Answered step by step

Verified Expert Solution

Question

1 Approved Answer

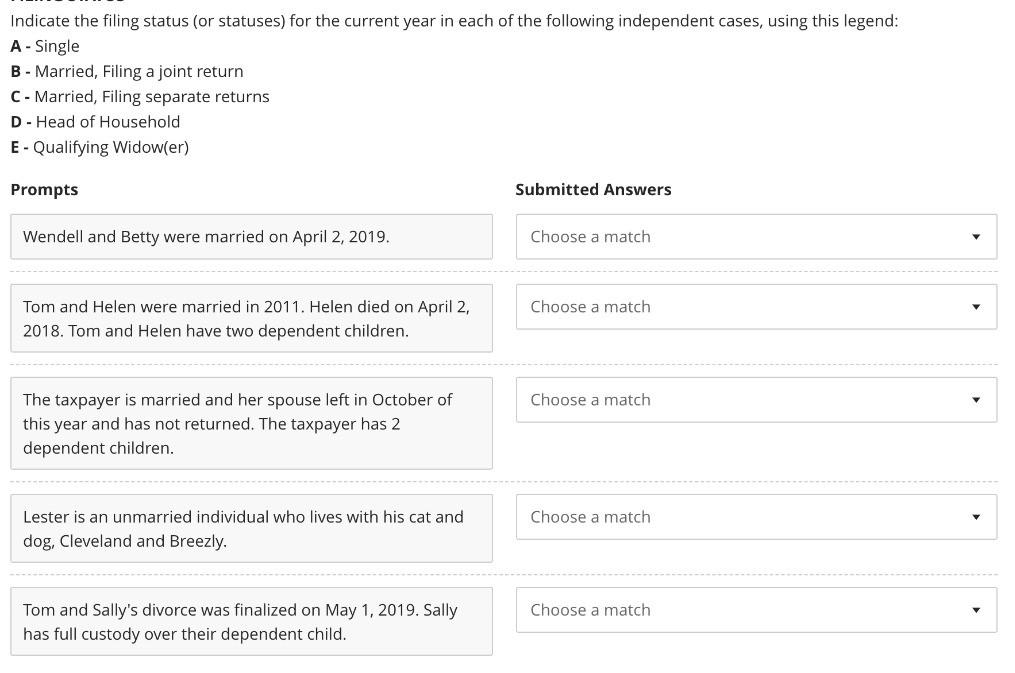

Indicate the filing status (or statuses) for the current year in each of the following independent cases, using this legend: A - Single B

Indicate the filing status (or statuses) for the current year in each of the following independent cases, using this legend: A - Single B - Married, Filing a joint return C - Married, Filing separate returns D - Head of Household E-Qualifying Widow(er) Prompts Wendell and Betty were married on April 2, 2019. Submitted Answers Choose a match Tom and Helen were married in 2011. Helen died on April 2, 2018. Tom and Helen have two dependent children. The taxpayer is married and her spouse left in October of this year and has not returned. The taxpayer has 2 dependent children. Choose a match Choose a match Lester is an unmarried individual who lives with his cat and dog, Cleveland and Breezly. Choose a match Tom and Sally's divorce was finalized on May 1, 2019. Sally has full custody over their dependent child. Choose a match.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started