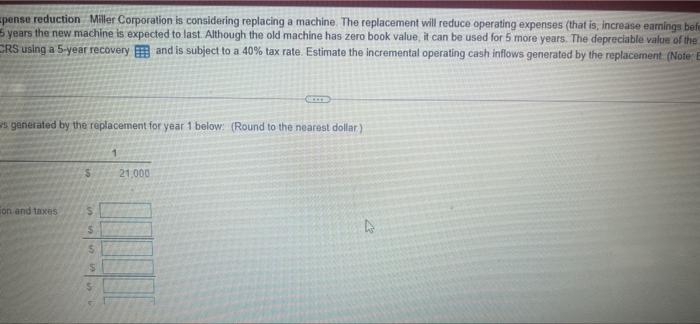

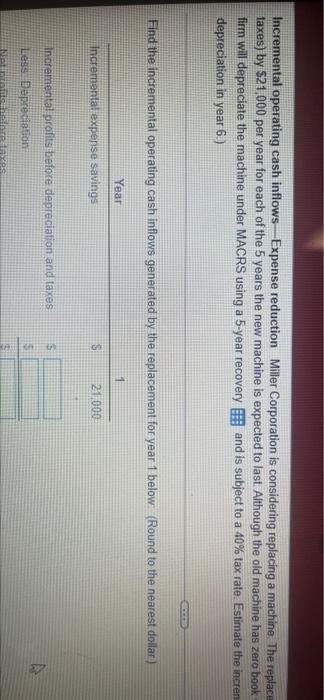

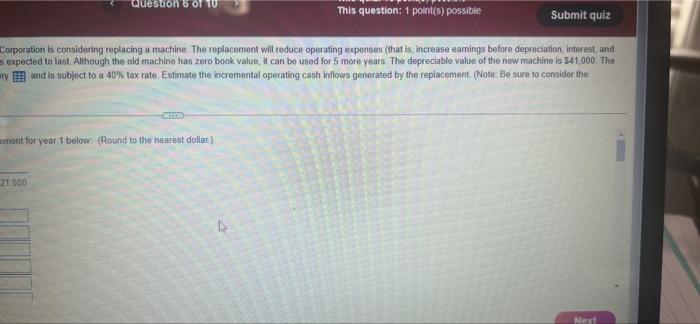

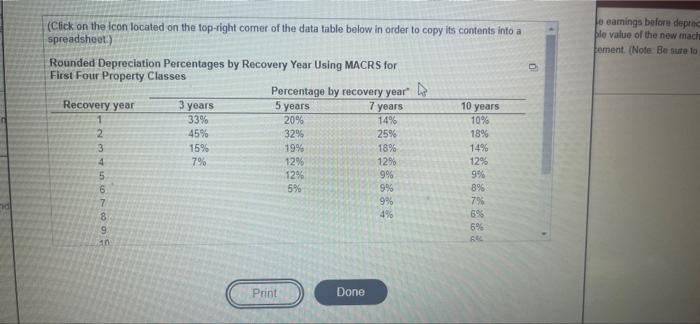

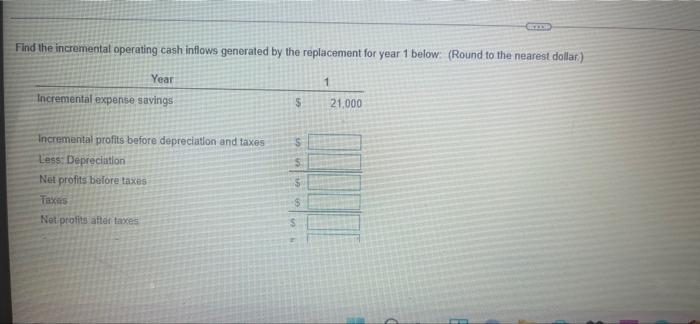

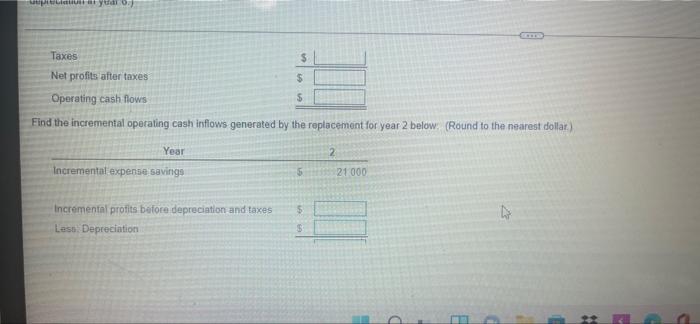

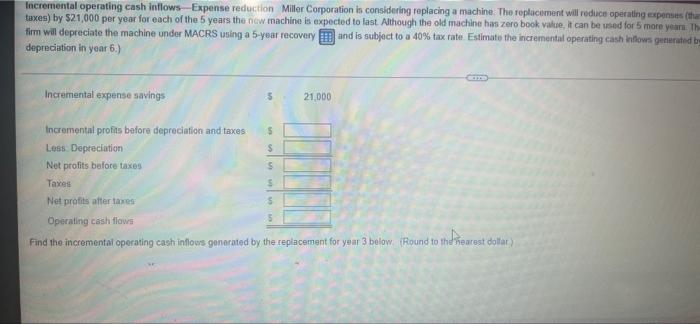

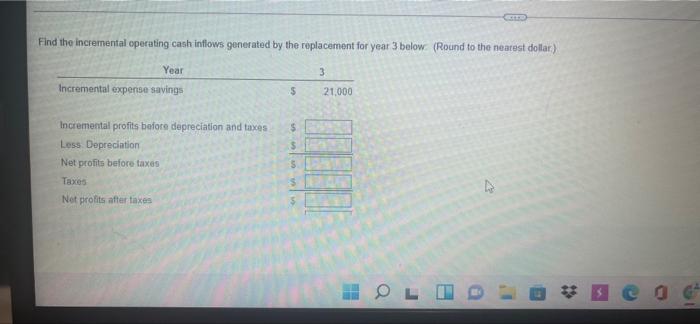

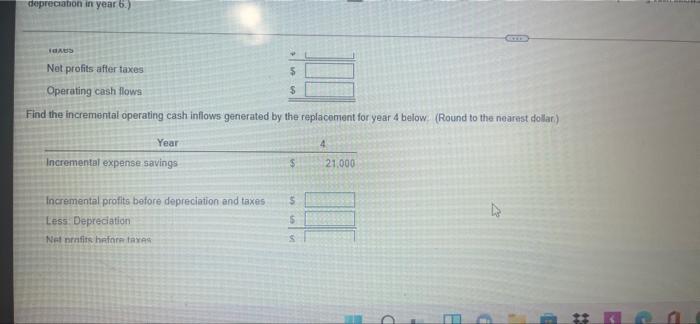

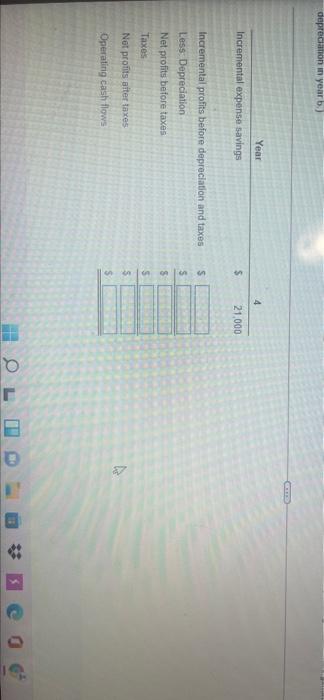

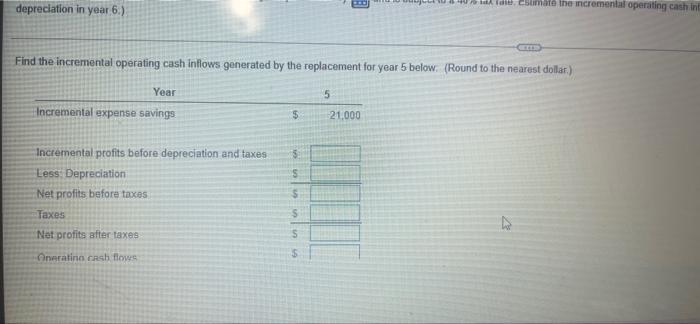

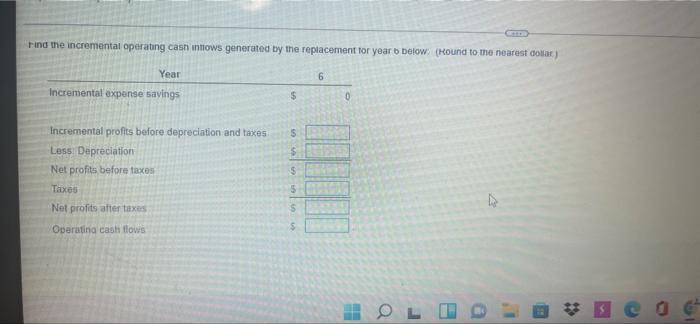

Incremental Operating cash inflows Expense reduction Mile Corporation conting placing a machine The competing proces a) by 21 000 per year for each of the years the machine is expected to fost Ahogh the old machine book. It can be used for more. The decide the new machines The firm will depreciate the machine under MACRS in a year recovery and issued to a 40 tax rate Estimate the incrementar as generated by the placement de consider the depredation in your 63 Epense reduction Miller Corporation is considering replacing a machine. The replacement will reduce operating expenses (that is increase earnings bef 3 years the new machine is expected to last. Although the old machine has zero book value, it can be used for 5 more years. The depreciable value of the CRS using a 5-year recovery and is subject to a 40% tax rate. Estimate the incremental operating cash inflows generated by the replacement (Note E es generated by the replacement for year 1 below (Round to the nearest dollar) 1 $ 21,000 ion and taxes 5 5 $ ng replacing a machine. The replacement will reduce operating expenses (that is, increase earnings before dopreciation, Interest, and ough the old machine has zero book value, it can be used for 5 more years. The depreciable value of the new machine is $41,000. The a 40% tax rate. Estimate the incremental operating cash inflows generated by the replacement (Note: Be sure to consider the (Round to the nearest dollar) Incremental operating cash inflows-Expense reduction Miller Corporation is considering replacing a machine. The replace faxes) by $21,000 per year for each of the 5 years the new machine is expected to last. Although the old machine has zero book firm will depreciate the machine under MACRS using a 5-year recovery B and is subject to a 40% tax rate. Estimate the increm depreciation in year 6.) Find the incremental operating cash inflows generated by the replacement for year 1 below (Round to the nearest dollar) Year 1 Incremental expense savings S 22.000 Incremental profits before depreciation and taxes Less Depreciation 5 5 Question of This question: 1 point(s) possible Submit quiz Corporation is considering replacing a machine. The replacement will reduce operating expenses (that is, increase earnings before depreciation, interest and expected to last. Although the old machine has zero book value, it can be used for 5 more years. The depreciable value of the new machine is $41.000. The and in subject to a 40% tax rate. Estimate the incremental operating cash inflows generated by the replacement (Note: Be sure to consider the ment for year 1 below (Round to the nearest dollar) 21 000 Next Jo earings before depre ble value of the new mach Fement. (Note Be sure to 3 years (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 5 years 7 years 10 years 33% 20% 1496 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 7% 129 12% 12% 5 129 9% 9% 6 5% 99% 89 7 99% 7% 8 4% 698 6% 4 H 000 $ 10 Print Done GODE Find the incremental operating cash inflows generated by the replacement for year 1 below (Round to the nearest dollar) 1 Year Incremental expense savings 5 21,000 5 5 Incremental profits before depreciation and taxes Less: Depreciation Net profits before taxes Taxes Net profits after taxes $ $ S yu Taxes $ Net profits after taxes $ Operating cash flows $ Find the incremental operating cash inflows generated by the replacement for year 2 below (Round to the nearest dollar) Year 2 Incrementat expense savingo 5 21 000 $ Incremental profits before depreciation and taxes Less Depreciation $ 3