Answered step by step

Verified Expert Solution

Question

1 Approved Answer

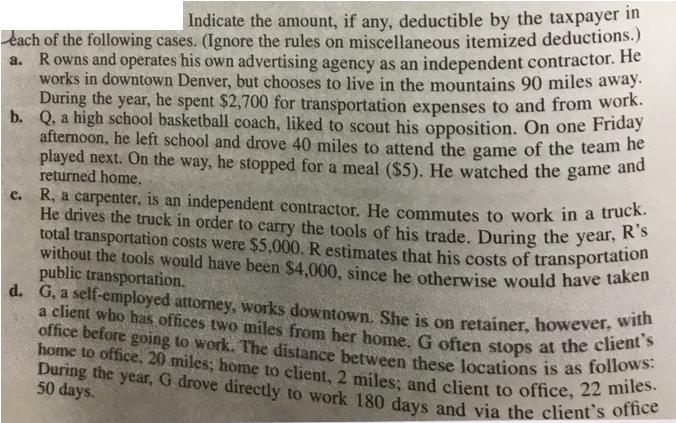

Indicate the amount, if any, deductible by the taxpayer in each of the following cases. (Ignore the rules on miscellaneous itemized deductions.) a. R

Indicate the amount, if any, deductible by the taxpayer in each of the following cases. (Ignore the rules on miscellaneous itemized deductions.) a. R owns and operates his own advertising agency as an independent contractor. He works in downtown Denver, but chooses to live in the mountains 90 miles away. During the year, he spent $2,700 for transportation expenses to and from work. Q. a high school basketball coach, liked to scout his opposition. On one Friday afternoon, he left school and drove 40 miles to attend the game of the team he played next. On the way, he stopped for a meal ($5). He watched the game and b. returned home. C. R, a carpenter, is an independent contractor. He commutes to work in a truck. He drives the truck in order to carry the tools of his trade. During the year, R's total transportation costs were $5,000. R estimates that his costs of transportation without the tools would have been $4,000, since he otherwise would have taken d. G, a self-employed attorney, works downtown. She is on retainer, however, with a client who has offices two miles from her home. G often stops at the client's office before going to work. The distance between these locations is as follows: home to office. 20 miles; home to client, 2 miles; and client to office, 22 miles. During the year, G drove directly to work 180 days and via the client's office 50 days.

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a R can deduct the full amount of 2700 for transportation expenses since they were incurred wh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started