Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Increase in long - term debtExcel Activity: Financial Statements, Cash Flow, and Taxes Laiho Industries's 2 0 2 0 and 2 0 2 1 balance

Increase in longterm debtExcel Activity: Financial Statements, Cash Flow, and Taxes

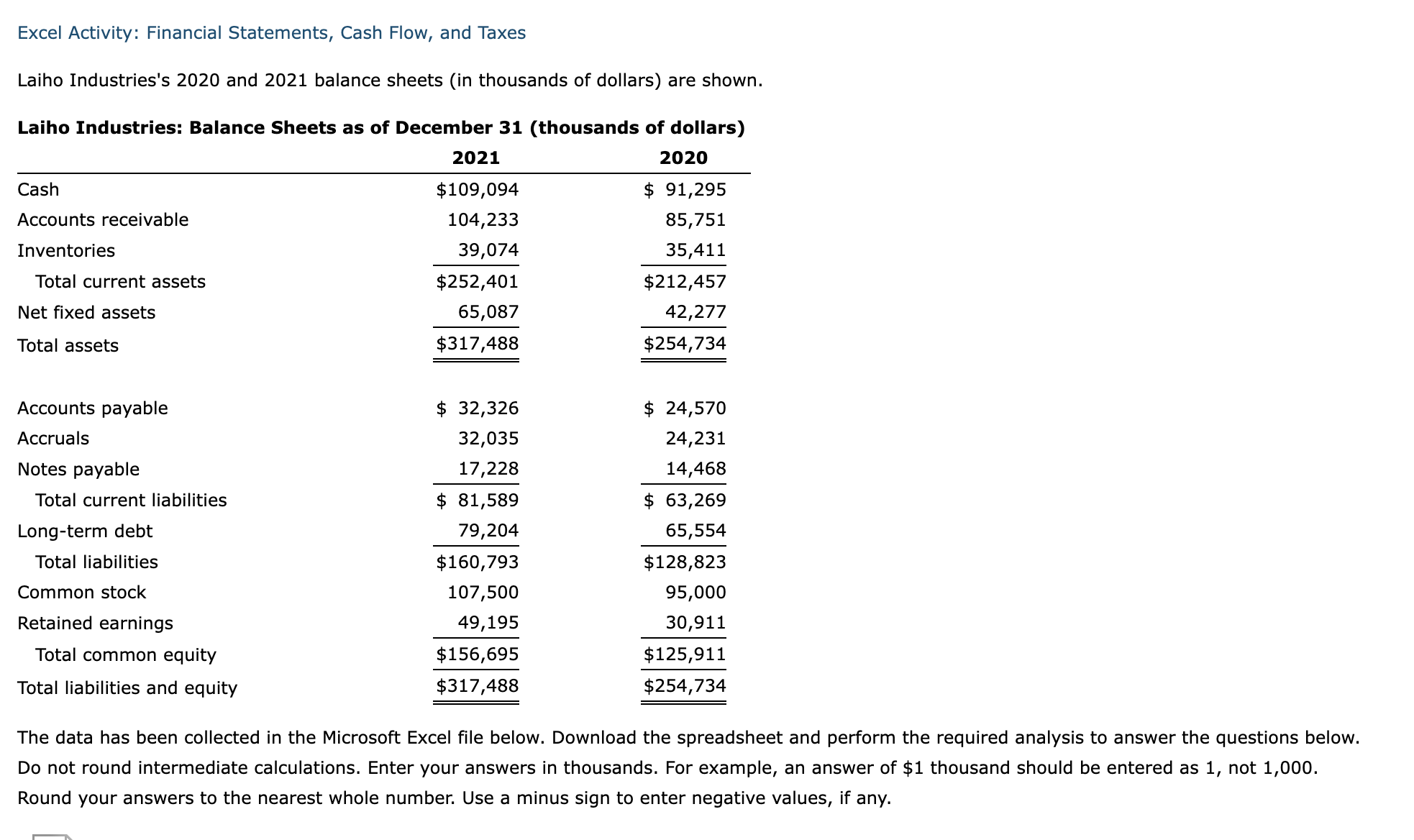

Laiho Industries's and balance sheets in thousands of dollars are shown.

Laiho Industries: Balance Sheets as of December thousands of dollars

The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below.

Do not round intermediate calculations. Enter your answers in thousands. For example, an answer of $ thousand should be entered as not

Round your answers to the nearest whole number. Use a minus sign to enter negative values, if any.

Increase in common stock

Payment of common dividends

Net cash provided by financing activities

Summary

Net increasedecrease in cash

Cash at the beginning of the year

Cash at the end of the year

c Calculate and net operating working capital NOWC and free cash flow FCF Assume the firm has no excess cash.

NOWC :$

thousand

NOWC :$

thousand

:$

thousand

If Laiho increased its dividend payout ratio, the firm would pay the same amount of corporate taxes and the company's shareholders would pay

taxes on the dividends they would receive.

e Assume that the firm's aftertax cost of capital is What is the firm's EVA?

$

thousand

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started