Answered step by step

Verified Expert Solution

Question

1 Approved Answer

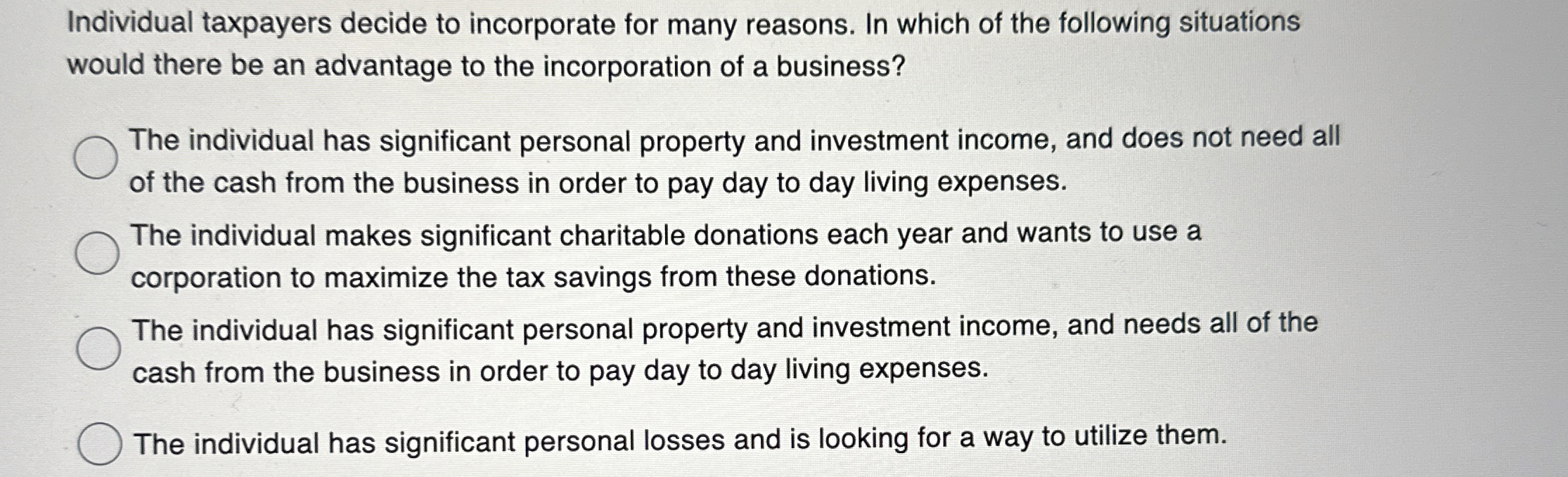

Individual taxpayers decide to incorporate for many reasons. In which of the following situations would there be an advantage to the incorporation of a business?

Individual taxpayers decide to incorporate for many reasons. In which of the following situations would there be an advantage to the incorporation of a business?

The individual has significant personal property and investment income, and does not need all of the cash from the business in order to pay day to day living expenses.

The individual makes significant charitable donations each year and wants to use a corporation to maximize the tax savings from these donations.

The individual has significant personal property and investment income, and needs all of the cash from the business in order to pay day to day living expenses.

The individual has significant personal losses and is looking for a way to utilize them.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started