Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Indicate whether the following statements are True or False regarding nonrecognition of gain or loss in certain property transactions. a. The nonrecognition provisions for nontaxable

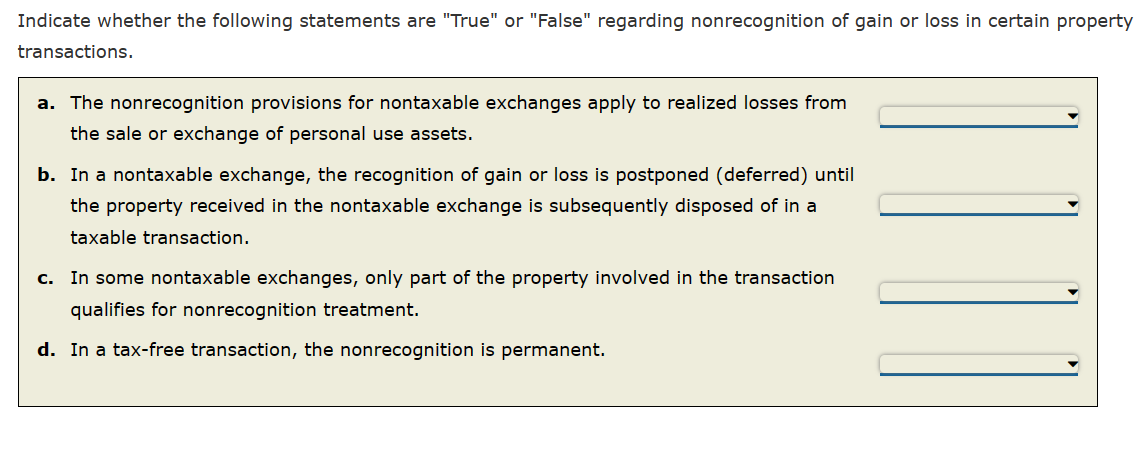

Indicate whether the following statements are "True" or "False" regarding nonrecognition of gain or loss in certain property transactions. a. The nonrecognition provisions for nontaxable exchanges apply to realized losses from the sale or exchange of personal use assets. b. In a nontaxable exchange, the recognition of gain or loss is postponed (deferred) until the property received in the nontaxable exchange is subsequently disposed of in a taxable transaction. c. In some nontaxable exchanges, only part of the property involved in the transaction qualifies for nonrecognition treatment. d. In a tax-free transaction, the nonrecognition is permanent

Indicate whether the following statements are "True" or "False" regarding nonrecognition of gain or loss in certain property transactions. a. The nonrecognition provisions for nontaxable exchanges apply to realized losses from the sale or exchange of personal use assets. b. In a nontaxable exchange, the recognition of gain or loss is postponed (deferred) until the property received in the nontaxable exchange is subsequently disposed of in a taxable transaction. c. In some nontaxable exchanges, only part of the property involved in the transaction qualifies for nonrecognition treatment. d. In a tax-free transaction, the nonrecognition is permanent Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started