Answered step by step

Verified Expert Solution

Question

1 Approved Answer

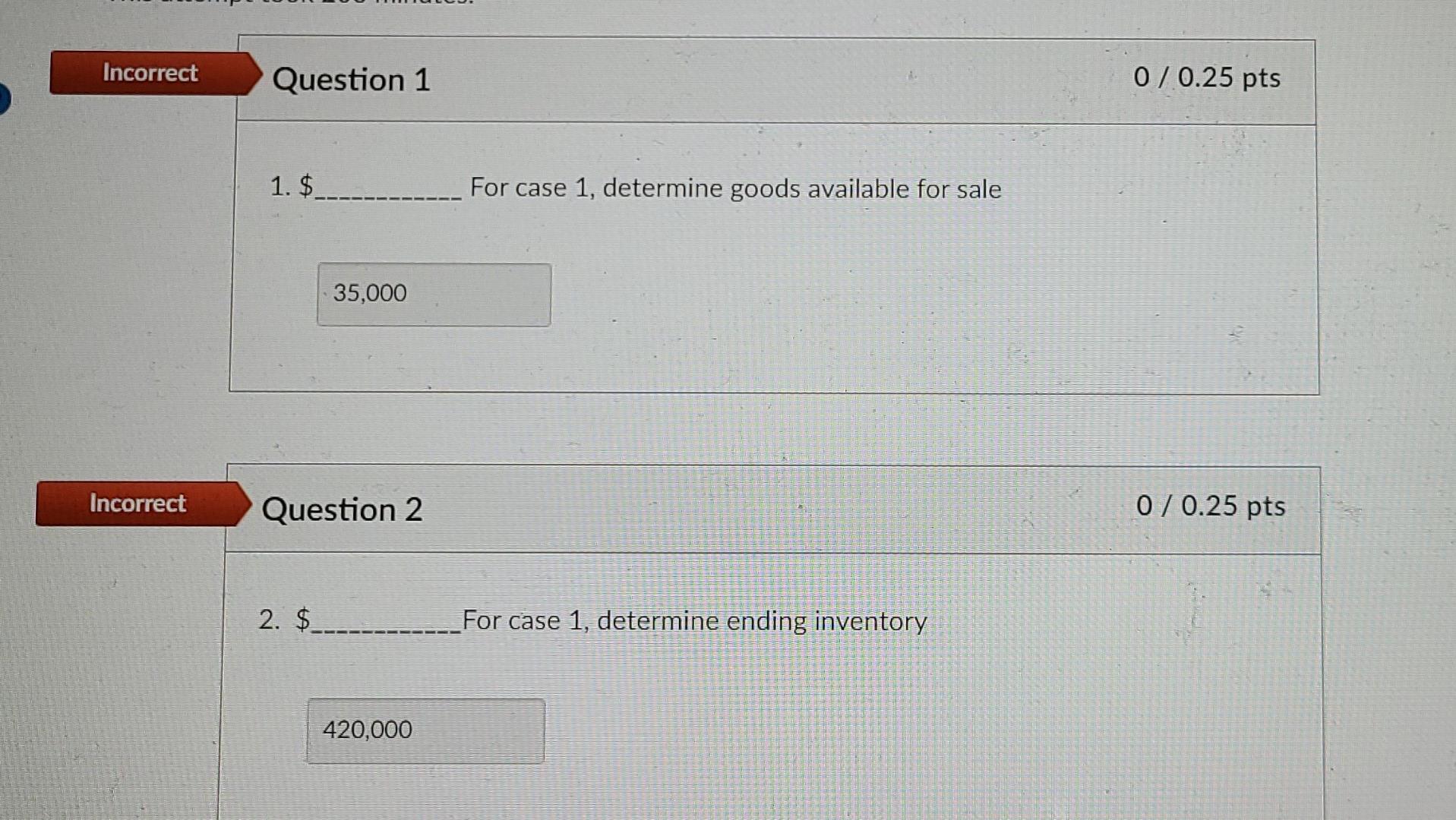

, Incorrect Question 1 0/0.25 pts 1. $ For case 1, determine goods available for sale 35,000 Incorrect Question 2 0 / 0.25 pts 2.

,

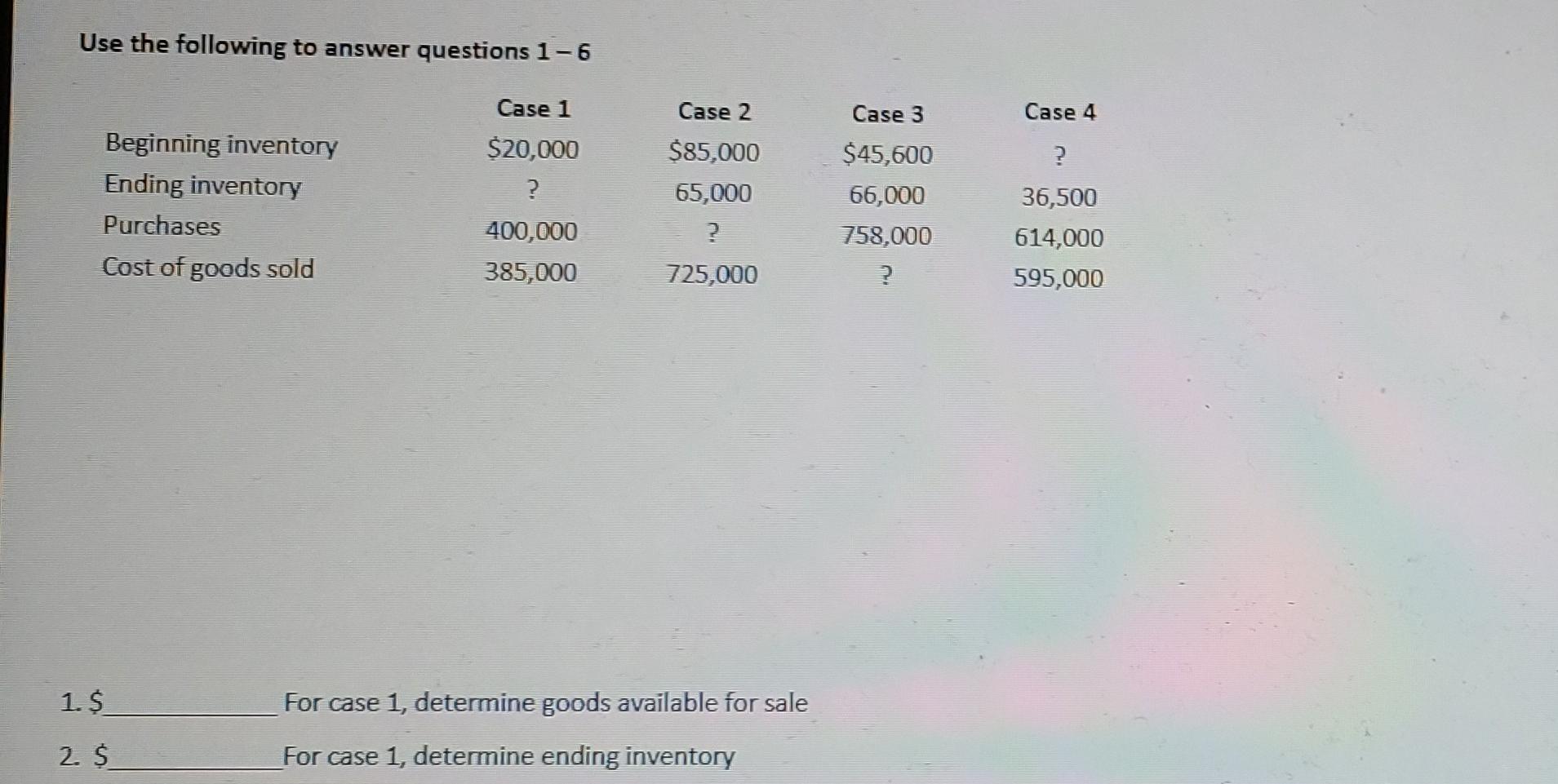

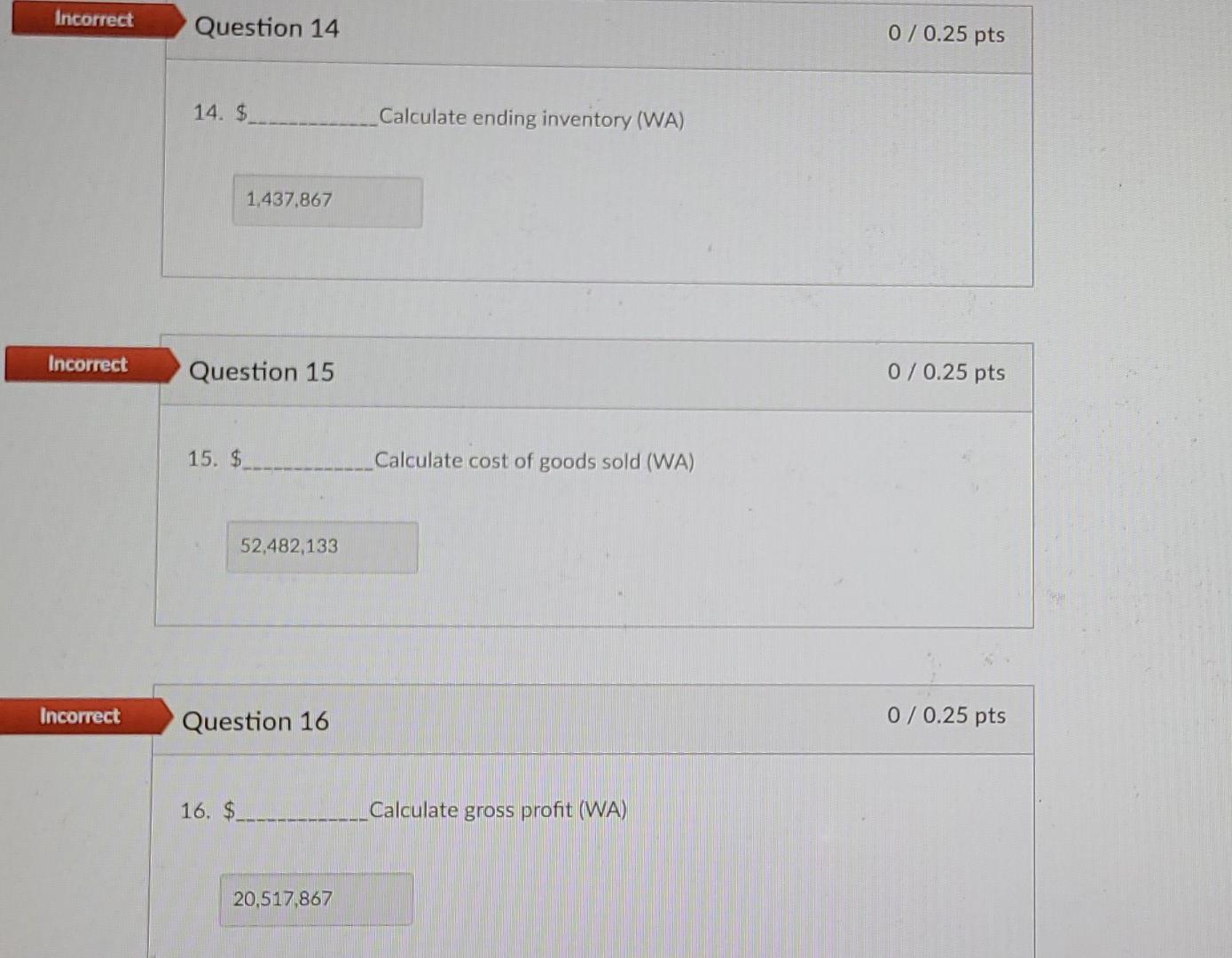

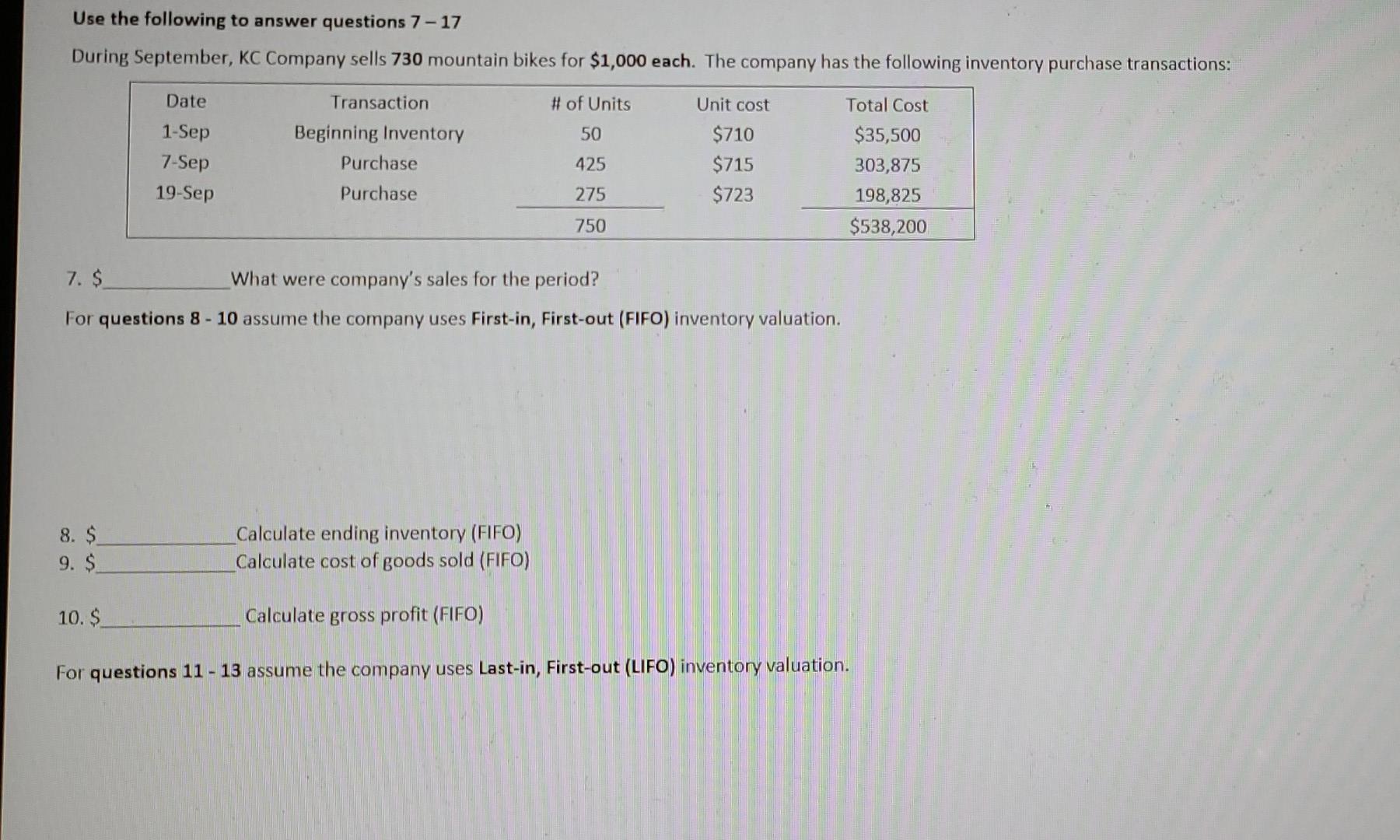

Incorrect Question 1 0/0.25 pts 1. $ For case 1, determine goods available for sale 35,000 Incorrect Question 2 0 / 0.25 pts 2. $ For case 1, determine ending inventory 420,000 Use the following to answer questions 1-6 Case 4 Case 1 $20,000 ? ? Beginning inventory Ending inventory Purchases Cost of goods sold Case 2 $85,000 65,000 ? 725,000 Case 3 $45,600 66,000 758,000 ? 400,000 385,000 36,500 614,000 595,000 1. $ For case 1, determine goods available for sale 2. $ For case 1, determine ending inventory Incorrect Question 14 0 / 0.25 pts 14. $ Calculate ending inventory (WA) 1,437.867 Incorrect Question 15 0 / 0.25 pts 15. $ Calculate cost of goods sold (WA) 52,482,133 Incorrect Question 16 0 / 0.25 pts 16. $ Calculate gross profit (WA) 20,517,867 Use the following to answer questions 7-17 During September, KC Company sells 730 mountain bikes for $1,000 each. The company has the following inventory purchase transactions: Date Transaction # of Units 50 1-Sep 7-Sep 19-Sep Beginning Inventory Purchase Purchase Unit cost $710 $715 $723 Total Cost $35,500 303,875 425 275 198,825 $538,200 750 7. $ What were company's sales for the period? For questions 8 - 10 assume the company uses First-in, First-out (FIFO) inventory valuation. 8. $ 9. $ Calculate ending inventory (FIFO) Calculate cost of goods sold (FIFO) 10.$ Calculate gross profit (FIFO) For questions 11 - 13 assume the company uses Last-in, First-out (LIFO) inventory valuation. 11. $ Calculate ending inventory (LIFO) 12. $. Calculate cost of goods sold (LIFO) 13. $ Calculate gross profit (LIFO) For questions 14 - 16 assume the company uses Weighted Average cost inventory valuation. 14. $ Calculate ending inventory (WA) 15. $ Calculate cost of goods sold (WA) 16. $ Calculate gross profit (WA) 17. Based on the above, which method would show a larger net income number? (FIFO, LIFO or WA)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started