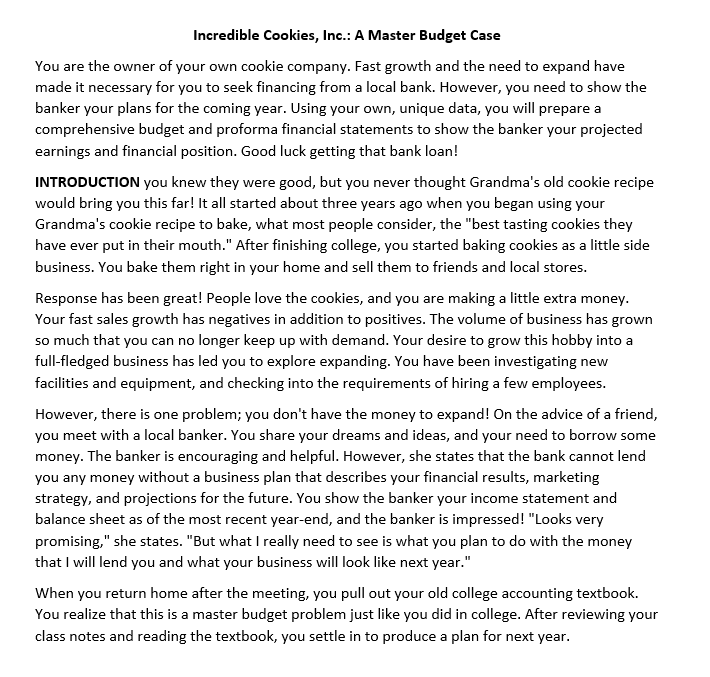

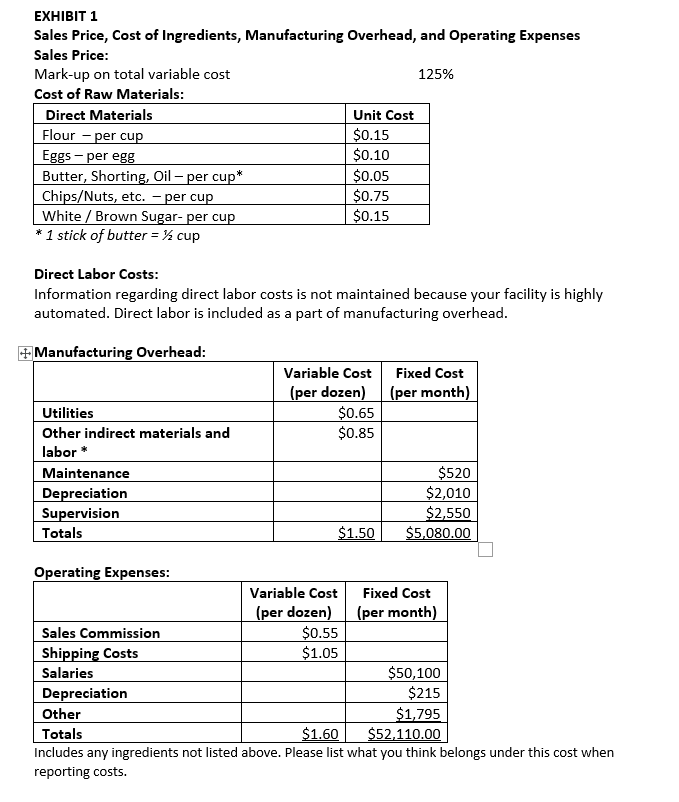

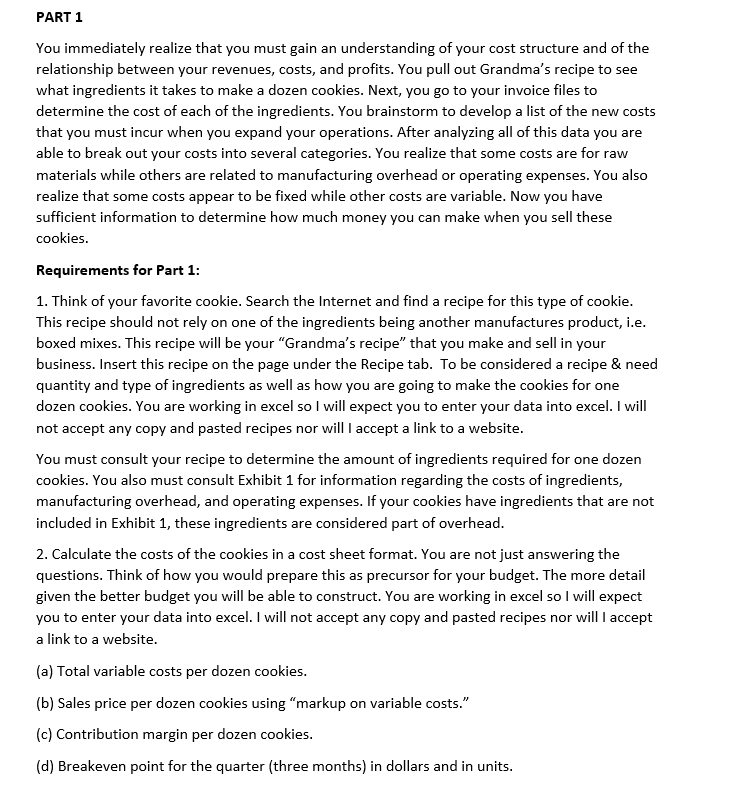

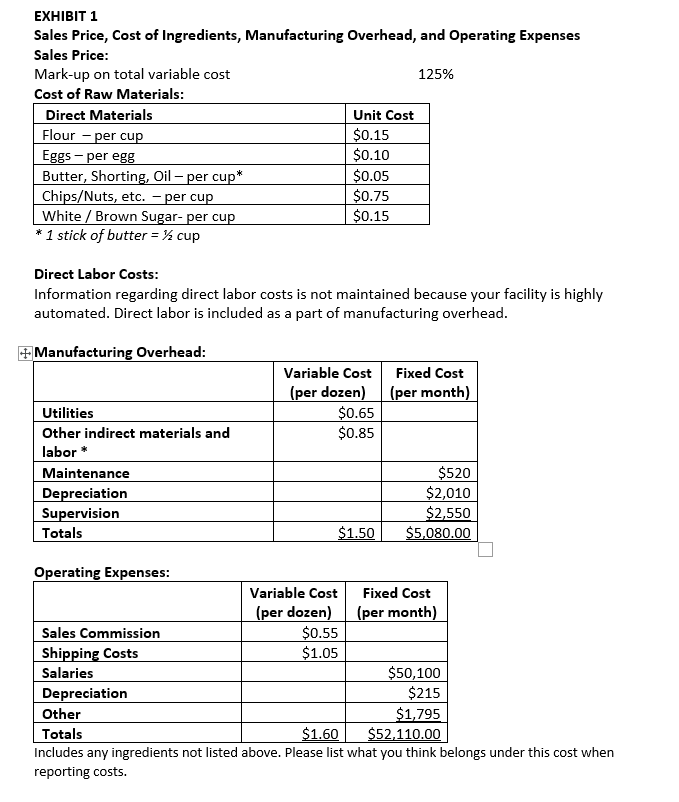

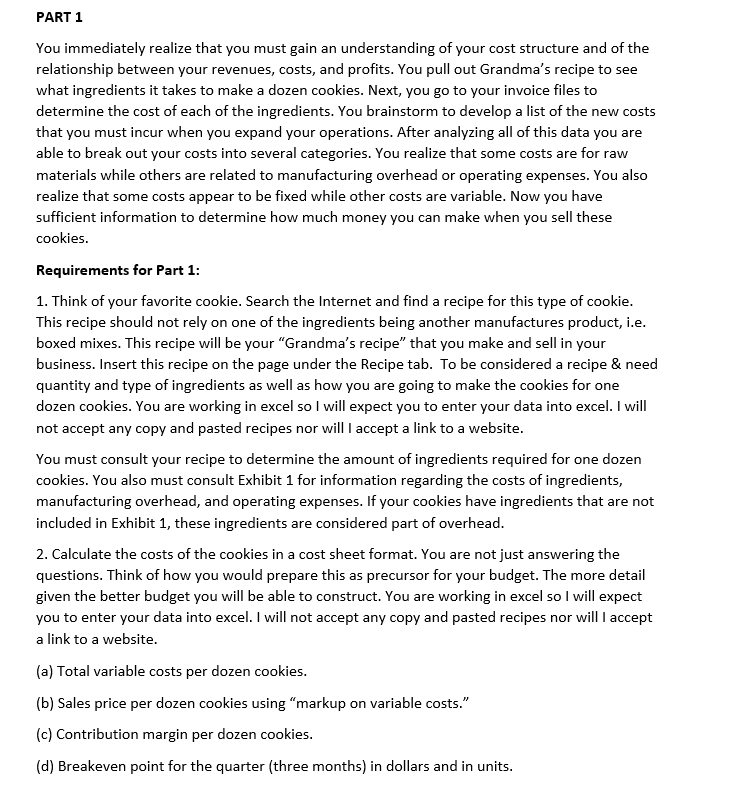

Incredible Cookies, Inc.: A Master Budget Case You are the owner of your own cookie company. Fast growth and the need to expand have made it necessary for you to seek financing from a local bank. However, you need to show the banker your plans for the coming year. Using your own, unique data, you will prepare a comprehensive budget and proforma financial statements to show the banker your projected earnings and financial position. Good luck getting that bank loan! INTRODUCTION you knew they were good, but you never thought Grandma's old cookie recipe would bring you this far! It all started about three years ago when you began using your Grandma's cookie recipe to bake, what most people consider, the "best tasting cookies they have ever put in their mouth." After finishing college, you started baking cookies as a little side business. You bake them right in your home and sell them to friends and local stores. Response has been great! People love the cookies, and you are making a little extra money. Your fast sales growth has negatives in addition to positives. The volume of business has grown so much that you can no longer keep up with demand. Your desire to grow this hobby into a full-fledged business has led you to explore expanding. You have been investigating new facilities and equipment, and checking into the requirements of hiring a few employees. However, there is one problem; you don't have the money to expand! On the advice of a friend, you meet with a local banker. You share your dreams and ideas, and your need to borrow some money. The banker is encouraging and helpful. However, she states that the bank cannot lend you any money without a business plan that describes your financial results, marketing strategy, and projections for the future. You show the banker your income statement and balance sheet as of the most recent year-end, and the banker is impressed! "Looks very promising," she states. "But what I really need to see is what you plan to do with the money that I will lend you and what your business will look like next year." When you return home after the meeting, you pull out your old college accounting textbook. You realize that this is a master budget problem just like you did in college. After reviewing your class notes and reading the textbook, you settle in to produce a plan for next year. EXHIBIT 1 Sales Price, Cost of Ingredients, Manufacturing Overhead, and Operating Expenses Sales Price: Mark-up on total variable cost 125% Cost of Raw Materials: Direct Materials Unit Cost Flour - per cup $0.15 Eggs - per egg $0.10 Butter, Shorting, Oil - per cup* $0.05 Chips/Nuts, etc. - per cup $0.75 White / Brown Sugar-per cup $0.15 * 1 stick of butter = % cup Direct Labor Costs: Information regarding direct labor costs is not maintained because your facility is highly automated. Direct labor is included as a part of manufacturing overhead. + Manufacturing Overhead: Fixed Cost (per month) Variable Cost (per dozen) $0.65 $0.85 Utilities Other indirect materials and labor * Maintenance Depreciation Supervision Totals $520 $2,010 $2,550 $5,080.00 $1.50 Operating Expenses: Variable Cost Fixed Cost (per dozen) (per month) Sales Commission $0.55 Shipping Costs $1.05 Salaries $50,100 Depreciation $215 Other $1,795 Totals $1.60 $52.110.00 Includes any ingredients not listed above. Please list what you think belongs under this cost when reporting costs. PART 1 You immediately realize that you must gain an understanding of your cost structure and of the relationship between your revenues, costs, and profits. You pull out Grandma's recipe to see what ingredients it takes to make a dozen cookies. Next, you go to your invoice files to determine the cost of each of the ingredients. You brainstorm to develop a list of the new costs that you must incur when you expand your operations. After analyzing all of this data you are able to break out your costs into several categories. You realize that some costs are for raw materials while others are related to manufacturing overhead or operating expenses. You also realize that some costs appear to be fixed while other costs are variable. Now you have sufficient information to determine how much money you can make when you sell these cookies. Requirements for Part 1: 1. Think of your favorite cookie. Search the Internet and find a recipe for this type of cookie. This recipe should not rely on one of the ingredients being another manufactures product, i.e. boxed mixes. This recipe will be your "Grandma's recipe that you make and sell in your business. Insert this recipe on the page under the Recipe tab. To be considered a recipe & need quantity and type of ingredients as well as how you are going to make the cookies for one dozen cookies. You are working in excel so I will expect you to enter your data into excel. I will not accept any copy and pasted recipes nor will I accept a link to a website. You must consult your recipe to determine the amount of ingredients required for one dozen cookies. You also must consult Exhibit 1 for information regarding the costs of ingredients, manufacturing overhead, and operating expenses. If your cookies have ingredients that are not included in Exhibit 1, these ingredients are considered part of overhead. 2. Calculate the costs of the cookies in a cost sheet format. You are not just answering the questions. Think of how you would prepare this as precursor for your budget. The more detail given the better budget you will be able to construct. You are working in excel so I will expect you to enter your data into excel. I will not accept any copy and pasted recipes nor will I accept a link to a website. (a) Total variable costs per dozen cookies. (b) Sales price per dozen cookies using "markup on variable costs." (c) Contribution margin per dozen cookies. (d) Breakeven point for the quarter (three months) in dollars and in units