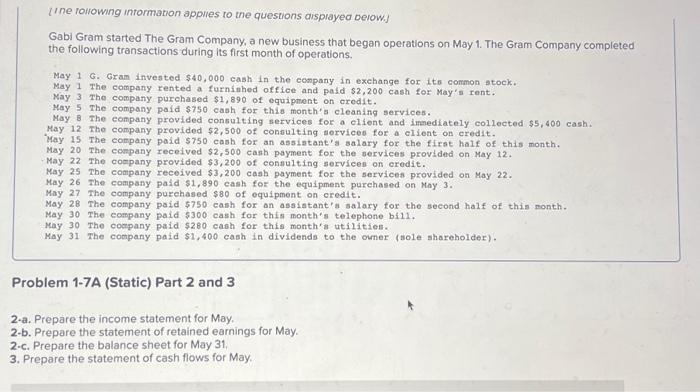

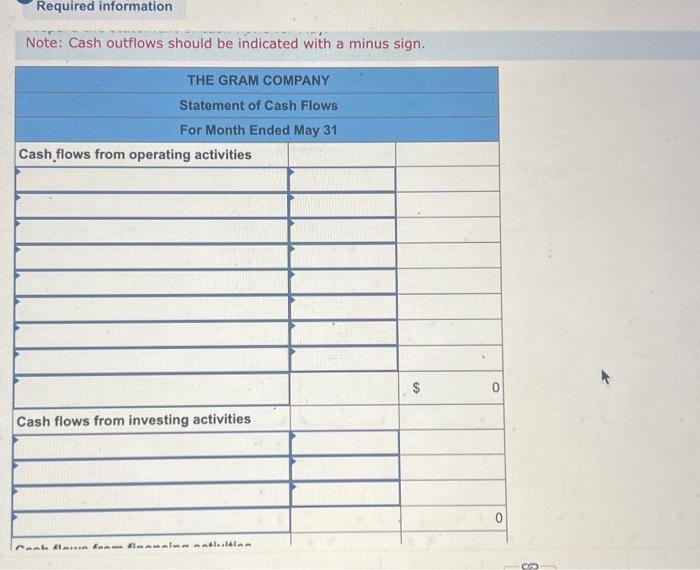

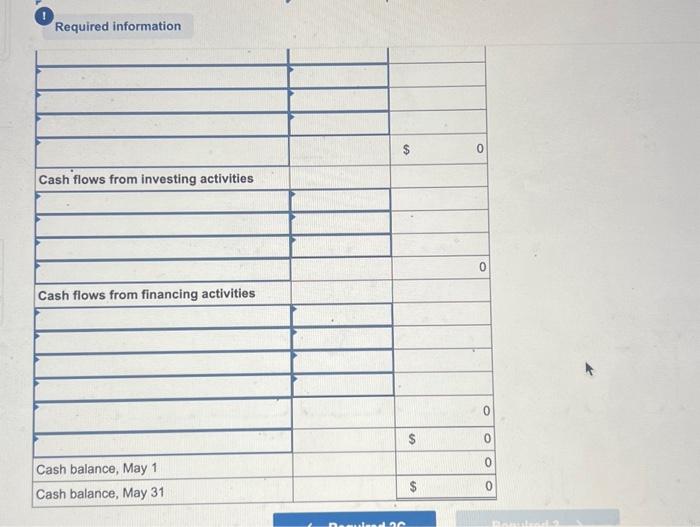

[ine roirowing intormation appies to the questions aisplayea Derow. Gabi Gram started The Gram Company, a new business that began operations on May 1. The Gram Company completed the following transactions during its first month of operations. May 1 G. Gram invested $40,000 cash in the cempany in exchange for its common atock. May 1 The company rented a furniahed offiee and pald $2,200 cash for May's rent. Nay 3 The company purchased $1,890 of equipment on oredit. May 5 The company paid $750 cash for this month'a cleaning services. May 8 The company provided consulting services for a olient and imediately collected $5,400 eash. May 12 The company provided $2,500 of conulting tervices for a elient on credit. 'May 15 The company paid $750 cash for an assistant's salary for the first half of this month. May 20 The company received $2,500 cast payment for the vervices provided on May 12. May 22 The company provided $3,200 of consulting servicen on eredit. May 25 The company received $3,200 cash payment for the services provided on May 22. May 26 The compsny paid $1,890 cash for the equipment purchased on Mny 3. May 27 The company purehased $80 of equipment on eredit. May 28 The company paid 5750 cash for on assistant'a salary for the second half of this nonth. May 30 The ecmpany paid $300 cash for this month's telephone bil1. May 30 The coeppany paid $280 cash for this month'a utilities. May 31 The company paid $1,400 cash in dividends to the oumer (sole shareholder). Problem 1-7A (Static) Part 2 and 3 2-a. Prepare the income statement for May. 2-b. Prepare the statement of retained earnings for May. 2-c. Prepare the balance sheet for May 31, 3. Prepare the statement of cash flows for May. Note: Cash outflows should be indicated with a minus sign. Required information [ine roirowing intormation appies to the questions aisplayea Derow. Gabi Gram started The Gram Company, a new business that began operations on May 1. The Gram Company completed the following transactions during its first month of operations. May 1 G. Gram invested $40,000 cash in the cempany in exchange for its common atock. May 1 The company rented a furniahed offiee and pald $2,200 cash for May's rent. Nay 3 The company purchased $1,890 of equipment on oredit. May 5 The company paid $750 cash for this month'a cleaning services. May 8 The company provided consulting services for a olient and imediately collected $5,400 eash. May 12 The company provided $2,500 of conulting tervices for a elient on credit. 'May 15 The company paid $750 cash for an assistant's salary for the first half of this month. May 20 The company received $2,500 cast payment for the vervices provided on May 12. May 22 The company provided $3,200 of consulting servicen on eredit. May 25 The company received $3,200 cash payment for the services provided on May 22. May 26 The compsny paid $1,890 cash for the equipment purchased on Mny 3. May 27 The company purehased $80 of equipment on eredit. May 28 The company paid 5750 cash for on assistant'a salary for the second half of this nonth. May 30 The ecmpany paid $300 cash for this month's telephone bil1. May 30 The coeppany paid $280 cash for this month'a utilities. May 31 The company paid $1,400 cash in dividends to the oumer (sole shareholder). Problem 1-7A (Static) Part 2 and 3 2-a. Prepare the income statement for May. 2-b. Prepare the statement of retained earnings for May. 2-c. Prepare the balance sheet for May 31, 3. Prepare the statement of cash flows for May. Note: Cash outflows should be indicated with a minus sign. Required information