Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Indicate using the above numbers where the following items should be reported on the income statement. Place an X in the blank if it should

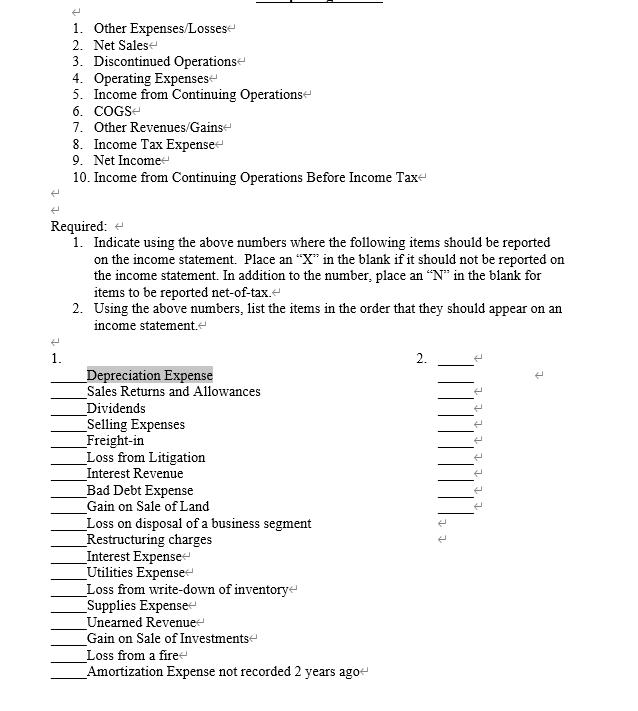

- Indicate using the above numbers where the following items should be reported on the income statement. Place an “X” in the blank if it should not be reported on the income statement. In addition to the number, place an “N” in the blank for items to be reported net-of-tax.

- Using the above numbers, list the items in the order that they should appear on an income statement.

1. Other Expenses/Lossese 2. Net Salese 3. Discontinued Operations- 4. Operating Expenses 5. Income from Continuing Operations- 6. COGS- 7. Other Revenues/Gains- 8. Income Tax Expense 9. Net Income 10. Income from Continuing Operations Before Income Tax Required: + 1. Indicate using the above numbers where the following items should be reported on the income statement. Place an "X" in the blank if it should not be reported on the income statement. In addition to the number, place an N" in the blank for items to be reported net-of-tax. 2. Using the above numbers, list the items in the order that they should appear on an income statement. 1. 2. Depreciation Expense Sales Returns and Allowances Dividends Selling Expenses _Freight-in _Loss from Litigation _Interest Revenue Bad Debt Expense Gain on Sale of Land _Loss on disposal of a business segment _Restructuring charges _Interest Expense Utilities Expensee _Loss from write-down of inventorye Supplies Expense _Unearned Revenue Gain on Sale of Investmentse Loss from a fire- Amortization Expense not recorded 2 years ago

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Depreciation Expense 4 Operating Expenses Sales Returns and Allowances 2 Net Sales Dividends X Sel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started