Answered step by step

Verified Expert Solution

Question

1 Approved Answer

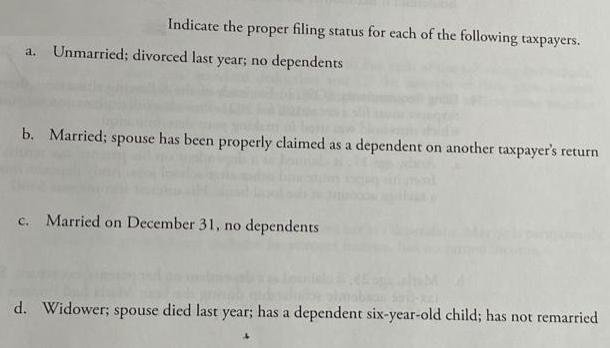

Indicate the proper filing status for each of the following taxpayers. Unmarried; divorced last year; no dependents a. b. Married; spouse has been properly

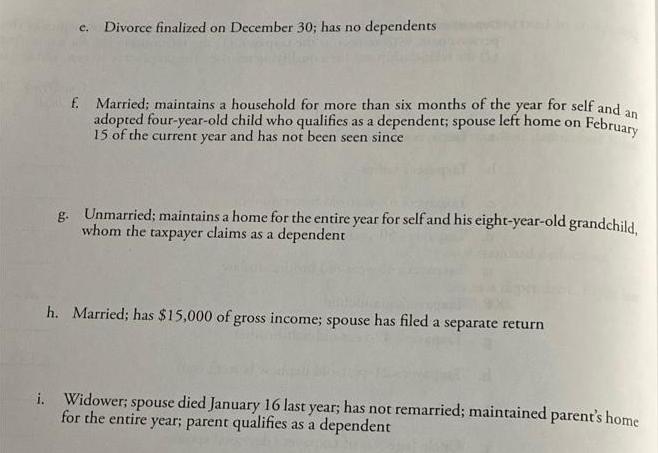

Indicate the proper filing status for each of the following taxpayers. Unmarried; divorced last year; no dependents a. b. Married; spouse has been properly claimed as a dependent on another taxpayer's return c. Married on December 31, no dependents d. Widower; spouse died last year; has a dependent six-year-old child; has not remarried Divorce finalized on December 30; has no dependents E. Married; maintains a household for more than six months of the year for self and an adopted four-year-old child who qualifies as a dependent; spouse left home on Februar 15 of the current year and has not been seen since g. Unmarried; maintains a home for the entire year for self and his eight-year-old grandchild. whom the taxpayer claims as a dependent h. Married; has $15,000 of gross income; spouse has filed a separate return i. Widower; spouse died January 16 last year; has not remarried; maintained parent's home for the entire year; parent qualifies as a dependent

Step by Step Solution

★★★★★

3.31 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Filling status determines the rate at which income is taxed a Singl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started