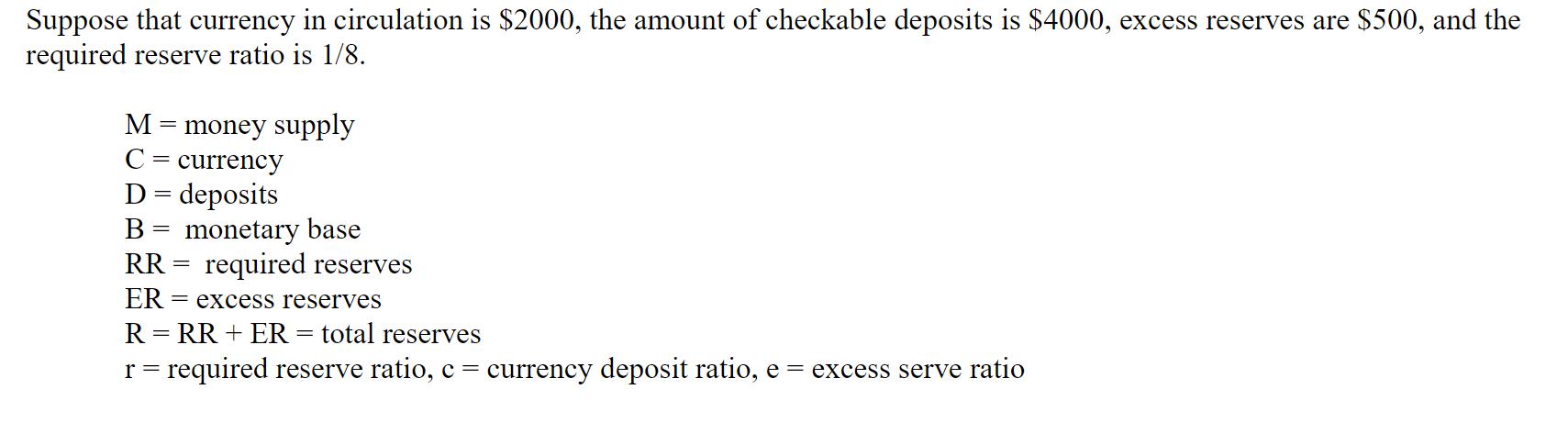

Suppose that currency in circulation is $2000, the amount of checkable deposits is $4000, excess reserves are $500, and the required reserve ratio is

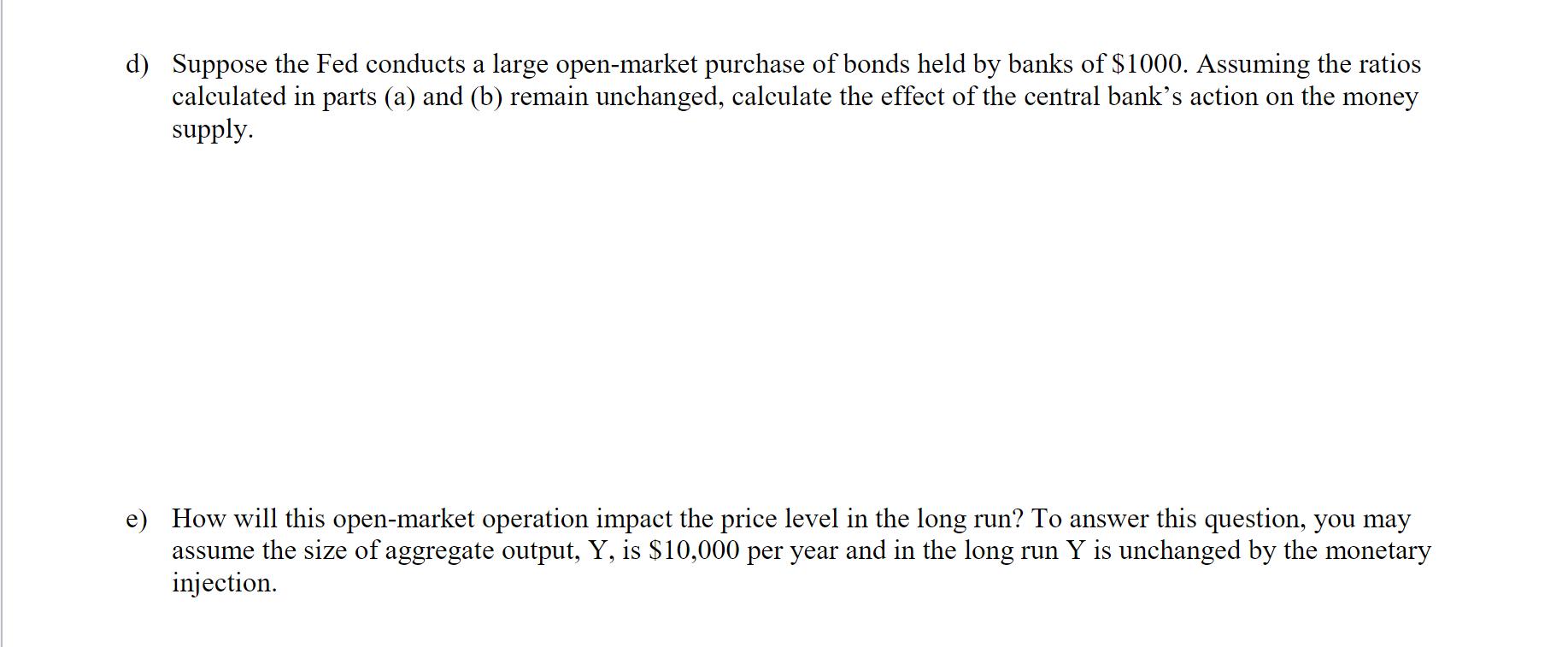

Suppose that currency in circulation is $2000, the amount of checkable deposits is $4000, excess reserves are $500, and the required reserve ratio is 1/8. M C = currency money supply D = deposits B = monetary base RR = required reserves ER = excess reserves R = RR + ER = total reserves r = required reserve ratio, c = currency deposit ratio, e = excess serve ratio d) Suppose the Fed conducts a large open-market purchase of bonds held by banks of $1000. Assuming the ratios calculated in parts (a) and (b) remain unchanged, calculate the effect of the central bank's action on the money supply. e) How will this open-market operation impact the price level in the long run? To answer this question, you may assume the size of aggregate output, Y, is $10,000 per year and in the long run Y is unchanged by the monetary injection.

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

d Answer Suppose the Fed conducts a large openmarket purchase of bonds held by banks of 1000 Assumin...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started