Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. 7. Picasso Co. issued 10,000 shares of its $1 par common stock, valued at $400,000, to acquire shares of Bull Company in an

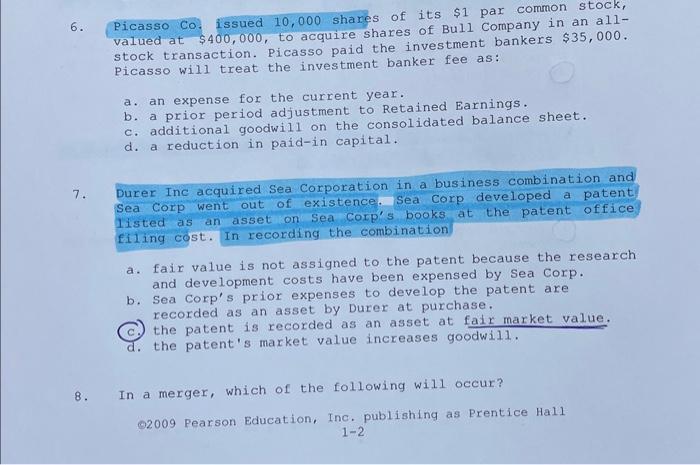

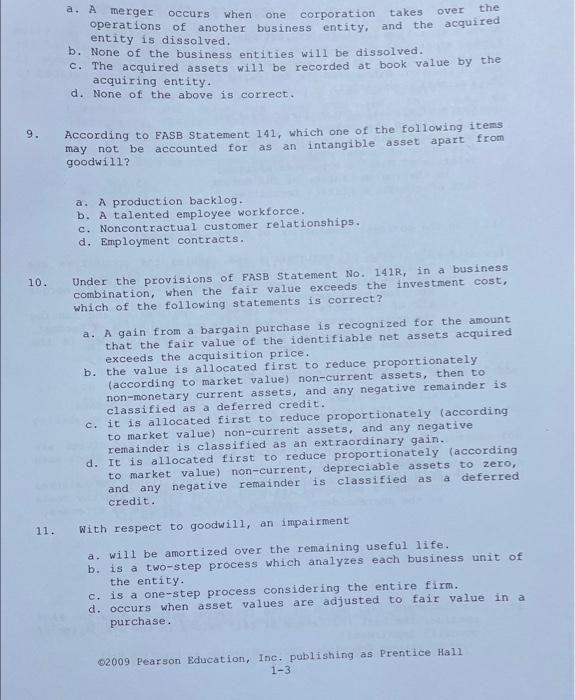

6. 7. Picasso Co. issued 10,000 shares of its $1 par common stock, valued at $400,000, to acquire shares of Bull Company in an all- stock transaction. Picasso paid the investment bankers $35,000. Picasso will treat the investment banker fee as: a. an expense for the current year. b. a prior period adjustment to Retained Earnings. c. additional goodwill on the consolidated balance sheet. d. a reduction in paid-in capital. Durer Inc acquired Sea Corporation in a business combination and Sea Corp went out of existence. Sea Corp developed a patent listed as an asset on Sea Corp's books at the patent office filing cost. In recording the combination a. fair value is not assigned to the patent because the research and development costs have been expensed by Sea Corp. b. Sea Corp's prior expenses to develop the patent are recorded as an asset by Durer at purchase. the patent is recorded as an asset at fair market value. d. the patent's market value increases goodwill. 8. In a merger, which of the following will occur? 2009 Pearson Education, Inc. publishing as Prentice Hall 1-2 9. a. A merger occurs when one corporation takes over the operations of another business entity, and the acquired entity is dissolved. b. None of the business entities will be dissolved. c. The acquired assets will be recorded at book value by the acquiring entity. d. None of the above is correct. According to FASB Statement 141, which one of the following items may not be accounted for as an intangible asset apart from goodwill? a. A production backlog.. b. A talented employee workforce. c. Noncontractual customer relationships. d. Employment contracts. 10. Under the provisions of FASB Statement No. 141R, in a business combination, when the fair value exceeds the investment cost, which of the following statements is correct? a. A gain from a bargain purchase is recognized for the amount that the fair value of the identifiable net assets acquired exceeds the acquisition price. b. the value is allocated first to reduce proportionately (according to market value) non-current assets, then to non-monetary current assets, and any negative remainder is classified as a deferred credit. c. it is allocated first to reduce proportionately (according. to market value) non-current assets, and any negative remainder is classified as an extraordinary gain. d. It is allocated first to reduce proportionately (according to market value) non-current, depreciable assets to zero, a deferred and any negative remainder is classified as credit. 11. With respect to goodwill, an impairment a. will be amortized over the remaining useful life. b. is a two-step process which analyzes each business unit of the entity. c. is a one-step process considering the entire firm. d. occurs when asset values are adjusted to fair value in a purchase. 2009 Pearson Education, Inc. publishing as Prentice Hall 1-3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 6 When a company issues stock to acquire another business in an allstock transaction any ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started