ine following pertains to the current year. Un January 1, you were appointed manager or a new operating division of Pirate inc., a manufacturer

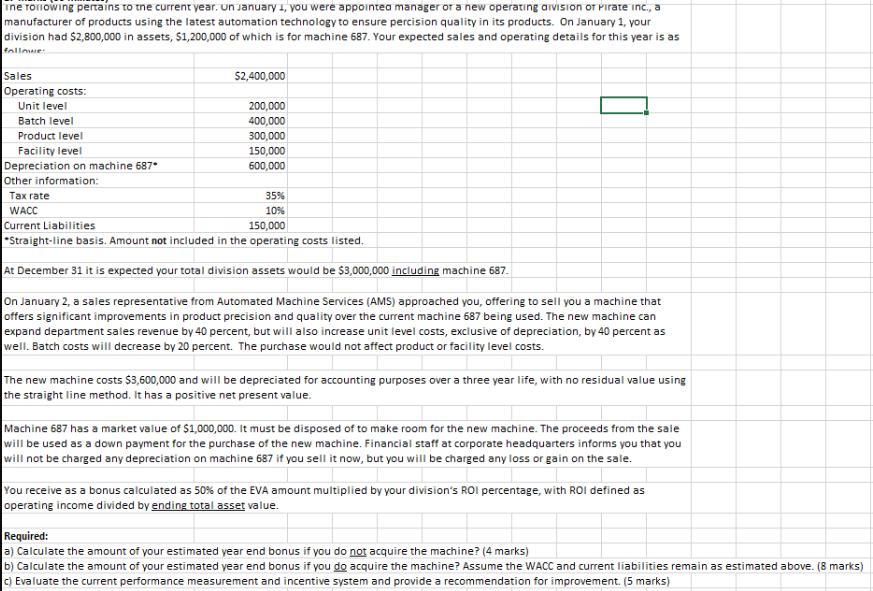

ine following pertains to the current year. Un January 1, you were appointed manager or a new operating division of Pirate inc., a manufacturer of products using the latest automation technology to ensure percision quality in its products. On January 1, your division had $2,800,000 in assets, $1,200,000 of which is for machine 687. Your expected sales and operating details for this year is as followe Sales Operating costs: Unit level Batch level $2,400,000 200,000 400,000 Product level 300,000 Facility level 150,000 Depreciation on machine 687* 600,000 Other information: Tax rate WACC Current Liabilities 35% 10% 150,000 *Straight-line basis. Amount not included in the operating costs listed. At December 31 it is expected your total division assets would be $3,000,000 including machine 687. On January 2, a sales representative from Automated Machine Services (AMS) approached you, offering to sell you a machine that offers significant improvements in product precision and quality over the current machine 687 being used. The new machine can expand department sales revenue by 40 percent, but will also increase unit level costs, exclusive of depreciation, by 40 percent as well. Batch costs will decrease by 20 percent. The purchase would not affect product or facility level costs. The new machine costs $3,600,000 and will be depreciated for accounting purposes over a three year life, with no residual value using the straight line method. It has a positive net present value. Machine 687 has a market value of $1,000,000. It must be disposed of to make room for the new machine. The proceeds from the sale will be used as a down payment for the purchase of the new machine. Financial staff at corporate headquarters informs you that you will not be charged any depreciation on machine 687 if you sell it now, but you will be charged any loss or gain on the sale. You receive as a bonus calculated as 50% of the EVA amount multiplied by your division's ROI percentage, with ROI defined as operating income divided by ending total asset value. Required: a) Calculate the amount of your estimated year end bonus if you do not acquire the machine? (4 marks) b) Calculate the amount of your estimated year end bonus if you do acquire the machine? Assume the WACC and current liabilities remain as estimated above. (8 marks) c) Evaluate the current performance measurement and incentive system and provide a recommendation for improvement. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing the Case and Calculating Bonuses Understanding the Scenario Were evaluating a decision to replace a machine 687 for a new oneconsidering the impact on salescostsand bonusesThe key factors in...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started