. person is a child but not your dependent Your fint name and middle inital Fom toso co2vil

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started