Answered step by step

Verified Expert Solution

Question

1 Approved Answer

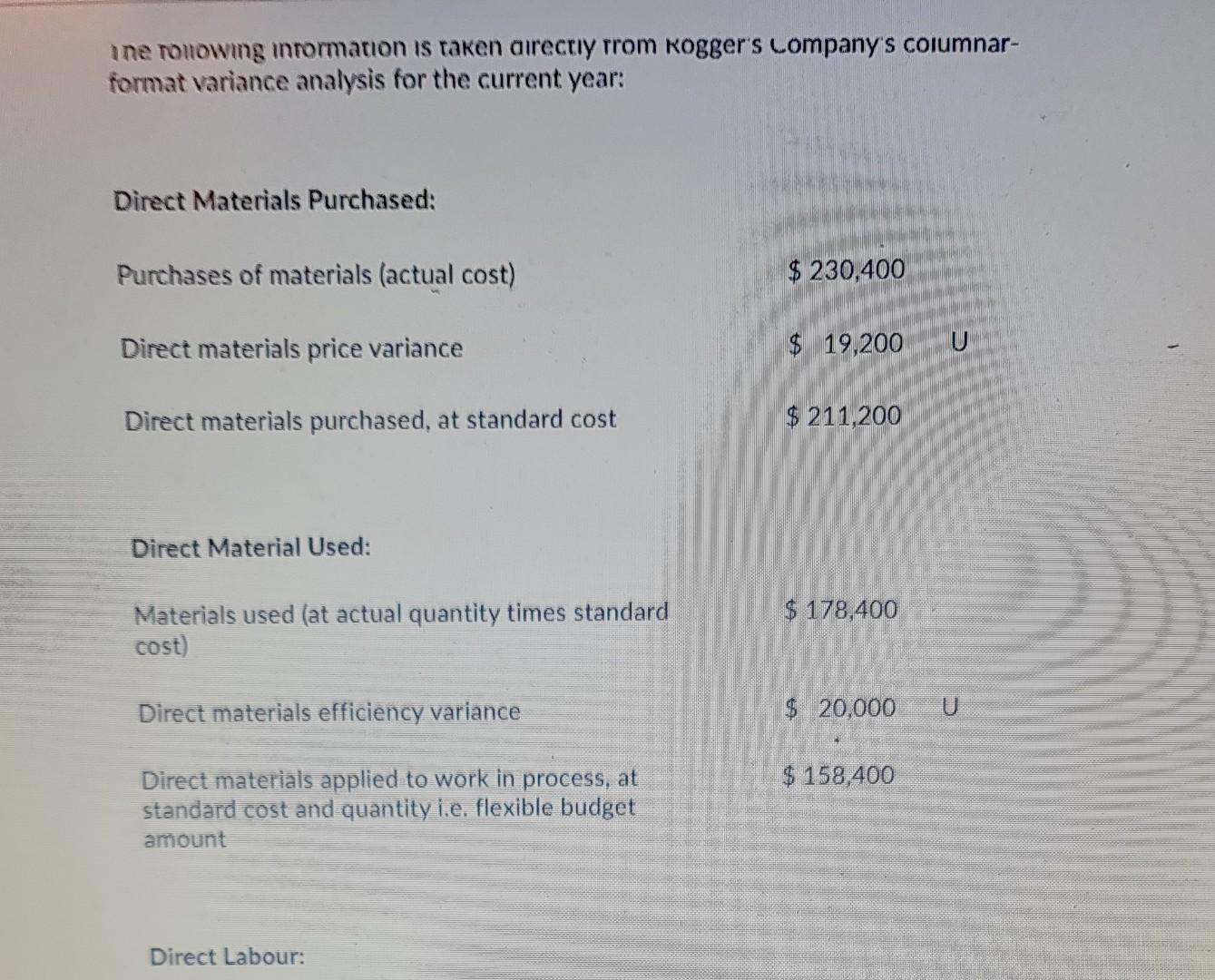

ine Tonowing intormation is taken directiy from Rogger's Company's columnar- format variance analysis for the current year: Direct Materials Purchased: Purchases of materials (actual cost)

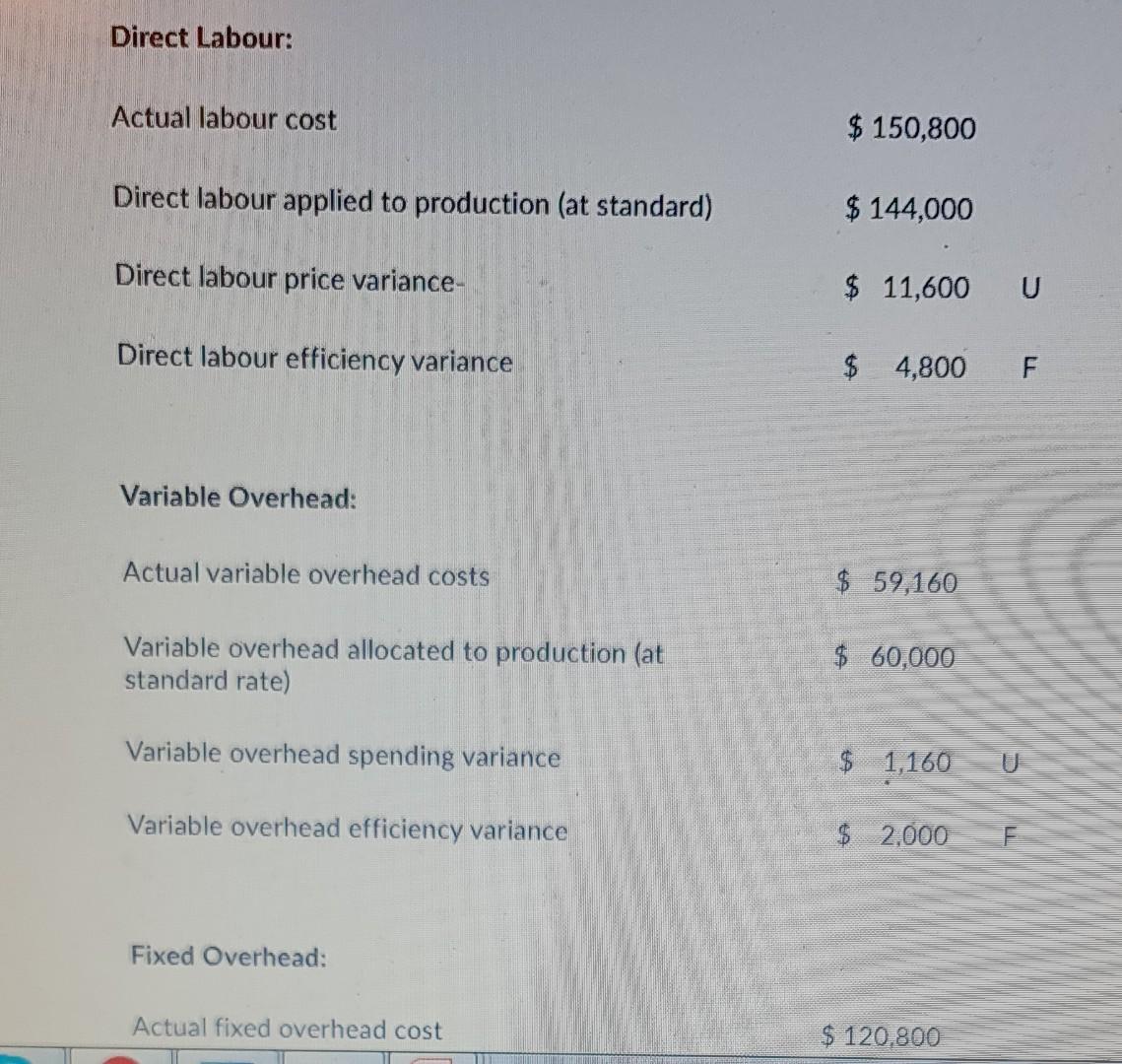

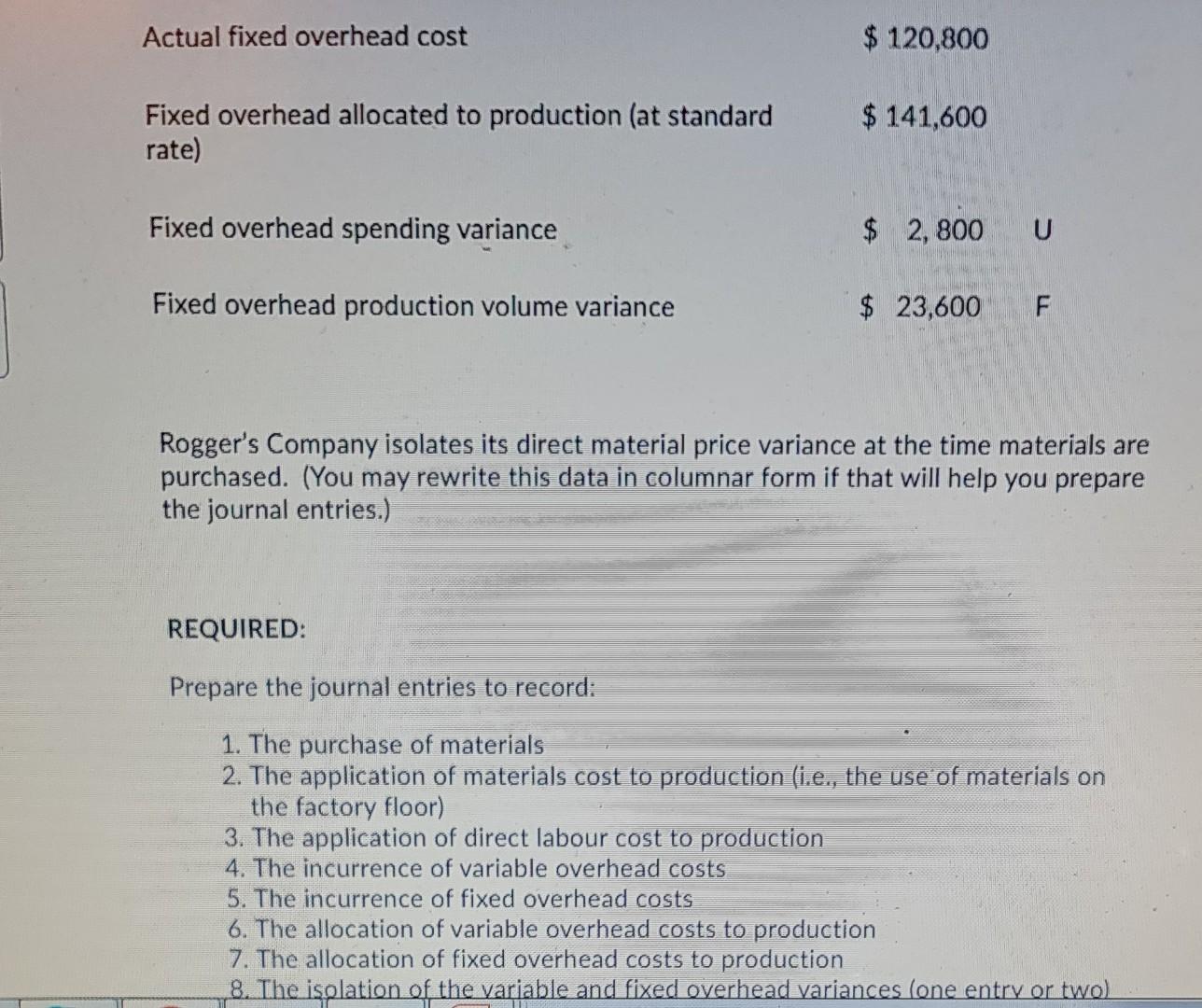

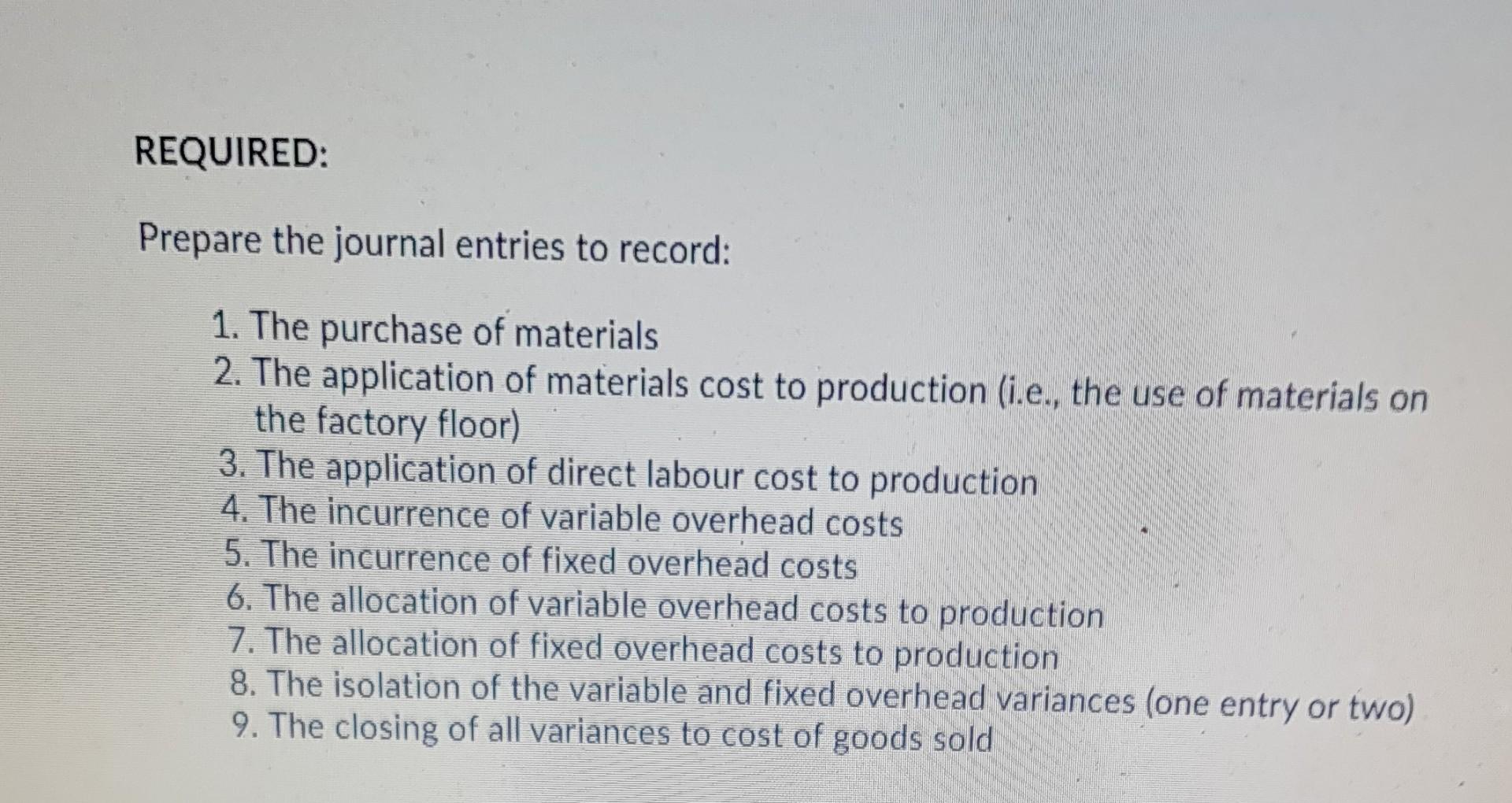

ine Tonowing intormation is taken directiy from Rogger's Company's columnar- format variance analysis for the current year: Direct Materials Purchased: Purchases of materials (actual cost) $ 230,400 Direct materials price variance $ 19,200 U Direct materials purchased, at standard cost $ 211,200 Direct Material Used: $ 178,400 Materials used (at actual quantity times standard cost) Direct materials efficiency variance $ 20,000 $ 158,400 Direct materials applied to work in process, at standard cost and quantity i.e. flexible budget amount Direct Labour: Direct Labour: Actual labour cost $ 150,800 Direct labour applied to production (at standard) $ 144,000 Direct labour price variance- $ 11,600 U Direct labour efficiency variance $ 4,800 F Variable Overhead: Actual variable overhead costs $ 59,160 Variable overhead allocated to production (at standard rate) $ 60,000 Variable overhead spending variance $ 1,160 Variable overhead efficiency variance $ 2,000 Fixed Overhead: Actual fixed overhead cost $ 120.800 Actual fixed overhead cost $ 120,800 Fixed overhead allocated to production (at standard rate) $ 141,600 Fixed overhead spending variance $ 2,800 U Fixed overhead production volume variance $ 23,600 F Rogger's Company isolates its direct material price variance at the time materials are purchased. (You may rewrite this data in columnar form if that will help you prepare the journal entries.) REQUIRED: Prepare the journal entries to record: 1. The purchase of materials 2. The application of materials cost to production (i.e., the use of materials on the factory floor) 3. The application of direct labour cost to production 4. The incurrence of variable overhead costs 5. The incurrence of fixed overhead costs 6. The allocation of variable overhead costs to production 7. The allocation of fixed overhead costs to production 8. The isolation of the variable and fixed overhead variances (one entry or two) REQUIRED: Prepare the journal entries to record: 1. The purchase of materials 2. The application of materials cost to production (i.e., the use of materials on the factory floor) 3. The application of direct labour cost to production 4. The incurrence of variable overhead costs 5. The incurrence of fixed overhead costs 6. The allocation of variable overhead costs to production 7. The allocation of fixed overhead costs to production 8. The isolation of the variable and fixed overhead variances (one entry or two) 9. The closing of all variances to cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started