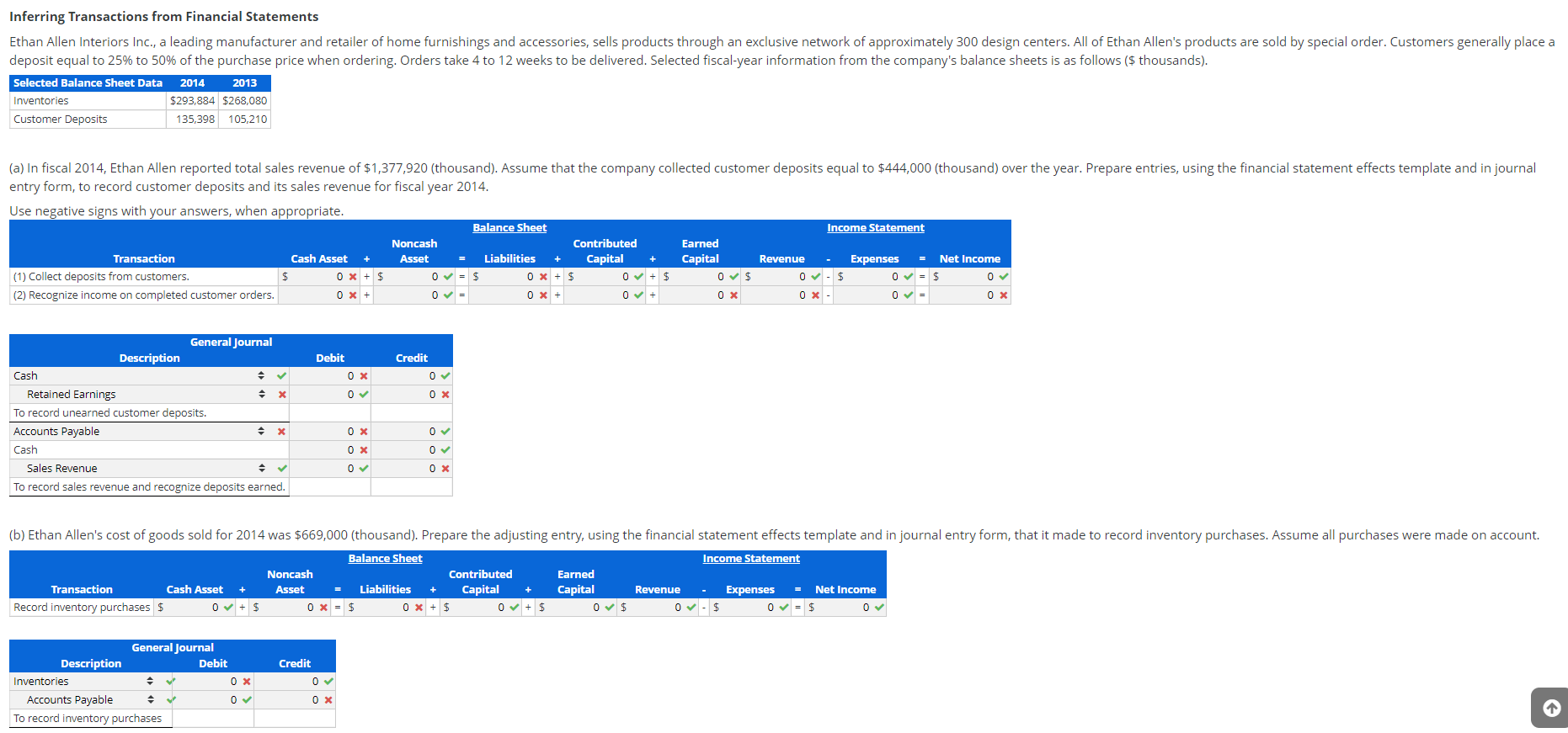

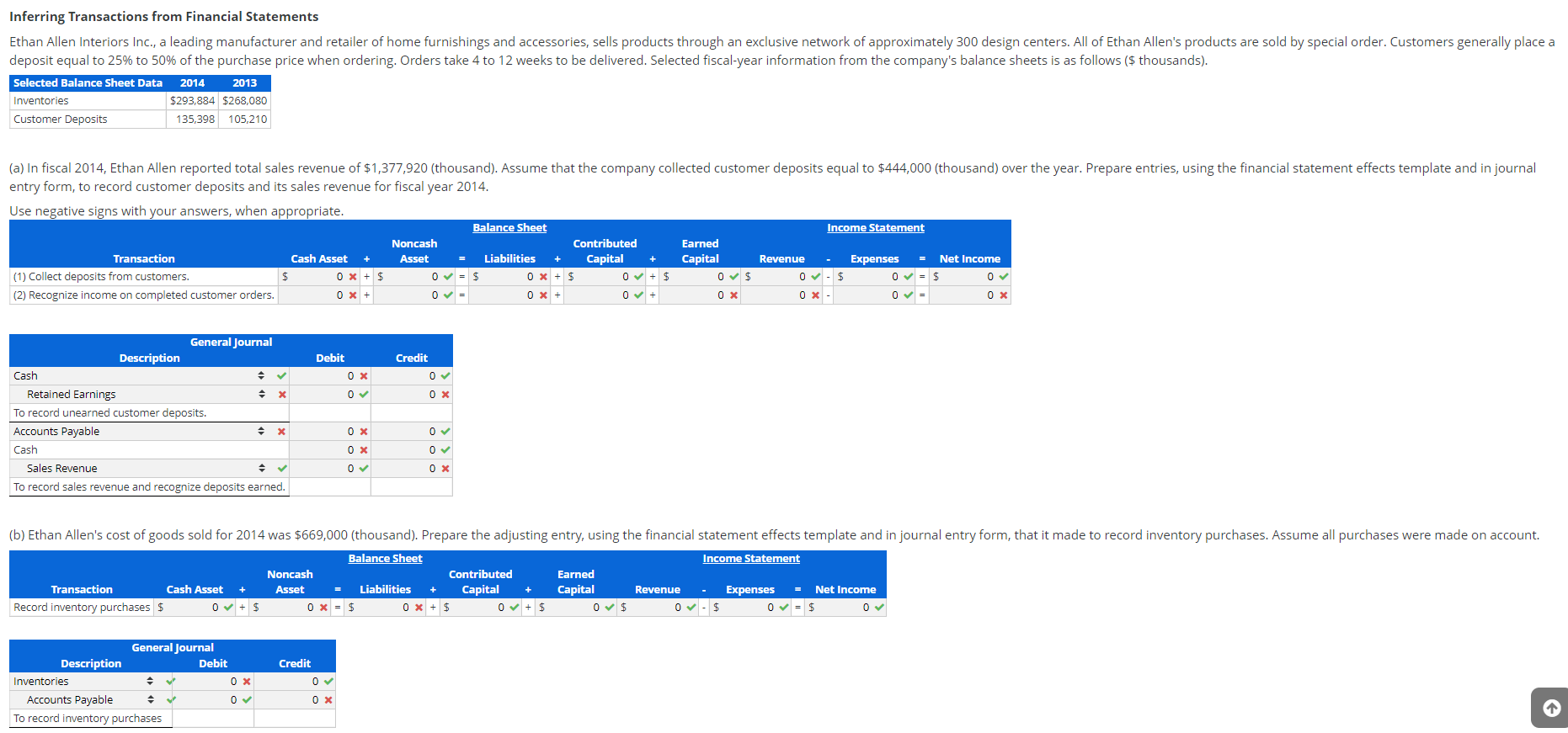

Inferring Transactions from Financial Statements Ethan Allen Interiors Inc., a leading manufacturer and retailer of home furnishings and accessories, sells products through an exclusive network of approximately 300 design centers. All of Ethan Allen's products are sold by special order. Customers generally place a deposit equal to 25% to 50% of the purchase price when ordering. Orders take 4 to 12 weeks to be delivered. Selected fiscal-year information from the company's balance sheets is as follows ($ thousands). Selected Balance Sheet Data 2014 2013 Inventories $293,884 $268,080 Customer Deposits 135,398 105,210 (a) In fiscal 2014, Ethan Allen reported total sales revenue of $1,377,920 (thousand). Assume that the company collected customer deposits equal to $444,000 (thousand) over the year. Prepare entries, using the financial statement effects template and in journal entry form, to record customer deposits and its sales revenue for fiscal year 2014. Use negative signs with your answers, when appropriate. Balance Sheet Income Statement Noncash Contributed Earned Transaction Cash Asset Asset Liabilities Capital Capital Revenue Expenses Net Income (1) Collect deposits from customers. OX 0 = $ 0x + $ 0 + $ 0 $ 0 - $ 0 = $ (2) Recognize income on completed customer orders. 0 0X 0 OX + = 0 X + OX Credit Debit 0 x 0 0 OX General Journal Description Cash Retained Earnings X To record unearned customer deposits. Accounts Payable X Cash Sales Revenue To record sales revenue and recognize deposits earned. OX 0 OX 0 0 (b) Ethan Allen's cost of goods sold for 2014 was $669,000 (thousand). Prepare the adjusting entry, using the financial statement effects template and in journal entry form, that it made to record inventory purchases. Assume all purchases were made on account. Balance Sheet Income Statement Noncash Contributed Earned Transaction Cash Asset Asset Liabilities Capital Capital Revenue Expenses Net Income Record inventory purchases $ 0 + $ 0x = $ 0x + $ 0 + $ 0$ 0 - $ 0 = $ + + 0 General Journal Description Debit Inventories OX Accounts Payable 0 To record inventory purchases Credit 0 Inferring Transactions from Financial Statements Ethan Allen Interiors Inc., a leading manufacturer and retailer of home furnishings and accessories, sells products through an exclusive network of approximately 300 design centers. All of Ethan Allen's products are sold by special order. Customers generally place a deposit equal to 25% to 50% of the purchase price when ordering. Orders take 4 to 12 weeks to be delivered. Selected fiscal-year information from the company's balance sheets is as follows ($ thousands). Selected Balance Sheet Data 2014 2013 Inventories $293,884 $268,080 Customer Deposits 135,398 105,210 (a) In fiscal 2014, Ethan Allen reported total sales revenue of $1,377,920 (thousand). Assume that the company collected customer deposits equal to $444,000 (thousand) over the year. Prepare entries, using the financial statement effects template and in journal entry form, to record customer deposits and its sales revenue for fiscal year 2014. Use negative signs with your answers, when appropriate. Balance Sheet Income Statement Noncash Contributed Earned Transaction Cash Asset Asset Liabilities Capital Capital Revenue Expenses Net Income (1) Collect deposits from customers. OX 0 = $ 0x + $ 0 + $ 0 $ 0 - $ 0 = $ (2) Recognize income on completed customer orders. 0 0X 0 OX + = 0 X + OX Credit Debit 0 x 0 0 OX General Journal Description Cash Retained Earnings X To record unearned customer deposits. Accounts Payable X Cash Sales Revenue To record sales revenue and recognize deposits earned. OX 0 OX 0 0 (b) Ethan Allen's cost of goods sold for 2014 was $669,000 (thousand). Prepare the adjusting entry, using the financial statement effects template and in journal entry form, that it made to record inventory purchases. Assume all purchases were made on account. Balance Sheet Income Statement Noncash Contributed Earned Transaction Cash Asset Asset Liabilities Capital Capital Revenue Expenses Net Income Record inventory purchases $ 0 + $ 0x = $ 0x + $ 0 + $ 0$ 0 - $ 0 = $ + + 0 General Journal Description Debit Inventories OX Accounts Payable 0 To record inventory purchases Credit 0