Answered step by step

Verified Expert Solution

Question

1 Approved Answer

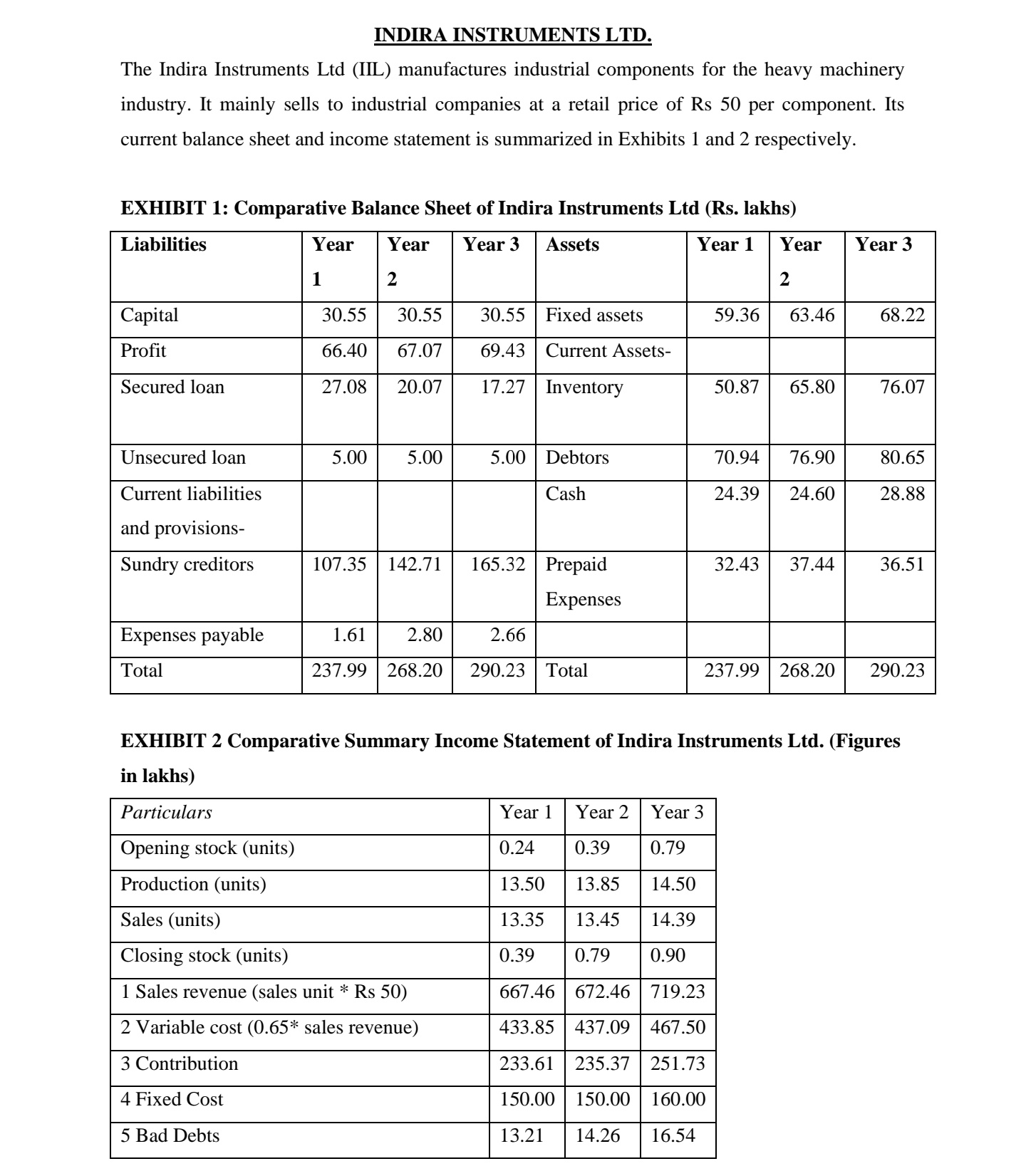

INDIRA INSTRUMENTS LTD. The Indira Instruments Ltd (IIL) manufactures industrial components for the heavy machinery industry. It mainly sells to industrial companies at retail

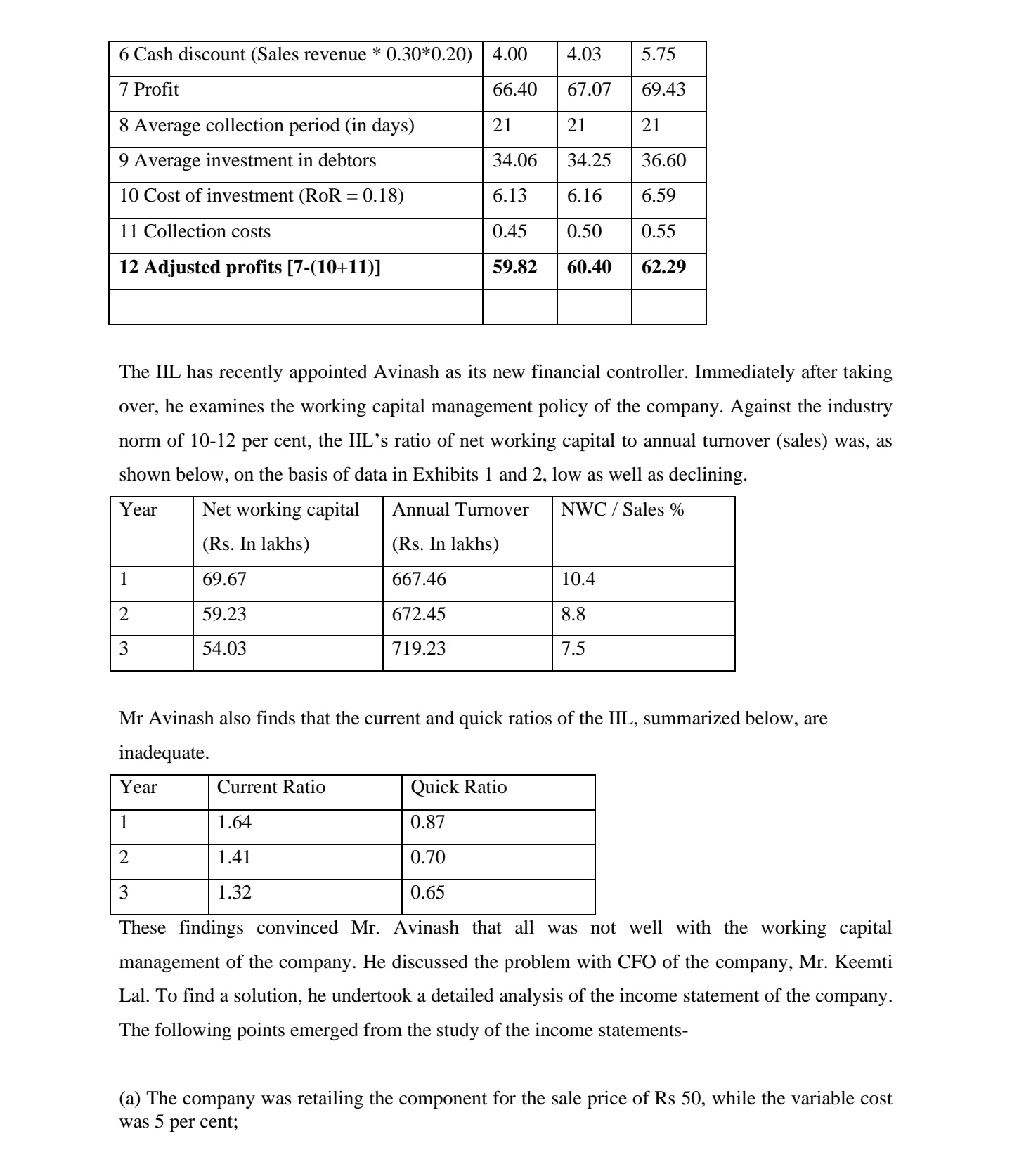

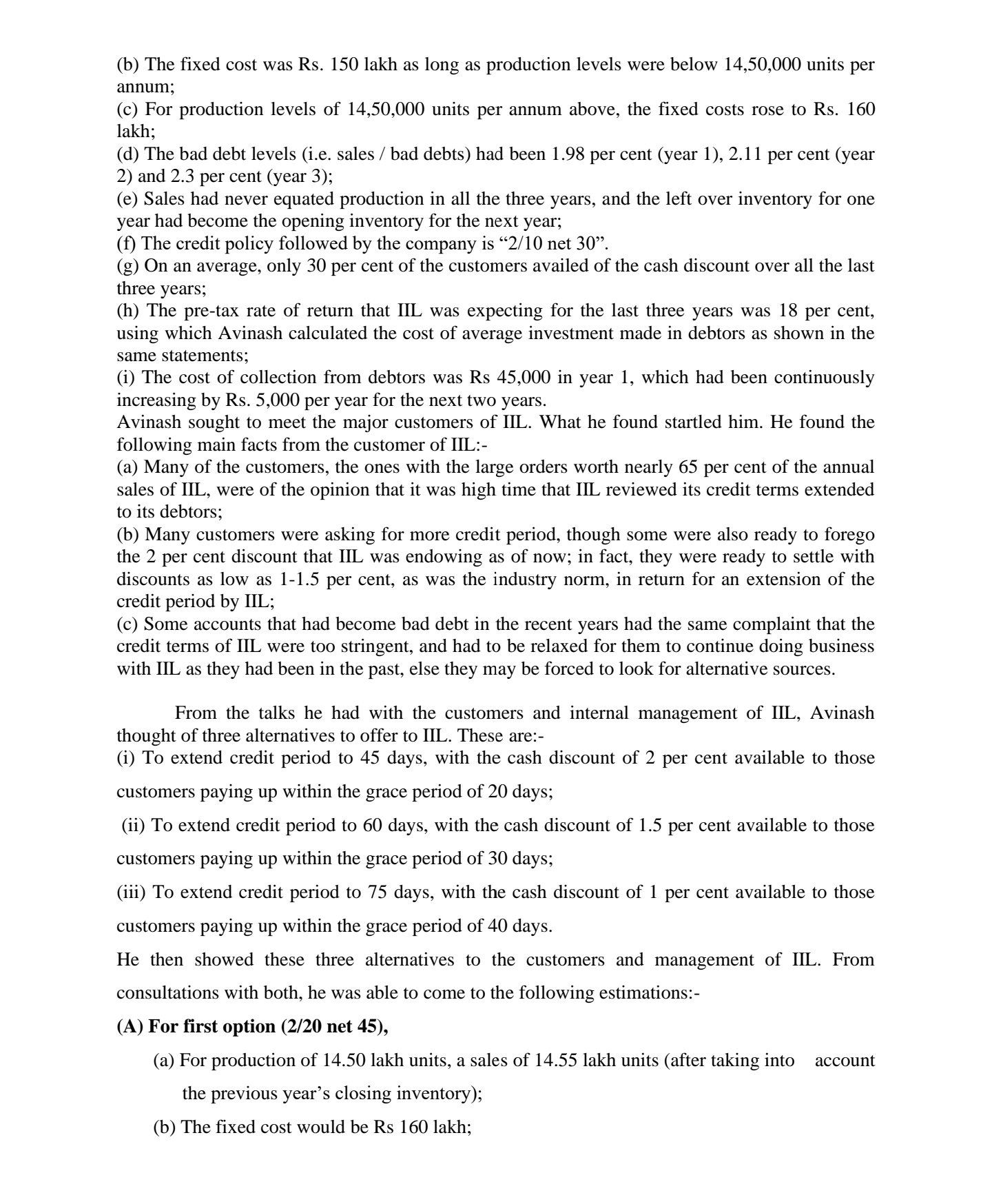

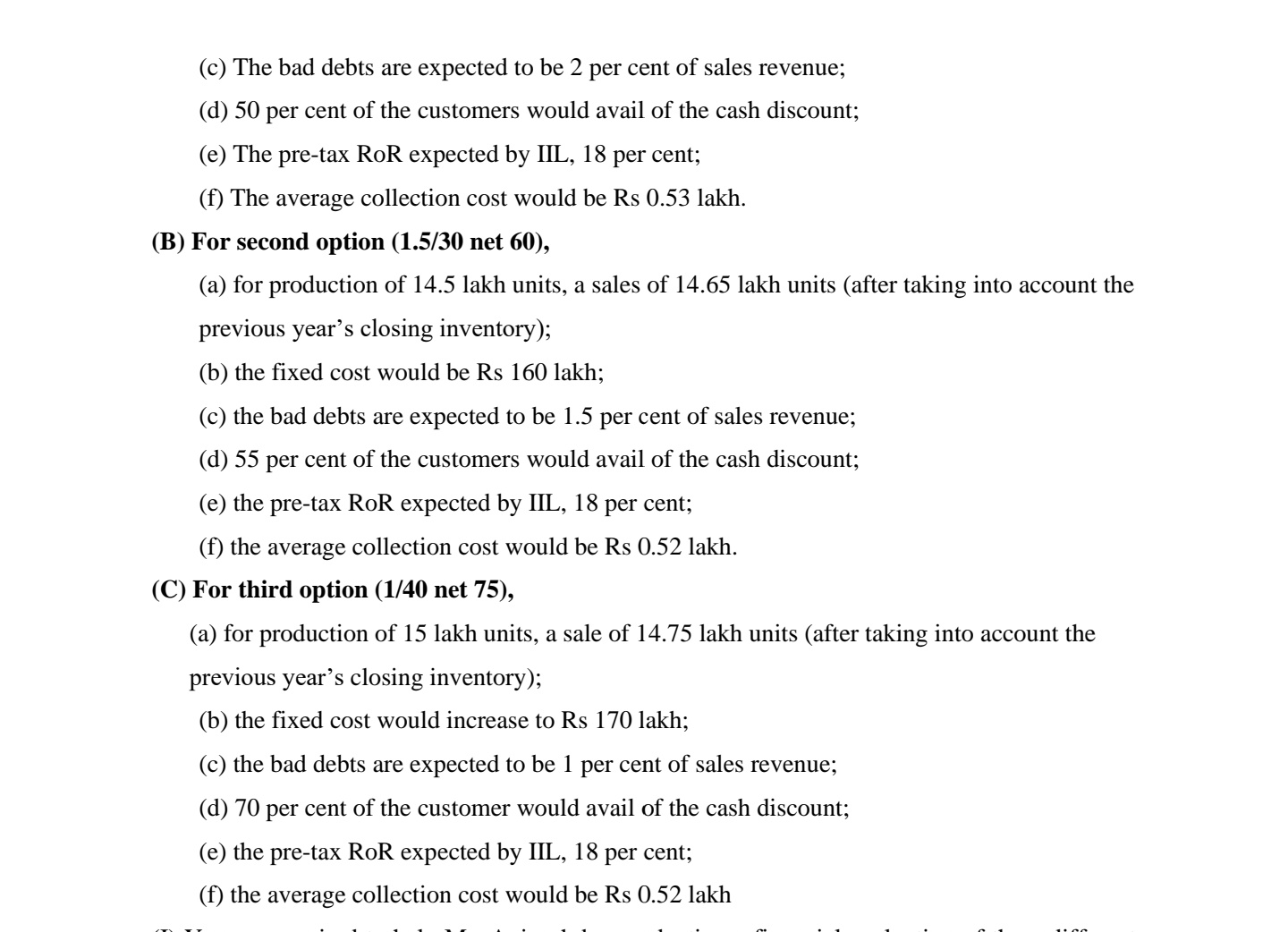

INDIRA INSTRUMENTS LTD. The Indira Instruments Ltd (IIL) manufactures industrial components for the heavy machinery industry. It mainly sells to industrial companies at retail price of Rs 50 per component. Its current balance sheet and income statement is summarized in Exhibits 1 and 2 respectively. EXHIBIT 1: Comparative Balance Sheet of Indira Instruments Ltd (Rs. lakhs) Liabilities Year Year Year 3 Year 1 1 2 Capital Profit Secured loan Unsecured loan Current liabilities and provisions- Sundry creditors Expenses payable Total 30.55 30.55 Fixed assets 67.07 69.43 Current Assets- Assets 30.55 66.40 27.08 20.07 17.27 Inventory 5.00 5.00 5.00 Debtors Cash 107.35 142.71 165.32 Prepaid Expenses 1.61 2.80 2.66 237.99 268.20 290.23 Total Sales (units) Closing stock (units) 1 Sales revenue (sales unit * Rs 50) 2 Variable cost (0.65* sales revenue) 3 Contribution 4 Fixed Cost 5 Bad Debts 59.36 Year 1 Year 2 Year 3 0.24 0.39 0.79 13.50 13.85 14.50 13.35 13.45 14.39 0.39 0.79 0.90 667.46 672.46 719.23 433.85 437.09 467.50 233.61 235.37 251.73 150.00 150.00 160.00 13.21 14.26 16.54 Year 2 63.46 50.87 65.80 32.43 70.94 76.90 24.39 24.60 37.44 Year 3 68.22 76.07 80.65 28.88 36.51 237.99 268.20 290.23 EXHIBIT 2 Comparative Summary Income Statement of Indira Instruments Ltd. (Figures in lakhs) Particulars Opening stock (units) Production (units) 6 Cash discount (Sales revenue * 0.30*0.20) | 4.00 7 Profit 66.40 21 34.06 6.13 0.45 59.82 8 Average collection period (in days) 9 Average investment in debtors 10 Cost of investment (RoR = 0.18) 11 Collection costs 12 Adjusted profits [7-(10+11)] The III has recently appointed Avinash as its new financial controller. Immediately after taking over, he examines the working capital management policy of the company. Against the industry norm of 10-12 per cent, the IIL's ratio of net working capital to annual turnover (sales) was, as shown below, on the basis of data in Exhibits 1 and 2, low as well as declining. Year Annual Turnover NWC/ Sales % Net working capital (Rs. In lakhs) (Rs. In lakhs) 69.67 667.46 59.23 672.45 54.03 719.23 1 2 3 4.03 5.75 67.07 69.43 21 21 34.25 36.60 6.16 6.59 0.50 0.55 60.40 62.29 Mr Avinash also finds that the current and quick ratios of the IIL, summarized below, are inadequate. Year 1 2 3 10.4 8.8 7.5 Current Ratio 1.64 1.41 1.32 Quick Ratio 0.87 0.70 0.65 These findings convinced Mr. Avinash that all was not well with the working capital management of the company. He discussed the problem with CFO of the company, Mr. Keemti Lal. To find a solution, he undertook a detailed analysis of the income statement of the company. The following points emerged from the study of the income statements- (a) The company was retailing the component for the sale price of Rs 50, while the variable cost was 5 per cent; (b) The fixed cost was Rs. 150 lakh as long as production levels were below 14,50,000 units per annum; (c) For production levels of 14,50,000 units per annum above, the fixed costs rose to Rs. 160 lakh; (d) The bad debt levels (i.e. sales / bad debts) had been 1.98 per cent (year 1), 2.11 per cent (year 2) and 2.3 per cent (year 3); (e) Sales had never equated production in all the three years, and the left over inventory for one year had become the opening inventory for the next year; (f) The credit policy followed by the company is "2/10 net 30". (g) On an average, only 30 per cent of the customers availed of the cash discount over all the last three years; (h) The pre-tax rate of return that IIL was expecting for the last three years was 18 per cent, using which Avinash calculated the cost of average investment made in debtors as shown in the same statements; (i) The cost of collection from debtors was Rs 45,000 in year 1, which had been continuously increasing by Rs. 5,000 per year for the next two years. Avinash sought to meet the major customers of IIL. What he found startled him. He found the following main facts from the customer of IIL:- (a) Many of the customers, the ones with the large orders worth nearly 65 per cent of the annual sales of IIL, were of the opinion that it was high time that IIL reviewed its credit terms extended to its debtors; (b) Many customers were asking for more credit period, though some were also ready to forego the 2 per cent discount that IIL was endowing as of now; in fact, they were ready to settle with discounts as low as 1-1.5 per cent, as was the industry norm, in return for an extension of the credit period by IIL; (c) Some accounts that had become bad debt in the recent years had the same complaint that the credit terms of IIL were too stringent, and had to be relaxed for them to continue doing business with IIL as they had been in the past, else they may be forced to look for alternative sources. From the talks he had with the customers and internal management of IIL, Avinash thought of three alternatives to offer to IIL. These are:- (i) To extend credit period to 45 days, with the cash discount of 2 per cent available to those customers paying up within the grace period of 20 days; (ii) To extend credit period to 60 days, with the cash discount of 1.5 per cent available to those customers paying up within the grace period of 30 days; (iii) To extend credit period to 75 days, with the cash discount of 1 per cent available to those customers paying up within the grace period of 40 days. He then showed these three alternatives to the customers and management of IIL. From consultations with both, he was able to come to the following estimations:- (A) For first option (2/20 net 45), (a) For production of 14.50 lakh units, a sales of 14.55 lakh units (after taking into account the previous year's closing inventory); (b) The fixed cost would be Rs 160 lakh; (c) The bad debts are expected to be 2 per cent of sales revenue; (d) 50 per cent of the customers would avail of the cash discount; (e) The pre-tax RoR expected by IIL, 18 per cent; (f) The average collection cost would be Rs 0.53 lakh. (B) For second option (1.5/30 net 60), (a) for production of 14.5 lakh units, a sales of 14.65 lakh units (after taking into account the previous year's closing inventory); (b) the fixed cost would be Rs 160 lakh; (c) the bad debts are expected to be 1.5 per cent of sales revenue; (d) 55 per cent of the customers would avail of the cash discount; (e) the pre-tax RoR expected by IIL, 18 (f) the average collection cost would be Rs 0.52 lakh. (C) For third option (1/40 net 75), (a) for production of 15 lakh units, a sale of 14.75 lakh units (after taking into account the previous year's closing inventory); (b) the fixed cost would increase to Rs 170 lakh; (c) the bad debts are expected to be 1 per cent of sales revenue; (d) 70 per cent of the customer would avail of the cash discount; (e) the pre-tax RoR expected by IIL, 18 per cent; (f) the average collection cost would be Rs 0.52 lakh per cent;

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the financial performance of Indira Instruments Ltd lets calculate some key financial ratios based on the provided information 1 Gross Profit Margin Gross Profit Margin Sales revenue Variab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started