Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Indicate the income tax consequences to the relevant shareholders of the transaction(s) described in each of the following four independent cases, including identifying the

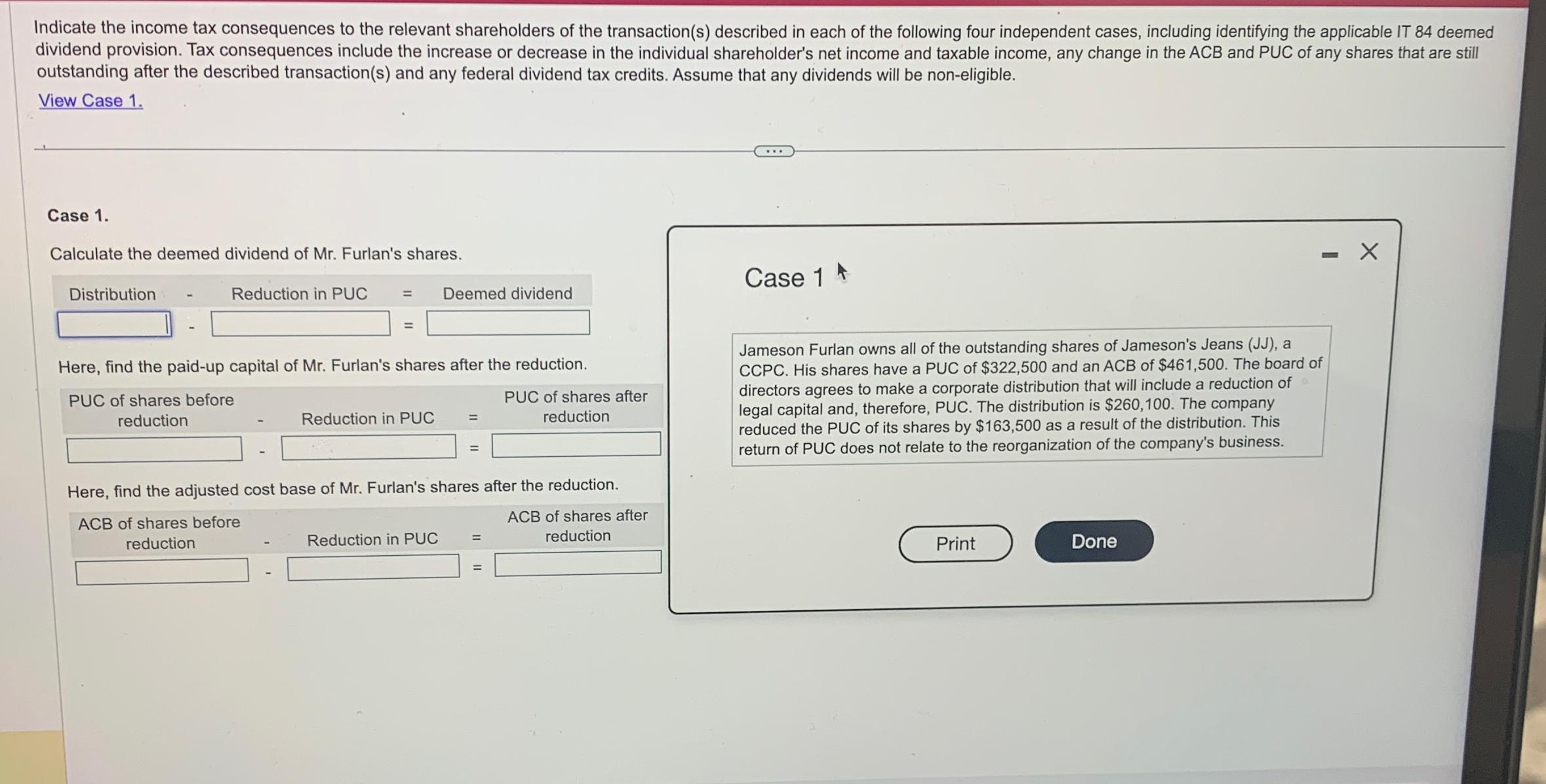

Indicate the income tax consequences to the relevant shareholders of the transaction(s) described in each of the following four independent cases, including identifying the applicable IT 84 deemed dividend provision. Tax consequences include the increase or decrease in the individual shareholder's net income and taxable income, any change in the ACB and PUC of any shares that are still outstanding after the described transaction(s) and any federal dividend tax credits. Assume that any dividends will be non-eligible. View Case 1. Case 1. Calculate the deemed dividend of Mr. Furlan's shares. Distribution Reduction in PUC = Deemed dividend Here, find the paid-up capital of Mr. Furlan's shares after the reduction. PUC of shares before reduction Reduction in PUC == PUC of shares after reduction = Here, find the adjusted cost base of Mr. Furlan's shares after the reduction. ACB of shares before reduction Reduction in PUC = ACB of shares after reduction Case 1 A Jameson Furlan owns all of the outstanding shares of Jameson's Jeans (JJ), a CCPC. His shares have a PUC of $322,500 and an ACB of $461,500. The board of directors agrees to make a corporate distribution that will include a reduction of legal capital and, therefore, PUC. The distribution is $260,100. The company reduced the PUC of its shares by $163,500 as a result of the distribution. This return of PUC does not relate to the reorganization of the company's business. Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the deemed dividend paidup capital PUC after the reduction and adjusted cost base A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started