Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Inferring Bad Debt Expense and Determining the Impact of Uncollectible Accounts on Income (Including Tax Effects) and Working Capital A recent annual report for CVS

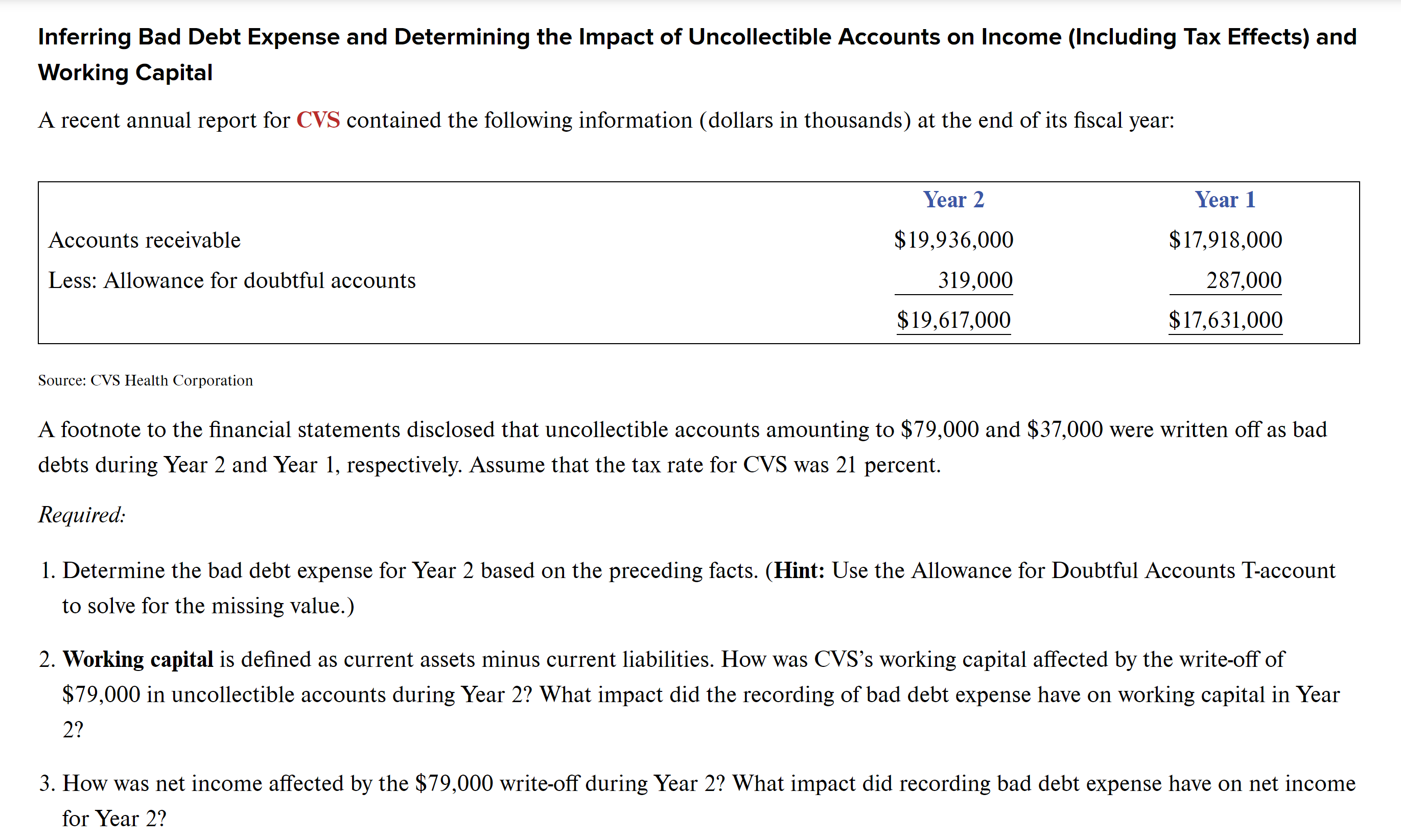

Inferring Bad Debt Expense and Determining the Impact of Uncollectible Accounts on Income (Including Tax Effects) and Working Capital A recent annual report for CVS contained the following information (dollars in thousands) at the end of its fiscal year: [I Source: CVS Health Corporation A footnote to the financial statements disclosed that uncollectible accounts amounting to $79,000 and $37,000 were written off as bad debts during Year 2 and Year 1, respectively. Assume that the tax rate for CVS was 21 percent. Required: 1. Determine the bad debt expense for Year 2 based on the preceding facts. (Hint: Use the Allowance for Doubtful Accounts T-account to solve for the missing value.) 2. Working capital is defined as current assets minus current liabilities. How was CVS's working capital affected by the write-off of $79,000 in uncollectible accounts during Year 2? What impact did the recording of bad debt expense have on working capital in Year 2? 3. How was net income affected by the $79,000 write-off during Year 2? What impact did recording bad debt expense have on net income for Year 2

Inferring Bad Debt Expense and Determining the Impact of Uncollectible Accounts on Income (Including Tax Effects) and Working Capital A recent annual report for CVS contained the following information (dollars in thousands) at the end of its fiscal year: [I Source: CVS Health Corporation A footnote to the financial statements disclosed that uncollectible accounts amounting to $79,000 and $37,000 were written off as bad debts during Year 2 and Year 1, respectively. Assume that the tax rate for CVS was 21 percent. Required: 1. Determine the bad debt expense for Year 2 based on the preceding facts. (Hint: Use the Allowance for Doubtful Accounts T-account to solve for the missing value.) 2. Working capital is defined as current assets minus current liabilities. How was CVS's working capital affected by the write-off of $79,000 in uncollectible accounts during Year 2? What impact did the recording of bad debt expense have on working capital in Year 2? 3. How was net income affected by the $79,000 write-off during Year 2? What impact did recording bad debt expense have on net income for Year 2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started