Question

Individual Rehabilitation Services (IRS) is a not-for-profit organization that assists individuals returning to society following a substance abuse conviction. IRS has been greatly successful in

Individual Rehabilitation Services (IRS) is a not-for-profit organization that assists individuals returning to society following a substance abuse conviction. IRS has been greatly successful in its urban efforts. Thus, more resources are needed. Late last year, IRS began a restaurant operation, The Golden Kettle, which specializes in soups. Last year€™s operation was a break- even effort. At the beginning of the year, The Golden Kettle relocated to a mall. It has been clearly established by the District Director of the Internal Revenue Service (the other IRS) that income generated by The Golden Kettle will be unrelated business income.

Required

Determine the minimum federal income tax liability and the taxes owed at the time of filing based on the following data: Cash receipts: $ 160,900 (Sales of $ 156,100 plus $ 4,800 donated to IRS by Golden Kettle customers)

Cash Disbursements

Merchandise purchases ............... $ 52,000

Wages and related payroll taxes (a) ........ 20,870

Rent€”space and equipment (b) .......... 3,600

Property insurance (c) ............. 2,850

Equipment purchases (d) .............. 15,000

Loan payments (e) .............. 1,200

Utilities 1,400 Food license (f) ......... 400

Professional fees (g) ............. 1,900

Repairs and maintenance (R& M) (h) ....... 950

Advertising and promotion (i) ......... 4,000

Taxes (j) ................... 10,000

Telephone .................. . 480

Supplies ................... 1,300

Miscellaneous ................. 520

Total ................... $ 116,470

Other Information

1. IRS is an accrual-basis, calendar-year taxpayer.

2. Inventory information FIFO LIFO

Beginning Inventory $ 12,000 $ 11,200

Ending Inventory $ 14,000 $ 12,100

3. Explanation of notes:

a. Includes employer€™s share of FICA.

b. Rent is $ 250/month. A $ 350 security deposit was made and the final month€™s rent was paid in advance on an 18-month lease.

c. Two assets are insured: Inventory€”$150 (a floating figure based on monthly inventory levels). Tangible personal property€”$2,700 (a three-year policy that was acquired on July 1 of the current year).

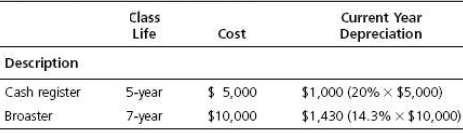

d. Additional equipment not provided by the owner of the facility is required and acquired. Information pertaining to this equipment is shown below:

e. $ 200 a month to Buckner Bank on a $ 3,000 loan used to purchase the equipment in (d). Interest expense is $ 450.

f. $ 200 is paid on January 1 and July 1 to the city controller who issues a six- month license at those dates.

g. Breakdown of this expense indicates: $ 200€”Preparation of prior year€™s tax return. $ 600€”Payment to an architect for her plans, which will be used to build another restaurant in the near future. $ 1,100€” Attorney fee in settling a claim brought by a customer who claimed that she was served undercooked food, which led to her illness.

h. The previous customer claim brought about an extensive inspection by the Health Department, which ordered several changes (costing $ 650) in the operation and fined IRS $ 300. The $ 300 is included in the $ 950 R& M figure. (Note that fines are not deductible on a federal income tax return.)

i. Includes $ 1,600 of newspaper advertising plus $ 2,400 paid for a Yellow Pages ad that will appear in next year€™s telephone directory, which will be distributed in October of next year.

j. Estimated federal income tax payments during theyear.

Class Life Current Year Cost Depreciation Description Cash register 5-year $ 5,000 $1,000 (20% x $5,000) Broaster 7-year $10,000 $1,430 (14.3% x $10,000)

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION IRS INDIAN REHABILITATION SERVICE TAX CALCULATION SALES 156100 LESS COST OF GOOD SOLD 51100 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started