Answered step by step

Verified Expert Solution

Question

1 Approved Answer

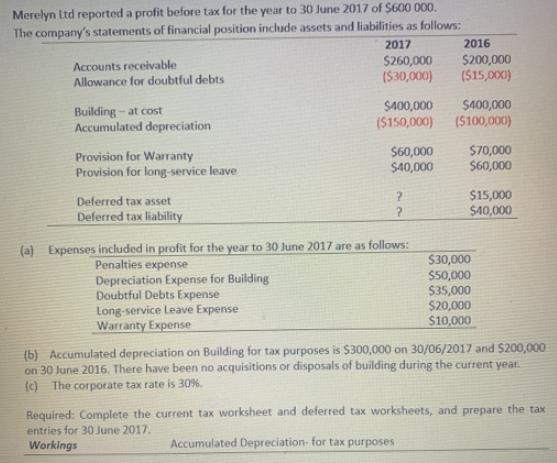

Merelyn Ltd reported a profit before tax for the year to 30 June 2017 of $600 000. The company's statements of financial position include

Merelyn Ltd reported a profit before tax for the year to 30 June 2017 of $600 000. The company's statements of financial position include assets and liabilities as follows: 2016 2017 Accounts receivable Allowance for doubtful debts $260,000 (S30,000) $200,000 (S15,000) Building - at cost Accumulated depreciation S400,000 ($150,000) $400,000 ($100,000) $60,000 $40,000 $70,000 $60,000 Provision for Warranty Provision for long-service leave $15,000 $40,000 Deferred tax asset Deferred tax liability (a) Expenses included in profit for the year to 30 June 2017 are as follows: Penalties expense Depreciation Expense for Building Doubtful Debts Expense Long-service Leave Expense Warranty Expense $30,000 $50,000 $35,000 $20,000 $10,000 (b) Accumulated depreciation on Building for tax purposes is $300,000 on 30/06/2017 and $200,000 on 30 June 2016. There have been no acquisitions or disposals of building during the current year. (c) The corporate tax rate is 30%. Required: Complete the current tax worksheet and deferred tax worksheets, and prepare the tax entries for 30 June 2017. Workings Accumulated Depreciation- for tax purposes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Merelyn Limited Current tax worksheet for the year ended 30 June 2017 Amount Amount Profit as pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started