Answered step by step

Verified Expert Solution

Question

1 Approved Answer

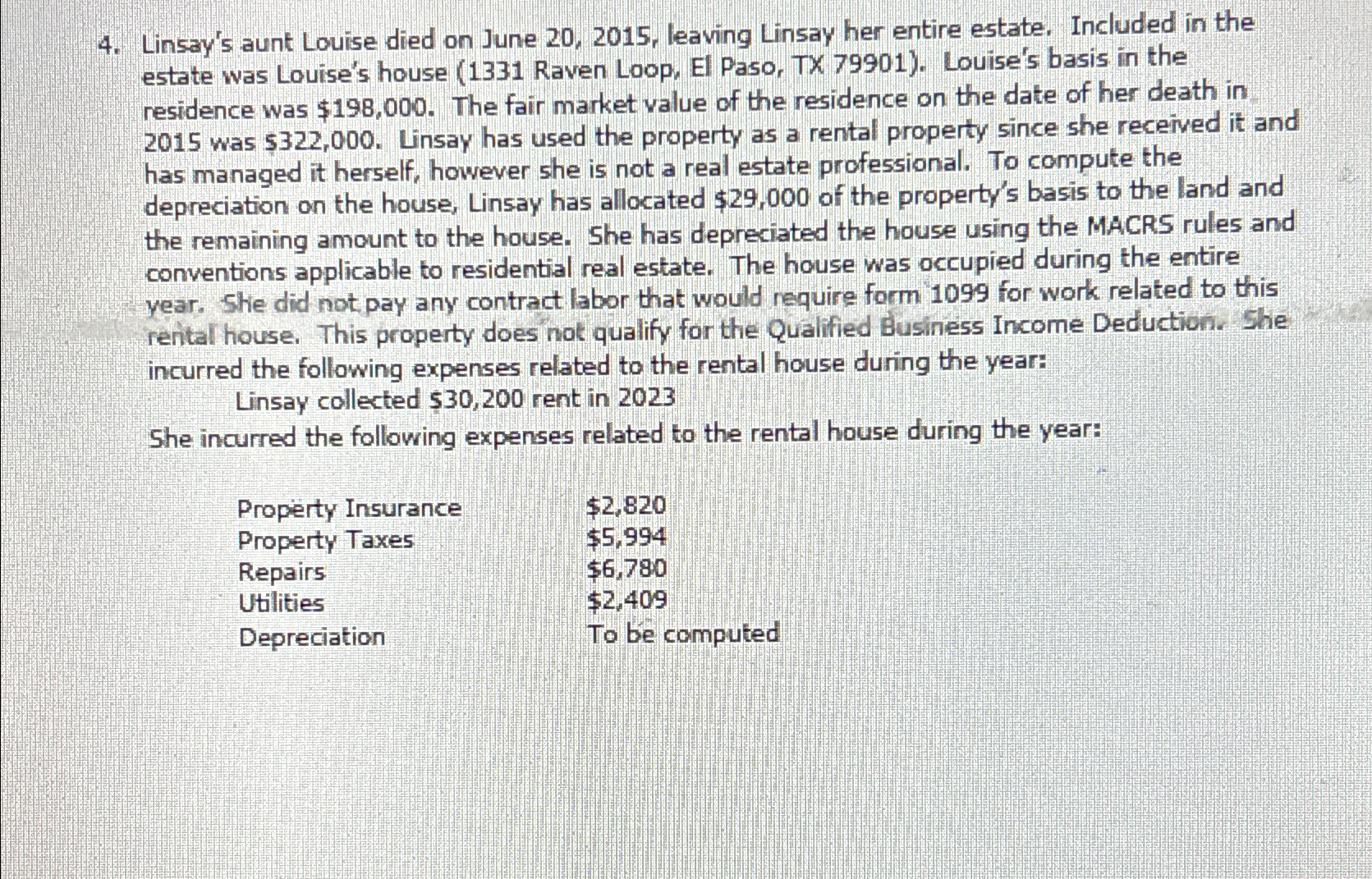

INDIVIDUAL TAX RETURN # 3 Linsay Adams Required Use the following information to complete Linsay Adams' 2 0 2 3 federal income tax return If

INDIVIDUAL TAX RETURN #

Linsay Adams

Required

Use the following information to complete Linsay Adams' federal income tax return If information is missing, use reasonable assumptions to fill in the gaps. You may need the following forms and schedules to complete the assignment: Form Schedule Schedule Schedule C Schedule SE Schedule E Form and possibly others. The forms, schedules, and instructions can be found in the Blackboard course under instructor resources or at the IRS Web site wevirsupx The instructions for the forms can be helpful and can be found on the IRS website. Also, use Form Finder in the TR Checkpoint library for additional line by line instructions.

Facts:

Linsay Adams unmarried is employed as a nurse practitioner at the main office of Canal Street Crisis Center. Linsay lives in a home she purchased years ago with her father Harold Adams for the entire year. Harold is disabled and receives $ of income each year housesitting for neighbors. Harold is able to save these funds because Linsay provides all of Harold's support. Linsay also supports her yearold son Connor. Connor is a fulltime student and in his first year at UTEP.

Linsay provided the following additional information:

The Adams' live at Spotted Yucca Dr El Paso, TX

Linsay's birthday is and her Social Security number is

Harold's birthday is and his Social Security number is

Connor's birthday is and his Social Security number is

Linsay does not have any foreign bank accounts or trusts, nor did she have any transactions with virtual currency.

A $ nonrefundable credit for other dependents is available for each qualifying dependent over the age of line Form You will NOT need to use Schedule

Linsay received a Form W Canal Street Crisis Center her employer that is attached.

Linsay did some accountingbookkeeping work on the side for some extra eamings. See the NEC attached for the bookkeeping income she had from the Fellini Film Cafe. She also had some expenses associated with this side business. She did not pay any contract labor that would require her to file form and she uses the cash method of accounting for this business.

The expenses are as follows:

tableOffice Expense,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started