Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Incorrect Question 4 Stellar Inc (acquirer) entered into a definitive merger agreement with Eads Inc (target) today. The deal was structured as a stock

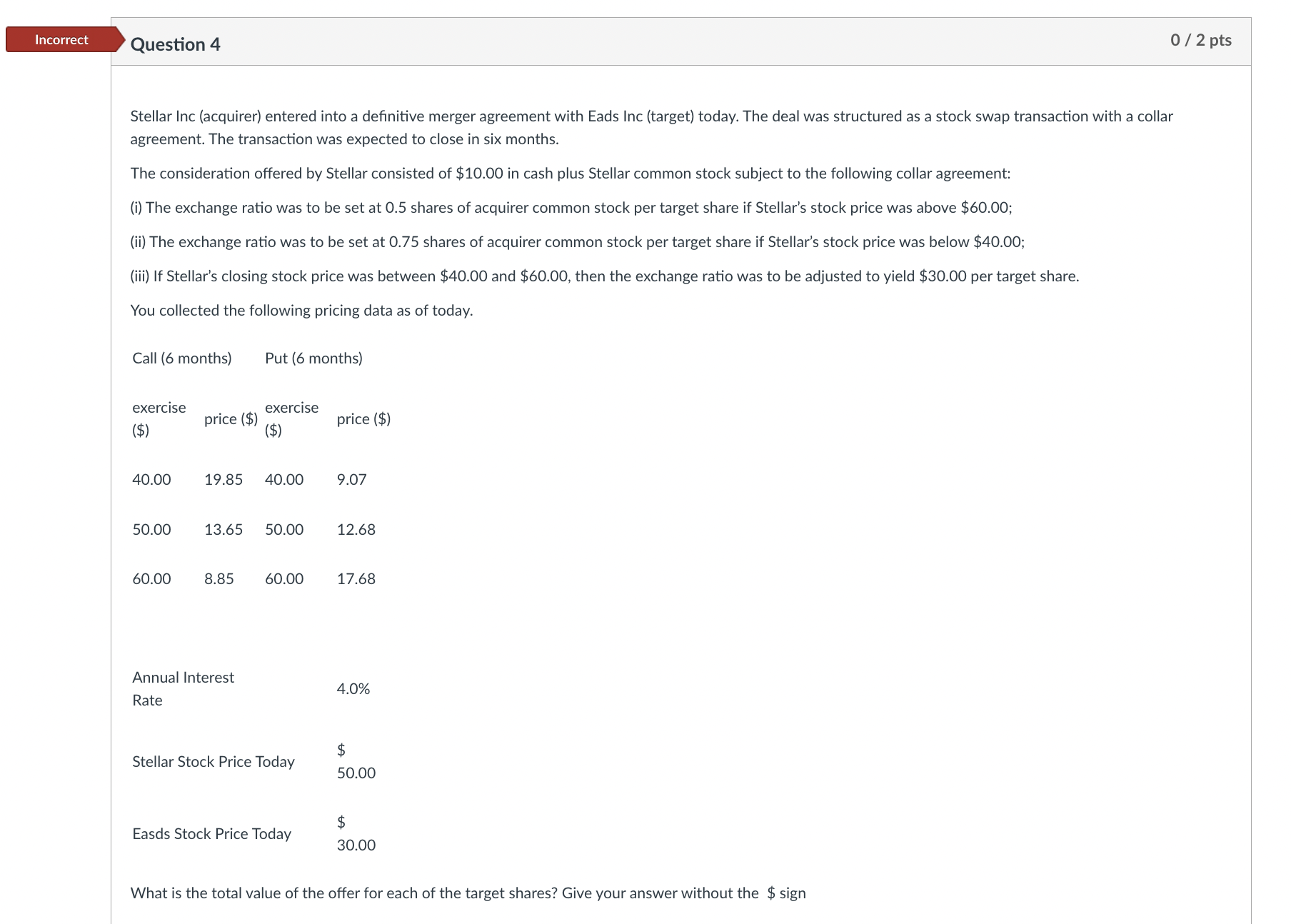

Incorrect Question 4 Stellar Inc (acquirer) entered into a definitive merger agreement with Eads Inc (target) today. The deal was structured as a stock swap transaction with a collar agreement. The transaction was expected to close in six months. The consideration offered by Stellar consisted of $10.00 in cash plus Stellar common stock subject to the following collar agreement: (i) The exchange ratio was to be set at 0.5 shares of acquirer common stock per target share if Stellar's stock price was above $60.00; (ii) The exchange ratio was to be set at 0.75 shares of acquirer common stock per target share if Stellar's stock price was below $40.00; (iii) If Stellar's closing stock price was between $40.00 and $60.00, then the exchange ratio was to be adjusted to yield $30.00 per target share. You collected the following pricing data as of today. Call (6 months) Put (6 months) exercise ($) price ($) exercise ($) price ($) 40.00 19.85 40.00 9.07 50.00 13.65 50.00 12.68 60.00 8.85 60.00 17.68 Annual Interest Rate 4.0% $ Stellar Stock Price Today 50.00 $ Easds Stock Price Today 30.00 What is the total value of the offer for each of the target shares? Give your answer without the $ sign 0 / 2 pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started