INDIVIDUAL LEARNING PROJECT INSTRUCTIONS This project will allow you the opportunity to explore a companys annual report and become familiar with the items it contains. Locate the most recent annual report, either from the EDGAR database (SEC Website) or the companys website. Once located, open Individual Learning Project Questions document and add your answers underneath each question. Do not delete the questions. Questions 5052 must be answered in Microsoft Excel and your answers must include formulas. Both documents (Word and Excel) must be uploaded into the Assignment link.

I chose General Mills as my company.

Analysis: (use Excel to complete this section)

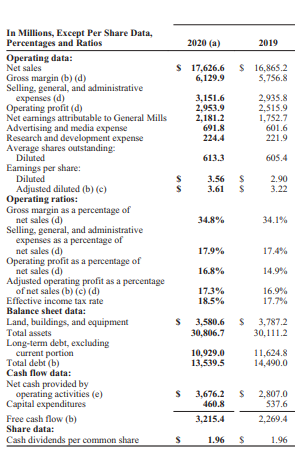

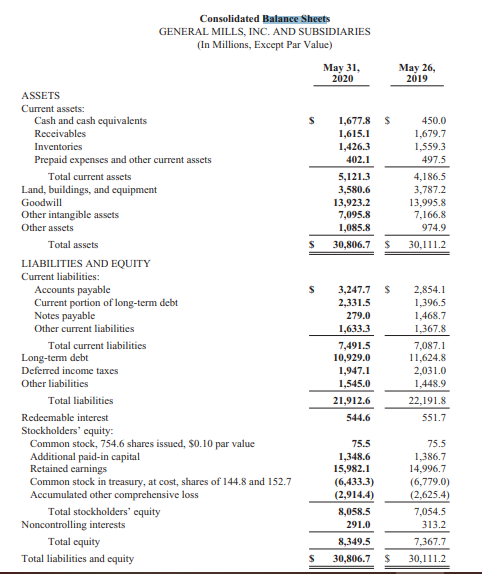

- Provide common-size analysis of your companys income statement and balance sheet for the 2 most recent years (must be done using Excel with formulas).

- Provide horizontal analysis of your companys income statement and balance sheet, showing the dollar amount and percent of change using the 2 most recent years (you must use an Excel spreadsheet with formulas).

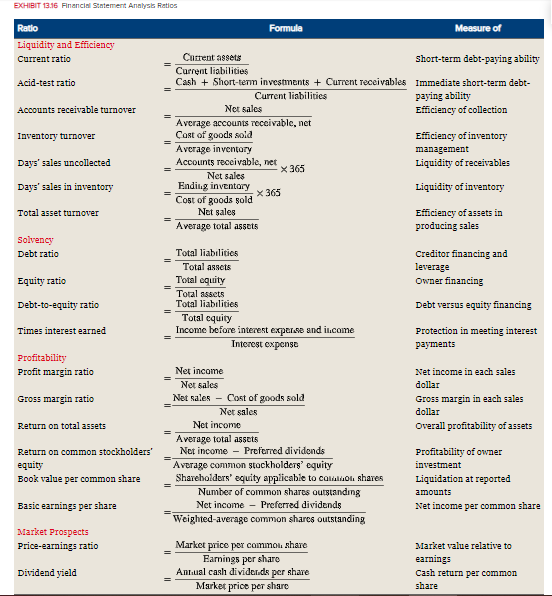

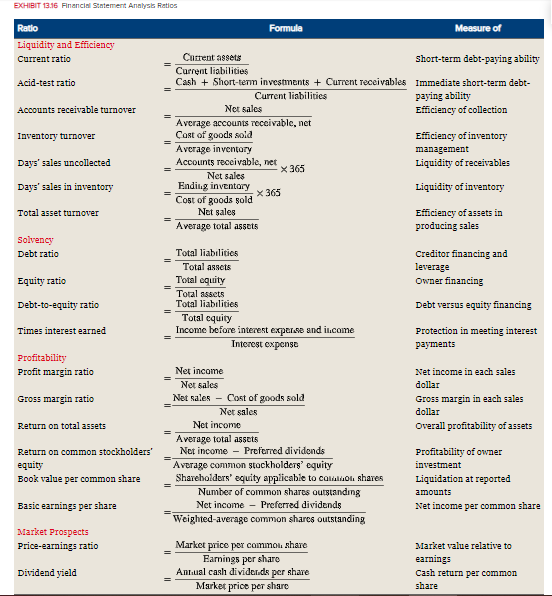

- Perform ratio analysis on your company using the ratios listed in Exhibit 13.16 on page 505 of your text (these must be in an Excel spreadsheet, using formulas to calculate the ratios). You should present them in a similar format as the text: group by category, list name of ratio, formula in words, and the ratio calculation. Give a short explanation of your conclusions about your company after each category of ratios (i.e. How liquid is your company? How efficiently is it using its assets?

Below is Exhibit 13.16 from my textbook

Please include Excel formulas/calculations.

Income Statement

Balance Sheet

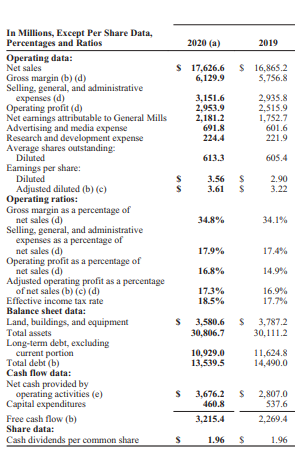

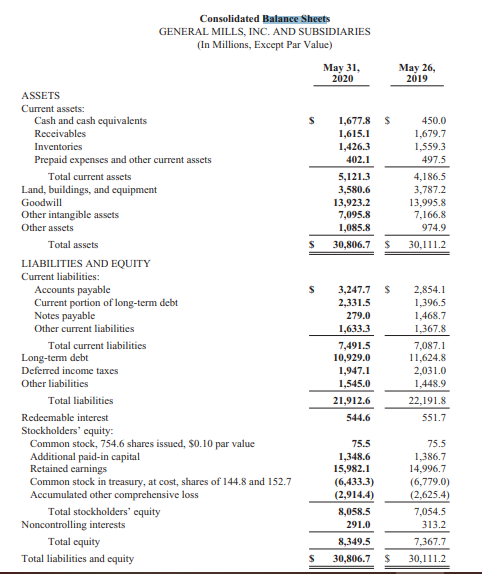

EXHIBIT 13.16 Financial Statement Analysis Ratics Formula Measure of Ratio Liquidity and Efficiency Current ratio Acid-test ratio Accounts receivable turnover Inventory turnover Current assets Short-term debt-paying ability Current liabilities Cash + Short-term investments + Current receivables Immediate short-term debt- Current liabilities paying ability Net sales Efficiency of collection Average accounts receivable, net Cost of goods sold Efficiency of inventory Average inventory management Accounts receivable, net Liquidity of receivables Net sales Ending inventory Liquidity of inventory Cost of goods sold Net sales Efficiency of assets in Average total assets producing sales Days' sales uncollected X 365 Days' sales in inventory x 363 Total asset turnover Solvency Debt ratio Creditor financing and leverage Owner financing Equity ratio Total liabilities Total assets Total equity Total assets Total liabilities Total equity Income before interest expense and income Interest expense Debt-to-equity ratio Times interest earned Debt versus equity financing Protection in meeting interest payments Profitability Profit margin ratio Gross margin ratio Net income in each sales dollar Gross margin in each sales dollar Overall profitability of assets Return on total assets Return on common stockholders' equity Book value per common share Net income Net sales Net sales - Cost of goods sold Net sales Net income Average total assets Nut income - Preferred dividends Average common stockholders' cquity Shareholders' equity applicable to calon shares Number of common shares outstanding Net income - Preferred dividends Weighted average common shares outstanding Market price per common share Famings per share Antual cash dividende per share Market price per share Profitability of owner investment Liquidation at reported amounts Net income per common share Basic earnings per share Market Prospects Price-earnings ratio Market value relative to earnings Cash return per common share Dividend yield 2020 (a) 2019 $ 17,626.6 $ 16,865.2 6,129.9 5,756.8 3,151.6 2.953.9 2.181.2 691.8 224.4 2.935.8 2,515.9 1.752.7 601.6 221.9 613.3 605.4 s 3.56 $ 3.61 $ 2.90 3.22 34.8% 34.1% In Millions, Except Per Share Data, Percentages and Ratios Operating data: Net sales Gross margin (b)(d) Selling, general, and administrative expenses (d) Operating profit (d) Net earnings attributable to General Mills Advertising and media expense Research and development expense Average shares outstanding Diluted Eamings per share: Diluted Adjusted diluted (b) (c) Operating ratios: Gross margin as a percentage of net sales (d) Selling general, and administrative expenses as a percentage of net sales (d) Operating profit as a percentage of net sales (d) Adjusted operating profit as a percentage of net sales (b) (e) (d) Effective income tax rate Balance sheet data: Land, buildings, and equipment Total assets Long-term debt, excluding current portion Total debt (b) Cash flow data: Net cash provided by operating activities (e) Capital expenditures Free cash flow (b) Share data: Cash dividends per common share 17.9% 17.4% 16.8% 14.9% 17.3% 18.5% 16.9% 17.7% $ 3,580.6 $ 3.787.2 30.806.7 30.111.2 10,929.0 13.539.5 11.624.8 14,490.0 $ 3,676.2 $ 460.8 3.215.4 2.807.0 537.6 2.269.4 S 1.96 s 1.96 Consolidated Balance Sheets GENERAL MILLS, INC. AND SUBSIDIARIES (In Millions, Except Par Value) May 31, 2020 May 26, 2019 1,677.8 $ 1,615.1 1,426.3 402.1 5,121.3 3,580.6 13,923.2 7,095.8 1,085.8 30,806.7 $ 450.0 1,679.7 1,559.3 497.5 4,186.5 3,787.2 13,995.8 7,166.8 974.9 30.111.2 S $ ASSETS Current assets: Cash and cash equivalents Receivables Inventories Prepaid expenses and other current assets Total current assets Land, buildings, and equipment Goodwill Other intangible assets Other assets Total assets LIABILITIES AND EQUITY Current liabilities: Accounts payable Current portion of long-term debt Notes payable Other current liabilities Total current liabilities Long-term debt Deferred income taxes Other liabilities Total liabilities Redeemable interest Stockholders' equity: Common stock, 754.6 shares issued, $0.10 par value Additional paid-in capital Retained earnings Common stock in treasury, at cost, shares of 144.8 and 152.7 Accumulated other comprehensive loss Total stockholders' equity Noncontrolling interests Total equity Total liabilities and equity 3,247.7 2,331.5 279.0 1,633.3 7,491.5 10,929.0 1,947.1 1,545.0 21,912.6 544.6 2,854.1 1,396.5 1,468.7 1,367.8 7,087.1 11,624.8 2,031.0 1,448.9 22,191.8 551.7 75.5 1,348.6 15,982.1 (6,433.3) (2,914.4) 8,058.5 291.0 8,349.5 30,806.7 75.5 1,386.7 14,996.7 (6,779.0) (2.625.4) 7,054.5 313.2 7,367.7 30.111.2 S $