Answered step by step

Verified Expert Solution

Question

1 Approved Answer

INDIVIDUAL ASSIGNMENT GUIDELINES 1) This task relates to completing a set of accounts for a business and preparing the financial statements for one financial

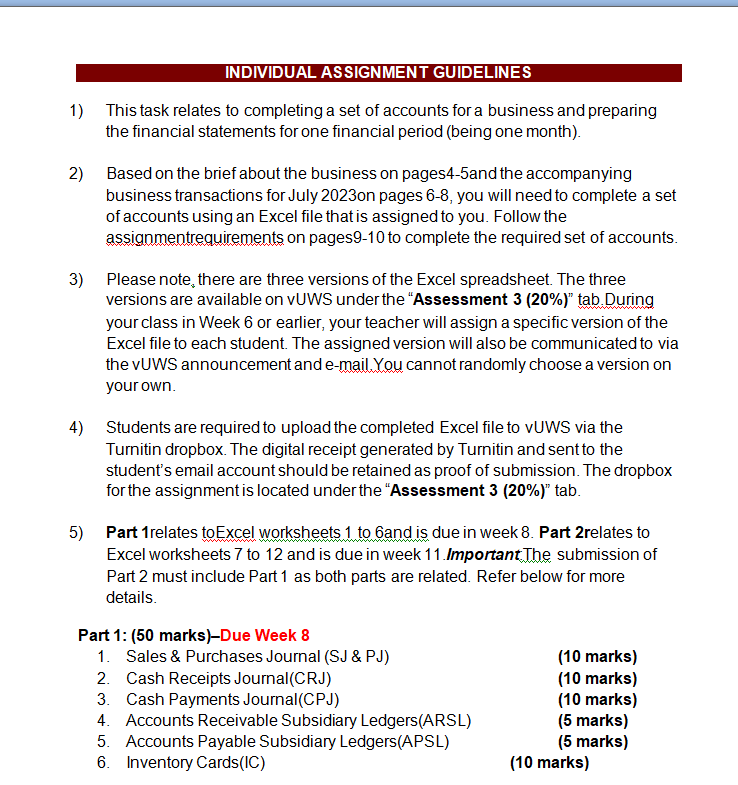

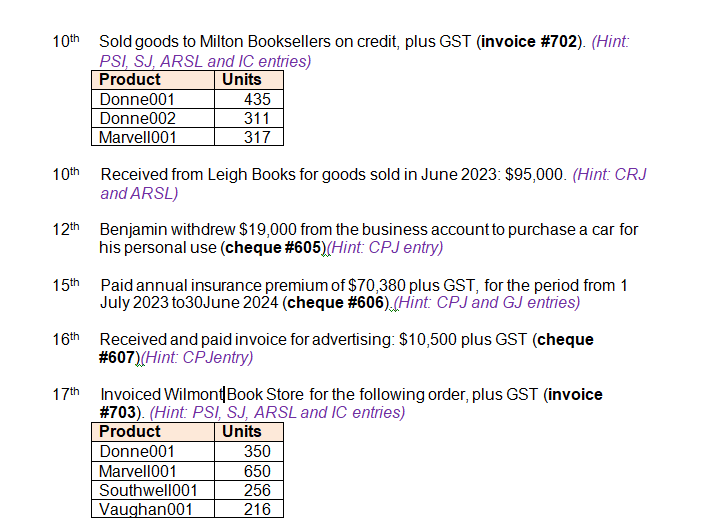

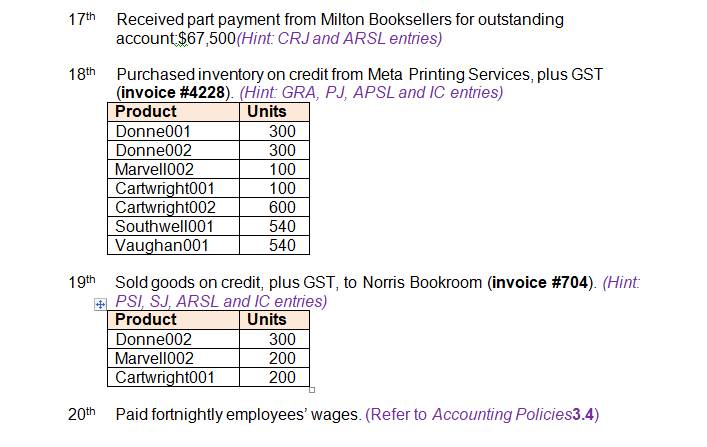

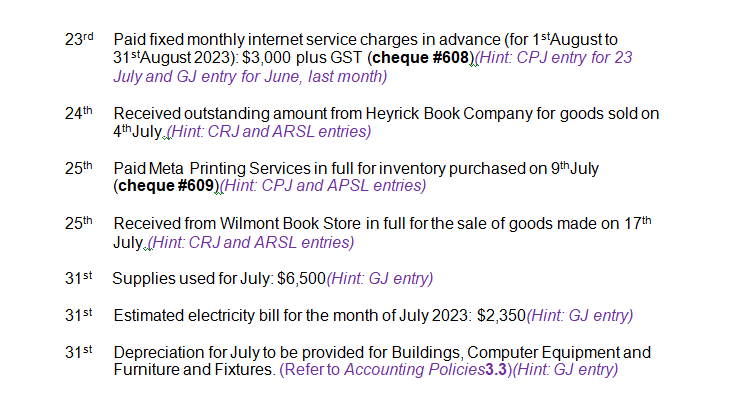

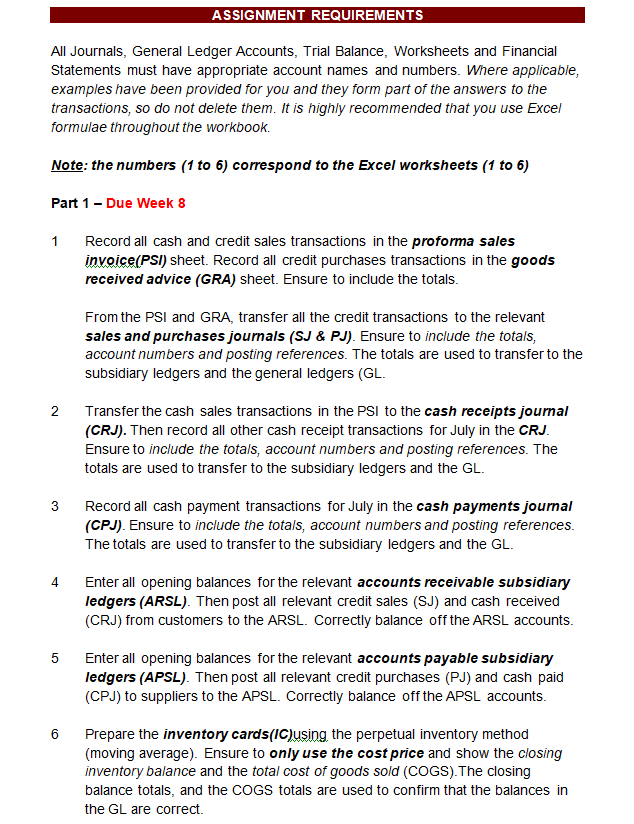

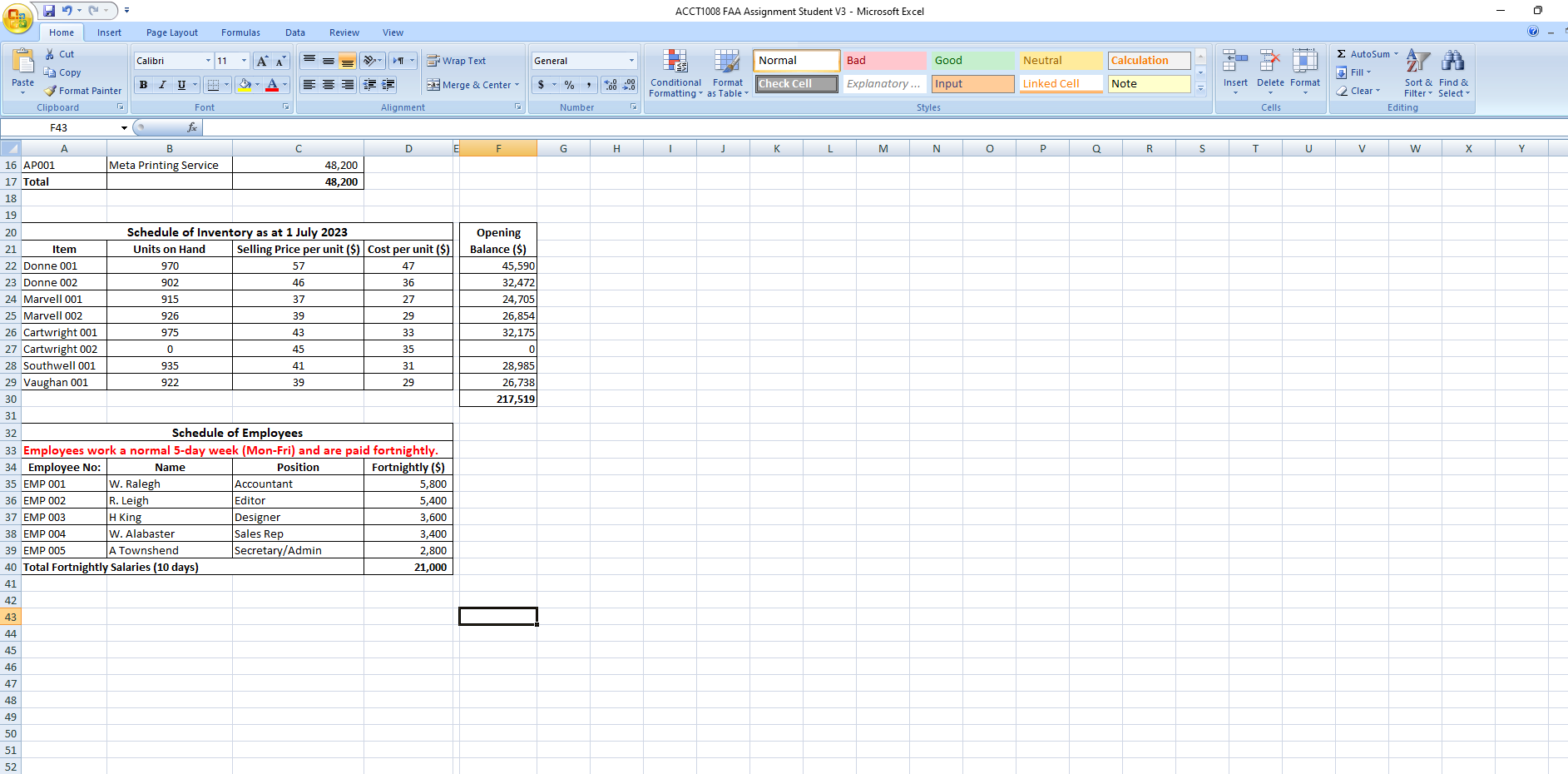

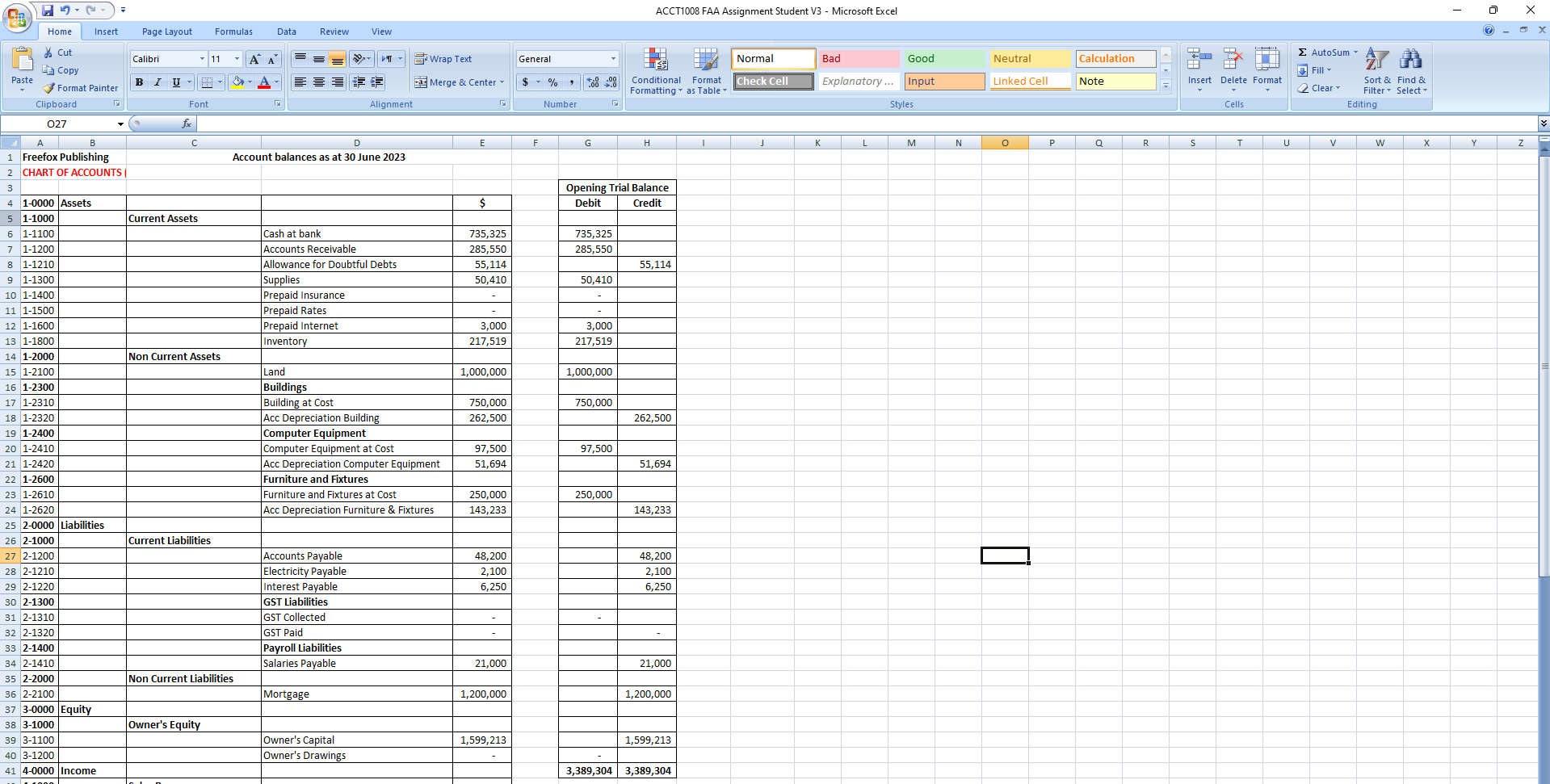

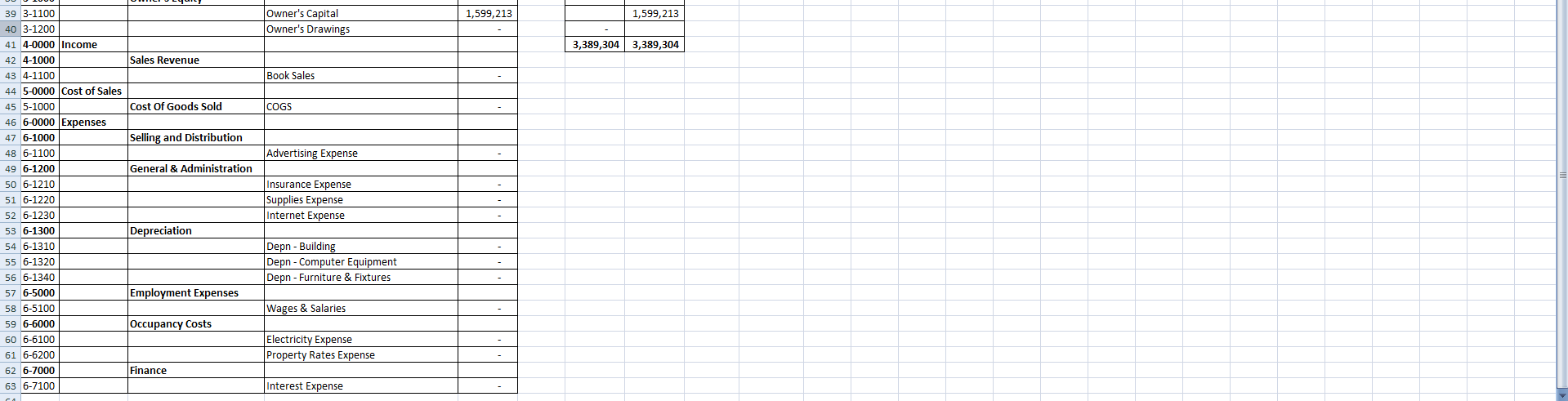

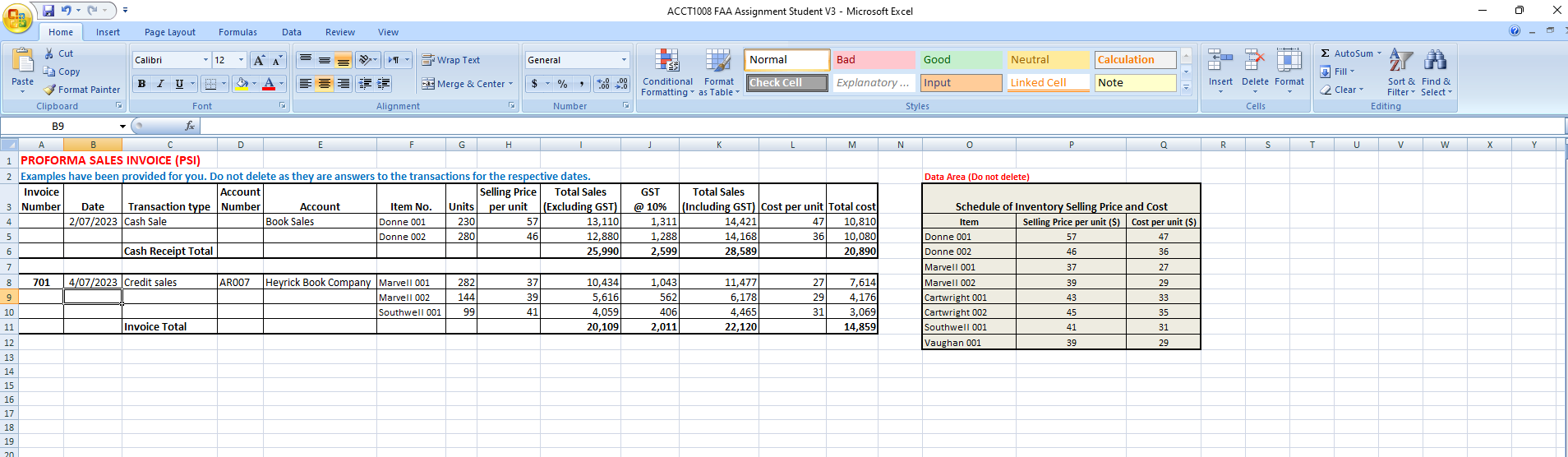

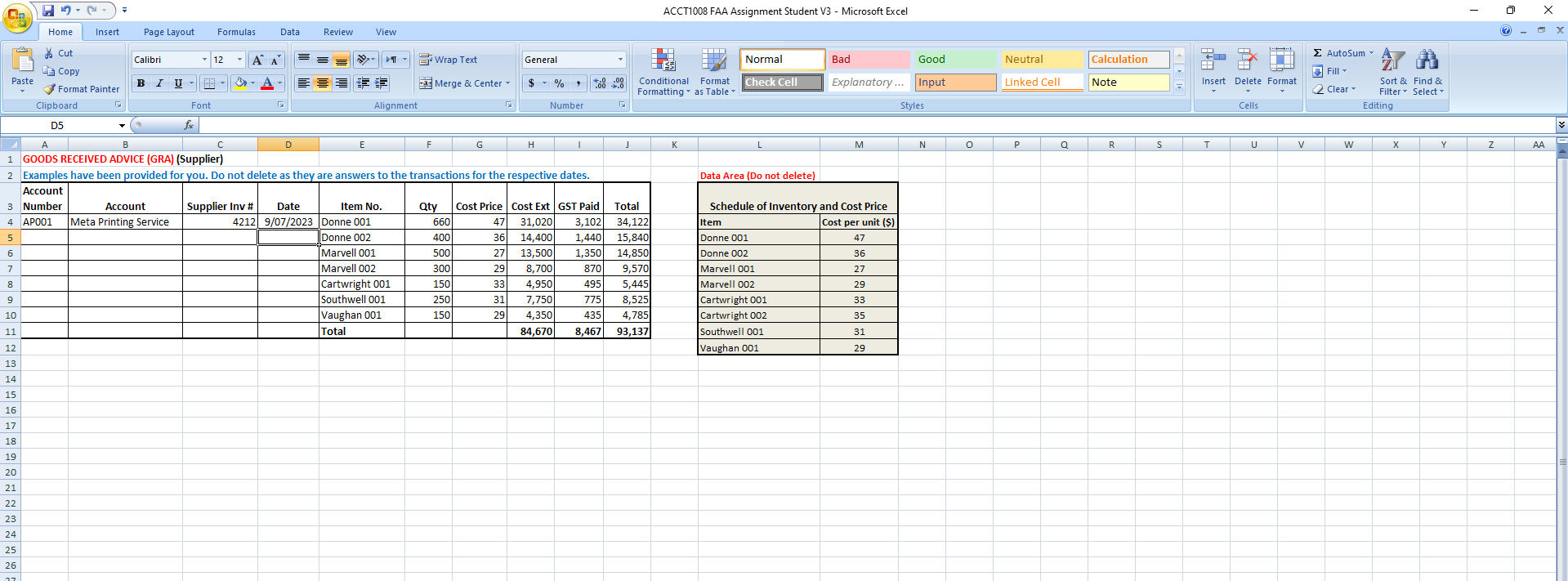

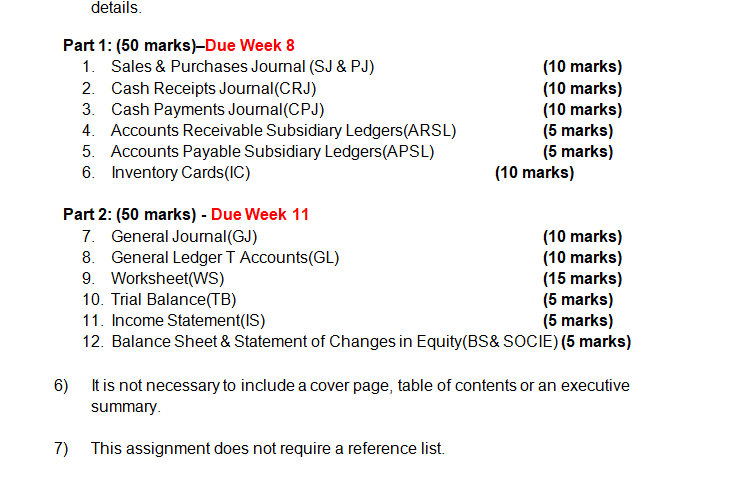

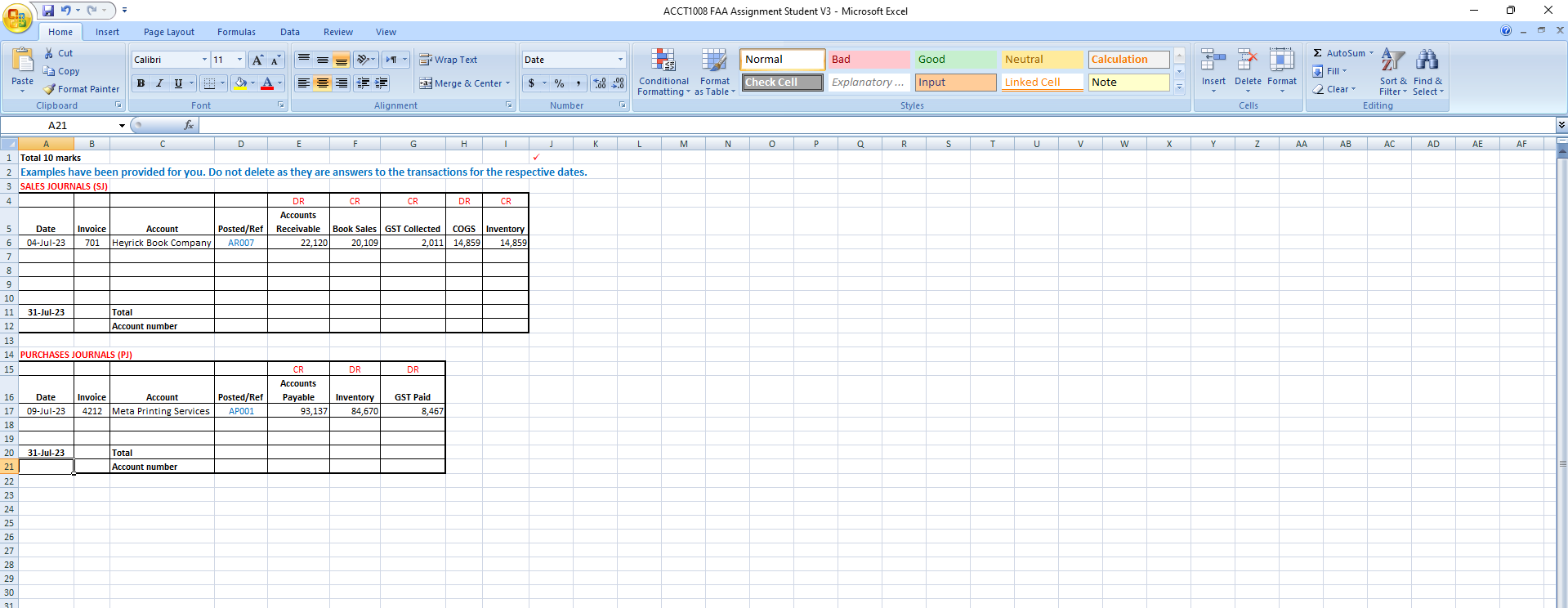

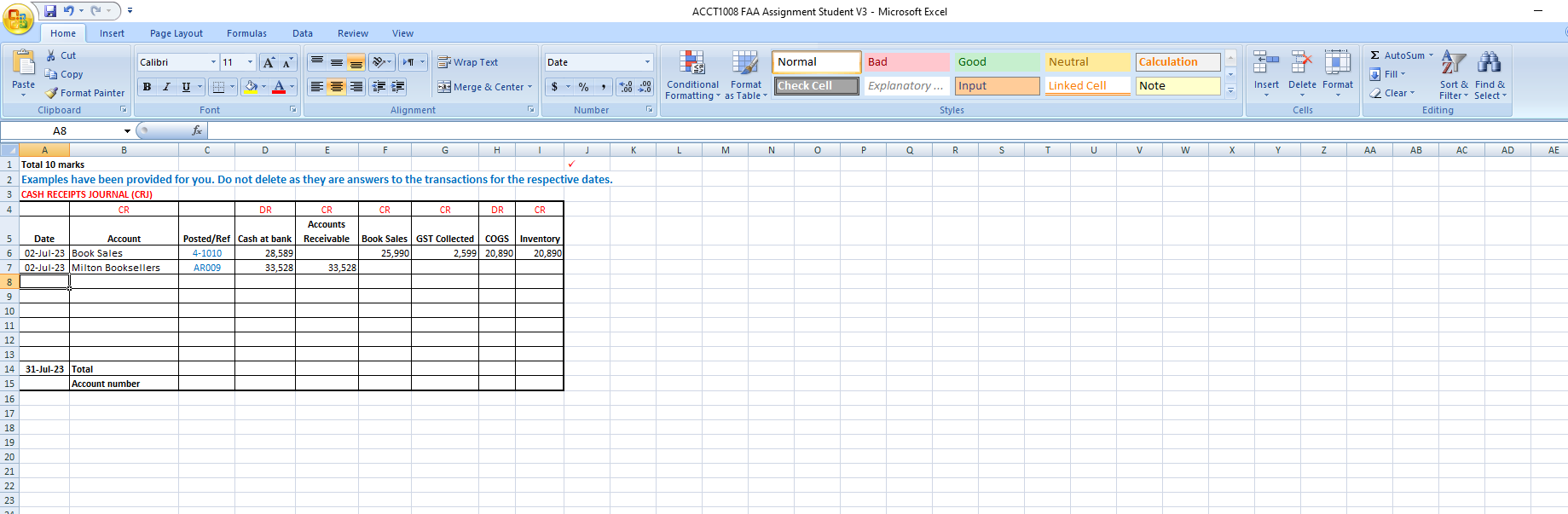

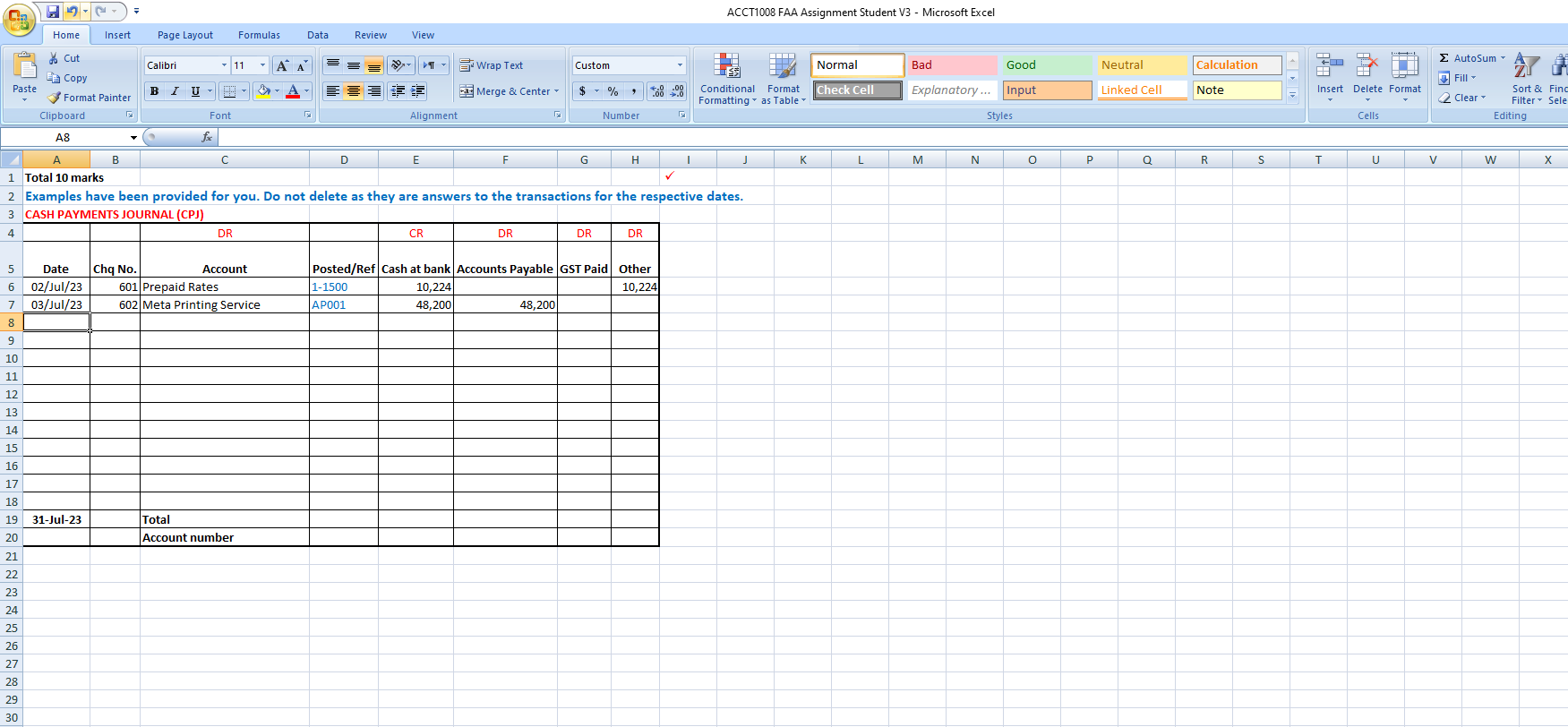

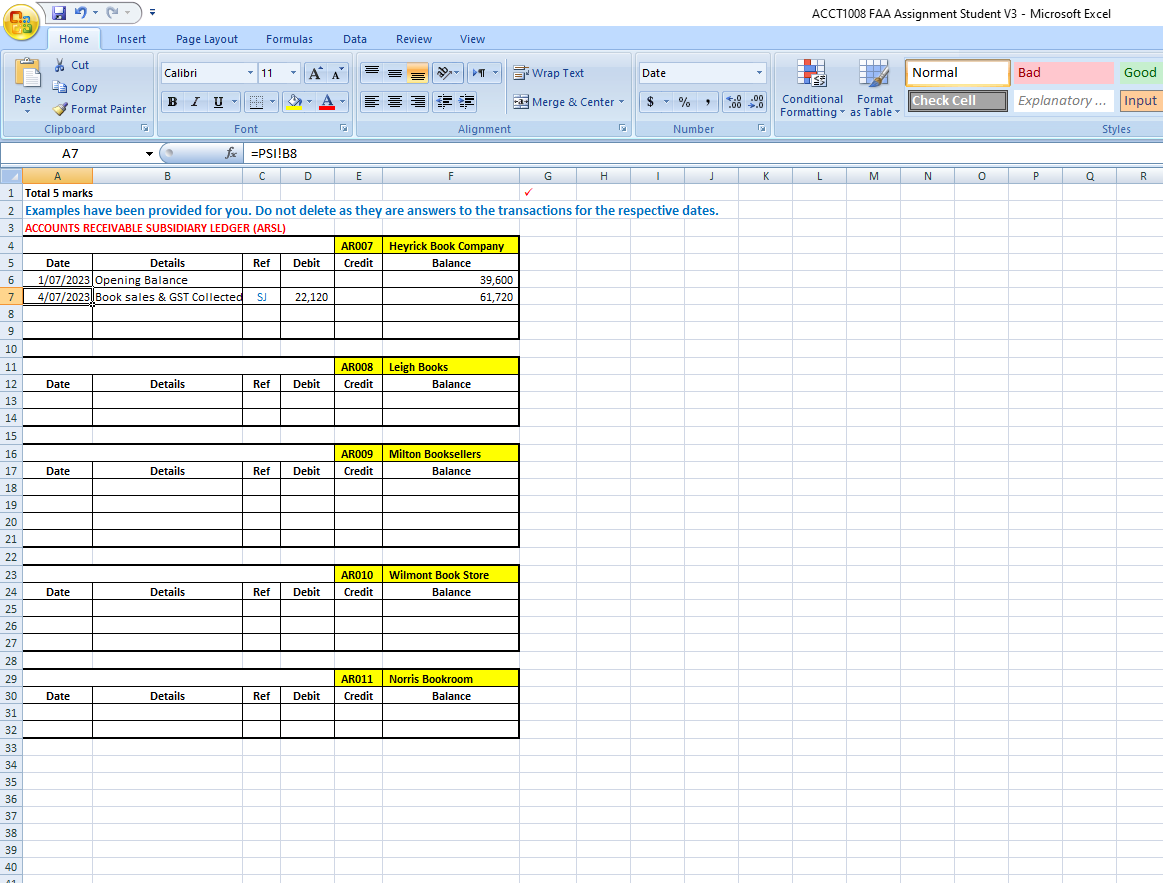

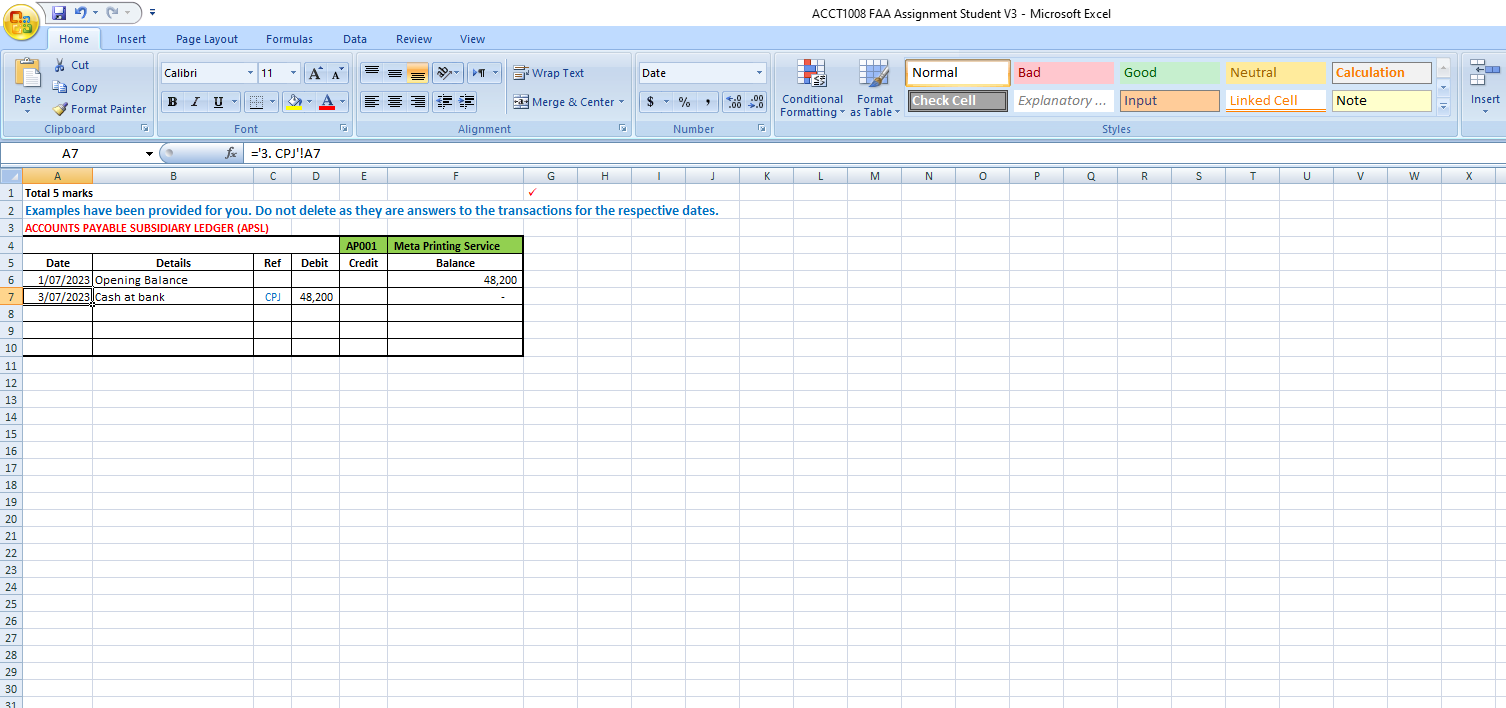

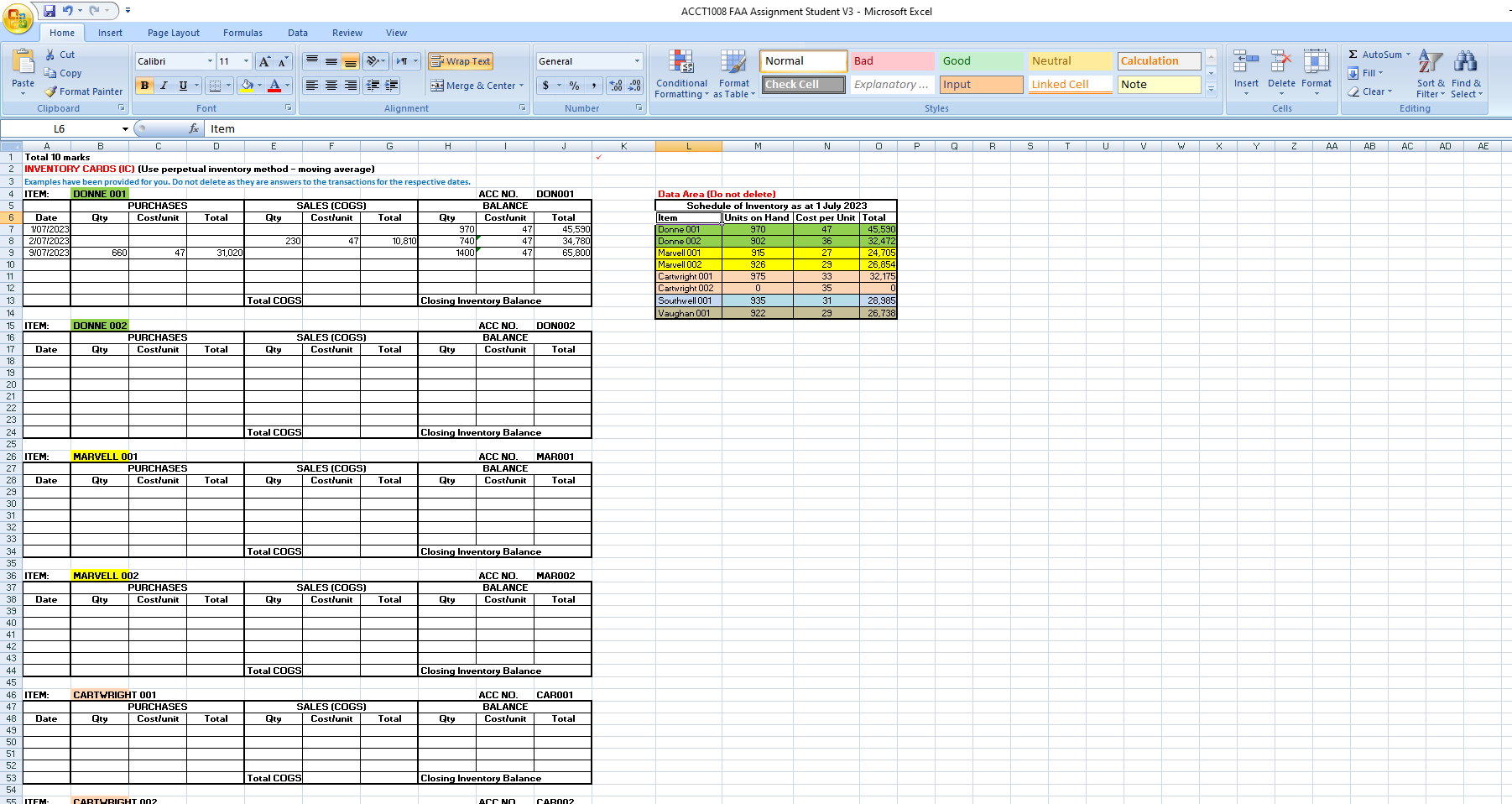

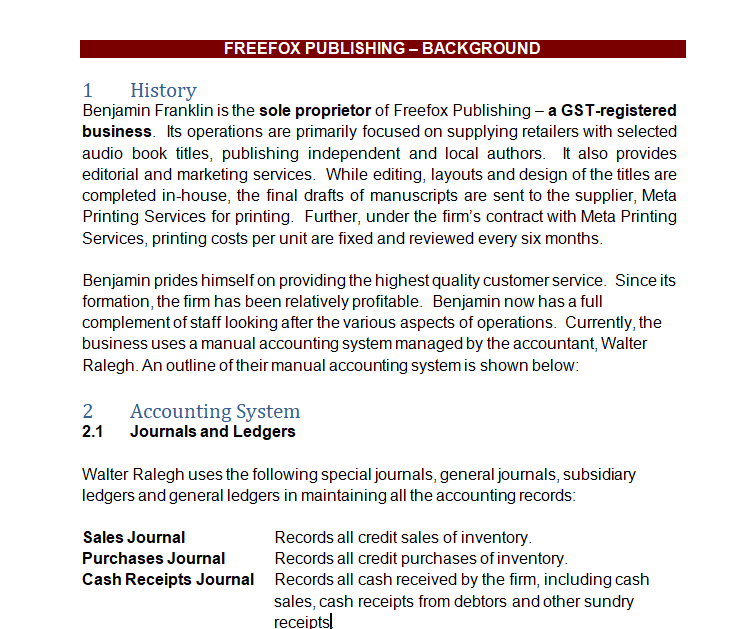

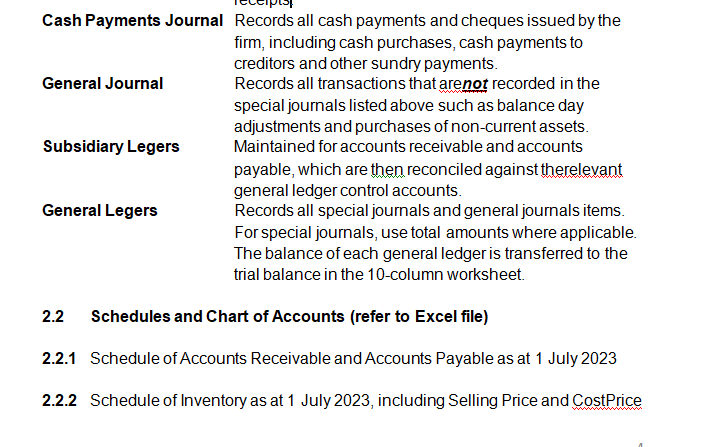

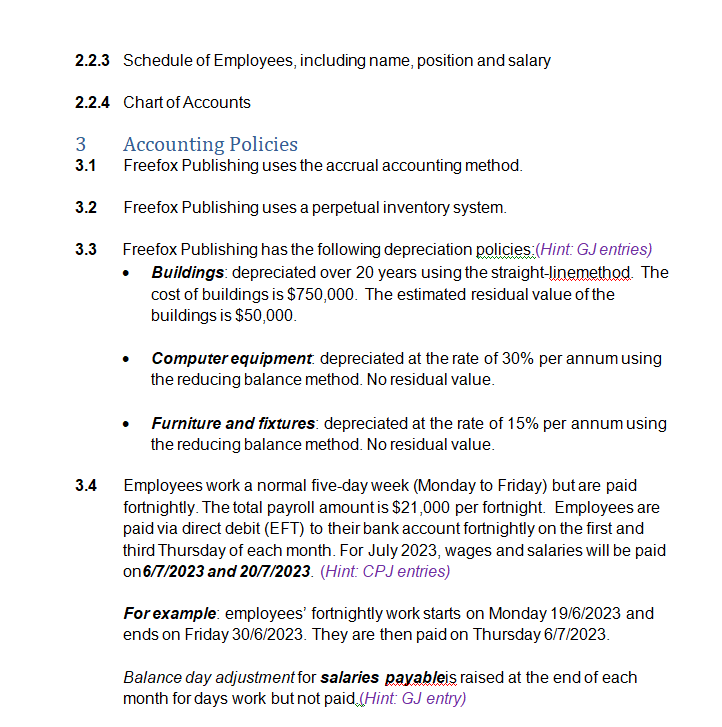

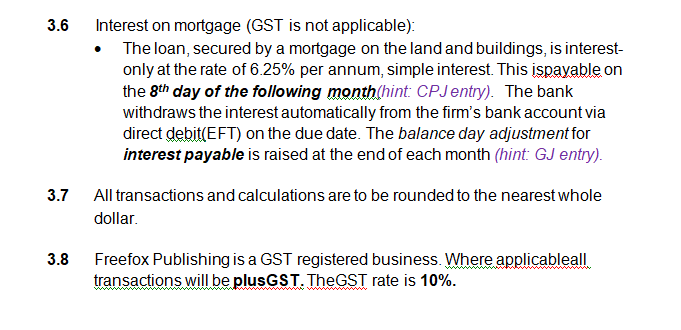

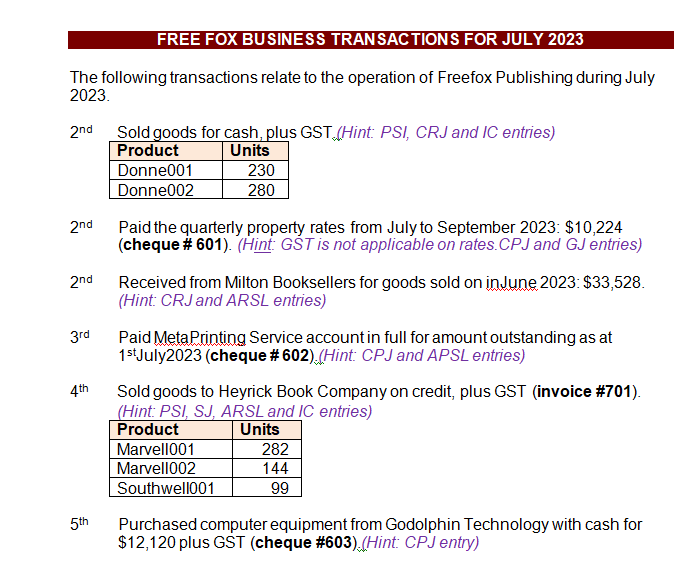

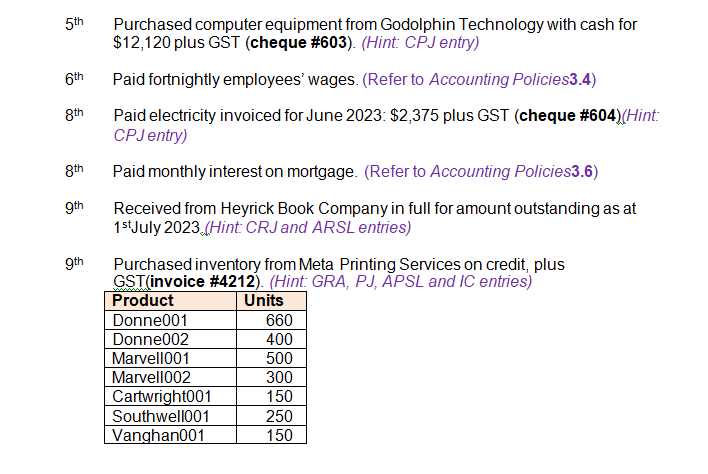

INDIVIDUAL ASSIGNMENT GUIDELINES 1) This task relates to completing a set of accounts for a business and preparing the financial statements for one financial period (being one month). 2) Based on the brief about the business on pages4-5and the accompanying business transactions for July 2023on pages 6-8, you will need to complete a set of accounts using an Excel file that is assigned to you. Follow the assignmentrequirements on pages9-10 to complete the required set of accounts. 3) Please note, there are three versions of the Excel spreadsheet. The three versions are available on VUWS under the "Assessment 3 (20%)" tab During your class in Week 6 or earlier, your teacher will assign a specific version of the Excel file to each student. The assigned version will also be communicated to via the vUWS announcement and e-mail.You cannot randomly choose a version on your own. 4) Students are required to upload the completed Excel file to vUWS via the Turnitin dropbox. The digital receipt generated by Turnitin and sent to the student's email account should be retained as proof of submission. The dropbox for the assignment is located under the "Assessment 3 (20%)" tab. 5) Part 1relates to Excel worksheets 1 to 6and is due in week 8. Part 2relates to Excel worksheets 7 to 12 and is due in week 11.Important The submission of Part 2 must include Part 1 as both parts are related. Refer below for more details. Part 1: (50 marks)-Due Week 8 1. Sales & Purchases Journal (SJ & PJ) 2. Cash Receipts Journal(CRJ) 3. Cash Payments Journal(CPJ) 4. Accounts Receivable Subsidiary Ledgers(ARSL) 5. Accounts Payable Subsidiary Ledgers(APSL) 6. Inventory Cards(IC) (10 marks) (10 marks) (10 marks) (5 marks) (5 marks) (10 marks) 10th Sold goods to Milton Booksellers on credit, plus GST (invoice #702). (Hint: PSI, SJ, ARSL and IC entries) Product Donne001 Donne002 Marvell001 Units 435 311 317 10th Received from Leigh Books for goods sold in June 2023: $95,000. (Hint: CRJ and ARSL) 12th Benjamin withdrew $19,000 from the business account to purchase a car for his personal use (cheque #605) (Hint: CPJ entry) 15th Paid annual insurance premium of $70,380 plus GST, for the period from 1 July 2023 to30June 2024 (cheque #606). (Hint: CPJ and GJ entries) 16th Received and paid invoice for advertising: $10,500 plus GST (cheque #607) (Hint: CPJentry) 17th Invoiced Wilmont Book Store for the following order, plus GST (invoice #703). (Hint: PSI, SJ, ARSL and IC entries) Product Units Donne001 350 Marvell001 650 Southwell001 256 Vaughan001 216 17th Received part payment from Milton Booksellers for outstanding account $67,500 (Hint: CRJ and ARSL entries) 18th Purchased inventory on credit from Meta Printing Services, plus GST (invoice #4228). (Hint: GRA, PJ, APSL and IC entries) Product Donne001 Units 300 Donne002 300 Marvel1002 100 Cartwright001 100 Cartwright002 600 Southwell001 540 Vaughan001 540 19th Sold goods on credit, plus GST, to Norris Bookroom (invoice #704). (Hint: + PSI, SJ, ARSL and IC entries) Product Donne002 Marvel1002 Cartwright001 Units 300 200 200 20th Paid fortnightly employees' wages. (Refer to Accounting Policies3.4) 23rd Paid fixed monthly internet service charges in advance (for 1st August to 31st August 2023): $3,000 plus GST (cheque #608) (Hint: CPJ entry for 23 July and GJ entry for June, last month) 24th Received outstanding amount from Heyrick Book Company for goods sold on 4th July. (Hint: CRJ and ARSL entries) 25th Paid Meta Printing Services in full for inventory purchased on 9th July (cheque #609) (Hint: CPJ and APSL entries) 25th Received from Wilmont Book Store in full for the sale of goods made on 17th July. (Hint: CRJ and ARSL entries) 31st Supplies used for July: $6,500 (Hint: GJ entry) 31st Estimated electricity bill for the month of July 2023: $2,350 (Hint: GJ entry) 31st Depreciation for July to be provided for Buildings, Computer Equipment and Furniture and Fixtures. (Refer to Accounting Policies3.3)(Hint: GJ entry) ASSIGNMENT REQUIREMENTS All Journals, General Ledger Accounts, Trial Balance, Worksheets and Financial Statements must have appropriate account names and numbers. Where applicable, examples have been provided for you and they form part of the answers to the transactions, so do not delete them. It is highly recommended that you use Excel formulae throughout the workbook. Note: the numbers (1 to 6) correspond to the Excel worksheets (1 to 6) Part 1 - Due Week 8 1 2 3 4 5 6 Record all cash and credit sales transactions in the proforma sales invoice(PSI) sheet. Record all credit purchases transactions in the goods received advice (GRA) sheet. Ensure to include the totals. From the PSI and GRA, transfer all the credit transactions to the relevant sales and purchases journals (SJ & PJ). Ensure to include the totals, account numbers and posting references. The totals are used to transfer to the subsidiary ledgers and the general ledgers (GL. Transfer the cash sales transactions in the PSI to the cash receipts journal (CRJ). Then record all other cash receipt transactions for July in the CRJ. Ensure to include the totals, account numbers and posting references. The totals are used to transfer to the subsidiary ledgers and the GL. Record all cash payment transactions for July in the cash payments journal (CPJ). Ensure to include the totals, account numbers and posting references. The totals are used to transfer to the subsidiary ledgers and the GL. Enter all opening balances for the relevant accounts receivable subsidiary ledgers (ARSL). Then post all relevant credit sales (SJ) and cash received (CRJ) from customers to the ARSL. Correctly balance off the ARSL accounts. Enter all opening balances for the relevant accounts payable subsidiary ledgers (APSL). Then post all relevant credit purchases (PJ) and cash paid (CPJ) to suppliers to the APSL. Correctly balance off the APSL accounts. Prepare the inventory cards (IC) using the perpetual inventory method (moving average). Ensure to only use the cost price and show the closing inventory balance and the total cost of goods sold (COGS). The closing balance totals, and the COGS totals are used to confirm that the balances in the GL are correct. Home Insert Page Layout Formulas Data Review View Cut Calibri 11 ' Copy Paste BIU Format Painter Clipboard Font *I * Wrap Text General Merge & Center % Alignment Number FL ACCT1008 FAA Assignment Student V3 - Microsoft Excel Normal Bad Good Neutral Calculation Conditional Format Check Cell Explanatory... Input Linked Cell Note Insert Delete Format Formatting as Table Styles Cells Autosum Y A Fill Clear Sort & Find & Filter Select Editing F43 A B C D F F G H I J K L M N P Q R S T U V W X Y 16 AP001 Meta Printing Service 48,200 17 Total 48,200 18 19 20 Schedule of Inventory as at 1 July 2023 21 Item Units on Hand Selling Price per unit ($) Cost per unit ($) Opening Balance ($) 22 Donne 001 970 57 47 45,590 23 Donne 002 902 46 36 32,472 24 Marvell 001 915 37 27 24,705 25 Marvell 002 926 39 29 26,854 26 Cartwright 001 975 43 33 32,175 27 Cartwright 002 0 45 35 0 28 Southwell 001 935 41 31 28,985 29 Vaughan 001 922 39 29 26,738 30 217,519 31 32 Schedule of Employees 33 Employees work a normal 5-day week (Mon-Fri) and are paid fortnightly. 34 Employee No: 35 EMP 001 36 EMP 002 37 EMP 003 38 EMP 004 39 EMP 005 Name W. Ralegh R. Leigh H King W. Alabaster A Townshend 40 Total Fortnightly Salaries (10 days) Position Accountant Editor Fortnightly ($) 5,800 5,400 Designer 3,600 Sales Rep 3,400 Secretary/Admin 2,800 21,000 41 42 43 44 45 46 47 48 49 50 51 52 ACCT1008 FAA Assignment Student V3 - Microsoft Excel Cla Home Insert Page Layout Formulas Data Review View Cut Copy Calibri 11 Paste BI U- Format Painter Clipboard 027 Font Autosum FT Wrap Text General Normal Bad Good Neutral Calculation Merge & Center % Conditional Format Formatting as Table Check Cell Explanatory... Input Linked Cell Note Insert Delete Format Fill Clear Alignment Number Styles Cells Editing YA Sort & Find & Filter Select fx A B C E F G H J K L M N P Q R S T U V W X Y Z 1 Freefox Publishing Account balances as at 30 June 2023 2 CHART OF ACCOUNTS 3 Opening Trial Balance 4 1-0000 Assets $ Debit Credit 5 1-1000 Current Assets 6 1-1100 Cash at bank 735,325 735,325 7 1-1200 Accounts Receivable 285,550 285,550 8 1-1210 9 1-1300 Allowance for Doubtful Debts 55,114 55.114 Supplies 50,410 50,410 10 1-1400 Prepaid Insurance - 11 1-1500 Prepaid Rates 12 1-1600 13 1-1800 Prepaid Internet Inventory 14 1-2000 Non Current Assets 15 1-2100 Land 16 1-2300 Buildings 17 1-2310 Building at Cost 18 1-2320 Acc Depreciation Building 3,000 217,519 3,000 217,519 1,000,000 1,000,000 750,000 750,000 262,500 262,500 19 1-2400 Computer Equipment 20 1-2410 Computer Equipment at Cost 21 1-2420 Acc Depreciation Computer Equipment 97,500 51,694 97,500 51,694 22 1-2600 Furniture and Fixtures 23 1-2610 Furniture and Fixtures at Cost 250,000 250,000 24 1-2620 Acc Depreciation Furniture & Fixtures 143,233 143,233 25 2-0000 Liabilities 26 2-1000 Current Liabilities 27 2-1200 Accounts Payable 28 2-1210 Electricity Payable 48,200 48,200 2,100 2,100 6,250 6,250 29 2-1220 Interest Payable 30 2-1300 GST Liabilities 31 2-1310 GST Collected 32 2-1320 GST Paid 33 2-1400 Payroll Liabilities 34 2-1410 Salaries Payable 21,000 21,000 35 2-2000 Non Current Liabilities 36 2-2100 Mortgage 1,200,000 1,200,000 37 3-0000 Equity 38 3-1000 Owner's Equity 39 3-1100 Owner's Capital 1,599,213 1,599,213 40 3-1200 Owner's Drawings 41 4-0000 Income 3,389,304 3,389,304 x 39 3-1100 40 3-1200 41 4-0000 Income 42 4-1000 43 4-1100 Owner's Capital 1,599,213 1,599,213 Owner's Drawings 3,389,304 3,389,304 Sales Revenue Book Sales 44 5-0000 Cost of Sales 45 5-1000 46 6-0000 Expenses 47 6-1000 48 6-1100 49 6-1200 50 6-1210 51 6-1220 Cost Of Goods Sold COGS Selling and Distribution General & Administration 52 6-1230 53 6-1300 Depreciation 54 6-1310 55 6-1320 56 6-1340 57 6-5000 58 6-5100 59 6-6000 Occupancy Costs 60 6-6100 61 6-6200 Employment Expenses 62 6-7000 Finance 63 6-7100 Advertising Expense Insurance Expense Supplies Expense Internet Expense Depn - Building Depn - Computer Equipment Depn - Furniture & Fixtures Wages & Salaries Electricity Expense Property Rates Expense Interest Expense Paste Home Cut Copy Insert Page Layout Formulas Data Review View Calibri 12 ' ' BIU Format Painter Clipboard B9 Font fx E ACCT1008 FAA Assignment Student V3 - Microsoft Excel I Wrap Text General Normal Bad Good Neutral Calculation Merge & Center $ - % .00 .0 Conditional Format Formatting as Table Check Cell Explanatory... Input Linked Cell Note Insert Delete Format Alignment Number - Styles Cells F G H 1 PROFORMA SALES INVOICE (PSI) 2 Examples have been provided for you. Do not delete as they are answers to the transactions for the respective dates. K M N Data Area (Do not delete) Invoice Account Selling Price Total Sales GST Total Sales 345678922231789 3 Number Date Transaction type Number 2/07/2023 Cash Sale Account Book Sales Item No. Units Donne 001 230 per unit (Excluding GST) 10% (Including GST) Cost per unit Total cost Schedule of Inventory Selling Price and Cost 57 13,110 1,311 14,421 47 10,810 Item Selling Price per unit ($) Cost per unit ($) Donne 002 280 46 12,880 1,288 14,168 36 10,080 Donne 001 57 47 Cash Receipt Total 25,990 2,599 28,589 20,890 Donne 002 46 36 Marvell 001 37 27 701 4/07/2023 Credit sales AR007 Heyrick Book Company Marvell 001 282 37 10,434 1,043 11,477 27 7,614 Marvell 002 39 29 Marvell 002 144 39 5,616 562 6,178 29 4,176 Cartwright 001 43 33 10 Southwell 001 99 41 4,059 406 4,465 31 3,069 Cartwright 002 45 35 11 Invoice Total 20,109 2,011 22,120 14,859 Southwell 001 41 31 Vaughan 001 39 29 20 YA Sort & Find & Filter Select AutoSum Fill Clear Editing R S T U V W X Y I Wrap Text General Merge & Center $ - % Alignment Number Paste Home Cut Copy Clipboard Insert Page Layout Formulas Data Review View Calibri 12 ' ' BIU Format Painter Font D5 fx A B C D E 1 GOODS RECEIVED ADVICE (GRA) (Supplier) F G H F| ACCT1008 FAA Assignment Student V3 - Microsoft Excel Normal Bad Good Neutral Calculation Conditional Format Formatting as Table Check Cell Explanatory... Input Linked Cell Note Insert Delete Format Styles Cells J K AutoSum YA Fill Clear Sort & Find & Filter Select Editing M N P Q R S T U V W X Y Z AA 12 345678222235 2 Examples have been provided for you. Do not delete as they are answers to the transactions for the respective dates. Account Data Area (Do not delete) 3 Number Account 4 AP001 Meta Printing Service Supplier Inv # Date 4212 9/07/2023 Item No. Donne 001 Donne 002 Qty Cost Price Cost Ext GST Paid 660 47 400 36 31,020 3,102 14,400 Total 34,122 1,440 15,840 Schedule of Inventory and Cost Price Item Cost per unit ($) Donne 001 47 Marvell 001 500 27 13,500 1,350 14,850 Donne 002 36 Marvell 002 300 29 8,700 870 Cartwright 001 150 33 4,950 495 9,570 5,445 Marvell 001 27 Marvell 002 29 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Southwell 001 250 31 7,750 775 8,525 Cartwright 001 33 Vaughan 001 150 29 4,350 435 4,785 Cartwright 002 35 Total 84,670 8,467 93,137 Southwell 001 Vaughan 001 31 29 x 6) details. Part 1: (50 marks)-Due Week 8 1. Sales & Purchases Journal (SJ & PJ) 2. Cash Receipts Journal(CRJ) 3. Cash Payments Journal(CPJ) 4. Accounts Receivable Subsidiary Ledgers(ARSL) 5. Accounts Payable Subsidiary Ledgers(APSL) 6. Inventory Cards(IC) Part 2: (50 marks) - Due Week 11 7. General Journal(GJ) 8. General Ledger T Accounts(GL) 9. Worksheet(WS) 10. Trial Balance(TB) 11. Income Statement(IS) (10 marks) (10 marks) (10 marks) (5 marks) (5 marks) (10 marks) (10 marks) (10 marks) (15 marks) (5 marks) (5 marks) 12. Balance Sheet & Statement of Changes in Equity (BS& SOCIE) (5 marks) It is not necessary to include a cover page, table of contents or an executive summary. 7) This assignment does not require a reference list. Paste Home Insert Page Layout Formulas Data Review View Cut Calibri ' Copy BIU Format Painter Font Clipboard A21 B 1 Total 10 marks C FT Wrap Text Date Merge & Center Alignment D B F G H % Number J 2 Examples have been provided for you. Do not delete as they are answers to the transactions for the respective dates. 3 SALES JOURNALS (SJ) 4 DR Accounts CR CR DR CR 5 Date Invoice Account 6 04-Jul-23 701 Heyrick Book Company Posted/Ref Receivable AR007 22,120 Book Sales GST Collected 20,109 COGS Inventory 2,011 14,859 14,859 7 8 9 10 11 31-Jul-23 Total 12 Account number 13 14 PURCHASES JOURNALS (PJ) 15 CR Accounts DR DR Posted/Ref 93,137 Payable Inventory 84,670 GST Paid 8,467 16 Date Invoice Account 17 09-Jul-23 4212 Meta Printing Services AP001 18 19 20 31-Jul-23 Total 21 Account number 22 23 24 25 26 27 28 29 30 31 FL ACCT1008 FAA Assignment Student V3 - Microsoft Excel A Sort & Find & Filter Select Autosum Normal Bad Good Neutral Calculation Conditional Format Formatting as Table Check Cell Explanatory... Input Linked Cell Note Insert Delete Format Fill Clear Styles Cells Editing x F L M N P Q R S U V W X Y Z AA AB AC AD AE AF Insert Page Layout Formulas Data Review View Calibri 11 ' ' BIU Font Paste Home Cut Copy Format Painter Clipboard A8 F| A 1 Total 10 marks B fx C ACCT1008 FAA Assignment Student V3 - Microsoft Excel I Wrap Text Date Normal Bad Good Neutral Calculation Merge & Center $ - % .00 .0 Conditional Format Formatting as Table Check Cell Explanatory... Input Linked Cell Note Insert Delete Format Alignment Number F| Styles Cells E F G H 2 Examples have been provided for you. Do not delete as they are answers to the transactions for the respective dates. 3 CASH RECEIPTS JOURNAL (CRJ) 4 CR DR CR CR CR DR CR 5 Date Account Posted/Ref Cash at bank Accounts Receivable Book Sales GST Collected 6 02-Jul-23 Book Sales 4-1010 7 02-Jul-23 Milton Booksellers AR009 28,589 33,528 25,990 COGS Inventory 2,599 20,890 20,890 33,528 8 9 10 11 12 13 14 31-Jul-23 Total 15 16 17 18 19 20 21 22 23 Account number AutoSum A Fill Clear Sort & Find & Filter Select Editing K M N P Q R S T U V W X Y Z AA AB AC AD AE ACCT1008 FAA Assignment Student V3 - Microsoft Excel Insert Page Layout Formulas Data Review View Calibri 11 ' ' BIU Paste Home Cut Copy Format Painter Clipboard A8 F| B 1 Total 10 marks fx Font C I Wrap Text Custom Normal Bad Good Neutral Calculation Merge & Center $ - % .00 .0 Conditional Formatting as Table Format Check Cell Explanatory... Input Linked Cell Note Insert Delete Format Alignment Number F| Styles Cells E F H 2 Examples have been provided for you. Do not delete as they are answers to the transactions for the respective dates. 3 CASH PAYMENTS JOURNAL (CPJ) K L M N Autosum Fill Sort & Find Clear Filter Sele Editing P R S T U V W 123456782 10 11 DR CR DR DR DR 10,224 Posted/Ref Cash at bank Accounts Payable GST Paid Other Date 02/Jul/23 03/Jul/23 Chq No. Account 601 Prepaid Rates 1-1500 602 Meta Printing Service AP001 12 13 14 15 16 17 18 19 31-Jul-23 Total 20 Account number 21 22 23 24 222222 10,224 48,200 48,200 Paste = Home Insert Page Layout Formulas Data Review View Cut Copy Format Painter Clipboard A7 Calibri 11 ' ' BIU F| Font fx =PSI!B8 B D E F A 1 Total 5 marks ACCT1008 FAA Assignment Student V3 - Microsoft Excel I Wrap Text Date Normal Bad Good Merge & Center $ - % .00 .00 .0 Conditional Format Formatting as Table Check Cell Explanatory... Input Alignment Number F| Styles H 2 Examples have been provided for you. Do not delete as they are answers to the transactions for the respective dates. 3 ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER (ARSL) 4 AR007 Heyrick Book Company 5 Date Details Ref Debit Credit Balance 6 1/07/2023 Opening Balance 39,600 7 4/07/2023 Book sales & GST Collected SJ 22,120 61,720 8 9 10 11 12 Date Details Ref Debit AR008 Credit Leigh Books Balance 13 14 15 16 17 Date Details Ref Debit AR009 Credit Milton Booksellers Balance 18 19 20 21 22 23 24 Date Details Ref Debit AR010 Credit Wilmont Book Store Balance 25 26 27 28 29 30 Date Details Ref Debit AR011 Credit Norris Bookroom Balance 31 32 33 34 35 36 37 38 39 40 K L M N P Q R Paste Home Cut Insert Page Layout Formulas Copy Format Painter Clipboard A7 F| A 1 Total 5 marks Data Review View Calibri 11 ' ' BIU Font fx ='3. CPJ'!A7 B D E ACCT1008 FAA Assignment Student V3 - Microsoft Excel I Wrap Text Date Normal Bad Good Neutral Calculation Merge & Center $ - % Conditional .00 .0 Format Formatting as Table Check Cell Explanatory... Input Linked Cell Note Insert Alignment Number F| Styles H 2 Examples have been provided for you. Do not delete as they are answers to the transactions for the respective dates. 3 ACCOUNTS PAYABLE SUBSIDIARY LEDGER (APSL) 4 5 Date Details 6 1/07/2023 Opening Balance 7 3/07/2023 Cash at bank 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 AP001 Ref Debit Credit Meta Printing Service Balance 48,200 CPJ 48,200 K L M N P Q R S T U V W X Home Insert Page Layout Formulas Data Review View Cut Calibri ' Wrap Text General Copy Paste BI U - Merge & Center % Format Painter Clipboard Font Alignment Number L6 A B C Item D G H 1 Total 10 marks INVENTORY CARDS (IC) (Use perpetual inventory method - moving average) Examples have been provided for you. Do not delete as they are answers to the transactions for the respective dates. ITEM: DONNE 001 K ACCT1008 FAA Assignment Student V3 - Microsoft Excel AutoSum Normal Bad Good Neutral Calculation Conditional Format Check Cell Formatting as Table Explanatory... Input Linked Cell Note Insert Delete Format Fill Clear Sort & Find & Filter Select Styles Cells Editing M N 0 P Q R S T U V W Y Z AA AB AC AD AB 4 5 6 Date PURCHASES Qty Cost/unit Total Qty SALES (COGS) Cost/unit Total Qty ACC NO. BALANCE Cost/unit DON001 Data Area (Do not delete) Schedule of Inventory as at 1 July 2023 Total Item Units on Hand Cost per Unit Total 7 1/07/2023 8 2/07/2023 9 9/07/2023 660 47 31020 10 11 12 13 14 15 ITEM: DONNE 002 16 17 Date Qty PURCHASES Cost/unit Total Qty SALES (COGS) Cost/unit Total Qty 18 19 20 21 22 23 24 Total COGS Closing Inventory Balance 230 47 10.810 970 740 47 47 45,590 Donne 001 970 47 45,590 34,780 Donne 002 902 36 32,472 1400 47 65.800 Marvell 001 915 27 24,705 Marvell 002 926 29 26,854 Cartwright 001 975 33 32,175 Cartwright 002 0 35 Total COGS Closing Inventory Balance Southwell 001 Vaughan 001 935 31 28,985 922 29 26,738 ACC NO. BALANCE Cost/unit DON002 Total 26 ITEM: MARVELL 001 27 28 Date Qty PURCHASES Cost/unit Total Qty SALES (COGS) Cost/unit Total Qty ACC NO. MAR001 BALANCE Cost/unit Total 29 30 31 32 33 Total COGS Closing Inventory Balance 35 36 ITEM: MARVELL 002 37 38 Date Qty PURCHASES Cost/unit SALES (COGS) Total Qty Cost/unit Total Qty ACC NO. BALANCE Cost/unit MAR002 Total 39 40 41 42 43 44 Total COGS Closing Inventory Balance 45 46 ITEM: CARTWRIGHT 001 47 48 Date Qty PURCHASES Cost/unit Total Qty SALES (COGS) Cost/unit Total Qty ACC NO BALANCE Cost/unit CAR001 Total 49 50 51 52 53 Total COGS Closing Inventory Balance 54 CARTYRIGHT 002 ACC NO CABO02 45 46 ITEM: CARTWRIGHT 001 Date Qty PURCHASES Cost/unit Total Qty SALES (COGS) Cost/unit Total Qty 50 Total COGS ACC NO. CAR001 BALANCE Cost/unit Total Closing Inventory Balance CARTWRIGHT 002 Date Qty PURCHASES Cost/unit Total Qty SALES (COGS) Cost/unit Total Qty ACC NO. CAR002 BALANCE Cost/unit Total 287872~138898828828884884848664AA 72 ITEM: 62 ITEM: Date 58 59 54 55 ITEM: 52 82 Total COGS Closing Inventory Balance Qty SOUTHWELL 001 PURCHASES Cost/unit Total Qty SALES (COGS) Cost/unit Total Qty ACC NO. BALANCE Cost/unit SOU001 Total Total COGS Closing Inventory Balance VAUGHAN 001 Date Qty PURCHASES Cost/unit Total Qty SALES (COGS) Cost/unit Total Qty ACC NO. BALANCE Cost/unit VAU001 Total Total COGS Closing Inventory Balance 8) This is an individual assignment and students should work independently. Any evidence of collusion will be reviewed and may lead to the application of the Student Misconduct Rule. 9) Please refer to the Learning Guide for details on Late Submissions and Disruption to Studies. 10) The Individual Assignment Marking Guide (pages 11-12) will show you how your markswill be determined and provide a form of additional feedback. FREEFOX PUBLISHING BACKGROUND 1 History Benjamin Franklin is the sole proprietor of Freefox Publishing - a GST-registered business. Its operations are primarily focused on supplying retailers with selected audio book titles, publishing independent and local authors. It also provides editorial and marketing services. While editing, layouts and design of the titles are completed in-house, the final drafts of manuscripts are sent to the supplier, Meta Printing Services for printing. Further, under the firm's contract with Meta Printing Services, printing costs per unit are fixed and reviewed every six months. Benjamin prides himself on providing the highest quality customer service. Since its formation, the firm has been relatively profitable. Benjamin now has a full complement of staff looking after the various aspects of operations. Currently, the business uses a manual accounting system managed by the accountant, Walter Ralegh. An outline of their manual accounting system is shown below: 2 Accounting System 2.1 Journals and Ledgers Walter Ralegh uses the following special journals, general journals, subsidiary ledgers and general ledgers in maintaining all the accounting records: Sales Journal Purchases Journal Cash Receipts Journal Records all credit sales of inventory. Records all credit purchases of inventory. Records all cash received by the firm, including cash sales, cash receipts from debtors and other sundry receipts Cash Payments Journal Records all cash payments and cheques issued by the firm, including cash purchases, cash payments to creditors and other sundry payments. General Journal Subsidiary Legers General Legers 2.2 Records all transactions that are not recorded in the special journals listed above such as balance day adjustments and purchases of non-current assets. Maintained for accounts receivable and accounts payable, which are then reconciled against therelevant general ledger control accounts. Records all special journals and general journals items. For special journals, use total amounts where applicable. The balance of each general ledger is transferred to the trial balance in the 10-column worksheet. Schedules and Chart of Accounts (refer to Excel file) 2.2.1 Schedule of Accounts Receivable and Accounts Payable as at 1 July 2023 2.2.2 Schedule of Inventory as at 1 July 2023, including Selling Price and CostPrice 2.2.3 Schedule of Employees, including name, position and salary 2.2.4 Chart of Accounts 3 3.1 3.2 3.3 3.4 Accounting Policies Freefox Publishing uses the accrual accounting method. Freefox Publishing uses a perpetual inventory system. Freefox Publishing has the following depreciation policies: (Hint: GJ entries) Buildings: depreciated over 20 years using the straight-linemethod. The cost of buildings is $750,000. The estimated residual value of the buildings is $50,000. Computer equipment. depreciated at the rate of 30% per annum using the reducing balance method. No residual value. Furniture and fixtures: depreciated at the rate of 15% per annum using the reducing balance method. No residual value. Employees work a normal five-day week (Monday to Friday) but are paid fortnightly. The total payroll amount is $21,000 per fortnight. Employees are paid via direct debit (EFT) to their bank account fortnightly on the first and third Thursday of each month. For July 2023, wages and salaries will be paid on 6/7/2023 and 20/7/2023. (Hint: CPJ entries) For example: employees' fortnightly work starts on Monday 19/6/2023 and ends on Friday 30/6/2023. They are then paid on Thursday 6/7/2023. Balance day adjustment for salaries payableis raised at the end of each month for days work but not paid. (Hint: GJ entry) 3.6 3.7 3.8 Interest on mortgage (GST is not applicable): The loan, secured by a mortgage on the land and buildings, is interest- only at the rate of 6.25% per annum, simple interest. This ispayable on the 8th day of the following month (hint: CPJ entry). The bank withdraws the interest automatically from the firm's bank account via direct debit(EFT) on the due date. The balance day adjustment for interest payable is raised at the end of each month (hint: GJ entry). All transactions and calculations are to be rounded to the nearest whole dollar. Freefox Publishing is a GST registered business. Where applicableall transactions will be plus GST. TheGST rate is 10%. FREE FOX BUSINESS TRANSACTIONS FOR JULY 2023 The following transactions relate to the operation of Freefox Publishing during July 2023. 2nd 2nd 2nd 3rd 4th Sold goods for cash, plus GST (Hint: PSI, CRJ and IC entries) Product Donne001 Donne002 Units 230 280 Paid the quarterly property rates from July to September 2023: $10,224 (cheque # 601). (Hint: GST is not applicable on rates.CPJ and GJ entries) Received from Milton Booksellers for goods sold on inJune 2023: $33,528. (Hint: CRJ and ARSL entries) Paid MetaPrinting Service account in full for amount outstanding as at 1st July2023 (cheque #602). (Hint: CPJ and APSL entries) Sold goods to Heyrick Book Company on credit, plus GST (invoice #701). (Hint: PSI, SJ, ARSL and IC entries) Product 5th Marvell001 Marvel1002 Southwell001 Units 282 144 99 Purchased computer equipment from Godolphin Technology with cash for $12,120 plus GST (cheque #603). (Hint: CPJ entry) 5th 6th 8th 8th 150 9th 9th Purchased computer equipment from Godolphin Technology with cash for $12,120 plus GST (cheque #603). (Hint: CPJ entry) Paid fortnightly employees' wages. (Refer to Accounting Policies3.4) Paid electricity invoiced for June 2023: $2,375 plus GST (cheque #604) (Hint: CPJ entry) Paid monthly interest on mortgage. (Refer to Accounting Policies3.6) Received from Heyrick Book Company in full for amount outstanding as at 1st July 2023. (Hint: CRJ and ARSL entries) Purchased inventory from Meta Printing Services on credit, plus GST (invoice #4212). (Hint: GRA, PJ, APSL and IC entries) Product Units Donne001 660 Donne002 400 Marvell001 500 Marvel1002 300 Cartwright001 150 Southwell001 250 Vanghan001 150

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started