Answered step by step

Verified Expert Solution

Question

1 Approved Answer

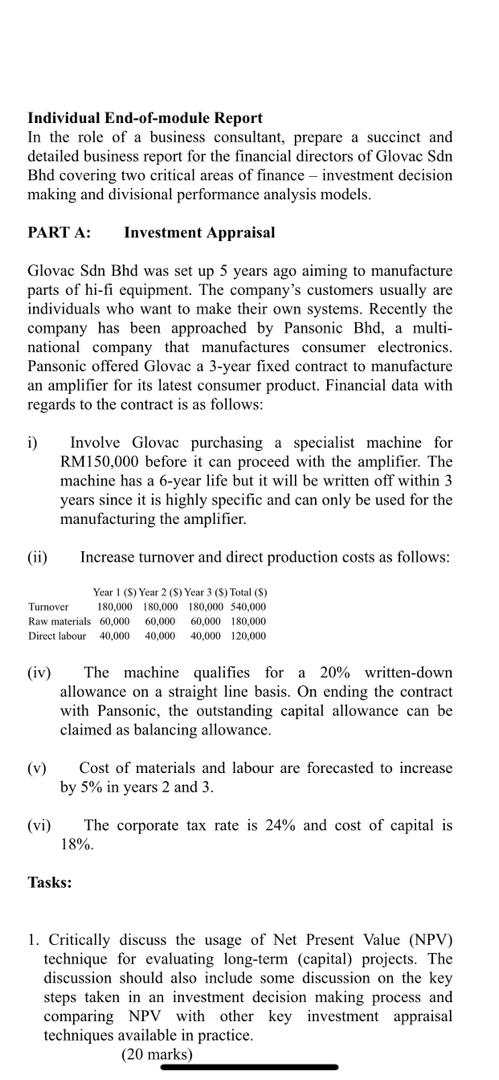

Individual End-of-module Report In the role of a business consultant, prepare a succinct and detailed business report for the financial directors of Glovac Sdn

Individual End-of-module Report In the role of a business consultant, prepare a succinct and detailed business report for the financial directors of Glovac Sdn Bhd covering two critical areas of finance - investment decision making and divisional performance analysis models. PART A: Investment Appraisal Glovac Sdn Bhd was set up 5 years ago aiming to manufacture parts of hi-fi equipment. The company's customers usually are individuals who want to make their own systems. Recently the company has been approached by Pansonic Bhd, a multi- national company that manufactures consumer electronics. Pansonic offered Glovac a 3-year fixed contract to manufacture an amplifier for its latest consumer product. Financial data with regards to the contract is as follows: i) Involve Glovac purchasing a specialist machine for RM150,000 before it can proceed with the amplifier. The machine has a 6-year life but it will be written off within 3 years since it is highly specific and can only be used for the manufacturing the amplifier. Increase turnover and direct production costs as follows: Year 1 (S) Year 2 (S) Year 3 (S) Total (S) Turnover 180,000 180,000 180,000 540,000 Raw materials 60,000 60,000 60,000 180,000 Direct labour 40,000 40,000 40,000 120,000 (ii) (iv) The machine qualifies for a 20% written-down allowance on a straight line basis. On ending the contract with Pansonic, the outstanding capital allowance can be claimed as balancing allowance. (v) Cost of materials and labour are forecasted to increase by 5% in years 2 and 3. (vi) The corporate tax rate is 24% and cost of capital is. 18%. Tasks: 1. Critically discuss the usage of Net Present Value (NPV) technique for evaluating long-term (capital) projects. The discussion should also include some discussion on the key steps taken in an investment decision making process and comparing NPV with other key investment appraisal techniques available in practice. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Title Investment Appraisal and DecisionMaking Process A Critical Analysis of Net Present Value NPV Technique Introduction This report aims to provide a comprehensive analysis of investment appraisal a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started