Answered step by step

Verified Expert Solution

Question

1 Approved Answer

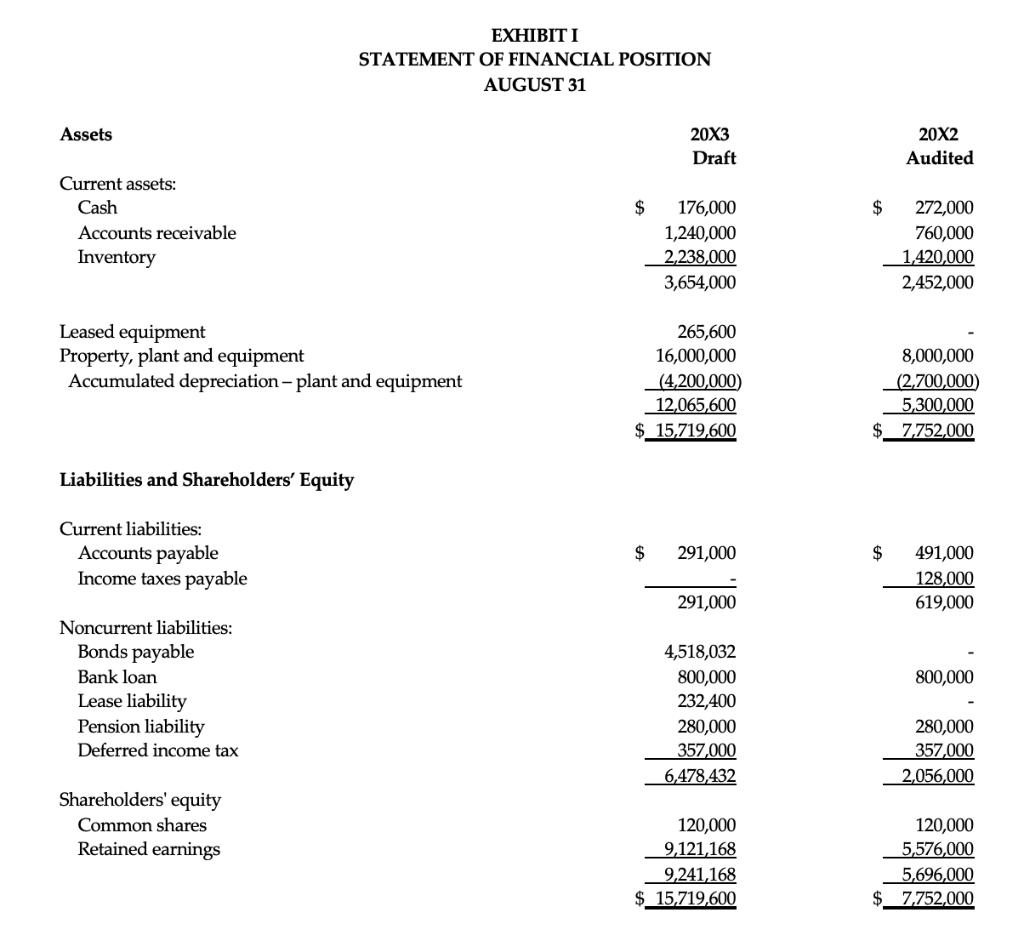

Indra: Lots. We purchased equipment costing $8,000,000 this year and we are now leasing 3 new forklifts over a 4-year lease term with semi-annual payments

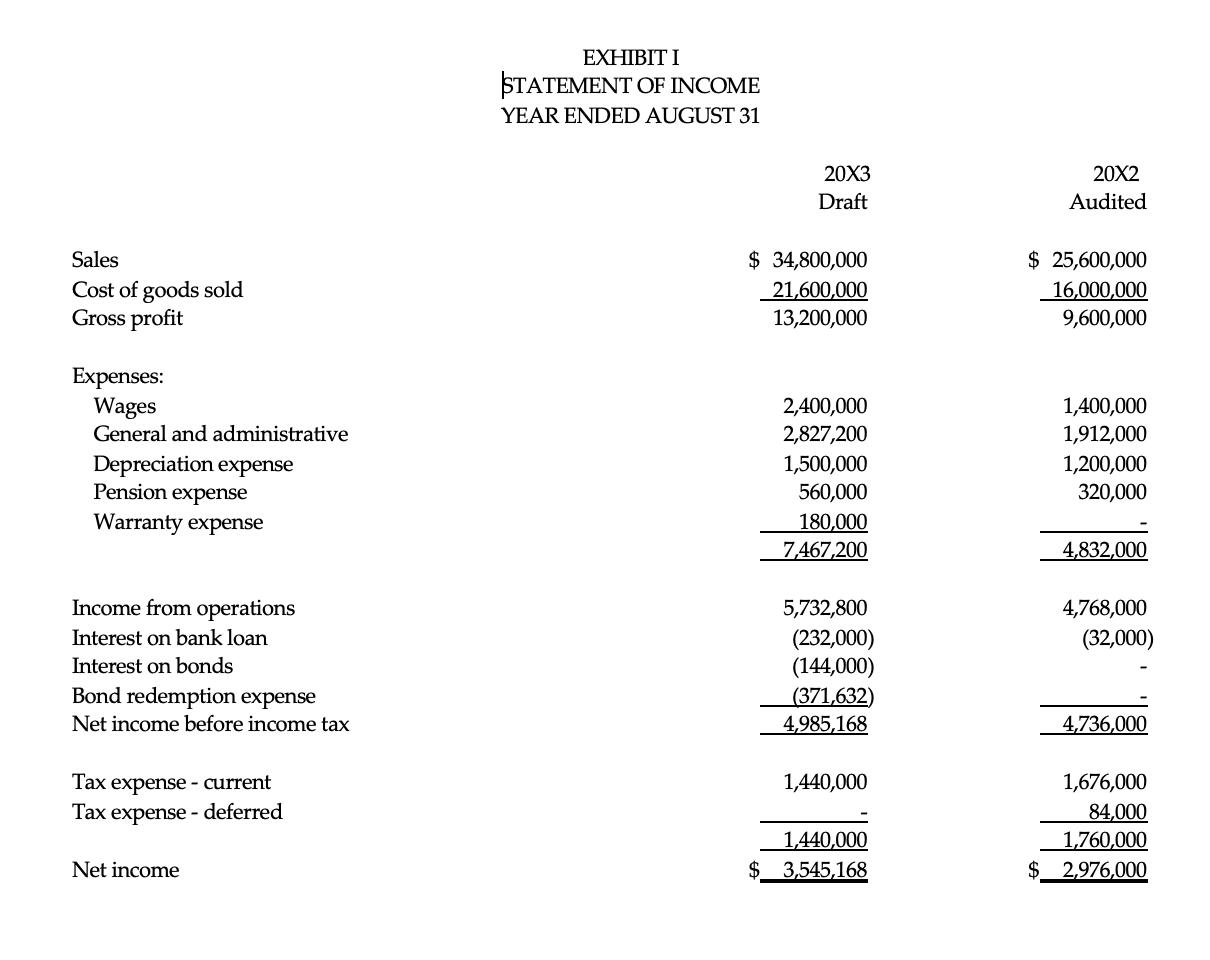

EXHIBIT I STATEMENT OF INCOME YEAR ENDED AUGUST 31 20X3 20X2 Draft Audited Sales $ 34,800,000 $ 25,600,000 Cost of goods sold Gross profit 16,000,000 9,600,000 21,600,000 13,200,000 Expenses: Wages 1,400,000 1,912,000 2,400,000 General and administrative 2,827,200 Depreciation expense Pension expense 1,500,000 1,200,000 560,000 320,000 Warranty expense 180,000 7,467,200 4,832,000 Income from operations 5,732,800 4,768,000 Interest on bank loan (32,000) (232,000) (144,000) (371,632) 4,985,168 Interest on bonds Bond redemption expense Net income before income tax 4,736,000 Tax expense - current 1,440,000 1,676,000 Tax expense - deferred 84,000 1,760,000 $_2,976,000 1,440,000 Net income $_ 3,545,168

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started