Answered step by step

Verified Expert Solution

Question

1 Approved Answer

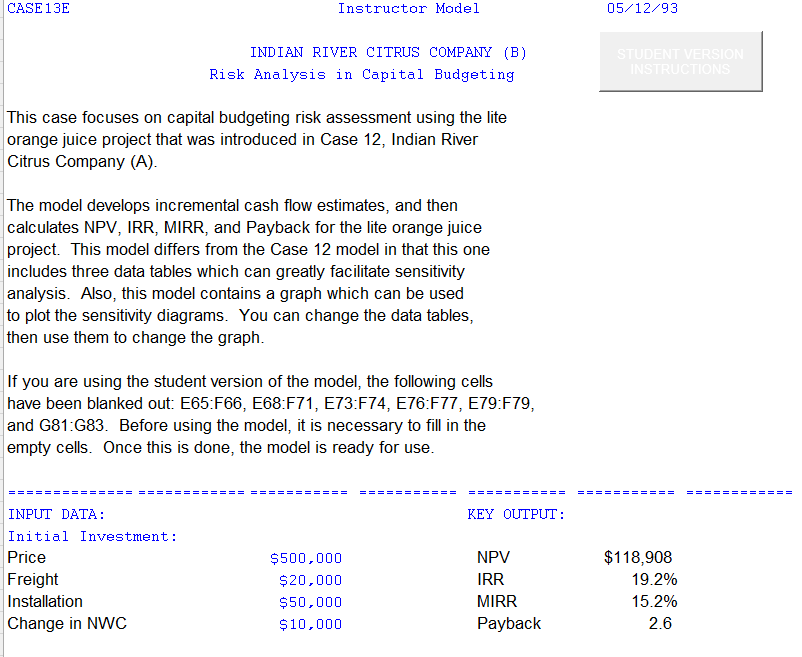

INDIAN RIVER CITRUS COMPANY (B) Risk Analysis in Capital Budgeting This case focuses on capital budgeting risk assessment using the lite orange juice project that

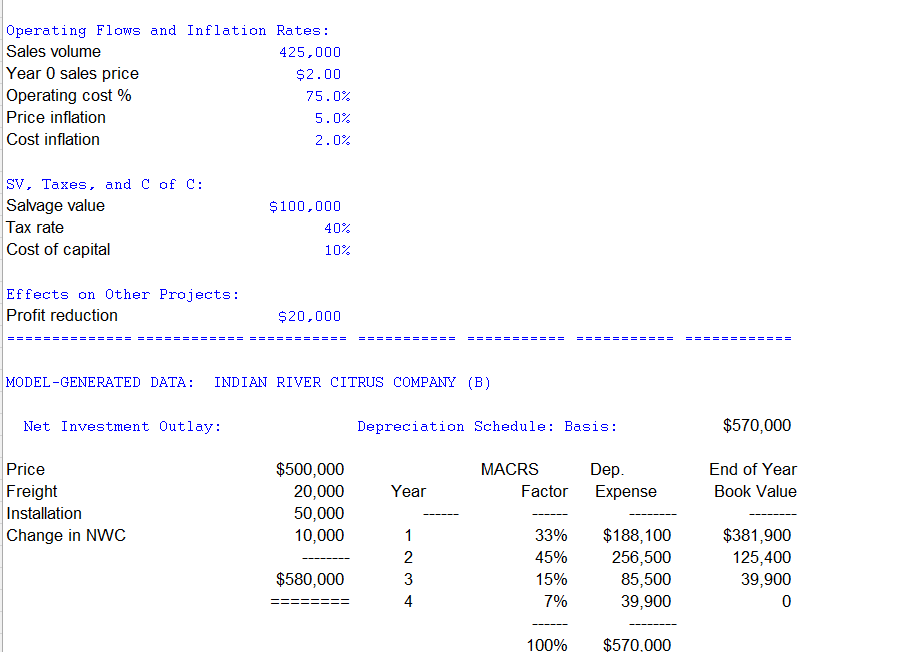

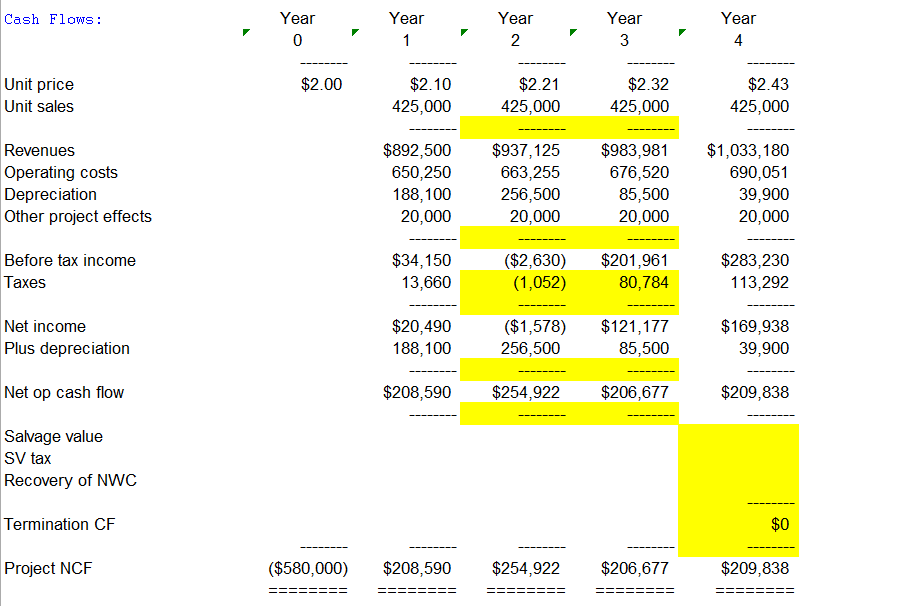

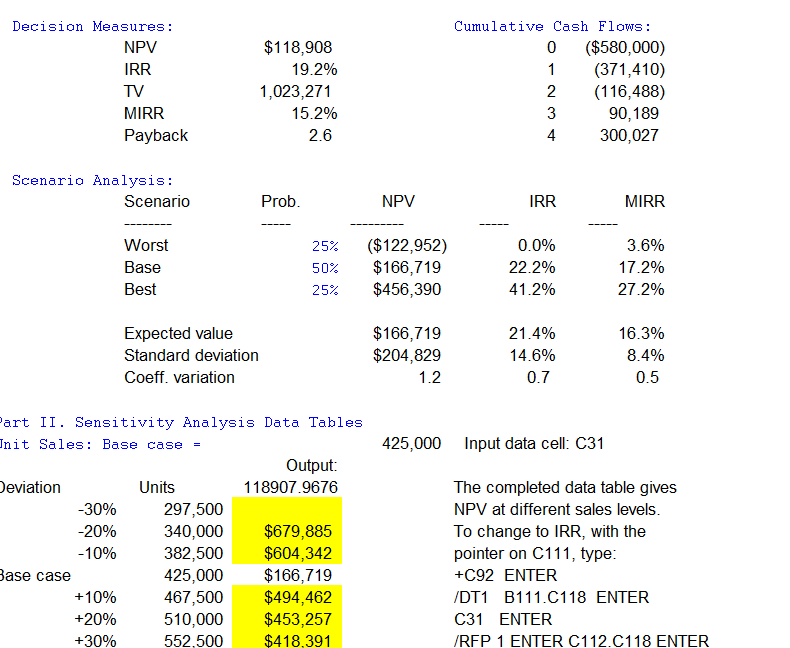

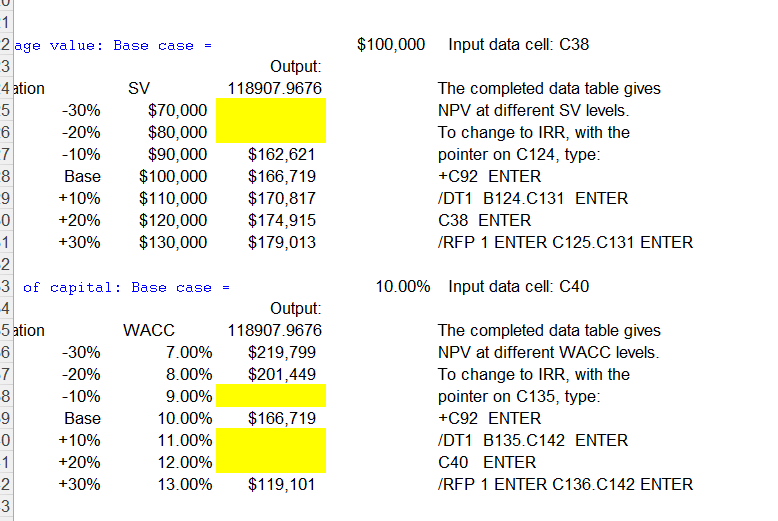

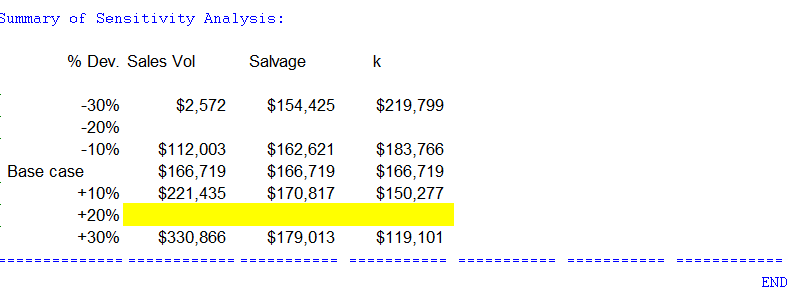

INDIAN RIVER CITRUS COMPANY (B) Risk Analysis in Capital Budgeting This case focuses on capital budgeting risk assessment using the lite orange juice project that was introduced in Case 12, Indian River Citrus Company (A). The model develops incremental cash flow estimates, and then calculates NPV, IRR, MIRR, and Payback for the lite orange juice project. This model differs from the Case 12 model in that this one includes three data tables which can greatly facilitate sensitivity analysis. Also, this model contains a graph which can be used to plot the sensitivity diagrams. You can change the data tables, then use them to change the graph. If you are using the student version of the model, the following cells have been blanked out: E65:F66, E68:F71, E73:F74, E76:F77, E79:F79, and G81:G83. Before using the model, it is necessary to fill in the empty cells. Once this is done, the model is ready for use. MODEL-GENERATED DATA: INDIAN RIVER CITRUS COMPANY (B) art II. Sensitivity Analysis Data Tables nit Sales: Base case = \begin{tabular}{|c|c|c|c|c|c|} \hline 2 age & value: B & Base case = & Output: & $100,000 & Input data cell: C38 \\ \hline ation & & SV & 118907.9676 & & The completed data table gives \\ \hline & 30% & $70,000 & & & NPV at different SV levels. \\ \hline & 20% & $80,000 & & & To change to IRR, with the \\ \hline & 10% & $90,000 & $162,621 & & pointer on C124, type: \\ \hline & Base & $100,000 & $166,719 & & +C92 ENTER \\ \hline & +10% & $110,000 & $170,817 & & /DT1 B124.C131 ENTER \\ \hline & +20% & $120,000 & $174,915 & & C38 ENTER \\ \hline & +30% & $130,000 & $179,013 & & /RFP 1 ENTER C125.C131 ENTER \\ \hline of & capital: & : Base case & Output: & 10.00% & Input data cell: C40 \\ \hline ion & & WACC & 118907.9676 & & The completed data table gives \\ \hline & 30% & 7.00% & $219,799 & & NPV at different WACC levels. \\ \hline & 20% & 8.00% & $201,449 & & To change to IRR, with the \\ \hline & 10% & 9.00% & & & pointer on C135, type: \\ \hline & Base & 10.00% & $166,719 & & +C92 ENTER \\ \hline & +10% & 11.00% & & & /DT1 B135.C142 ENTER \\ \hline & +20% & 12.00% & & & C40 ENTER \\ \hline & +30% & 13.00% & $119,101 & & /RFP 1 ENTER C136.C142 ENTER \\ \hline \end{tabular} Summary of Sensitivity Analysis

INDIAN RIVER CITRUS COMPANY (B) Risk Analysis in Capital Budgeting This case focuses on capital budgeting risk assessment using the lite orange juice project that was introduced in Case 12, Indian River Citrus Company (A). The model develops incremental cash flow estimates, and then calculates NPV, IRR, MIRR, and Payback for the lite orange juice project. This model differs from the Case 12 model in that this one includes three data tables which can greatly facilitate sensitivity analysis. Also, this model contains a graph which can be used to plot the sensitivity diagrams. You can change the data tables, then use them to change the graph. If you are using the student version of the model, the following cells have been blanked out: E65:F66, E68:F71, E73:F74, E76:F77, E79:F79, and G81:G83. Before using the model, it is necessary to fill in the empty cells. Once this is done, the model is ready for use. MODEL-GENERATED DATA: INDIAN RIVER CITRUS COMPANY (B) art II. Sensitivity Analysis Data Tables nit Sales: Base case = \begin{tabular}{|c|c|c|c|c|c|} \hline 2 age & value: B & Base case = & Output: & $100,000 & Input data cell: C38 \\ \hline ation & & SV & 118907.9676 & & The completed data table gives \\ \hline & 30% & $70,000 & & & NPV at different SV levels. \\ \hline & 20% & $80,000 & & & To change to IRR, with the \\ \hline & 10% & $90,000 & $162,621 & & pointer on C124, type: \\ \hline & Base & $100,000 & $166,719 & & +C92 ENTER \\ \hline & +10% & $110,000 & $170,817 & & /DT1 B124.C131 ENTER \\ \hline & +20% & $120,000 & $174,915 & & C38 ENTER \\ \hline & +30% & $130,000 & $179,013 & & /RFP 1 ENTER C125.C131 ENTER \\ \hline of & capital: & : Base case & Output: & 10.00% & Input data cell: C40 \\ \hline ion & & WACC & 118907.9676 & & The completed data table gives \\ \hline & 30% & 7.00% & $219,799 & & NPV at different WACC levels. \\ \hline & 20% & 8.00% & $201,449 & & To change to IRR, with the \\ \hline & 10% & 9.00% & & & pointer on C135, type: \\ \hline & Base & 10.00% & $166,719 & & +C92 ENTER \\ \hline & +10% & 11.00% & & & /DT1 B135.C142 ENTER \\ \hline & +20% & 12.00% & & & C40 ENTER \\ \hline & +30% & 13.00% & $119,101 & & /RFP 1 ENTER C136.C142 ENTER \\ \hline \end{tabular} Summary of Sensitivity Analysis Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started