Answered step by step

Verified Expert Solution

Question

1 Approved Answer

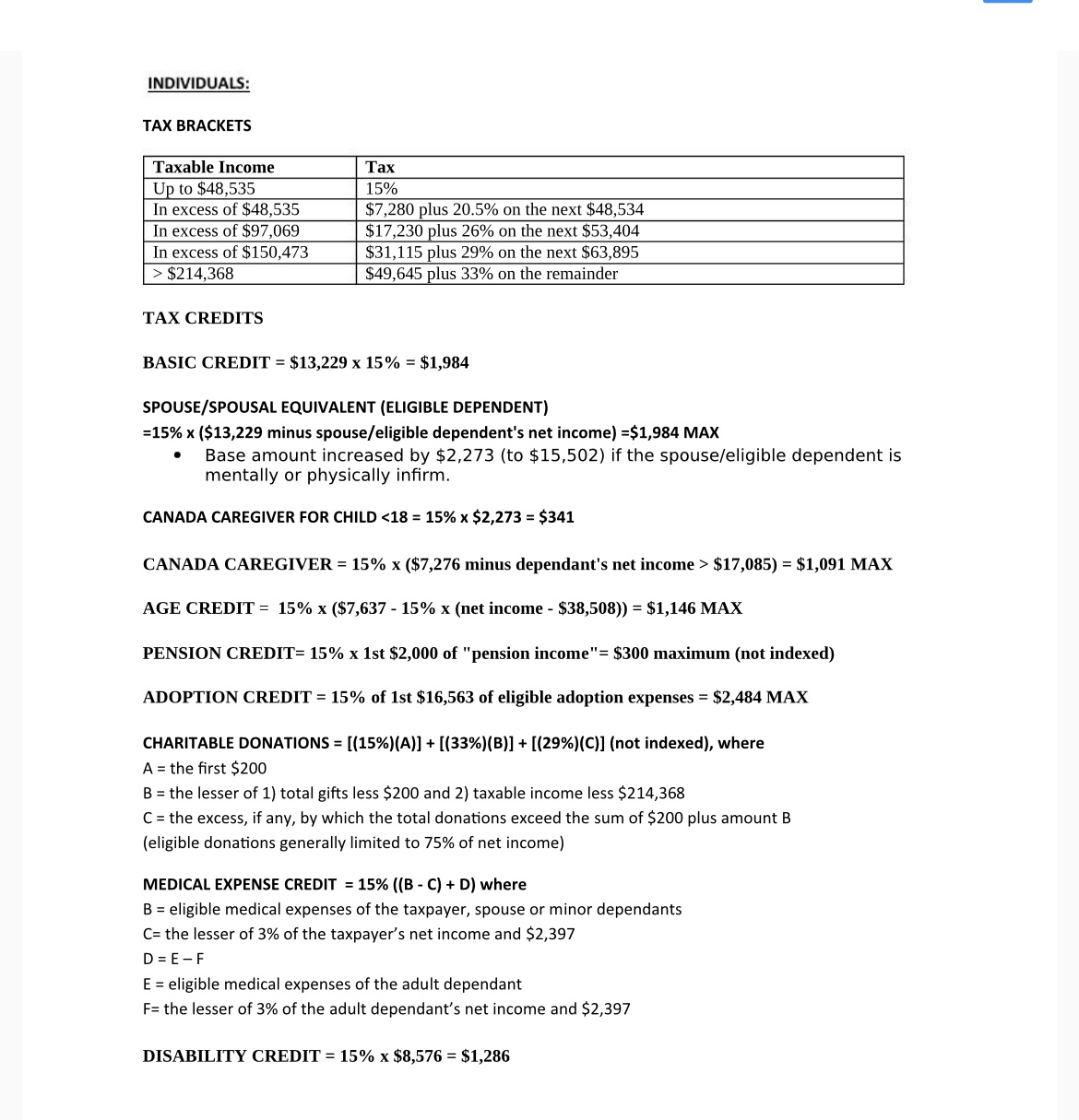

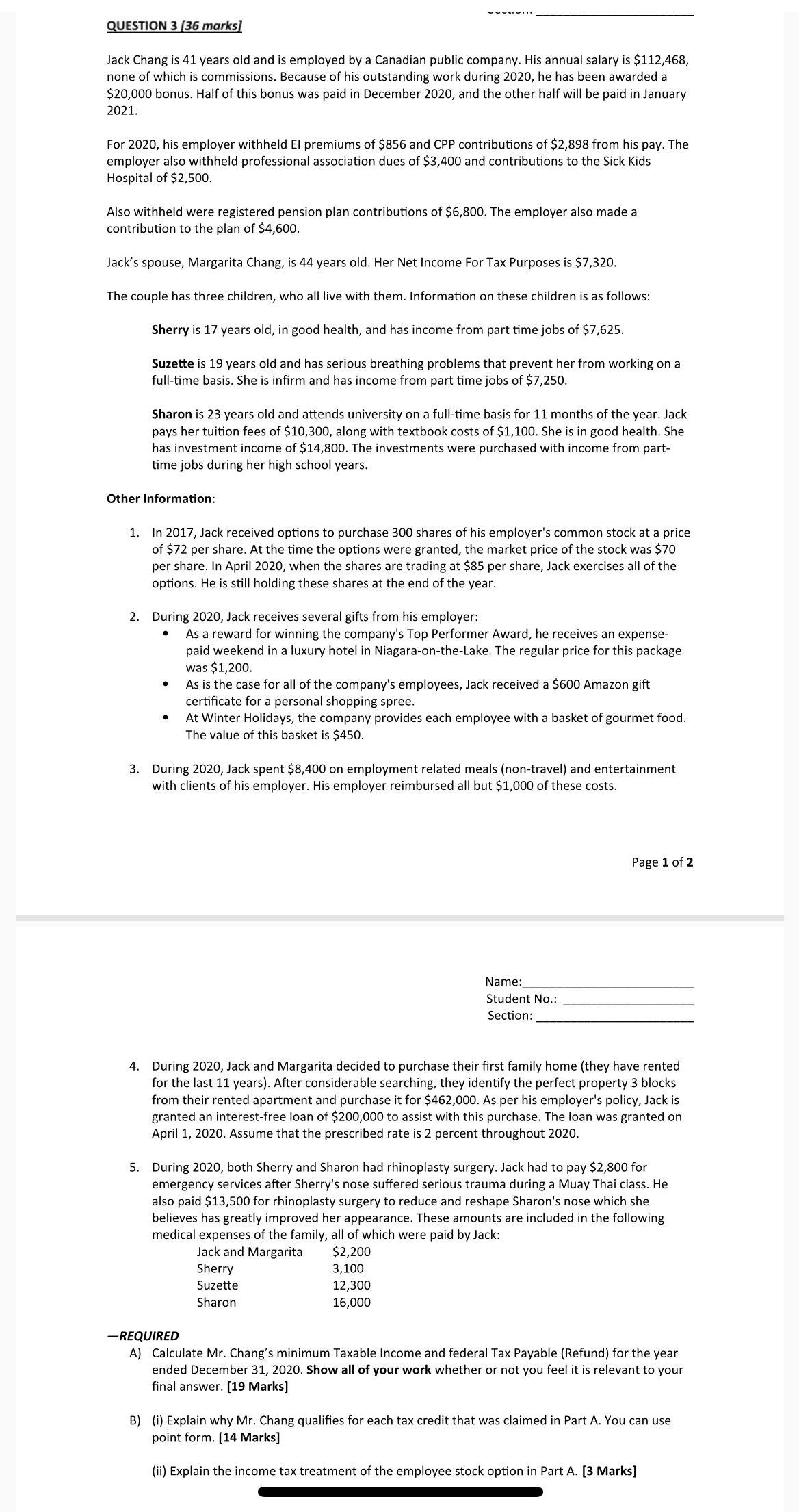

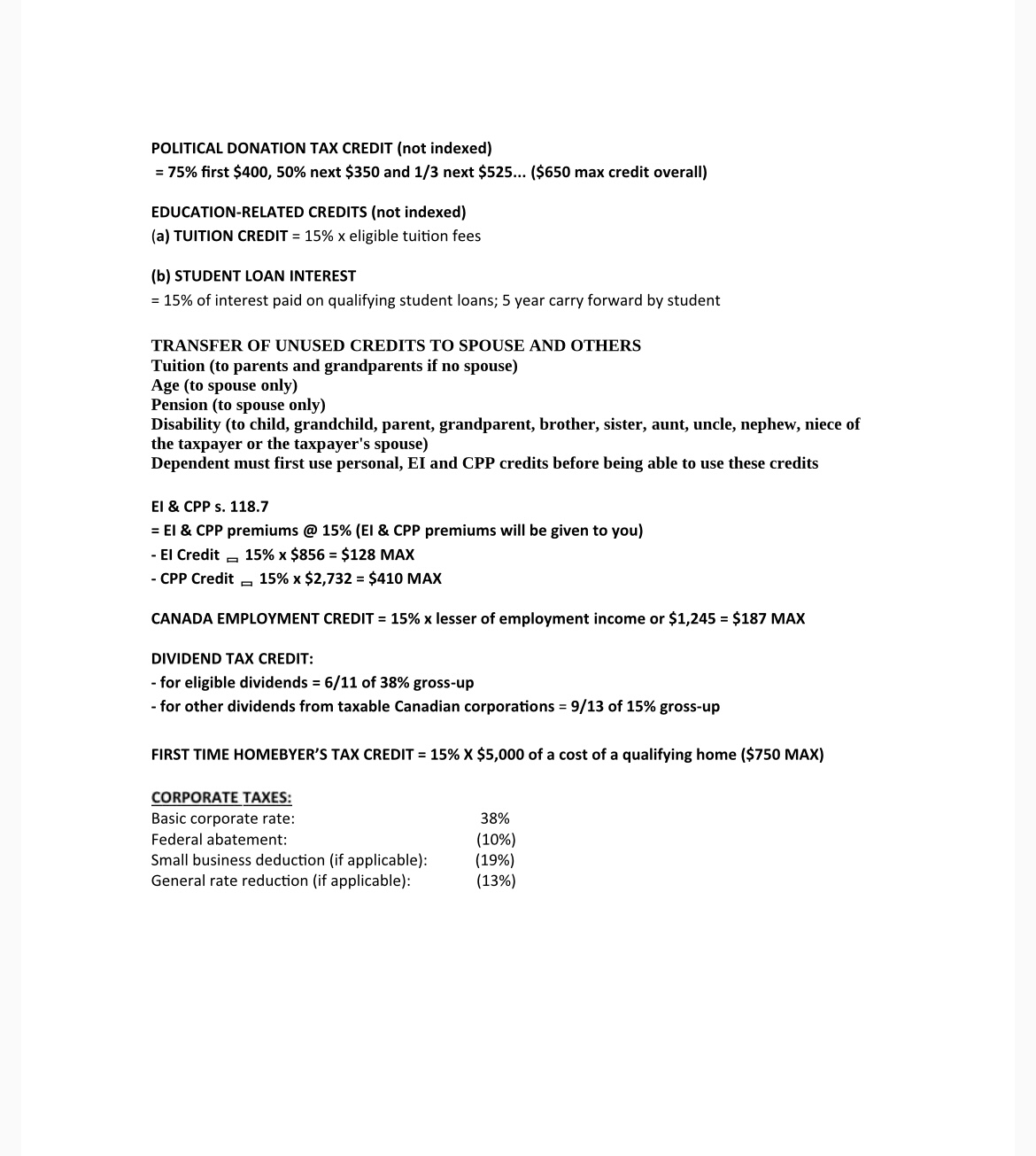

INDIVIDUALS: TAX BRACKETS Taxable Income Up to $48,535 In excess of $48,535 In excess of $97,069 In excess of $150,473 > $214,368 TAX CREDITS

INDIVIDUALS: TAX BRACKETS Taxable Income Up to $48,535 In excess of $48,535 In excess of $97,069 In excess of $150,473 > $214,368 TAX CREDITS Tax 15% $7,280 plus 20.5% on the next $48,534 $17,230 plus 26% on the next $53,404 $31,115 plus 29% on the next $63,895 $49,645 plus 33% on the remainder BASIC CREDIT = $13,229 x 15% = $1,984 SPOUSE/SPOUSAL EQUIVALENT (ELIGIBLE DEPENDENT) =15% x ($13,229 minus spouse/eligible dependent's net income) =$1,984 MAX Base amount increased by $2,273 (to $15,502) if the spouse/eligible dependent is mentally or physically infirm. CANADA CAREGIVER FOR CHILD

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Mr Changs minimum taxable income and federal tax payable for the year ended December 31 2020 we need to consider various sources of income deductions and tax credits Lets go through each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started