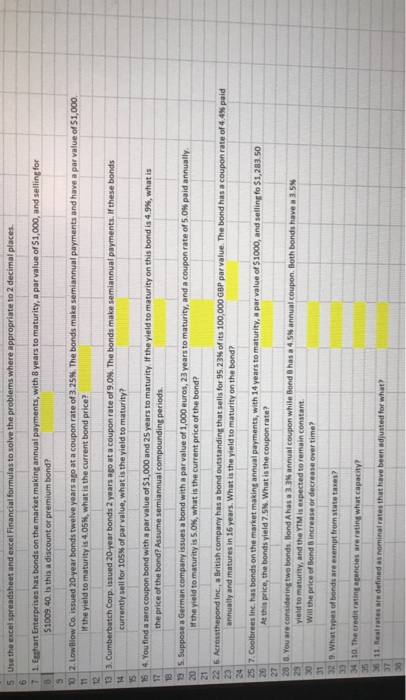

indexcel Financial formulas to solve the problems where appropriate to 2 decimal places 7 1. Erhart Enterprises has bends on the market making annual payments, with 3 years to maturity, a par value of $1,000, and selling for 51009.40. Is this a discount or premium bond? 0 2 Low Bow Caissued 20 year bonds twelve years ago at a coupon rate of 3 25. The bonds make semiannual payments and have a par value of $1.000 the yield to maturity is 4.05, what is the current bond price? 13 3. Cumberbatch Corp.issued 20-year bonds 2 years ago at a coupon rate of 9.0%. The bonds make semiannual payments, these bonds currently sell for 105 of par value, what is the yield to maturity? You find a coupon bond with a par value of $1,000 and 25 years to maturity, the yield to maturity on this bond is 4.95, what is the price of the bond? Assume semiannual compounding periods 5. Suppose a German company issues a bond with a par value of 1.000 euros, 23 years to maturity, and a coupon rate of S.ON paid annually the yield to maturity is SON, what is the current price of the band? 6. Acrossthepondine, a British company has a bond outstanding that sells for 95.23 of its 100,000 GBP par value. The band has a coupon rate of 4.45 paid annually and matures in 16 years. What is the yield to maturity on the bond? 7. Coolbrees Inc. has bonds on the market making annual payments, with 14 years to maturity, a par value of $1000, and selling fo $1,283.50 At this price, the bonds yield 7.5N. What is the coupon rate? a B. You are considering two bonds Bond Ahas annual coupon while Bond Bhasa S tomaty, and the YTM is expected to remain constant wil the price of Bond increase or decrease over time? coupon. Both bonds have a 3. SN 9. What types of bonds are exempt from state taxes? 34 10. The credit rating agencies are rating what capacity! 11. Real rates are defined as nominates that have been adjusted for what? indexcel Financial formulas to solve the problems where appropriate to 2 decimal places 7 1. Erhart Enterprises has bends on the market making annual payments, with 3 years to maturity, a par value of $1,000, and selling for 51009.40. Is this a discount or premium bond? 0 2 Low Bow Caissued 20 year bonds twelve years ago at a coupon rate of 3 25. The bonds make semiannual payments and have a par value of $1.000 the yield to maturity is 4.05, what is the current bond price? 13 3. Cumberbatch Corp.issued 20-year bonds 2 years ago at a coupon rate of 9.0%. The bonds make semiannual payments, these bonds currently sell for 105 of par value, what is the yield to maturity? You find a coupon bond with a par value of $1,000 and 25 years to maturity, the yield to maturity on this bond is 4.95, what is the price of the bond? Assume semiannual compounding periods 5. Suppose a German company issues a bond with a par value of 1.000 euros, 23 years to maturity, and a coupon rate of S.ON paid annually the yield to maturity is SON, what is the current price of the band? 6. Acrossthepondine, a British company has a bond outstanding that sells for 95.23 of its 100,000 GBP par value. The band has a coupon rate of 4.45 paid annually and matures in 16 years. What is the yield to maturity on the bond? 7. Coolbrees Inc. has bonds on the market making annual payments, with 14 years to maturity, a par value of $1000, and selling fo $1,283.50 At this price, the bonds yield 7.5N. What is the coupon rate? a B. You are considering two bonds Bond Ahas annual coupon while Bond Bhasa S tomaty, and the YTM is expected to remain constant wil the price of Bond increase or decrease over time? coupon. Both bonds have a 3. SN 9. What types of bonds are exempt from state taxes? 34 10. The credit rating agencies are rating what capacity! 11. Real rates are defined as nominates that have been adjusted for what