Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Industrial versus Retail A B C Industrial versus Multifamily (Suburban) A B C Retail versus Multifamily (Suburban) A B C There is wide market consensus

Industrial versus Retail A

B

C

Industrial versus Multifamily (Suburban) A

B

C

Retail versus Multifamily (Suburban) A

B

C

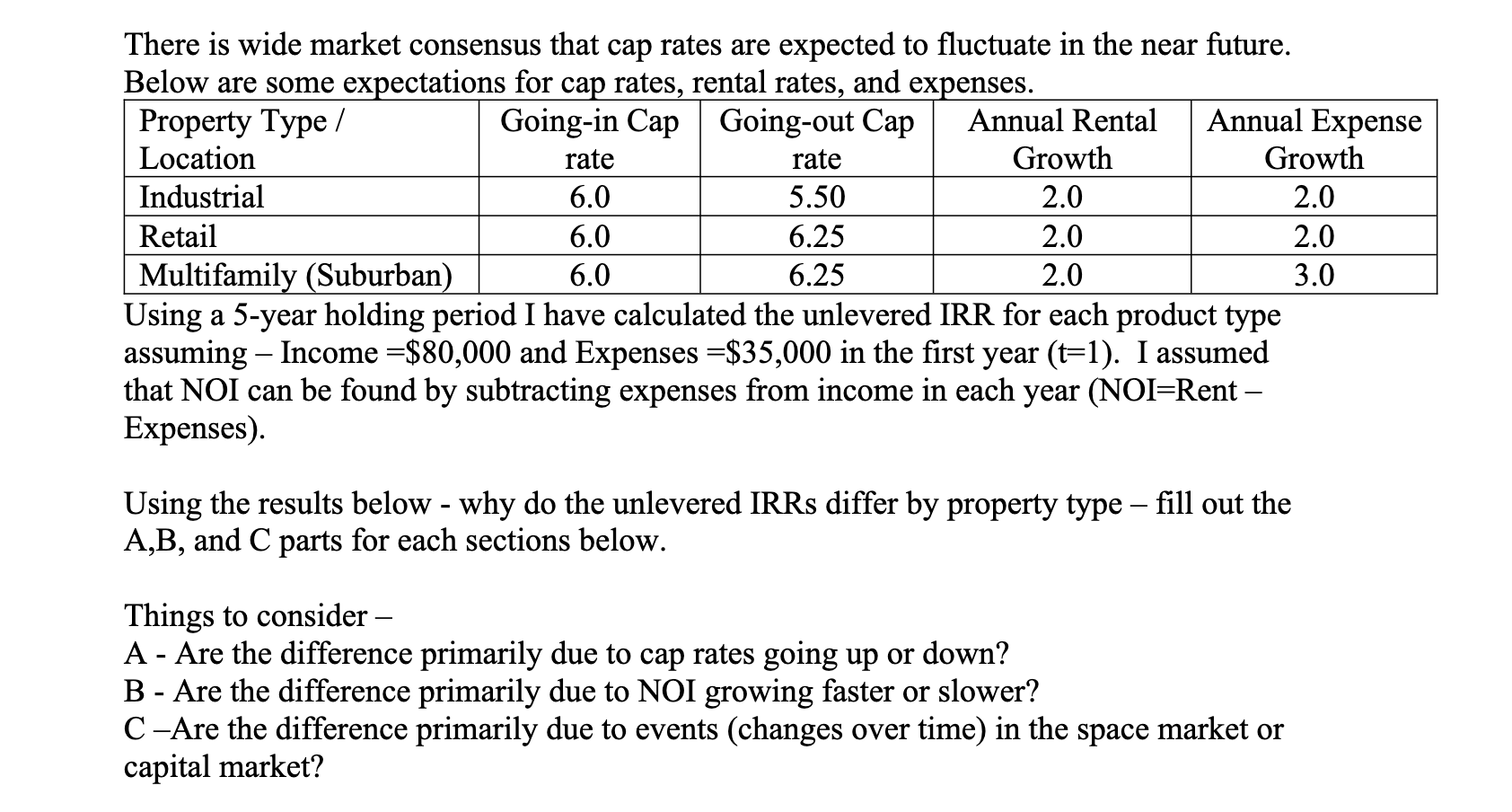

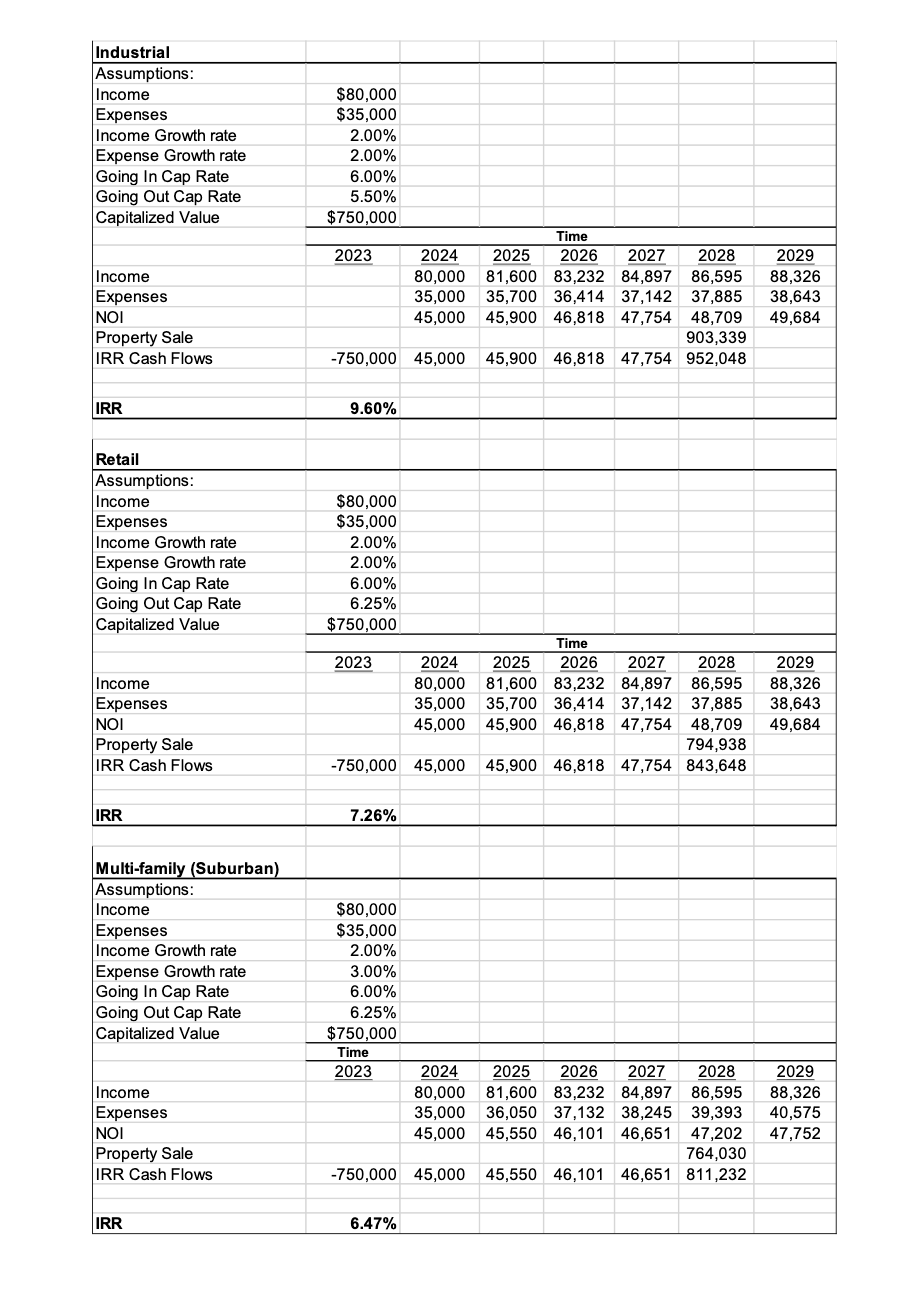

There is wide market consensus that cap rates are expected to fluctuate in the near future. Below are some expectations for cap rates, rental rates, and expenses. Using a 5-year holding period I have calculated the unlevered IRR for each product type assuming - Income =$80,000 and Expenses =$35,000 in the first year (t=1). I assumed that NOI can be found by subtracting expenses from income in each year (NOI=Rent Expenses). Using the results below - why do the unlevered IRRs differ by property type - fill out the A,B, and C parts for each sections below. Things to consider - A - Are the difference primarily due to cap rates going up or down? B - Are the difference primarily due to NOI growing faster or slower? C-Are the difference primarily due to events (changes over time) in the space market or capital market? There is wide market consensus that cap rates are expected to fluctuate in the near future. Below are some expectations for cap rates, rental rates, and expenses. Using a 5-year holding period I have calculated the unlevered IRR for each product type assuming - Income =$80,000 and Expenses =$35,000 in the first year (t=1). I assumed that NOI can be found by subtracting expenses from income in each year (NOI=Rent Expenses). Using the results below - why do the unlevered IRRs differ by property type - fill out the A,B, and C parts for each sections below. Things to consider - A - Are the difference primarily due to cap rates going up or down? B - Are the difference primarily due to NOI growing faster or slower? C-Are the difference primarily due to events (changes over time) in the space market or capital market

There is wide market consensus that cap rates are expected to fluctuate in the near future. Below are some expectations for cap rates, rental rates, and expenses. Using a 5-year holding period I have calculated the unlevered IRR for each product type assuming - Income =$80,000 and Expenses =$35,000 in the first year (t=1). I assumed that NOI can be found by subtracting expenses from income in each year (NOI=Rent Expenses). Using the results below - why do the unlevered IRRs differ by property type - fill out the A,B, and C parts for each sections below. Things to consider - A - Are the difference primarily due to cap rates going up or down? B - Are the difference primarily due to NOI growing faster or slower? C-Are the difference primarily due to events (changes over time) in the space market or capital market? There is wide market consensus that cap rates are expected to fluctuate in the near future. Below are some expectations for cap rates, rental rates, and expenses. Using a 5-year holding period I have calculated the unlevered IRR for each product type assuming - Income =$80,000 and Expenses =$35,000 in the first year (t=1). I assumed that NOI can be found by subtracting expenses from income in each year (NOI=Rent Expenses). Using the results below - why do the unlevered IRRs differ by property type - fill out the A,B, and C parts for each sections below. Things to consider - A - Are the difference primarily due to cap rates going up or down? B - Are the difference primarily due to NOI growing faster or slower? C-Are the difference primarily due to events (changes over time) in the space market or capital market Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started