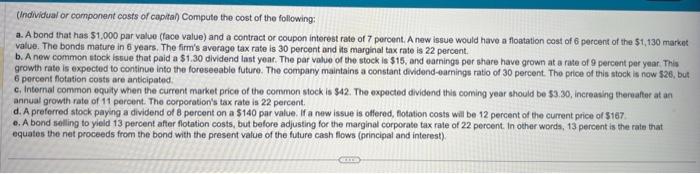

(Individual or camponent costs of capital) Compute the cost of the following: a. A bond that has $1,000 par valu0 (face value) and a contract or coupon interest rale of 7 peroent. A new issue would have a floatation cost of 6 percent of the $1,130 market value. The bonds mature in 6 years. The firm's average tax rate is 30 percent and its marginal tax rate is 22 percent. b. A new common stock issue that paid a $1.30 dividend last year. The par value of the stock is $15, and earnings per ahare have grown at a rate of 9 percent per year. This growth rate is expected to continue into the foreseeable future. The company maintains a constant dividend-earnings ratio of 30 percent. The price of this stock is now 586 , but 6 porcent flotation costs are anticipated. c. Internal common equity when the current market price of the common stock is $42. The oxpected dividend this coming year should be 53.30 , increasing thereatter at an annual growith rate of 11 percent. The corporation's tax rate is 22 percent. d. A preferred stock paying a dividend of 8 percent on a 5140 par value. If a new issue is otfered, fotation costs will be 12 percent of the current price of 5167 . e. A bond selling to yield 13 percent after flotation costs, but belore adjusting for the marginal corporate tax rate of 22 percent. in other words, 13 percent is the rate that equates the net proceeds from the bond with the present value of the future cash flows (nrincipal and interest). (Individual or camponent costs of capital) Compute the cost of the following: a. A bond that has $1,000 par valu0 (face value) and a contract or coupon interest rale of 7 peroent. A new issue would have a floatation cost of 6 percent of the $1,130 market value. The bonds mature in 6 years. The firm's average tax rate is 30 percent and its marginal tax rate is 22 percent. b. A new common stock issue that paid a $1.30 dividend last year. The par value of the stock is $15, and earnings per ahare have grown at a rate of 9 percent per year. This growth rate is expected to continue into the foreseeable future. The company maintains a constant dividend-earnings ratio of 30 percent. The price of this stock is now 586 , but 6 porcent flotation costs are anticipated. c. Internal common equity when the current market price of the common stock is $42. The oxpected dividend this coming year should be 53.30 , increasing thereatter at an annual growith rate of 11 percent. The corporation's tax rate is 22 percent. d. A preferred stock paying a dividend of 8 percent on a 5140 par value. If a new issue is otfered, fotation costs will be 12 percent of the current price of 5167 . e. A bond selling to yield 13 percent after flotation costs, but belore adjusting for the marginal corporate tax rate of 22 percent. in other words, 13 percent is the rate that equates the net proceeds from the bond with the present value of the future cash flows (nrincipal and interest)