Answered step by step

Verified Expert Solution

Question

1 Approved Answer

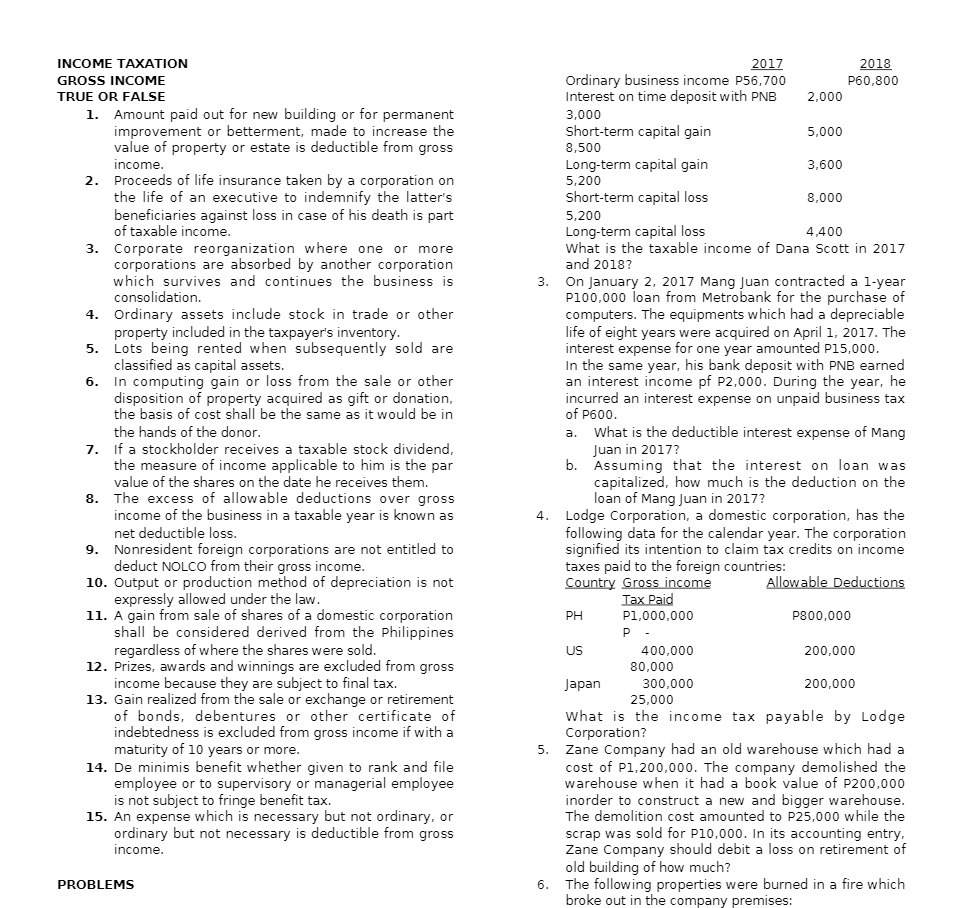

INCOME TAXATION GROSS INCOME TRUE OR FALSE 1. Amount paid out for new building or for permanent improvement or betterment, made to increase the

INCOME TAXATION GROSS INCOME TRUE OR FALSE 1. Amount paid out for new building or for permanent improvement or betterment, made to increase the value of property or estate is deductible from gross income. 2. Proceeds of life insurance taken by a corporation on the life of an executive to indemnify the latter's beneficiaries against loss in case of his death is part of taxable income. 3. Corporate reorganization where one or more corporations are absorbed by another corporation which survives and continues the business is consolidation. 4. 5. Lots being rented when subsequently sold are classified as capital assets. 6. In computing gain or loss from the sale or other disposition of property acquired as gift or donation, the basis of cost shall be the same as it would be in the hands of the donor. Ordinary assets include stock in trade or other property included in the taxpayer's inventory. 7. If a stockholder receives a taxable stock dividend, the measure of income applicable to him is the par value of the shares on the date he receives them. 8. The excess of allowable deductions over gross income of the business in a taxable year is known as net deductible loss. 9. Nonresident foreign corporations are not entitled to deduct NOLCO from their gross income. 10. Output or production method of depreciation is not expressly allowed under the law. 11. A gain from sale of shares of a domestic corporation shall be considered derived from the Philippines regardless of where the shares were sold. 12. Prizes, awards and winnings are excluded from gross income because they are subject to final tax. 13. Gain realized from the sale or exchange or retirement of bonds, debentures or other certificate of indebtedness is excluded from gross income if with a maturity of 10 years or more. 14. De minimis benefit whether given to rank and file employee or to supervisory or managerial employee is not subject to fringe benefit tax. 15. An expense which is necessary but not ordinary, or ordinary but not necessary is deductible from gross income. PROBLEMS 2017 Ordinary business income P56,700 Interest on time deposit with PNB 3,000 Short-term capital gain 8,500 Long-term capital gain 5,200 Short-term capital loss PH 5,200 Long-term capital loss 4,400 What is the taxable income of Dana Scott in 2017 and 2018? 3. On January 2, 2017 Mang Juan contracted a 1-year P100,000 loan from Metrobank for the purchase of computers. The equipments which had a depreciable life of eight years were acquired on April 1, 2017. The interest expense for one year amounted P15,000. In the same year, his bank deposit with PNB earned an interest income pf P2,000. During the year, he incurred an interest expense on unpaid business tax of P600. a. b. US 4. Lodge Corporation, a domestic corporation, has the following data for the calendar year. The corporation signified its intention to claim tax credits on income taxes paid to the foreign countries: Country Gross income Allowable Deductions Tax Paid P1,000,000 What is the deductible interest expense of Mang Juan in 2017? Assuming that the interest on loan was capitalized, how much is the deduction on the loan of Mang Juan in 2017? P 2,000 400,000 5,000 3,600 8,000 80,000 2018 P60,800 300,000 P800,000 200,000 Japan 25,000 What is the income tax payable by Lodge Corporation? 200,000 5. Zane Company had an old warehouse which had a cost of P1,200,000. The company demolished the warehouse when it had a book value of P200,000 inorder to construct a new and bigger warehouse. The demolition cost amounted to P25,000 while the scrap was sold for P10,000. In its accounting entry, Zane Company should debit a loss on retirement of old building of how much? 6. The following properties were burned in a fire which broke out in the company premises:

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

INCOME TAXATION TRUE OR FALSE 1 True 2 True 3 False 4 True 5 False 6 False 7 True 8 True 9 True 10 F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started