Answered step by step

Verified Expert Solution

Question

1 Approved Answer

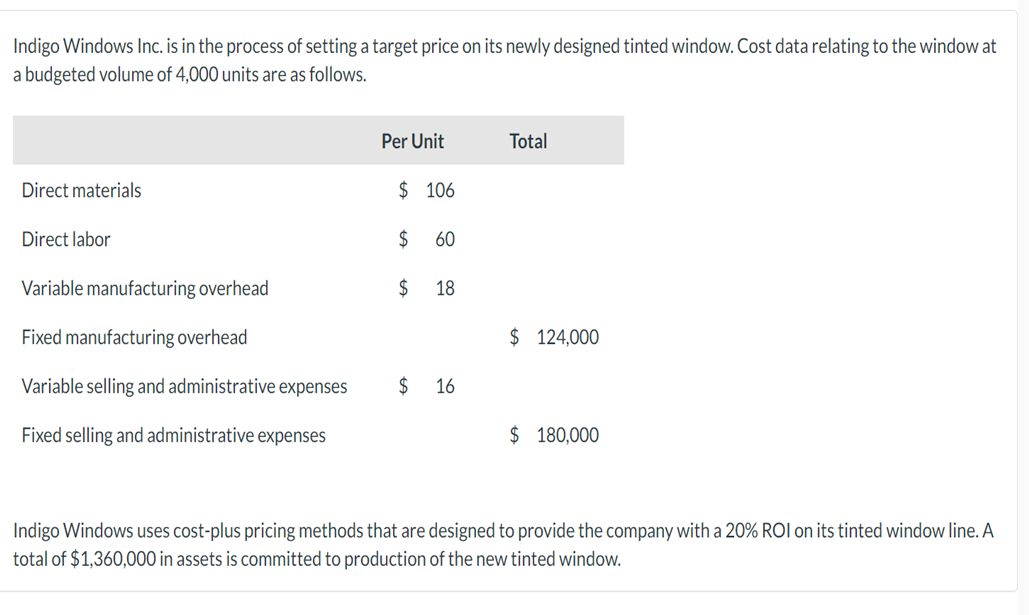

Indigo Windows Inc. is in the process of setting a target price on its newly designed tinted window. Cost data relating to the window

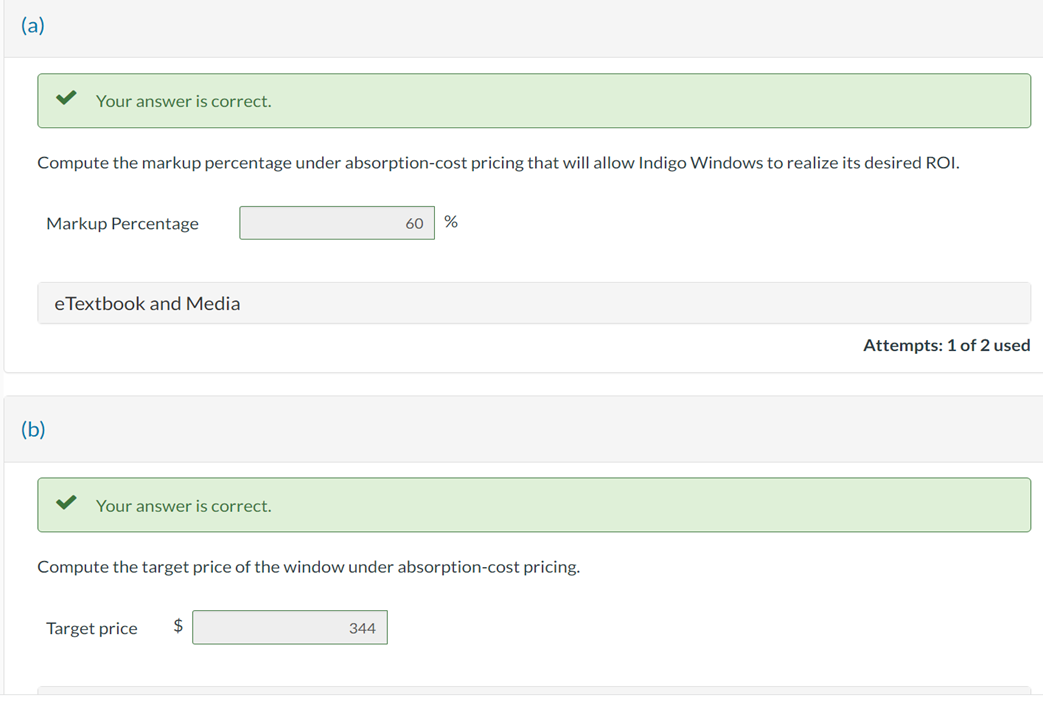

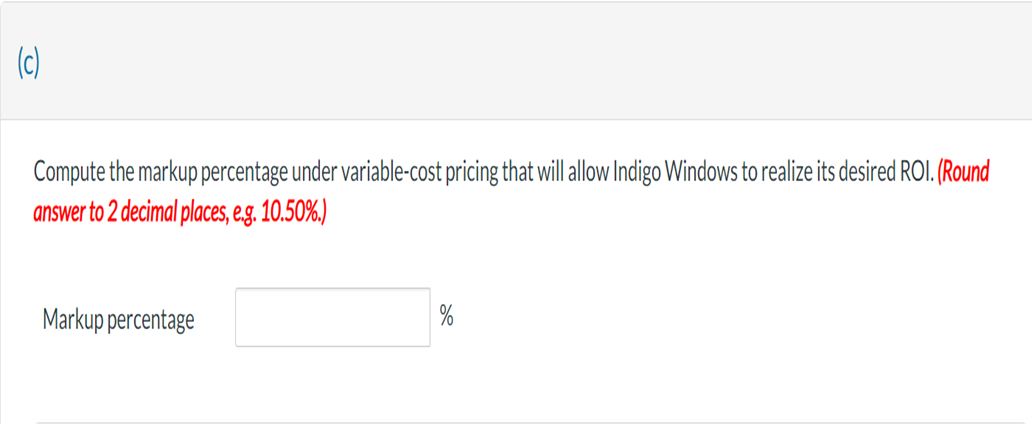

Indigo Windows Inc. is in the process of setting a target price on its newly designed tinted window. Cost data relating to the window at a budgeted volume of 4,000 units are as follows. Per Unit Total Direct materials $ 106 Direct labor $ 60 Variable manufacturing overhead $ 18 Fixed manufacturing overhead $ 124,000 Variable selling and administrative expenses $ 16 Fixed selling and administrative expenses $ 180,000 Indigo Windows uses cost-plus pricing methods that are designed to provide the company with a 20% ROI on its tinted window line. A total of $1,360,000 in assets is committed to production of the new tinted window. C (a) Your answer is correct. Compute the markup percentage under absorption-cost pricing that will allow Indigo Windows to realize its desired ROI. (b) Markup Percentage eTextbook and Media Your answer is correct. 60 % Compute the target price of the window under absorption-cost pricing. Target price $ 344 Attempts: 1 of 2 used (c) Compute the markup percentage under variable-cost pricing that will allow Indigo Windows to realize its desired ROI. (Round answer to 2 decimal places, e.g. 10.50%.) Markup percentage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Indigo Windows Pricing Calculations Well calculate the markup percentages and target price under both absorption costing and variable costing D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started