Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Indicate which formulas where used to get the values in each cell. *UPLOAD EXCEL FILE ( indicating the formulas used) * USE EXCEL 1. You

Indicate which formulas where used to get the values in each cell.

*UPLOAD EXCEL FILE ( indicating the formulas used)

* USE EXCEL

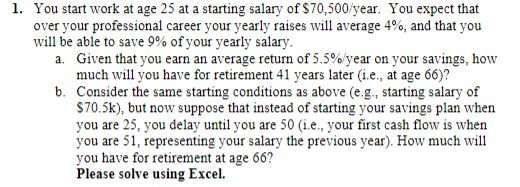

1. You start work at age 25 at a starting salary of $70,500/year. You expect that over your professional career your yearly raises will average 4%, and that you will be able to save 9% of your yearly salary. a. Given that you earn an average return of 5.5%/year on your savings, how much will you have for retirement 41 years later (i.e., at age 66)? b. Consider the same starting conditions as above (e.g., starting salary of $70.5k), but now suppose that instead of starting your savings plan when you are 25, you delay until you are 50 (1.e., your first cash flow is when you are 51, representing your salary the previous year). How much will you have for retirement at age 66? Please solve using ExcelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started